概述

本策略基于动态马克均线的指标,结合布林带和RSI进行交易信号过滤,实现了一个只做多不做空的趋势跟踪策略。该策略通过计算海克线收盘价的动态马克均线变化来判断趋势,并与布林带比较来发出交易信号。结合RSI过滤器,可以有效识别趋势的爆发点,实现趋势跟踪。

策略原理

本策略的核心是计算海克线收盘价的动态马克均线的变化。具体来说,是计算当前K线与前两个K线的马克均线差值,再乘以灵敏度系数,得到准确的马克均线变化值。

然后,将这个变化值与布林带的上轨和下轨的差值进行比较。如果马克均线变化大于布林带差值,则认为趋势出现“爆发”。当该爆发是正的,即马克均线变化为正,则产生做多信号和绿色柱状线。当爆发是负的,即马克均线变化为负,则产生平仓信号和红色柱状线。

此外,该策略还设置了RSI过滤器,只有当RSI高于阈值时才会发出做多信号,从而避免趋势反转的风险。

策略优势

- 利用动态马克均线判断趋势,可以有效跟踪趋势的变化

- 布林带作为动态指标,结合马克均线,可以更好地识别趋势爆发

- RSI过滤器可以避免低位反弹带来的假信号

- 只做多不做空,适合持续上涨的牛市

- 可调参数灵活,可针对不同品种和周期进行优化

策略风险

- 只做多不做空,无法获利于下跌行情

- 过于依赖参数优化,不同品种和周期需要重新测试

- 无法有效捕捉趋势反转,可能带来较大亏损

- RSI过滤器设置不当可能错过交易机会

- 高参数灵敏度容易产生噪音交易

风险缓解措施包括:适当调整参数使之更稳健、结合其它指标判断趋势反转、只在长线清晰趋势中使用等。

策略优化方向

本策略还有一定的优化空间:

尝试不同的价格源,如收盘价、均线等,以获得更好的平滑效果

调整马克均线和布林带的周期参数,优化针对不同品种

尝试比例关系替代灵敏度系数,使指标结果更直观

增加其它过滤器,如趋势均线、交易量等,提高信号质量

开发空头策略,根据指标形态进行逆向操作

加入止损机制,更好地控制风险

总结

本策略总体来说是一个较为稳定的趋势跟踪策略。它利用动态均线判断趋势方向,布林带识别爆发点,RSI过滤假信号,实现了一个只做多的趋势系统。但也存在一定的风险,需要针对不同品种和周期进行参数优化,且无法获利于下跌行情。本策略还有进一步提高信号质量、开发空头策略、加入止损等优化空间,以获得更好的绩效。

