概述

该策略是一个基于动量突破和均线的短线交易策略。它结合了移动平均线、K线形态、交易量和波动性等多个指标,识别具有突破动能的方向性机会,以捕捉较短线的趋势行情。

策略原理

使用3日EMA作为参考均线,当收盘价跌破该均线时,视为市场处于下跌趋势(Cond01)。

开盘价高于前一日的OHLC价格(开盘价、最高价、最低价、收盘价的平均价),表示有买盘成交推高开盘价,是上涨信号(Cond02)。

volume小于前一日volume,表示动量不足,利于方向性突破(Cond03)。

收盘价突破前一日的价格区间,表明有突破(Cond04)。

当上述4个条件同时满足时,做多开仓(Entries)。

止损条件:开仓超过10根K线或已获利平仓达到5次时,平仓(Exits)。

该策略综合多个指标判断市场突破方向,在短期内捕捉价格趋势,具有较强的方向性。但每个条件仅考虑1到3根K线的信息,对于长期趋势判断能力较弱。

优势分析

使用多个指标综合判断,可以过滤假突破,识别有效突破。

动量不足利于价格产生方向性突破和趋势爆发,可以捕捉比较明确的方向性机会。

交易次数较多,适合短线操作,可以快速锁定每次小 profits。

止损和止盈设置合理,可以有效控制单笔损失和风险。

风险分析

多条持仓同时打开,存在加仓风险。

单一指标参数设置可能过于死板,可引入自适应参数。

突破失败概率存在,可能形成破净。

仅关注短期信息,对大趋势把握不足。

停损点过近,可放宽至20至30根K线。

优化方向

加入趋势判断,避免逆势开仓。可以考虑加入长期均线判定,只在大趋势方向打开仓位。

优化参数设置。可以对EMA周期、突破参数进行测试和优化,使之更符合不同市场状态。也可以设置自适应参数,让指标自动调整周期等。

条件优化。可以考虑添加其他辅助指标,如能量潮、布林带宽度、RSI等,来验证突破的有效性,减少假突破。

充分测试,检查极端行情下收益曲线。可以对过去行情进行回测,检验策略在特大涨跌、震荡等极端行情中的表现。

优化止损机制。可以考虑追踪止损、百分比止损、自适应止损等方式,让止损更具弹性。

总结

该策略整合EMA、交易量、波动性等多个指标,识别短期内具有突破动能的机会,属于典型的短线突破策略。它回报频繁、运作敏捷,能快速锁定短线利润。但仅关注近期信息,对大行情把握不足。我们可以从加入趋势因素、优化参数设置、提高突破有效性、检验极端行情等方面进行优化,使策略更稳健、适应性更强。

