概述

该策略是一种基于多个指标判断趋势的短线交易策略。它综合运用了包括WOW、BMA、BarColor、SuperTrend、DI、TTS、RSI和WTO等8个指标来判断趋势方向,并以此制定买入和卖出决策。

策略原理

该策略首先计算并判断WOW、BMA、BarColor、SuperTrend、DI、TTS、RSI和WTO这8个指标的趋势方向。

WOW指标是根据价格中的实体位置来判断多空趋势的。如果实体位置接近上轨,为看涨;如果接近下轨,为看跌。

BMA指标是根据SMA多空关系来判断趋势,如果收盘价SMA上穿开盘价SMA为看涨,下穿为看跌。

BarColor指标是根据K线颜色来判断趋势,连续多个阳线为看涨,阴线为看跌。

SuperTrend指标是根据平均波动范围来判断价格趋势,价格在上轨之上为看涨,下轨之下为看跌。

DI指标是根据多空动量大小关系来判断趋势,多头动量大于空头动量为看涨,反之为看跌。

TTS指标根据价格与均线的位置关系来判断多空趋势。

RSI指标根据相对强弱指标的位置来判断趋势方向。

WTO指标根据波动性指标的多空来判断趋势方向。

然后,该策略会统计这8个指标看涨的数量,并据此绘制分级别的SILA看涨支撑线和看跌阻力线。支撑线和阻力线的数量越多,表示趋势信号越强。

当多个指标看涨时,如果收盘价处于最低级别的支撑线之上,则产生买入信号;当多个指标看跌时,如果收盘价处于最低级别的阻力线之下,则产生卖出信号。

此外,该策略还会利用K线形态来判断短期回调的机会,在趋势反转时寻找更有利的进场点。

策略优势

- 综合多个指标判断趋势,提高判断准确率

该策略不依赖单一指标,而是综合运用8个常用的趋势判断指标,对趋势进行多方位判定,可以提高判断的准确性和可靠性。

- SILA系统绘制分级支撑阻力,识别趋势信号强弱

该策略基于多个指标的看涨看跌信号,采用SILA系统绘制多个分级别的支撑线和阻力线。线的数量越多表示趋势信号越强。这可以帮助交易者进一步识别信号的强弱。

- 结合K线形态寻找回调机会,进场点更优

该策略不仅依据趋势指标判断方向,还会结合K线形态来寻找短期回调的机会,在趋势反转点进场,可以争取到更优的入场点位。

策略风险

- 多个指标之间可能出现分歧

本策略采用多个指标,这些指标之间在某些情况下可能会出现判断分歧的情况,需要交易者自己权衡,增加了决策难度。

- 指标参数设置可能需要优化

本策略中诸多指标都采用了默认参数,实际应用时可能需要对参数进行优化,以取得最佳效果。

- 系统性风险需要考虑

如遇到重大黑天鹅事件,系统性风险会导致正常的技术指标失效,需要注意评估市场系统性风险。

- 回撤风险

跟随趋势而交易回撤在扩大阶段可能比较大,需要注意控制单笔交易规模以限制回撤。

策略优化方向

- 对指标参数进行测试优化

可以通过更系统的方法对各个指标的参数如周期长度、数值大小等进行优化,寻找最佳参数组合。

- 增加止损方式

可以考虑增加移动止损或者百分比止损来控制回撤。

- 结合量能指标

可以引入像MAVP、OBV等量能指标与趋势指标进行组合,提高战术决策的准确性。

- 优化仓位管理

可以研究不同市场阶段的持仓比例,以便在趋势更明朗时加大仓位。

总结

本策略Overall是一种多指标跟踪趋势的短线交易策略。它综合运用多个指标判断趋势方向,采用SILA系统识别信号强度,并辅以K线形态优化入场。该策略可以提高判断准确率,但需要注意不同指标的分歧风险。下一步可以通过参数优化、止损优化、量能结合等方法进一步改进该策略。

