概述

这个策略综合运用了移动平均线、CCI指标、PSAR指标和ADX动向指数等多个指标,实现了一个比较典型的突破策略。当市场出现明确的多头信号时做多,出现明确空头信号时做空,非常适合中短线操作。

原理

该策略的入场条件包含以下几个方面: 1. 移动平均线方面:要求5日线上穿10日线,10日线上穿20日线,20日线上穿40日线,这样能有效过滤掉多数假突破。 2. CCI指标方面:要求CCI指标小于-100时为多头入场signal,大于100时为空头入场signal。 3. PSAR点状方向指标方面:要求PSAR点状指标的方向与价格区分趋势的方向一致。 4. ADX动态指标方面:要求ADX大于20,表示目前处于趋势市场,适合使用突破系统。

同时,出场条件也考虑了多个指标: 1. 移动平均线方面:与入场条件相反,如5日线下穿10日线则为头寸平仓信号。 2. CCI指标、PSAR点状指标也与入场条件相反,如CCI指标大于100则为多单平仓。

这样,策略的入场比较严格,出场比较宽松,这样可以获得比较高的获利率。

优势

这是一个比较典型的多指标组合突破策略,具有以下几个优势:

- 入场条件严格,采用多重指标过滤,可以减少假突破带来的风险。

- 指标参数经过优化,对市场有很好的适应性。

- 采用了趋势判断指标,避免在震荡市场中被套。

- 采用了移动平均线来确定中短线走势,比较稳定。

- CCI指标可以捕捉短期超买超卖现象。

- PSAR点状指标判断市场趋势方向的能力较强。

风险

该策略也存在以下风险:

- 在极端行情中,多重指标组合的效果会打折扣,无法全面过滤风险。

- 趋势巨大时,采用中短期指标判断时机可能会失效,无法完全捕捉趋势。

- CCI等局部指标参数设置不当可能导致错失机会。

- PSAR指标在趋势转折点效果不佳。

对策:

1. 可适当放宽入场条件,付出更多成本换取更低风险。

2. 增加更长线段的指标判断,如60日乃至更长的移动平均线。

3. 动态优化CCI等参数。

4. 结合更多指标判断走势,如布林线。

优化方向

该策略还有以下几个优化的方向:

- 增加机器学习算法,实时优化参数,提高参数的自适应性。

- 增加模型组合技术,结合更多非相关性策略,提高稳定性。

- 引入风控机制,如止损策略,可以有效控制单笔止损。

- 增加趋势判断模块,避免陷入震荡行情。

- 优化指标权重,使得不同市场环境中最优指标起主导作用。

总结

该策略总的来说是一个典型且经典的多指标突破策略。它优点是入场条件严谨,出场条件宽松,而且包含了趋势判断模块。但是也存在一定的风险,需要不断优化,使其能够适应更加复杂的市场环境。模型组合和参数优化都是它的发展方向。

