概述

该策略运用双均线交叉的原理,结合ATR指标设定止损止盈,辅以交易时间控制,设计出一套适合日间交易期货合约的策略。策略简单明了,容易掌握,适合初学者使用。

策略原理

该策略使用5周期和20周期的WMA均线交叉做为入场信号。当5周期线从下方向上突破20周期线时,做多;当5周期线从上方向下跌破20周期线时,做空。同时,策略还使用50周期WMA均线判断趋势方向。只有当价格突破均线方向与大趋势方向一致时,才产生交易信号。

此外,策略还运用ATR指标来设定止损止盈位置。ATR指标能动态反映市场波动幅度。策略以ATR指标的数值乘以一个倍数(如3倍)来确定止损止盈位置,从而控制单笔损失。

最后,策略限定只在美国交易时段(9:00-14:30 CST)触发交易信号。这避免在开市和收市时段交易,因为这两个时段波动较大,容易形成虚假信号。

优势分析

该策略具有以下优势:

使用双均线交叉,可以有效捕捉趋势转折点,及时入场。

借助大趋势判断过滤掉部分噪音交易信号,避免逆势操作。

应用ATR指标动态调整止损止盈位置,有效控制单笔损失。

限定交易时段,避开市场开盘和收盘时的剧烈波动。

策略规则简单清晰,容易理解和实现,适合初学者掌握。

可自定义参数,如均线周期、ATR倍数、交易时段等,优化策略。

风险分析

该策略也存在以下风险:

震荡行情中,可能出现较多止损。

双均线交叉会有一定滞后,可能错过短线突破。

ATR参数设定不当可能导致止损过大或过小。

仅依靠技术指标,忽略基本面信息。

交易品种和周期不合适都会影响策略效果。

机械交易系统存在被套利的风险。

不同交易时段的参数需要调整。

这需要通过参数优化、指标组合、适当人工干预等方法来改进。

优化方向

该策略可以从以下方面进行优化:

尝试不同的均线系统,如EMA、DMA等。

增加其他技术指标过滤,如MACD、RSI等。

优化ATR参数,使止损止盈更合理。

结合交易量指标寻找高效入场点。

根据不同品种特点调整参数。

结合基本面因素,避免逆市场操作。

增加机器学习成分,利用神经网络对数据进行建模。

尝试多周期结合,发掘更多交易机会。

构建策略组合,提高稳定性。

总结

本策略整体较为简单通俗,适合初学者实盘练习。同时也留有很大的优化空间,可以引入更多技术指标或机器学习方法来完善。此外,根据不同交易品种特性和市场环境调整参数也很关键。总之,本策略为量化交易初学者提供了一个参考框架,但还需要根据实际情况不断测试与优化,方能获得稳定收益。

