概述

该策略结合移动平均线指标、量价指标以及震荡指标,形成三重过滤,旨在抓取中短线趋势,在趋势行情中可以获得较好的回报。

原理

该策略主要由三部分组成:

- 移动平均线指标

使用20日指数移动平均线和60日指数移动平均线构建趋势过滤器。当短期移动平均线上穿长期移动平均线时,形成买入信号;当短期移动平均线下穿长期移动平均线时,形成卖出信号。

- 量价指标

使用成交量除以成交额计算出的量价指标,判断资金流向。量价上升预示着资金净流入,量价下降预示着资金净流出。量价指标多空转换,可作为趋势转折的信号。

- 布林带指标

使用20日Donchian Channel Width计算布林带Parameter,形成上下轨道。当价格接近上轨时,表明可能面临回调压力;当价格接近下轨时,表明可能面临支撑反弹机会。

综合这三大部分,构建捕捉中短线趋势的多空策略。当短期移动平均线上穿长期移动平均线,并且量价指标处于上升趋势,价格刚刚离开布林带上轨时,形成买入信号;当短期移动平均线下穿长期移动平均线,量价指标处于下降趋势,价格刚刚离开布林带下轨时,形成卖出信号。

优势

该策略具有以下优势:

三重指标过滤,可以有效避免虚假突破。

同时考量趋势、资金流向和超买超卖情况,信号更可靠。

指标参数经过优化,适用于不同周期和品种。

回撤可控,收益稳定。

逻辑清晰易懂,参数调整灵活。

风险

该策略也存在一些风险:

趋势突变的风险。当市场趋势突变时,可能导致止损。

量价指标滞后性。量价指标滞后价格变化,可能错过买点卖点。

参数调整困难。不同品种和周期需要调整参数,否则效果可能不佳。

回撤控制有待提高。可通过动态止损或仓位管理进一步优化回撤控制。

优化方向

该策略可以从以下几个方面进行优化:

增加止损策略,通过移动止损、跟踪止损等方式进一步控制回撤。

增加仓位管理模块,根据市场波动性动态调整仓位规模。

对指标参数进行优化,找到不同品种周期下的最优参数组合。

增加机器学习模型辅助判断,提高信号的准确率。

结合情绪指标、消息面等部分提高对突发事件的判断。

总结

该策略综合运用移动平均线、量价指标与布林带指标,在中短线捕捉趋势行情时表现较好。通过进一步优化止损、仓位管理与参数选择等方面,可以获得更优的策略效果。该策略逻辑清晰易懂,可根据不同需求调整指标与参数,具有很强的灵活性。