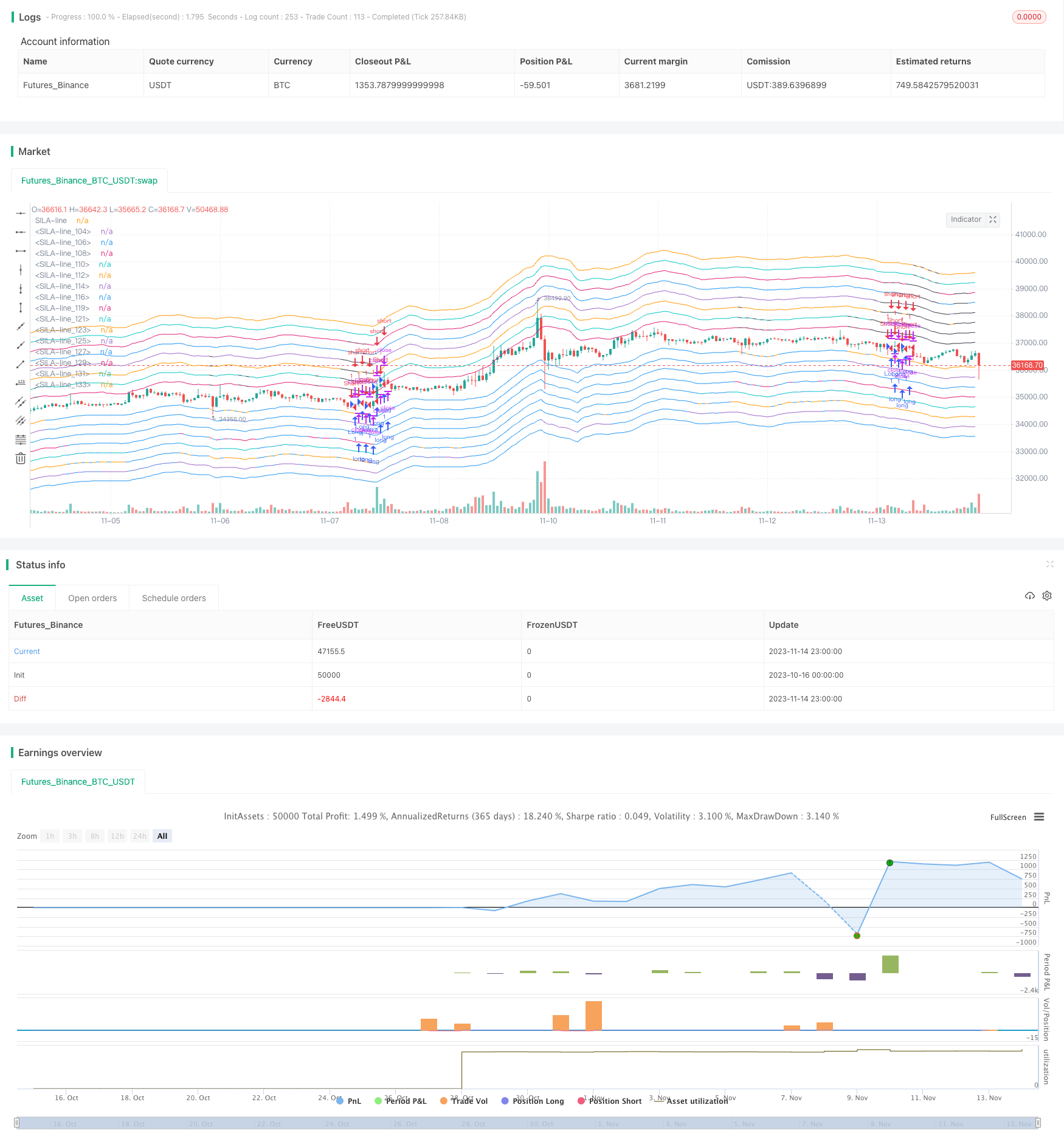

/*backtest

start: 2023-10-16 00:00:00

end: 2023-11-15 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// (c) Noro

//2017

//@version=2

strategy(title="Noro's SILA v1.6L Strategy", shorttitle="SILA v1.6L str", overlay=true)

//settings

sensup = input(5, title="Uptrend-sensivity", minval = -8, maxval = 8)

sensdn = input(5, title="Downtrend-sensivity", minval = -8, maxval = 8)

usewow = input(true, title="Use trend-indicator WOW?")

usebma = input(true, title="Use trend-indicator BestMA?")

usebc = input(true, title="Use trend-indicator BarColor?")

usest = input(true, title="Use trend-indicator SuperTrend?")

usedi = input(true, title="Use trend-indicator DI?")

usetts = input(true, title="Use trend-indicator TTS?")

usersi = input(true, title="Use trend-indicator RSI?")

usewto = input(true, title="Use trend-indicator WTO?")

dist = input(100, title="Distance SILA-lines", minval = 0, maxval = 100)

usetl = input(true, title="Need SILA-lines?")

usebgup = input(true, title="Need uptrend-background?")

usebgdn = input(true, title="Need downtrend-background?")

usealw = input(true, title="Need background always?")

usearr = input(true, title="Need new-trend-arrows?")