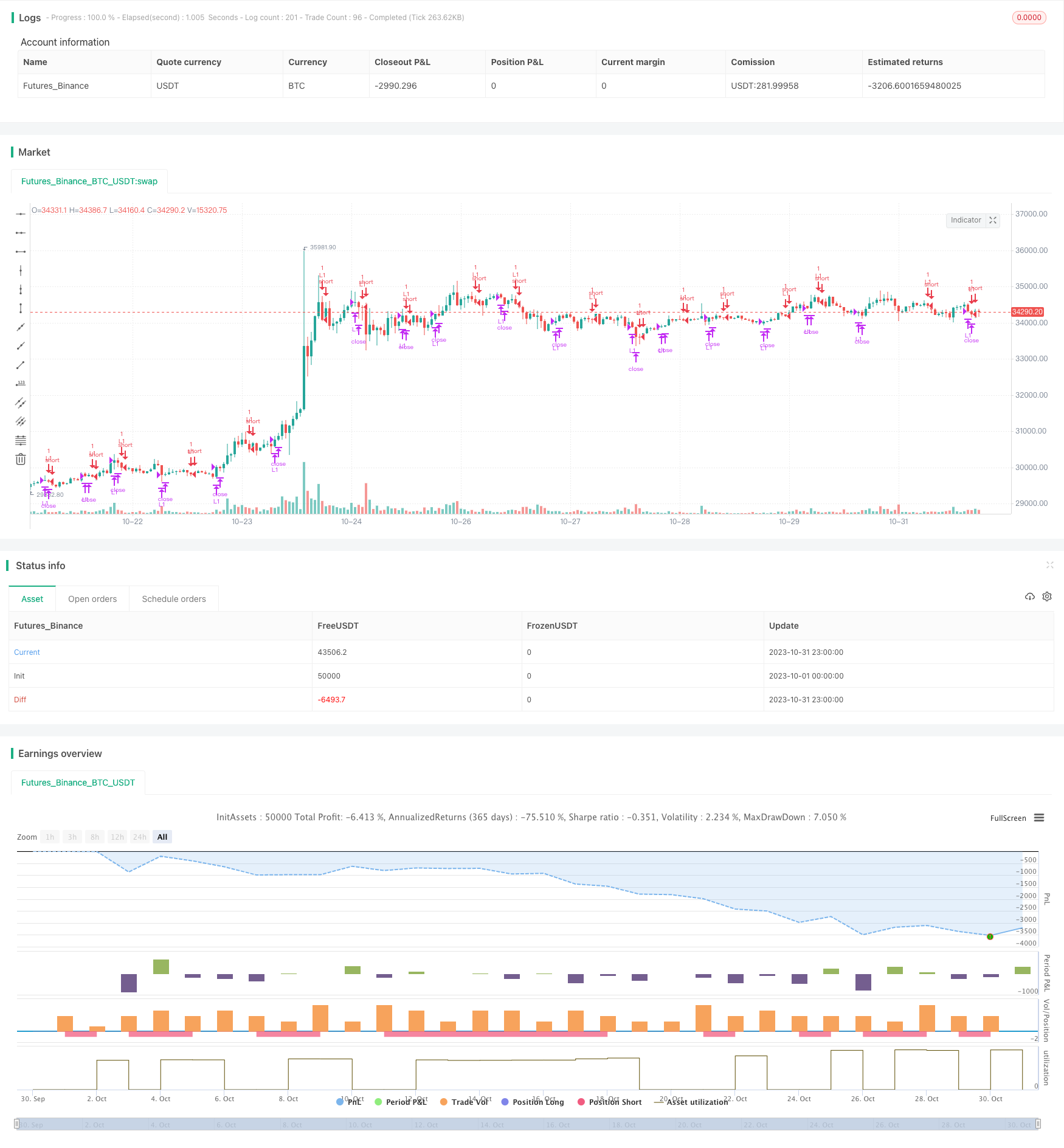

/*backtest

start: 2023-10-01 00:00:00

end: 2023-10-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("Free Strategy #01 (ES / SPY)", overlay=true)

// Inputs

Quantity = input(1, minval=1, title="Quantity")

EmaPeriod = input(3, minval=1, title="EMA Period")

MaxProfitCloses = input(5, minval=1, title="Max Profit Close")

MaxBars = input(10, minval=1, title="Max Total Bars")

// Misc Variables

src = close

BarsSinceEntry = 0

MaxProfitCount = 0

Ema = ema(close, EmaPeriod)

OHLC = (open + high + low + close) / 4.0

// Conditions

Cond00 = strategy.position_size == 0

Cond01 = close < Ema

Cond02 = open > OHLC

Cond03 = volume <= volume[1]

Cond04 = (close < min(open[1], close[1]) or close > max(open[1], close[1]))

// Update Exit Variables

BarsSinceEntry := Cond00 ? 0 : nz(BarsSinceEntry[1]) + 1

MaxProfitCount := Cond00 ? 0 : (close > strategy.position_avg_price and BarsSinceEntry > 1) ? nz(MaxProfitCount[1]) + 1 : nz(MaxProfitCount[1])

// Entries

strategy.entry(id="L1", long=true, qty=Quantity, when=(Cond00 and Cond01 and Cond02 and Cond03 and Cond04))

// Exits

strategy.close("L1", (BarsSinceEntry - 1 >= MaxBars or MaxProfitCount >= MaxProfitCloses))