概述

双均线反转策略(Dual Moving Average Reversion Strategy)是一种典型的短期反转交易策略。该策略运用两个不同参数设置的均线进行交易信号发出,在趋势出现反转的时候获取利润。

策略原理

该策略使用两个均线进行交易信号的生成。第一个均线maopening用于判断趋势方向,第二个均线maclosing用于发出交易信号。

当maopening上涨时,表示目前处于趋势上升阶段;当maopening下跌时,表示目前处于趋势下降阶段。maclosing乘以一个大于1的系数,使其更加灵敏,可以提前发出反转信号。

具体来说,当maopening上涨且maclosing下穿maopening时,表示趋势反转,这时策略会开仓做空;当maopening下跌且maclosing上穿maopening时,表示趋势反转,这时策略会开仓做多。

该策略的参数包括均线类型、长度、数据源等,可以通过调整这些参数来获得更好的交易效果。另外,策略还内置了一些可选项,如开仓方式、止损方式等,可以根据需要进行设置。

优势分析

双均线反转策略的优势主要包括:

回撤小,适合短线交易。使用两个快速均线,可以快速捕捉短期趋势的反转,回撤较小。

实现简单,容易掌握。双均线形成交叉就是交易信号,非常简单明了。

可调参数多,可以优化。包含2个均线的参数及系数,可以通过优化找到最佳参数组合。

可スケジュール化,适合自动化交易。策略逻辑简单清晰,执行频率高,非常适合编程实现自动交易。

可控风险,具有止损机制。可设置移动止损或数值止损,可以控制单笔损失。

风险分析

双均线反转策略也存在一些风险:

双均线交叉存在滞后。均线本身滞后于价格,交叉发生时趋势可能已经反转了一段时间。

容易被套。趋势反转不一定能持续,可能很快再次反转回来,造成套牢。

回撤依然存在。及时止损可以降低单笔损失,但连续止损也会造成较大回撤。

数据优化风险。过度优化参数,在历史数据表现好但实盘效果不佳。

对应风险的解决方法包括:

优化参数,找到快速响应的均线设置。

结合其他指标避免套牢,如量价指标、波动率指标等。

调整止损位置,降低连续止损概率。

多组参数优化测试,评估参数健壮性。

优化方向

双均线反转策略可以从以下几个方面进行优化:

测试不同类型的均线,寻找反应更灵敏的均线。如Kama、ZLEMA等。

优化均线参数,找到最佳长度组合。通常较短周期的均线效果更好。

测试不同的数据源,如收盘价、均价、典型价等。

增加趋势过滤,避免不合适的反转信号。可用Donchian通道等。

结合其他指标进行确认,如量价指标MACD、OBV等。

增加风险管理机制,如移动止损、账户最大损失等。

进行组合优化,寻找最佳资产配置比例。

增加参数健壮性测试,评估参数过优化风险。

总结

双均线反转策略是一个简单实用的短线策略,适合用于捕捉市场的短期反转。该策略回撤小、容易实现,非常适合定量交易。但也存在一些问题,如滞后、套牢等风险。可以通过优化参数、增加指标过滤、改进风险控制等方法来改进策略效果,开发出一个稳定、具有实盘效果的高效策略。

