概述

本策略使用TEMA, VWMACD和HMA三个指标来捕捉比特币的下跌行情。它的主要逻辑是在VWMACD下穿0轴、价格低于HMA均线和快线TEMA低于慢线TEMA时做空。当VWMACD上穿0轴、价格高于HMA均线或快线TEMA上穿慢线TEMA时平仓。

原理

首先计算VWMACD(和普通MACD的区别只在于计算移动平均线的方式不同)并画成柱状图。然后添加HMA作为趋势过滤器。接着创建并添加快线TEMA(5周期)和慢线TEMA(8周期),并计算两者的差值绘制在0轴附近。这是做空决策的关键。

具体入场规则是:当VWMACD低于0轴、价格低于HMA均线和快线TEMA低于慢线TEMA时做空。

具体出场规则是:当VWMACD上穿0轴、价格高于HMA均线或快线TEMA上穿慢线TEMA时平仓。

优势分析

- 使用了三个指标组合,提高了交易信号的可靠性

- VWMACD能识别背离提供较准的趋势判断

- HMAfilt作为趋势滤波器,避免被噪音误导

- 快慢TEMA组合,捕捉短期反转点位

- 采用短周期参数,适合高频交易,捕捉短期下跌行情

风险分析

- 多指标组合,参数设置较复杂,需要经验进行调优

- 虽有HMA滤波器,但仍需防止震荡市场的假突破

- 短周期参数容易被市场噪音干扰,出现失误信号

- 需严格控制止损,避免出现超出预期的大幅度损失

- 需关注交易成本控制,高频交易容易被手续费摩擦损耗

优化方向

- 可以测试不同周期的参数组合,寻找最佳参数

- 可以添加其他指标,如RSI,KD等辅助判断

- 可以根据不同市场情况使用自适应参数

- 可以优化止损策略,如随价格移动止损

- 可以结合量能指标,避免量能不足的假突破

总结

本策略采用VWMACD,HMA和快慢TEMA的组合, Ziel在捕捉比特币短期下跌行情。它的优势是信号较可靠,适合高频交易。但也存在参数调优复杂,容易被噪音干扰等风险。通过继续优化参数组合、加入辅助指标等方式,可以使策略更稳定可靠。总体来说,本策略利用多指标确认和短周期参数的特点,能够对比特币的短期下跌行情做出较准确判断,属于一个行之有效的高频做空策略。