策略源码

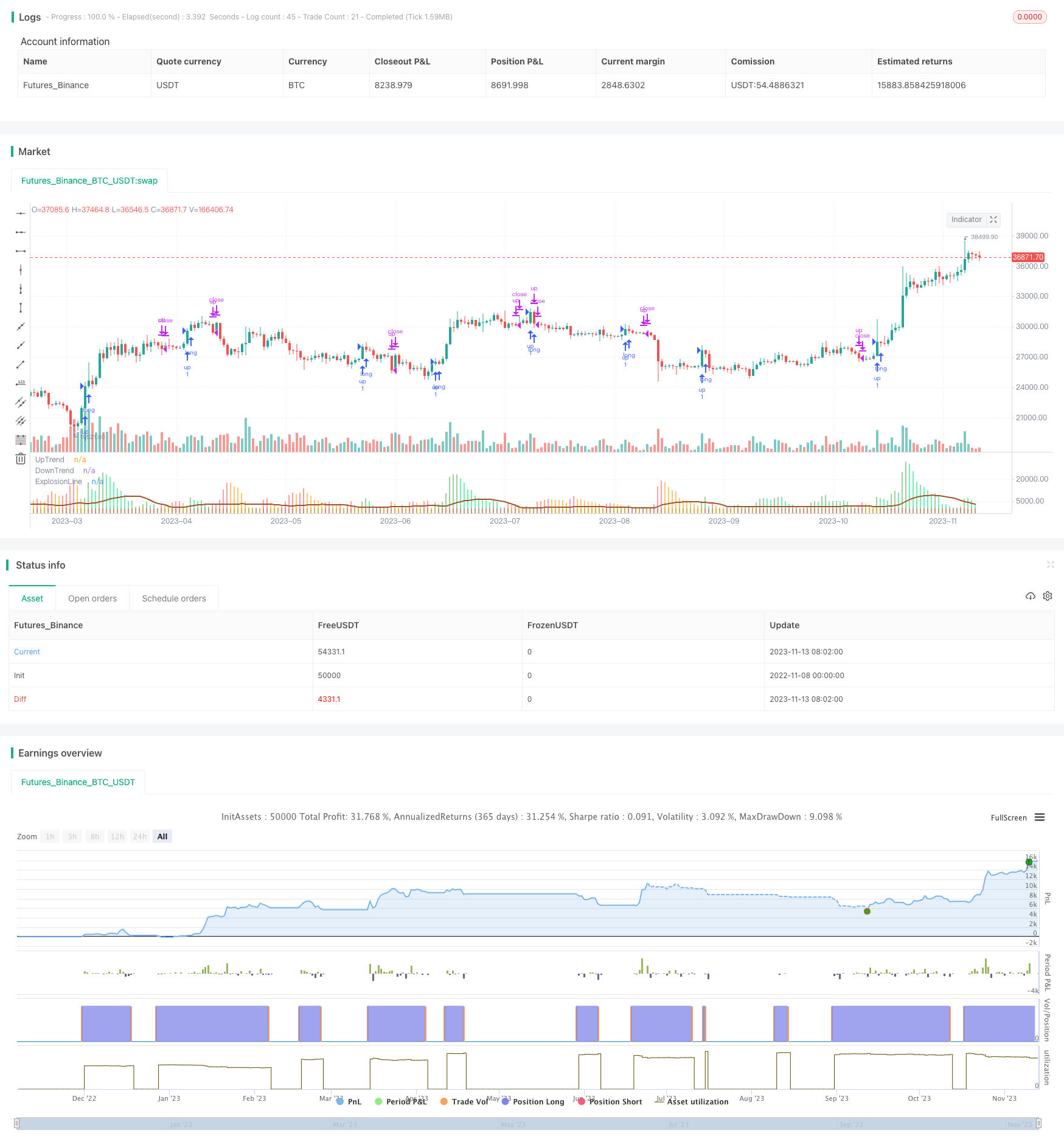

/*backtest

start: 2022-11-08 00:00:00

end: 2023-11-14 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

///////////Original Script Courtesy of Lazy_Bear.... Absolute Legend\\\\\\\\\\\\\\\

strategy('SmoothedWaddah', overlay=false, initial_capital=1)

sensitivity = input(150, title='Sensitivity')

fastLength = input(20, title='MacD FastEMA Length')

slowLength = input(40, title='MacD SlowEMA Length')

channelLength = input(20, title='BB Channel Length')

mult = input(1.5, title='BB Stdev Multiplier')

RSI14filter = input(40, title='RSI Value trade filter')

////////////MacD Calculation of price//////////////////////////////

calc_macd(source, fastLength, slowLength) =>

fastMA = ta.ema(source, fastLength)

slowMA = ta.ema(source, slowLength)

fastMA - slowMA

/////////BolingerBand Calculation of Price///////////////////////

calc_BBUpper(source, length, mult) =>

basis = ta.sma(source, length)

dev = mult * ta.stdev(source, length)

basis + dev

calc_BBLower(source, length, mult) =>

basis = ta.sma(source, length)

dev = mult * ta.stdev(source, length)

basis - dev

//////heinkenashi chart call for closing price "smoothing mechanism"\\\\\\\\\\\\\\\\\\\\\\\\\\\

point = request.security(ticker.heikinashi(syminfo.tickerid), timeframe.period, close)

////////////////////T1 is change in MacD current candle from previous candle Sensitivy amplifies calculation/////////////////////

t1 = (calc_macd(point, fastLength, slowLength) - calc_macd(point[1], fastLength, slowLength)) * sensitivity

//////////////////////T2 is T1 from two candles prior\\\\\\\\\\\\\\\\\\\\\\\\\\\

t2 = (calc_macd(point[2], fastLength, slowLength) - calc_macd(point[3], fastLength, slowLength)) * sensitivity

////////////////E1 is difference in bolinger band upper and lower...E2 is E1 from one candle prior not needed//////////////

e1 = calc_BBUpper(ohlc4, channelLength, mult) - calc_BBLower(ohlc4, channelLength, mult)

//e2 = (calc_BBUpper(close[1], channelLength, mult) - calc_BBLower(close[1], channelLength, mult))

//////signal bar printing.. Up if MacD positive .. Down if MacD negative//////////

trendUp = t1 >= 0 ? t1 : 0

trendDown = t1 < 0 ? -1 * t1 : 0

///////plots difference in macD*Sensitivity, color change if increasing or decreasing.

//////color is green/lime if explosion is up \ color is red/orange if explosion is down/////////

plot(trendUp, style=plot.style_columns, linewidth=1, color=trendUp < trendUp[1] ? color.new(color.lime,45) : color.new(color.green,45), title='UpTrend')

plot(trendDown, style=plot.style_columns, linewidth=1, color=trendDown < trendDown[1] ? color.new(color.orange,45) : color.new(color.red,45), title='DownTrend')

plot(e1, style=plot.style_line, linewidth=2, color=color.new(#A0522D, 0), title='ExplosionLine')

////////////Entry conditions and Concept/////////////////////

////////////Long Only System. T1 is measuring the distance between MACD EMA's. This is Multiplied

////////////by the sensitivity so that it can be compared to the difference between BollingerBand.

/////////////{this could have been a ratio maybe i will work with that in a different script.}

/////////////I found that 135-175 sensitivy allows for values to be compared on most charts.....

////////////If the (difference between the EMA)*(Sensitivity) is greater than (BB upper line- BB lower line)

////////////it is considered an explosion in either the downside or the upside.The indicator will print

///////////a bar higher than the trigger line either green or red (up or down respectively)//////////////////

longCondition = trendUp > e1 and ta.rsi(close, 14) > RSI14filter

if longCondition

strategy.entry('up', strategy.long)

strategy.close('up', trendDown > e1)