概述

本策略基于布林带指标,结合动量指标,实现布林带回归和动量突破的组合交易策略。当价格从布林带下方突破中线时做多,当价格从布林带上方突破中线时做空,并追踪止损止盈情况,在达到目标盈亏比后平仓。

策略原理

本策略使用布林带中线sma作为均线指标,带宽通过参数mult*stdev动态调整。当价格从下方突破中线时,说明价格获取上行动量,这时做多;当价格从上方突破中线时,说明价格获取下行动量,这时做空。做多做空后设置止盈止损参数,用于追踪利润和控制风险。

具体来说,布林带的计算通过length和mult两个参数完成,长度length决定中线的周期,mult决定带宽的大小。enterLong和enterShort判断突破的时机,exitLong和exitShort根据入场价格和目标止盈止损比例计算止损止盈价格。

策略优势

本策略结合了均线回归和动量指标,能够在趋势开始阶段顺势捕捉较大行情。与简单跟踪均线相比,增加了基于布林带宽度的动量判断,可以过滤掉部分假突破。止盈止损设置直接基于入场价格计算,无需人工干预。

策略风险

- 布林带拟合价格时存在滞后,可能错过部分行情

- 止损设置过于宽松会增加亏损风险

- 多头行情中做空的信号可能获取不佳

可以通过调整布林中线周期、带宽参数以及止损范围来优化,使得策略更加适应不同市场情况。

策略优化

- 加入交易量或波动率指标,避免低量的假突破

- param分批优化布林周期长度、宽度系数、止损幅度

- 在特定市场阶段只做多或只做空

- 加入机器学习模型判定趋势方向

总结

本策略整合布林带回归和动量指标的优点,可以在趋势开始的时候顺势捕捉部分行情,通过参数调整可以适应不同阶段市场,是一种较为通用的突破系统。止盈止损设置直接从价格计算可以减少人工干预。本策略也存在一些改进空间,例如加入更多辅助判决指标等,这些将在后续的研究和优化中进一步完善。