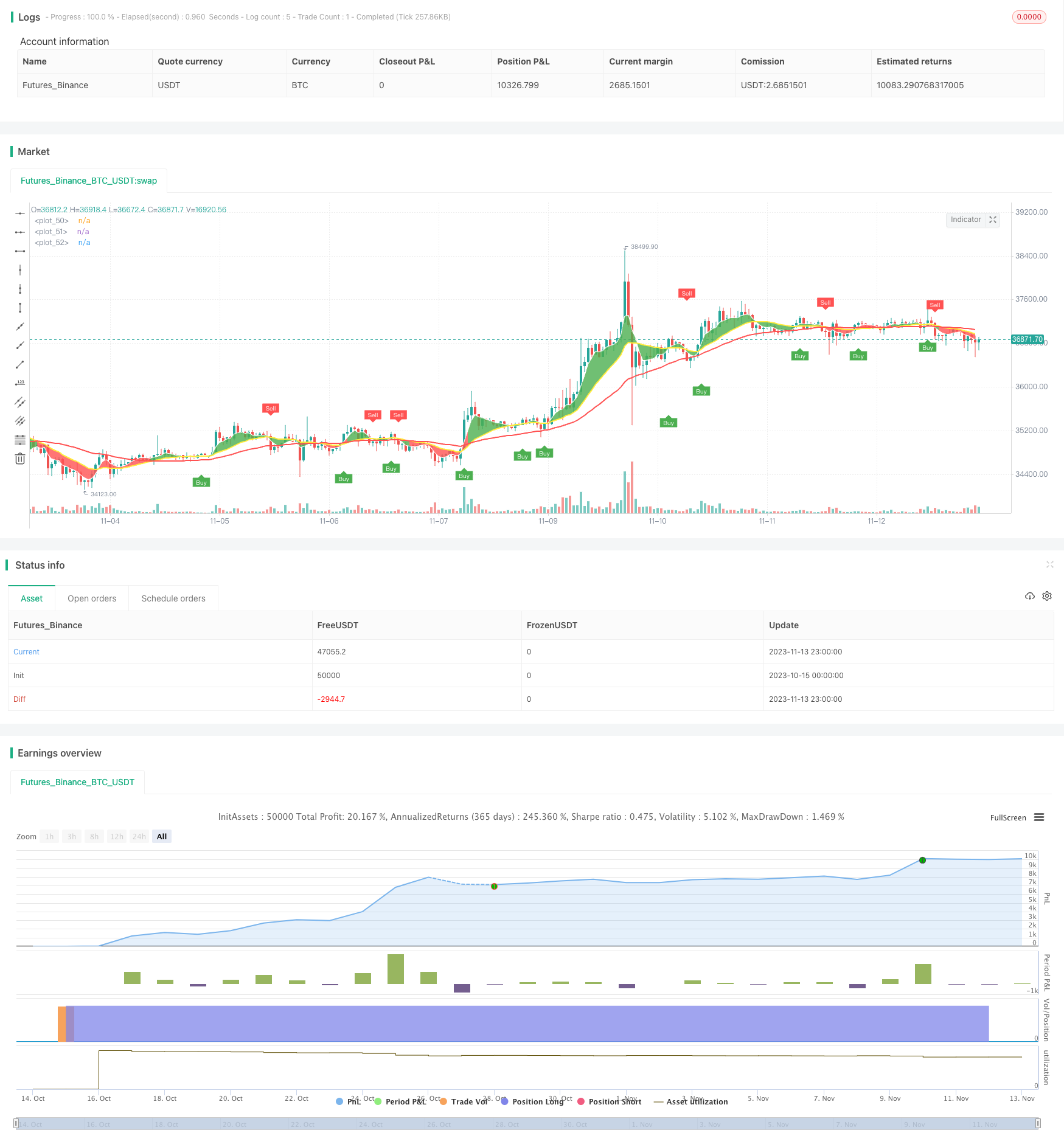

/*backtest

start: 2023-10-15 00:00:00

end: 2023-11-14 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © james4392010

//@version=4

strategy(title="DayTradingFutures Cross-Strategy", overlay=true)

// === GENERAL INPUTS ===

Periods = input(title="ATR Period", type=input.integer, defval=10)

src = input(hl2, title="Source")

Multiplier = input(title="ATR Multiplier", type=input.float, step=0.1, defval=3.0)

changeATR= input(title="Change ATR Calculation Method ?", type=input.bool, defval=true)

showsignals = input(title="Show Buy/Sell Signals ?", type=input.bool, defval=true)

//highlighting = input(title="Highlighter On/Off ?", type=input.bool, defval=true)

atr2 = sma(tr, Periods)

atr= changeATR ? atr(Periods) : atr2

up=src-(Multiplier*atr)

up1 = nz(up[1],up)

up := close[1] > up1 ? max(up,up1) : up

dn=src+(Multiplier*atr)

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? min(dn, dn1) : dn

wmaFastSource = input(defval = close, title = "Fast WMA Source")

wmaFastLength = input(defval = 5, title = "Fast WMA Period")

wmaSlowSource = input(defval = close, title = "Slow WMA Source")

wmaSlowLength = input(defval = 20, title = "Slow WMA Period")

wmaDirectionSource = input(defval = close, title = "Trend 50 Period Source")

wmaDirectionLength = input(defval = 50, title = "Trend 50 Period")

timeinrange(res, sess) => time(res, sess) != 0

// === SERIES SETUP ===

/// a couple of ma's..