useloco = input(true, title="Need locomotive-arrows?")

usemon = input(true, title="Need money?") //joke

// WOW 1.0 method

lasthigh = highest(close, 30)

lastlow = lowest(close, 30)

center = (lasthigh +lastlow) / 2

body = (open + close) / 2

trend1 = body > center ? 1 : body < center ? -1 : trend1[1]

trend2 = center > center[1] ? 1 : center < center[1] ? -1 : trend2[1]

WOWtrend = usewow == true ? trend1 == 1 and trend2 == 1 ? 1 : trend1 == -1 and trend2 == -1 ? -1 : WOWtrend[1] : 0

// BestMA 1.0 method

SMAOpen = sma(open, 30)

SMAClose = sma(close, 30)

BMAtrend = usebma == true ? SMAClose > SMAOpen ? 1 : SMAClose < SMAOpen ? -1 : BMAtrend[1] : 0

// BarColor 1.0 method

color = close > open ? 1 : 0

score = color + color[1] + color[2] + color[3] + color[4] + color[5] + color[6] + color[7]

BARtrend = usebc == true ? score > 5 ? 1 : score < 3 ? -1 : BARtrend[1] : 0

// SuperTrend mehtod

Up = hl2 - (7 * atr(3))

Dn = hl2 + (7 * atr(3))

TrendUp = close[1] > TrendUp[1] ? max(Up, TrendUp[1]) : Up

TrendDown = close[1] < TrendDown[1] ? min(Dn, TrendDown[1]) : Dn

SUPtrend = usest == true ? close > TrendDown[1] ? 1: close < TrendUp[1]? -1 : SUPtrend[1] : 0

//DI method

th = 20

TrueRange = max(max(high-low, abs(high-nz(close[1]))), abs(low-nz(close[1])))

DirectionalMovementPlus = high-nz(high[1]) > nz(low[1])-low ? max(high-nz(high[1]), 0): 0

DirectionalMovementMinus = nz(low[1])-low > high-nz(high[1]) ? max(nz(low[1])-low, 0): 0

SmoothedTrueRange = nz(SmoothedTrueRange[1]) - (nz(SmoothedTrueRange[1])/14) + TrueRange

SmoothedDirectionalMovementPlus = nz(SmoothedDirectionalMovementPlus[1]) - (nz(SmoothedDirectionalMovementPlus[1])/14) + DirectionalMovementPlus

SmoothedDirectionalMovementMinus = nz(SmoothedDirectionalMovementMinus[1]) - (nz(SmoothedDirectionalMovementMinus[1])/14) + DirectionalMovementMinus

DIPlus = SmoothedDirectionalMovementPlus / SmoothedTrueRange * 100

DIMinus = SmoothedDirectionalMovementMinus / SmoothedTrueRange * 100

DItrend = usedi == true ? DIPlus > DIMinus ? 1 : -1 : 0

//TTS method (Trend Trader Strategy)

//Start of HPotter's code

//Andrew Abraham' idea

avgTR = wma(atr(1), 21)

highestC = highest(21)

lowestC = lowest(21)

hiLimit = highestC[1]-(avgTR[1] * 3)

loLimit = lowestC[1]+(avgTR[1] * 3)

ret = iff(close > hiLimit and close > loLimit, hiLimit, iff(close < loLimit and close < hiLimit, loLimit, nz(ret[1], 0)))

pos = iff(close > ret, 1, iff(close < ret, -1, nz(pos[1], 0)))

//End of HPotter's code

TTStrend = usetts == true ? pos == 1 ? 1 : pos == -1 ? -1 : TTStrend[1] : 0

//RSI method

RSIMain = (rsi(close, 13) - 50) * 1.5

rt = iff(RSIMain > -10, 1, iff(RSIMain < 10, -1, nz(pos[1], 0)))

RSItrend = usersi == true ? rt : 0

//WTO ("WaveTrend Oscilator") method by LazyBear

//Start of LazyBear's code

esa = ema(hlc3, 10)

d = ema(abs(hlc3 - esa), 10)

ci = (hlc3 - esa) / (0.015 * d)

tci = ema(ci, 21)