策略源码

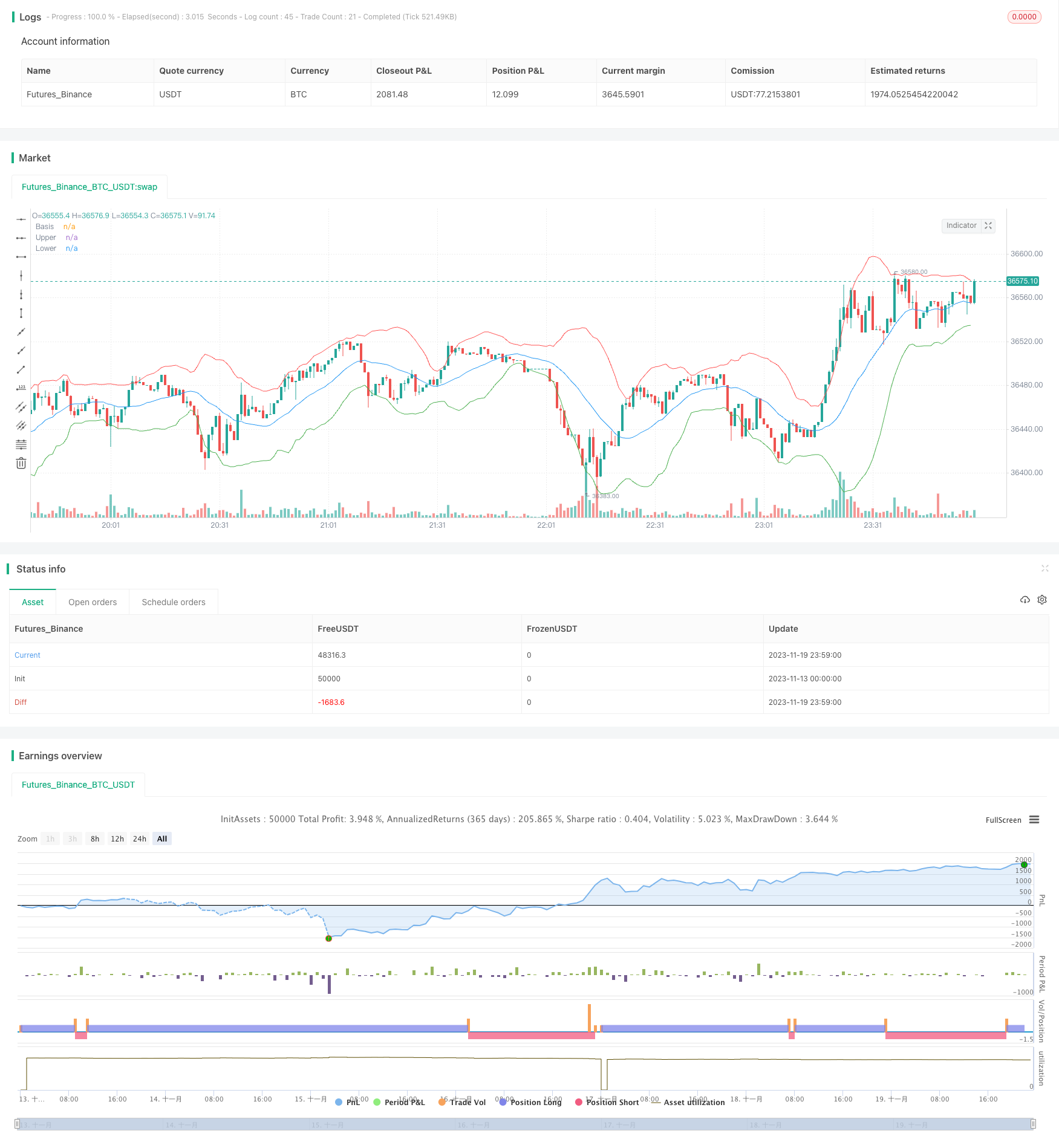

/*backtest

start: 2023-11-13 00:00:00

end: 2023-11-20 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("BURATINO", overlay=true)

// Входные параметры

length = input(20, minval=1, title="Length")

mult = input(2.0, minval=0.1, maxval=5, title="Multiplier")

target_percent = input(0.5, minval=0.1, title="Target Percent")

stop_loss_percent = input(95, minval=0.1, title="Stop Loss Percent")

// Расчет полос Боллинджера

basis = sma(close, length)

dev = mult * stdev(close, length)

upper = basis + dev

lower = basis - dev

// Переворот снизу вверх через среднюю линию Боллинджера для открытия лонга

enterLong = cross(close, basis) and close[1] < basis[1]

// Переворот сверху вниз через среднюю линию Боллинджера для открытия шорта

enterShort = cross(basis, close) and close[1] > basis[1]

// Закрытие лонга после роста цены на указанный процент или падения на указанный процент

exitLong = close >= strategy.position_avg_price * (1 + (target_percent / 100)) or close <= strategy.position_avg_price * (1 - (stop_loss_percent / 100))

// Закрытие шорта после падения цены на указанный процент или роста на указанный процент

exitShort = close <= strategy.position_avg_price * (1 - (target_percent / 100)) or close >= strategy.position_avg_price * (1 + (stop_loss_percent / 100))

// Управление позициями и ограничениями на открытие противоположных позиций

strategy.entry("Long", strategy.long, when = enterLong and strategy.position_size == 0)

strategy.entry("Short", strategy.short, when = enterShort and strategy.position_size == 0)

strategy.close("Long", when = exitLong)

strategy.close("Short", when = exitShort)

// Визуализация полос Боллинджера

plot(basis, color=color.blue, title="Basis")

plot(upper, color=color.red, title="Upper")

plot(lower, color=color.green, title="Lower")