概述

本策略的目的是测试不同的输入变量如K线颜色、成交量和随机方法,是否可以用正弦波的方式来预测价格变化。策略将这些变量转化为正弦波的形式,当波峰或波谷达到设定次数时,做出买入或卖出决策。

策略原理

策略分为三个部分,第一个部分检测K线的颜色变化。当几根相同颜色的K线后,出现不同颜色时则正弦波转向。第二部分检测成交量是否高于或低于均值,当突破均值时波转向。第三部分使用随机方法模拟掷硬币,随机结果不同则波转向。这三个波累积到设定次数时,做出交易决策。

代码通过跟踪三个波的当前方向、波峰数和上一个K线的情况,来控制波的运行。当波峰数达到参数设定时,改变运行方向。通过这个循环来模拟正弦波运行。

优势分析

这种正弦波理论看似很有道理,模拟出来的波形也与现实市场有一定关联。但通过本策略的测试可以发现,其实都是随机结果。哪种变量组合的波形看起来更像,并不能提高交易结果。

所以该策略的一个优势是反驳了“市场可以预测”这一错误观念。市场中的变量确实会影响价格,但不可预测,随机决策也可获得相近结果。

风险分析

本策略最大的风险就是随机交易中难以确定盈亏。不同参数下结果也难以预测,无法提前确定是否可盈利。

此外,正弦波预测理论本身就是错误的。市场变化太复杂,不可能用简单周期性模拟。所以该策略无法真正应用于实盘交易中。

为降低风险,需要对随机结果进一步分析,确定参数范围;或者结合其他分析方法来验证交易信号。

优化方向

本策略可以从以下几个方向进行优化:

- 增加更多变量转换为波,扩大样本空间

- 对当前三个波进行组合,寻找最佳遍历组合

- 设置止损方式,比如亏损比例止损

- 优化入场出场逻辑,进行回测寻找最佳参数

总结

本策略通过测试不同正弦波,说明了市场不可预测的本质。同时也反驳了用波形循环来预测的错误理论。

下一步,可以通过增加变量、组合波形、设置止损和优化参数等方式提高策略的实盘可用性。但关键还是要理解,市场变化复杂多变,不容易预测。我们要做的是降低随机风险,而不是预测市场。