//End of LazyBear's code

WTOtrend = usewto == true ? tci > 0 ? 1 : tci < 0 ? -1 : 0 : 0

//plots

trends = usemon == true ? WOWtrend + BMAtrend + BARtrend + SUPtrend + DItrend + TTStrend + RSItrend + WTOtrend: -1 * (WOWtrend + BMAtrend + BARtrend + SUPtrend + DItrend + TTStrend + RSItrend + WTOtrend)

pricehi = sma(high, 10)

pricelo = sma(low, 10)

per = usetl == 1 ? dist / 10000 : 0

color1 = usetl == true ? trends > 0 ? blue : na : na

plot(pricelo * (1 - per), color=color1, linewidth=1, title="SILA-line")

color2 = usetl == true ? trends > 1 ? blue : na : na

plot(pricelo * (1 - 2 * per), color=color2, linewidth=1, title="SILA-line")

color3 = usetl == true ? trends > 2 ? blue : na : na

plot(pricelo * (1 - 3 * per), color=color3, linewidth=1, title="SILA-line")

color4 = usetl == true ? trends > 3 ? blue : na : na

plot(pricelo * (1 - 4 * per), color=color4, linewidth=1, title="SILA-line")

color5 = usetl == true ? trends > 4 ? blue : na : na

plot(pricelo * (1 - 5 * per), color=color5, linewidth=1, title="SILA-line")

color6 = usetl == true ? trends > 5 ? blue : na : na

plot(pricelo * (1 - 6 * per), color=color6, linewidth=1, title="SILA-line")

color7 = usetl == true ? trends > 6 ? blue : na : na

plot(pricelo * (1 - 7 * per), color=color7, linewidth=1, title="SILA-line")

color8 = usetl == true ? trends > 7 ? blue : na : na

plot(pricelo * (1 - 8 * per), color=color8, linewidth=1, title="SILA-line")

color10 = usetl == true ? trends < 0 ? black : na : na

plot(pricehi * (1 + per), color=color10, linewidth=1, title="SILA-line")

color11 = usetl == true ? trends < -1 ? black : na : na

plot(pricehi * (1 + 2 * per), color=color11, linewidth=1, title="SILA-line")

color12 = usetl == true ? trends < -2 ? black : na : na

plot(pricehi * (1 + 3 * per), color=color12, linewidth=1, title="SILA-line")

color13 = usetl == true ? trends < -3 ? black : na : na

plot(pricehi * (1 + 4 * per), color=color13, linewidth=1, title="SILA-line")

color14 = usetl == true ? trends < -4 ? black : na : na

plot(pricehi * (1 + 5 * per), color=color14, linewidth=1, title="SILA-line")

color15 = usetl == true ? trends < -5 ? black : na : na

plot(pricehi * (1 + 6 * per), color=color15, linewidth=1, title="SILA-line")

color16 = usetl == true ? trends < -6 ? black : na : na

plot(pricehi * (1 + 7 * per), color=color16, linewidth=1, title="SILA-line")

color17 = usetl == true ? trends < -7 ? black : na : na

plot(pricehi * (1 + 8 * per), color=color17, linewidth=1, title="SILA-line")

//background

col = usebgup == true and trends >= sensup ? 1 : usebgdn == true and trends <= (-1 * sensdn) ? -1 : usealw == true ? col[1] : 0

bgcolor = col == 1 ? lime : col == -1 ? red : na

//bgcolor(bgcolor, transp=70)

//arrows

posi = trends >= sensup ? 1 : trends <= (-1 * sensdn) ? -1 : posi[1]

arr = usearr == true ? posi == 1 and posi[1] < 1 ? 1 : posi == -1 and posi[1] > -1 ? -1 : na : na

//plotarrow(arr == 1 ? 1 : na, title="UpArrow", colorup=blue, maxheight=60, minheight=50, transp=0)

//plotarrow(arr == -1 ? -1 : na, title="DnArrow", colordown=blue, maxheight=60, minheight=50, transp=0)

//locomotive

bar = close > open ? 1 : close < open ? -1 : 0

locotop = bar == -1 and bar[1] == 1 and bar[2] == 1 ? 1 : 0

locobot = bar == 1 and bar[1] == -1 and bar[2] == -1 ? 1 : 0

entry = useloco == false ? 1 : posi == posi[1] ? (locotop == 1 and posi == -1) or (locobot == 1 and posi == 1) ? 1 : entry[1] : 0

//plotarrow(locobot == 1 and entry[1] == 0 and posi == 1 ? 1 : na, title="UpLocomotive", colorup=yellow, maxheight=60, minheight=50, transp=0)

//plotarrow(locotop == 1 and entry[1] == 0 and posi == -1 ? -1 : na, title="DnLocomotive", colordown=yellow, maxheight=60, minheight=50, transp=0)

longCondition = arr == 1

if (longCondition)

strategy.entry("Long", strategy.long)

shortCondition = arr == -1

if (shortCondition)

strategy.entry("Short", strategy.short)