wmaFast = wma(close, 5)

wmaSlow = wma(close, 20)

wmaDirection = wma(close, 50)

// === PLOTTING ===

fast = plot(series=wmaFast, color=color.white, linewidth=2)

slow = plot(series=wmaSlow, color=color.yellow, linewidth=2)

direction = plot(series=wmaDirection, color=color.red, linewidth=2)

// === INPUT BACKTEST RANGE ===

//fromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

//fromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

//fromYear = input(defval = 2022, title = "From Year", minval = 2022)

// To Date Inputs

//toDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

//toMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

//toYear = input(defval = 2022, title = "To Year", minval = 2022)

//startDate = timestamp(fromYear, fromMonth, fromDay)

//finishDate = timestamp(toYear, toMonth, toDay)

//inDateRange= (time >= fromDay, fromMonth, fromYear and time <= toDay, toMonth, toYear)

// === FUNCTION EXAMPLE ===

//inDateRange = (time >= fromDay, fromMonth, fromYear) and (time <= toDay, toMonth, toYear)

// === LOGIC ===

enterLong = crossover(wmaFast, wmaSlow) and close > wmaDirection and timeinrange(timeframe.period, "0900-1430")

enterShort = crossunder(wmaFast, wmaSlow) and close < wmaDirection and timeinrange(timeframe.period, "0900-1430")

//trend := nz(trend[1], trend)

//trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

//upPlot = plot(trend == 1 ? up : na, title="Up Trend", style=plot.style_linebr, linewidth=2, color=color.green)

buySignal = enterLong

//plotshape(enterLong ? up : na, title="UpTrend Begins", location=location.absolute, style=shape.circle, size=size.tiny, color=color.green)

plotshape(enterLong and showsignals ? up : na, title="Buy", text="Buy", location=location.absolute, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white)

//dnPlot = plot(trend == 1 ? na : dn, title="Down Trend", style=plot.style_linebr, linewidth=2, color=color.red)

sellSignal = enterShort

//plotshape(enterShort ? dn : na, title="DownTrend Begins", location=location.absolute, style=shape.circle, size=size.tiny, color=color.red)

plotshape(enterShort and showsignals ? dn : na, title="Sell", text="Sell", location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.red, textcolor=color.white)

//mPlot = plot(ohlc4, title="", style=plot.style_circles, linewidth=0)

//longFillColor = highlighting ? (trend == 1 ? color.green : color.white) : color.white

//shortFillColor = highlighting ? (trend == -1 ? color.red : color.white) : color.white

//fill(mPlot, upPlot, title="UpTrend Highligter", color=longFillColor)

//fill(mPlot, dnPlot, title="DownTrend Highligter", color=shortFillColor)

alertcondition(buySignal, title="Buy", message="Buy!")

alertcondition(sellSignal, title="Sell", message="Sell!")

//changeCond = trend != trend[1]

//alertcondition(changeCond, title="SuperTrend Direction Change", message="SuperTrend has changed direction!")

// Entry for strategy //

//tp=input(25,title="TakeProfit")

//sl=input(40,title="StopLoss")

strategy.entry("Long",1, when=buySignal)

//strategy.exit("Exit",profit=tp,loss=sl)

//strategy.exit("TakeProfit",profit=tp)

//strategy.exit("StopLoss",loss=sl)

strategy.entry("Short",1, when=sellSignal)

//strategy.exit("Exit",profit=tp,loss=sl)

//strategy.exit("TakeProfit",profit=tp)

//strategy.exit("StopLoss",loss=sl)

//strategy.exit("Exit", wmaFastwmaSlow)

//Buy and Sell Signals

//strategy.close_all(when =not timeinrange(timeframe.period, "1000-1430"))

// === FILL ====

fill (fast, slow, color = wmaSlow > wmaDirection ? color.green : color.red)

//fill(when=enterLong, tp, color = color.new(color.green, 90), title = "Profit area")

//fill(when=enterLong, sl, color = color.new(color.red, 90), title = "Loss area")

//fill(when=enterShort, tp, color = color.new(color.green, 90), title = "Profit area")

//fill(when=enterShort, sl, color = color.new(color.red, 90), title = "Loss area")