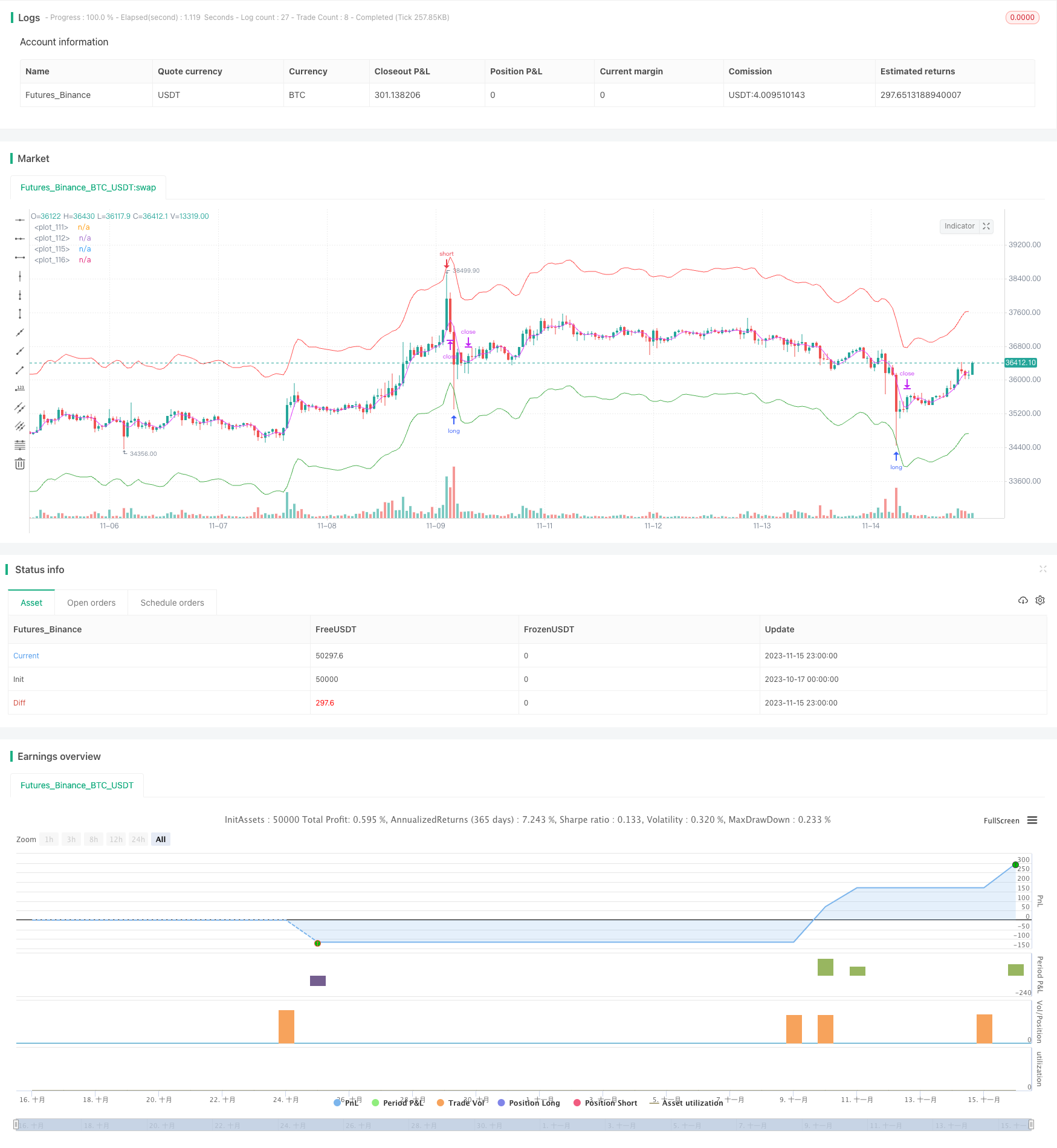

/*backtest

start: 2023-10-17 00:00:00

end: 2023-11-16 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title = "hamster-bot MRS 2", overlay = true, default_qty_type = strategy.percent_of_equity, initial_capital = 100, default_qty_value = 100, pyramiding = 9, commission_value = 0.045, backtest_fill_limits_assumption = 1)

info_options = "Options"

on_close = input(false, title = "Entry on close", inline=info_options, group=info_options)

OFFS = input.int(0, minval = 0, maxval = 1, title = "| Offset View", inline=info_options, group=info_options)

trade_offset = input.int(0, minval = 0, maxval = 1, title = "Trade", inline=info_options, group=info_options)

use_kalman_filter = input.bool(false, title="Use Kalman filter", group=info_options)

//MA Opening

info_opening = "MA Opening"

maopeningtyp = input.string("SMA", title="Type", options=["SMA", "EMA", "TEMA", "DEMA", "ZLEMA", "WMA", "Hma", "Thma", "Ehma", "H", "L", "DMA"], title = "", inline=info_opening, group=info_opening)

maopeningsrc = input.source(ohlc4, title = "", inline=info_opening, group=info_opening)

maopeninglen = input.int(3, minval = 1, maxval = 200, title = "", inline=info_opening, group=info_opening)