策略源码

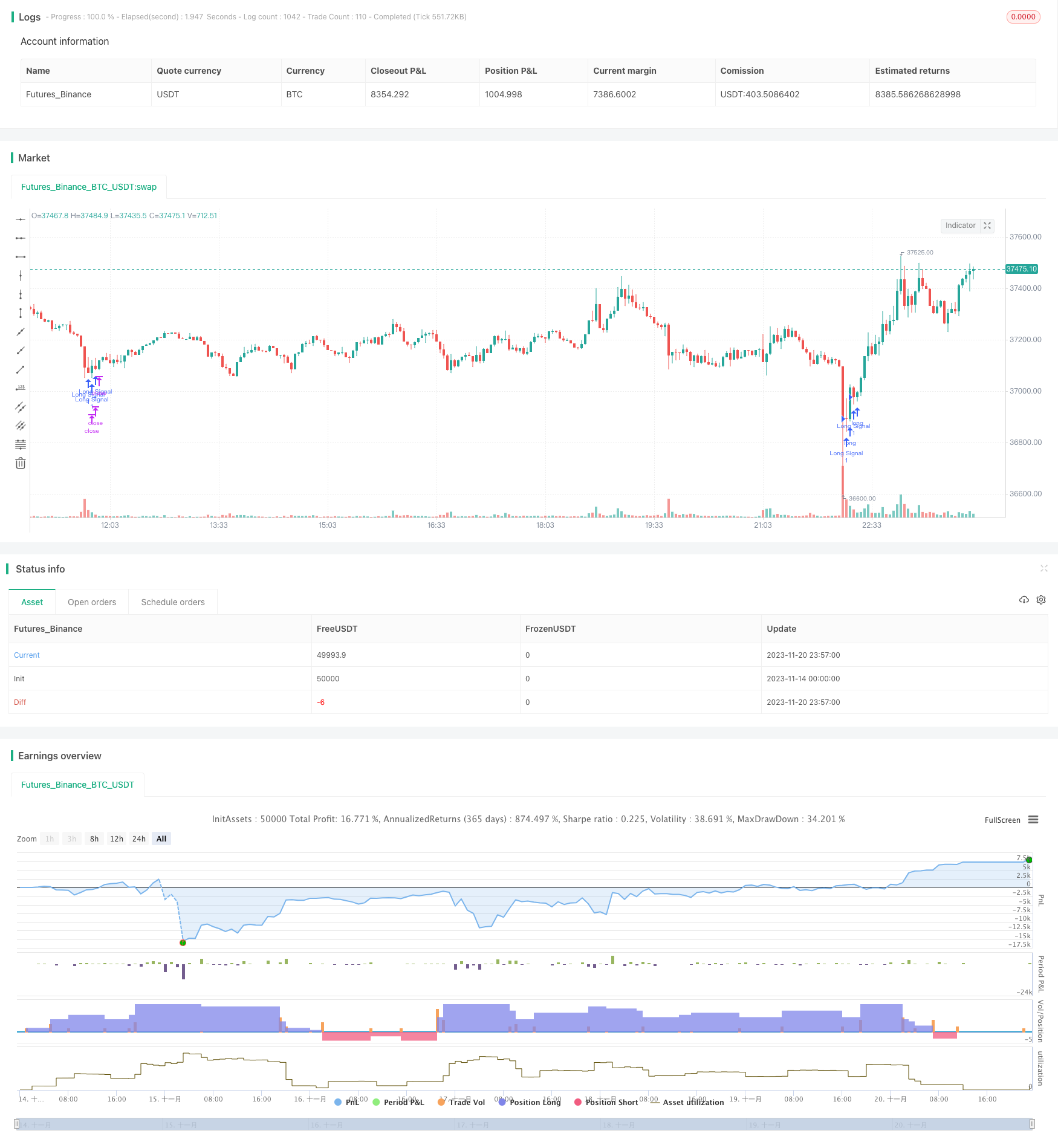

/*backtest

start: 2023-11-14 00:00:00

end: 2023-11-21 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="Bukan Kaleng Kaleng Li", shorttitle="BKKL", overlay=true)

psarDot = sar(0.01, 0.01, 0.2)

up = change(high)

down = -change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

trur = rma(tr, 14)

plus = fixnan(100 * rma(plusDM, 14) / trur)

minus = fixnan(100 * rma(minusDM, 14) / trur)

sum = plus + minus

adx = 100 * rma(abs(plus - minus) / (sum == 0 ? 1 : sum), 14)

longConditionSMA4020 = sma(close, 40) > sma(close, 20)

longConditionSMA2010 = sma(close, 20) > sma(close, 10)

longConditionSMA105 = sma(close, 10) > sma(close, 5)

longConditionSMA = longConditionSMA4020 and longConditionSMA2010 and longConditionSMA105

longConditionCCI = cci(close, 20) < -100

longConditionPSAR = psarDot > close

longConditionDMI = plus < 10

adxCondition = adx > 20

longCondition = longConditionSMA and longConditionCCI and longConditionPSAR and longConditionDMI

if (longCondition and adxCondition)

strategy.order("Long Signal", true)

shortConditionSMA4020 = sma(close, 40) < sma(close, 20)

shortConditionSMA2010 = sma(close, 20) < sma(close, 10)

shortConditionSMA105 = sma(close, 10) < sma(close, 5)

shortConditionSMA = shortConditionSMA4020 and shortConditionSMA2010 and shortConditionSMA105

shortConditionCCI = cci(close, 20) > 100

shortConditionPSAR = psarDot < close

shortConditionDMI = minus < 10

shortCondition = shortConditionSMA and shortConditionCCI and shortConditionPSAR and shortConditionDMI

if (shortCondition and adxCondition)

strategy.order("Short Signal", false)