策略源码

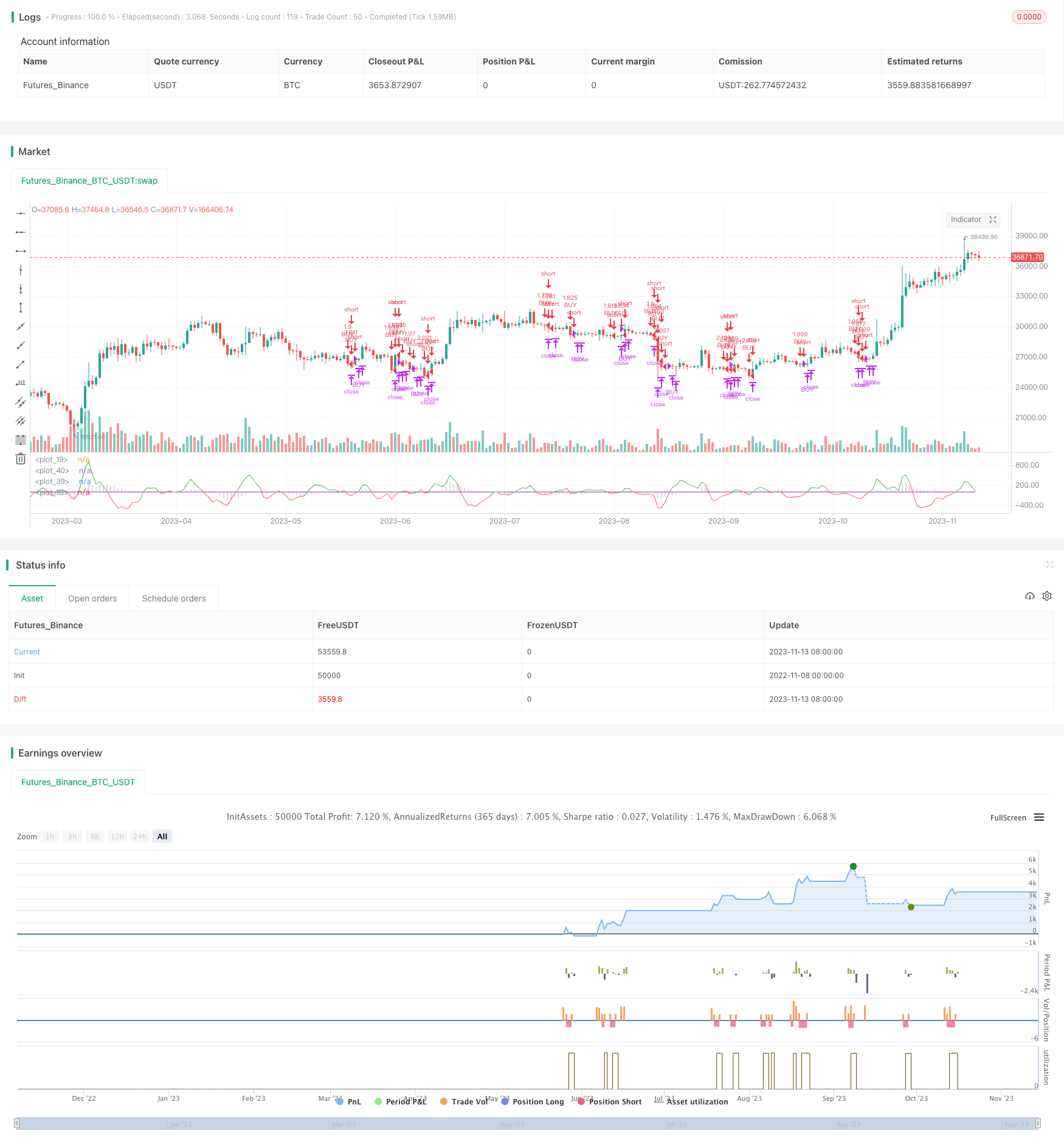

/*backtest

start: 2022-11-08 00:00:00

end: 2023-11-14 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="TEMA_HMA_VWMACD short strategy", shorttitle="Short strategy", overlay=false, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.018, currency='USD')

startP = timestamp(input(2017, "Start Year"), input(12, "Month"), input(17, "Day"), 0, 0)

end = timestamp(9999,1,1,0,0)

_testPeriod() =>

iff(time >= startP and time <= end, true, false)

slow = input(13, "Short period")

fast = input(21, "Long period")

signal = input(5, "Smoothing period")

Fast = ema( volume * close, fast ) / ema( volume, fast )

Slow = ema( volume * close, slow ) / ema( volume, slow )

Macd = Slow - Fast

Signal = ema(Macd, signal)

Hist=Macd-Signal

plot(Hist, color=color.silver, linewidth=1, style=plot.style_histogram)

plot(0, color=color.red)

length = input(400, minval=1, title = "HMA")

hullma = wma(2*wma(close, length/2)-wma(close, length), floor(sqrt(length)))

tema_length_1 = input(5, "Fast moving TEMA")

tema_length_2 = input(8, "Slow moving TEMA")

tema(sec, length)=>

tema1= ema(sec, length)

tema2= ema(tema1, length)

tema3= ema(tema2, length)

tema = 3*tema1-3*tema2+tema3

tema1 = tema(hlc3, tema_length_1)

tema2 = tema(hlc3, tema_length_2)

threshold = 0

tm = tema1 - tema2

plot_fast = plot(tm, color = tm > 0 ? color.green : color.red)

plot(threshold, color=color.purple)

up = crossover(tm, 0)

down = crossunder(tm, 0)

longCondition = (Hist < 0) and hullma > close and (tema1 < tema2) and _testPeriod()

strategy.entry('BUY', strategy.short, when=longCondition)

shortCondition = (Hist > 0) or hullma < close or up

strategy.close('BUY', when=shortCondition)

// Take profit

tp = input(1, type=input.float, title='Take Profit (%)')

sl = input(4, type=input.float, title='Stop Loss (%)')

strategy.exit('XLong', from_entry='BUY', profit=(close * (tp/100) * (1/syminfo.mintick)), loss=(close * (sl/100) * (1/syminfo.mintick)))