//MA Closing

info_closing = "MA Closing"

maclosingtyp = input.string("SMA", title="Type", options=["SMA", "EMA", "TEMA", "DEMA", "ZLEMA", "WMA", "Hma", "Thma", "Ehma", "H", "L", "DMA"], title = "", inline=info_closing, group=info_closing)

maclosingsrc = input.source(ohlc4, title = "", inline=info_closing, group=info_closing)

maclosinglen = input.int(3, minval = 1, maxval = 200, title = "", inline=info_closing, group=info_closing)

maclosingmul = input.float(1, step = 0.005, title = "mul", inline=info_closing, group=info_closing)

long1on = input(true, title = "", inline = "long1")

long1shift = input.float(0.96, step = 0.005, title = "Long", inline = "long1")

long1lot = input.int(10, minval = 0, maxval = 10000, step = 10, title = "Lot 1", inline = "long1")

short1on = input(true, title = "", inline = "short1")

short1shift = input.float(1.04, step = 0.005, title = "short", inline = "short1")

short1lot = input.int(10, minval = 0, maxval = 10000, step = 10, title = "Lot 1", inline = "short1")

startTime = input(timestamp("01 Jan 2010 00:00 +0000"), "Start date", inline = "period")

finalTime = input(timestamp("31 Dec 2030 23:59 +0000"), "Final date", inline = "period")

HMA(_src, _length) => ta.wma(2 * ta.wma(_src, _length / 2) - ta.wma(_src, _length), math.round(math.sqrt(_length)))

EHMA(_src, _length) => ta.ema(2 * ta.ema(_src, _length / 2) - ta.ema(_src, _length), math.round(math.sqrt(_length)))

THMA(_src, _length) => ta.wma(ta.wma(_src,_length / 3) * 3 - ta.wma(_src, _length / 2) - ta.wma(_src, _length), _length)

tema(sec, length)=>

tema1= ta.ema(sec, length)

tema2= ta.ema(tema1, length)

tema3= ta.ema(tema2, length)

tema_r = 3*tema1-3*tema2+tema3

donchian(len) => math.avg(ta.lowest(len), ta.highest(len))

ATR_func(_src, _len)=>

atrLow = low - ta.atr(_len)

trailAtrLow = atrLow

trailAtrLow := na(trailAtrLow[1]) ? trailAtrLow : atrLow >= trailAtrLow[1] ? atrLow : trailAtrLow[1]

supportHit = _src <= trailAtrLow

trailAtrLow := supportHit ? atrLow : trailAtrLow

trailAtrLow

f_dema(src, len)=>

EMA1 = ta.ema(src, len)

EMA2 = ta.ema(EMA1, len)

DEMA = (2*EMA1)-EMA2

f_zlema(src, period) =>

lag = math.round((period - 1) / 2)

ema_data = src + (src - src[lag])

zl= ta.ema(ema_data, period)

f_kalman_filter(src) =>

float value1= na

float value2 = na

value1 := 0.2 * (src - src[1]) + 0.8 * nz(value1[1])

value2 := 0.1 * (ta.tr) + 0.8 * nz(value2[1])

lambda = math.abs(value1 / value2)

alpha = (-math.pow(lambda, 2) + math.sqrt(math.pow(lambda, 4) + 16 * math.pow(lambda, 2)))/8

value3 = float(na)

value3 := alpha * src + (1 - alpha) * nz(value3[1])