策略源码

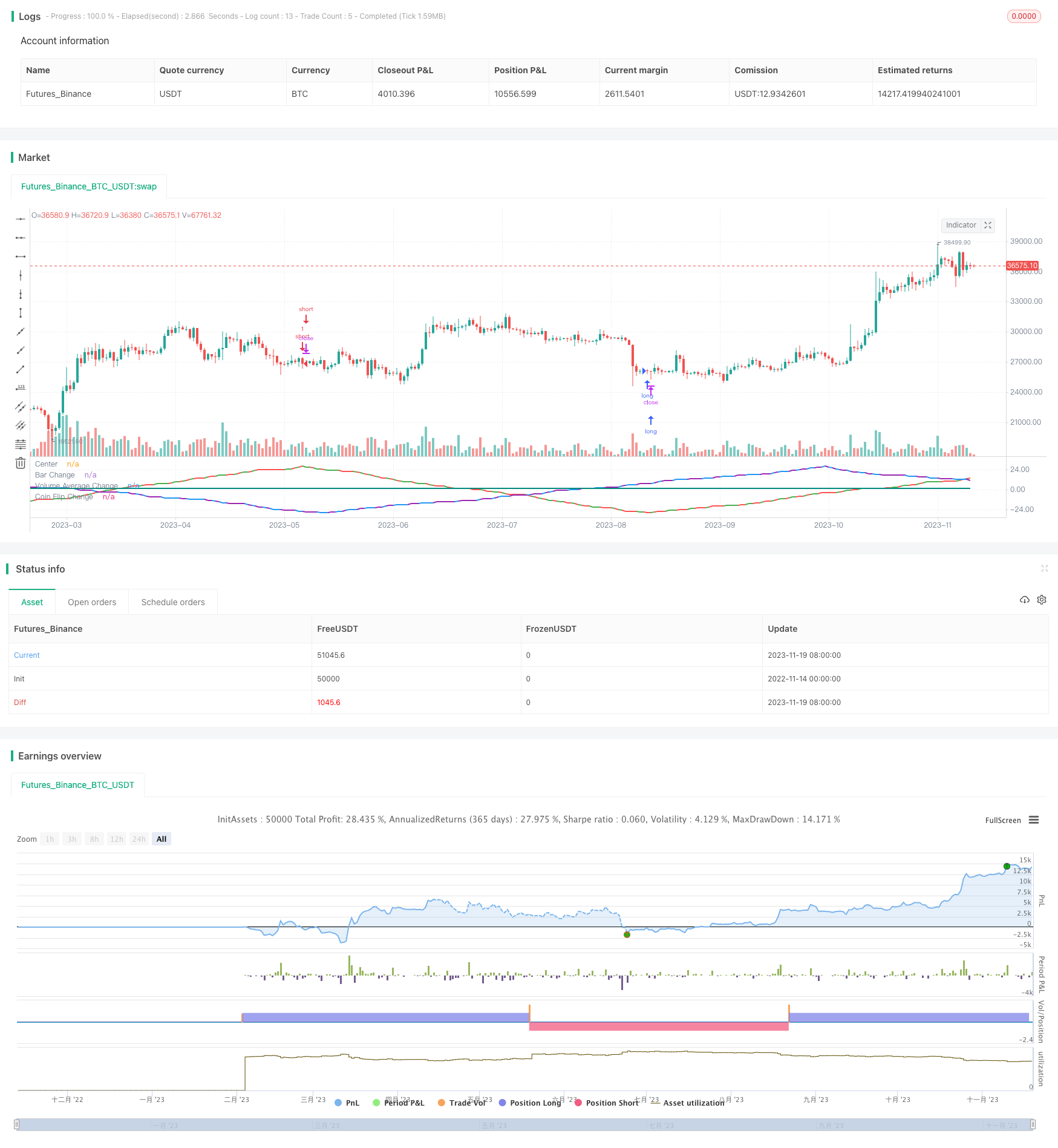

/*backtest

start: 2022-11-14 00:00:00

end: 2023-11-20 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Gentleman-Goat

//@version=5

strategy("Sine Wave Theory",overlay=false, precision = 2, initial_capital = 1000,shorttitle = "SINE_W_T")

var bar_change_wave_direction = input.int(defval=1,title="Starting Wave Direction",group="Bar Change")

bar_change_sine_wave_number = input.int(defval=28,title="Sine Wave #",group="Bar Change")

bar_change_sine_wave_res = input.timeframe(defval="D",title="Resolution",group="Bar Change")

bar_change_trade = input.bool(defval=true,title="Trade",group="Bar Change")

var volume_wave_direction = input.int(defval=1,title="Starting Wave Direction",group="Volume")

avg_volume_length = input.int(7,title="Lookback Length",group="Volume")

volume_sine_wave_number = input.int(defval=28,title="Sine Wave #",group="Volume")

volume_sine_wave_res = input.timeframe(defval="D",title="Resolution",group="Volume")

volume_trade = input.bool(defval=false,title="Trade",group="Volume")

var coin_flip_wave_direction = input.int(defval=1,title="Starting Wave Direction",group="Coin Flip")

coin_flip_sine_wave_number = input.int(defval=28,title="Sine Wave #",group="Coin Flip")

coin_flip_seed = input.int(defval=1,title="Seed #",group="Coin Flip")

coin_flip_trade = input.bool(defval=false,title="Trade",group="Coin Flip")

avg_volume = ta.sma(volume,avg_volume_length)

//Green or Red Candle

bar_color = close>open ? color.green : color.red

bar_color_time_adj = request.security(syminfo.tickerid, bar_change_sine_wave_res, bar_color)

//Above or Below Average

volume_state = (volume>avg_volume) ? color.blue : color.purple

volume_state_time_adj = request.security(syminfo.tickerid, volume_sine_wave_res, volume_state)

//Coinflip

coin_flip = math.random(0,100,coin_flip_seed)>=50 ? color.teal : color.yellow

var bar_change_wave_count = 0

var volume_wave_count = 0

var coin_flip_wave_count = 0

//Wave Counters

if(volume_state_time_adj[1] != volume_state_time_adj)

volume_wave_count := volume_wave_count + volume_wave_direction

if(bar_color_time_adj[1] != bar_color_time_adj)

bar_change_wave_count := bar_change_wave_count + bar_change_wave_direction

if(coin_flip[1] != coin_flip)

coin_flip_wave_count := coin_flip_wave_count + coin_flip_wave_direction

//Direction changers

if(math.abs(bar_change_wave_count) == bar_change_sine_wave_number and bar_color_time_adj[1] != bar_color_time_adj)

bar_change_wave_direction := bar_change_wave_direction * -1

if(math.abs(volume_wave_count) == volume_sine_wave_number and volume_state_time_adj[1] != volume_state_time_adj)

volume_wave_direction := volume_wave_direction * -1

if(math.abs(coin_flip_wave_count) == coin_flip_sine_wave_number and coin_flip[1] != coin_flip)

coin_flip_wave_direction := coin_flip_wave_direction * -1

//Entry positions

if(bar_change_wave_count==bar_change_sine_wave_number and bar_change_trade==true)

strategy.entry(id="short",direction=strategy.short)

if(bar_change_wave_count==bar_change_sine_wave_number*-1 and bar_change_trade==true)

strategy.entry(id="long",direction=strategy.long)

if(volume_wave_count==volume_sine_wave_number and volume_trade==true)

strategy.entry(id="short-volume",direction=strategy.short)

if(volume_wave_count==volume_sine_wave_number*-1 and volume_trade==true)

strategy.entry(id="long-volume",direction=strategy.long)

if(coin_flip_wave_count==coin_flip_sine_wave_number and coin_flip_trade==true)

strategy.entry(id="short-coinflip",direction=strategy.short)

if(coin_flip_wave_count==coin_flip_sine_wave_number*-1 and coin_flip_trade==true)

strategy.entry(id="long-coinflip",direction=strategy.long)

hline(0, title='Center', color=color.white, linestyle=hline.style_dashed, linewidth=1)

plot(bar_change_wave_count,title="Bar Change", color=bar_color, linewidth=2)

plot(volume_wave_count,title="Volume Average Change", color=volume_state, linewidth=2)

plot(coin_flip_wave_count,title="Coin Flip Change", color=coin_flip, linewidth=2)