概述

本策略利用布林带的黄金分割线,结合均线形态判断进行回归交易。当价格接触布林带黄金分割线时看作买入信号,利用价格的均衡回归特征获得获利。

策略原理

- 计算布林带的中轨、上轨和黄金分割下轨

- 中轨:n周期的加权移动平均线vwma

- 上轨:中轨 + k * n周期的标准差

- 黄金分割下轨:中轨 - 0.618 * n周期的标准差

- 判断形态

- 50日均线上穿200日均线,符合趋势向上

- 价格接触或低于黄金分割下轨,作为买入信号

- 退出

- 价格上穿布林带上轨,认为价格已经离开下轨回归,此时平仓

- 止损

- 设定固定百分比止损,如5%

策略优势

使用vwma而不是sma作为布林带的中轨,可以更好地反映价格的移动趋势

黄金分割是重要的支撑/阻力区域,这为回归提供依据

均线多头排列,确保大趋势向上

固定止损确保单笔损失控制

策略风险

黄金分割线不是确定的支撑,价格可能直接跌穿

固定止损可能过于武断,应考虑根据市场波动调整

均线多头排列也可能是假突破,应结合更多指标判断

回归长度不确定,需要设定合理的止盈离场点

优化方向

可以测试不同参数组合,如布林带周期、标准差倍数、固定止损百分比等

可以加入更多指标判断市场趋势和回归概率,如MACD、KD等

可以考虑动态止损,根据ATR止损或跟踪止损

可以优化止盈策略,如移动止盈、分批止盈等

总结

本策略利用布林带黄金分割线进行均衡回归交易,具有交易逻辑清晰、参数设定简单、回撤可控等优点。但也存在一定的风险,需要进一步测试和优化,加入更多技术指标判断和止损/止盈工具,才能实际应用。总体来说,该策略提供了一种利用黄金分割法则进行量化交易的思路,值得进一步探索。