//SWITCH

ma_func(modeSwitch, src, len, use_k_f=true) =>

modeSwitch == "SMA" ? use_kalman_filter and use_k_f ? f_kalman_filter(ta.sma(src, len)) : ta.sma(src, len) :

modeSwitch == "RMA" ? use_kalman_filter and use_k_f ? f_kalman_filter(ta.rma(src, len)) : ta.rma(src, len) :

modeSwitch == "EMA" ? use_kalman_filter and use_k_f ? f_kalman_filter(ta.ema(src, len)) : ta.ema(src, len) :

modeSwitch == "TEMA" ? use_kalman_filter and use_k_f ? f_kalman_filter(tema(src, len)) : tema(src, len):

modeSwitch == "DEMA" ? use_kalman_filter and use_k_f ? f_kalman_filter(f_dema(src, len)) : f_dema(src, len):

modeSwitch == "ZLEMA" ? use_kalman_filter and use_k_f ? f_kalman_filter(f_zlema(src, len)) : f_zlema(src, len):

modeSwitch == "WMA" ? use_kalman_filter and use_k_f ? f_kalman_filter(ta.wma(src, len)) : ta.wma(src, len):

modeSwitch == "VWMA" ? use_kalman_filter and use_k_f ? f_kalman_filter(ta.vwma(src, len)) : ta.vwma(src, len):

modeSwitch == "Hma" ? use_kalman_filter and use_k_f ? f_kalman_filter(HMA(src, len)) : HMA(src, len):

modeSwitch == "Ehma" ? use_kalman_filter and use_k_f ? f_kalman_filter(EHMA(src, len)) : EHMA(src, len):

modeSwitch == "Thma" ? use_kalman_filter and use_k_f ? f_kalman_filter(THMA(src, len/2)) : THMA(src, len/2):

modeSwitch == "ATR" ? use_kalman_filter and use_k_f ? f_kalman_filter(ATR_func(src, len)): ATR_func(src, len) :

modeSwitch == "L" ? use_kalman_filter and use_k_f ? f_kalman_filter(ta.lowest(len)): ta.lowest(len) :

modeSwitch == "H" ? use_kalman_filter and use_k_f ? f_kalman_filter(ta.highest(len)): ta.highest(len) :

modeSwitch == "DMA" ? donchian(len) : na

//Var

sum = 0.0

maopening = 0.0

maclosing = 0.0

os = maopeningsrc

cs = maclosingsrc

pos = strategy.position_size

p = 0.0

p := pos == 0 ? (strategy.equity / 100) / close : p[1]

truetime = true

loss = 0.0

maxloss = 0.0

equity = 0.0

//MA Opening

maopening := ma_func(maopeningtyp, maopeningsrc, maopeninglen)

//MA Closing

maclosing := ma_func(maclosingtyp, maclosingsrc, maclosinglen) * maclosingmul

long1 = long1on == false ? 0 : long1shift == 0 ? 0 : long1lot == 0 ? 0 : maopening == 0 ? 0 : maopening * long1shift

short1 = short1on == false ? 0 : short1shift == 0 ? 0 : short1lot == 0 ? 0 : maopening == 0 ? 0 : maopening * short1shift

//Colors

maopeningcol = maopening == 0 ? na : color.blue

maclosingcol = maclosing == 0 ? na : color.fuchsia

long1col = long1 == 0 ? na : color.green

short1col = short1 == 0 ? na : color.red

//Lines

plot(maopening, offset = OFFS, color = maopeningcol)

plot(maclosing, offset = OFFS, color = maclosingcol)

long1line = long1 == 0 ? close : long1

short1line = short1 == 0 ? close : short1

plot(long1line, offset = OFFS, color = long1col)

plot(short1line, offset = OFFS, color = short1col)

//Lots

lotlong1 = p * long1lot

lotshort1 = p * short1lot

//Entry

if maopening > 0 and maclosing > 0 and truetime

//Long

sum := 0

strategy.entry("L", strategy.long, lotlong1, limit = on_close ? na : long1, when = long1 > 0 and pos <= sum and (on_close ? close <= long1[trade_offset] : true))

sum := lotlong1

//Short

sum := 0

pos := -1 * pos

strategy.entry("S", strategy.short, lotshort1, limit = on_close ? na : short1, when = short1 > 0 and pos <= sum and (on_close ? close >= short1[trade_offset] : true))

sum := lotshort1

strategy.exit("Exit", na, limit = maclosing)

if time > finalTime

strategy.close_all()