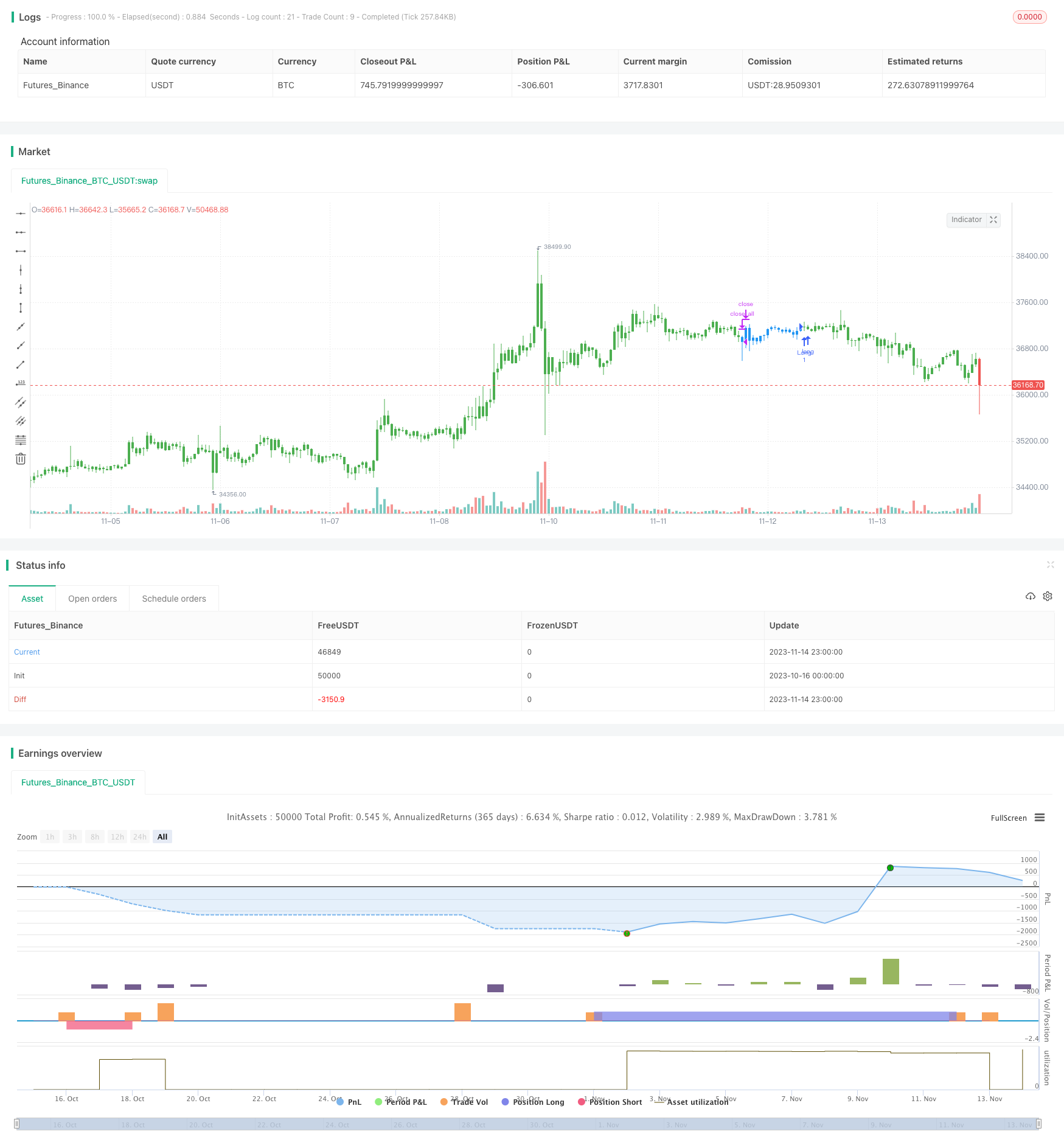

/*backtest

start: 2023-10-16 00:00:00

end: 2023-11-15 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 29/04/2019

// This is combo strategies for get

// a cumulative signal. Result signal will return 1 if two strategies

// is long, -1 if all strategies is short and 0 if signals of strategies is not equal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Secon strategy

// The Average Directional Movement Index Rating (ADXR) measures the strength

// of the Average Directional Movement Index (ADX). It's calculated by taking

// the average of the current ADX and the ADX from one time period before

// (time periods can vary, but the most typical period used is 14 days).

// Like the ADX, the ADXR ranges from values of 0 to 100 and reflects strengthening

// and weakening trends. However, because it represents an average of ADX, values

// don't fluctuate as dramatically and some analysts believe the indicator helps

// better display trends in volatile markets.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

fADX(Len) =>

up = change(high)

down = -change(low)

trur = rma(tr, Len)

plus = fixnan(100 * rma(up > down and up > 0 ? up : 0, Len) / trur)

minus = fixnan(100 * rma(down > up and down > 0 ? down : 0, Len) / trur)

sum = plus + minus

100 * rma(abs(plus - minus) / (sum == 0 ? 1 : sum), Len)

ADXR(LengthADX, LengthADXR, Signal1, Signal2) =>

xADX = fADX(LengthADX)

xADXR = (xADX + xADX[LengthADXR]) / 2

pos = 0.0

pos := iff(xADXR < Signal1, 1,

iff(xADXR > Signal2, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal and Average Directional Movement Index Rating", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

LengthADX = input(title="Length ADX", defval=14)

LengthADXR = input(title="Length ADXR", defval=14)

Signal1 = input(13, step=0.01)

Signal2 = input(45, step=0.01)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posADXR = ADXR(LengthADX, LengthADXR, Signal1, Signal2 )

pos = iff(posReversal123 == 1 and posADXR == 1 , 1,

iff(posReversal123 == -1 and posADXR == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? red: possig == 1 ? green : blue )