策略源码

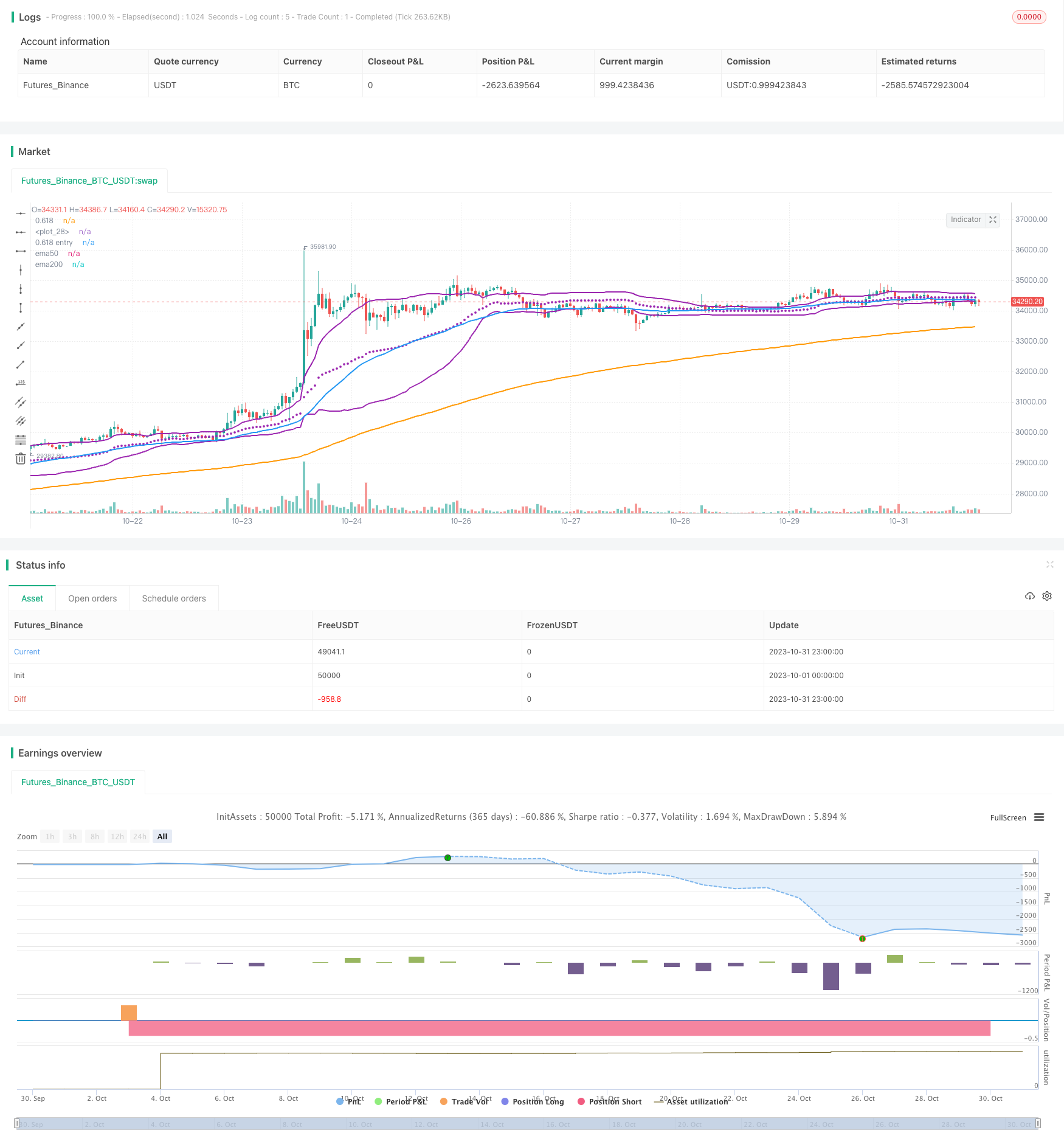

/*backtest

start: 2023-10-01 00:00:00

end: 2023-10-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © mohanee

//@version=4

strategy(title="Bollinger Band with Fib Golden Ratio (0.618)", shorttitle="Bollinger Band with Fib Golden Ratio" , overlay=true, pyramiding=1, default_qty_type=strategy.percent_of_equity, default_qty_value=20, initial_capital=10000, currency=currency.USD)

length = input(50,title="BB Length" , minval=1)

src1 = input(hlc3, title="Source")

//mult1 = input(1.33, minval=0.001, maxval=50)

mult = input(1.5,title="multplier", minval=0.001, maxval=50)

stopLoss=input(5,title="Stop Loss",minval=1)

basis = vwma(src1, length)

dev = mult * stdev(src1, length)

//dev3 = mult3 * stdev(src, length)

upper_618= basis + (0.618*dev)

lower_618= basis - (0.618*dev)

//lower_618_dev3= basis - (0.618*dev3)

plot_upper618= plot(upper_618, color=color.purple, linewidth=2, title="0.618")

plot(basis, color=color.purple,style=plot.style_circles, linewidth=2)

plot_lower618= plot(lower_618, color=color.purple, linewidth=2, title="0.618 entry")

//plot_lower618_dev3= plot(lower_618_dev3, color=color.red, linewidth=1, title="0.618 stop")

//plot_lower618= plot(lower_618, color=color.purple, linewidth=1, title="0.618 entry")

ema200=ema(close,200)

ema50=ema(close,50)

plot (ema200, title="ema200", color=color.orange, linewidth=2)

plot (ema50, title="ema50", color=color.blue , linewidth=2)

longCondition= ema50 > ema200

strategy.entry(id="BB_Fib618", long=true, when = longCondition and ( close < lower_618 or low <= lower_618) )

strategy.close(id="BB_Fib618", comment="points="+tostring(close - strategy.position_avg_price, "###.##") , when = strategy.position_size >= 1 and crossover(close,upper_618 ))

//stoploss exit

stopLossVal = strategy.position_size>=1 ? strategy.position_avg_price * ( 1 - (stopLoss/100) ) : 0.00

strategy.close(id="BB_Fib618", comment="SL="+tostring(close - strategy.position_avg_price, "###.##"), when=abs(strategy.position_size)>=1 and close < stopLossVal ) //and close > strategy.position_avg_price )