概述

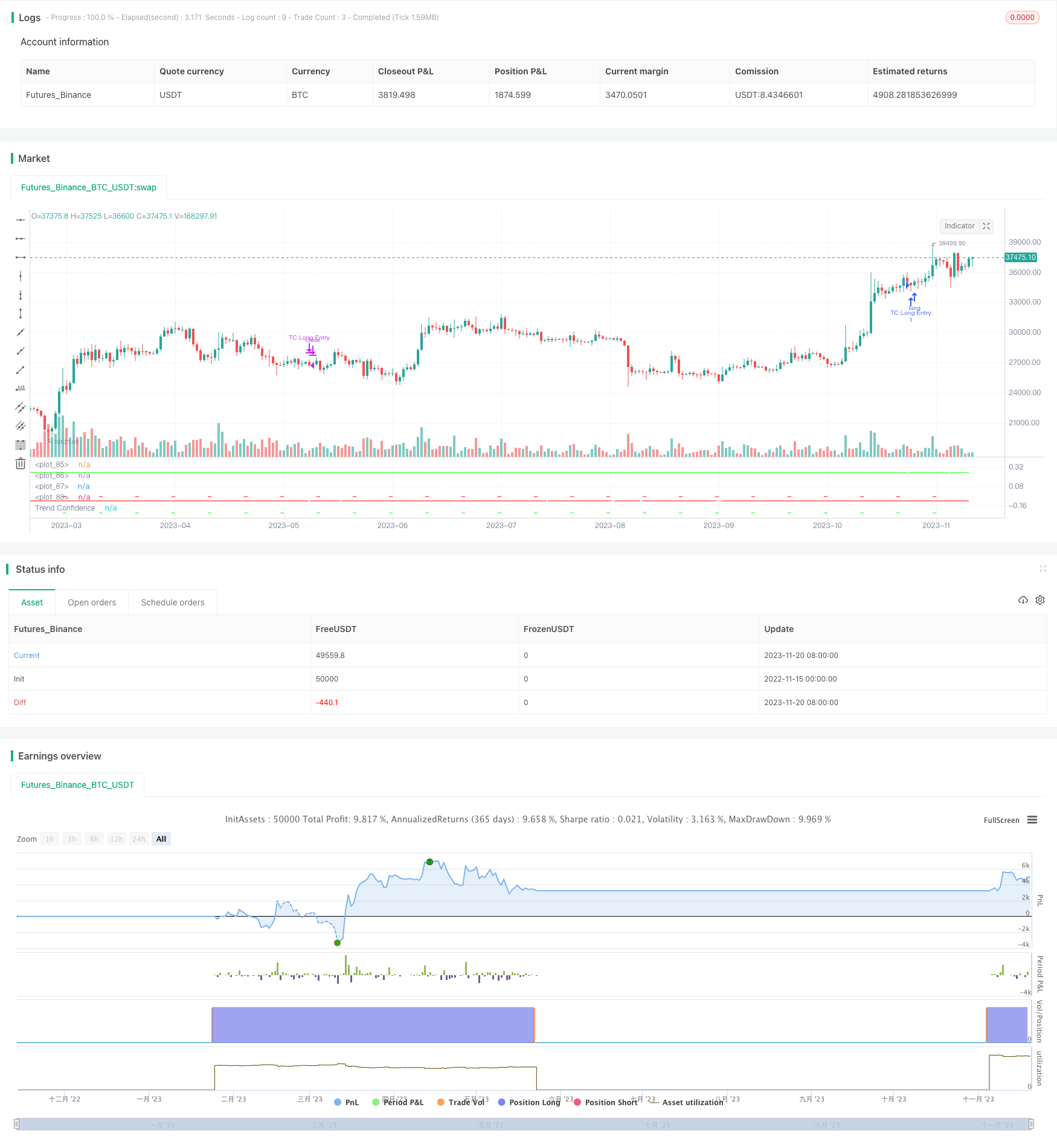

该策略的主要思想是实现一个尽可能精确的趋势跟踪策略。它通过计算过去一定数量收盘价的“置信度”来判断当前线性趋势的持续可能性。该策略假设,一旦置信度超过一定水平,正在发生的线性趋势更有可能持续下去。

策略原理

该策略通过普通线性回归方法计算过去N个收盘价的线性拟合,获得线性拟合的斜率k和与收盘价的偏差标准差σ。然后定义趋势置信度为k/σ。

当趋势置信度超过“做多入场”阈值时,做多;当下跌到“做多平仓”阈值时,平仓。同理,当趋势置信度低于“做空入场”阈值时,做空;当超过“做空平仓”阈值时,平仓。

这样,它可以过滤掉野性的、不遵循明确线性趋势的价格变动带来的信号。

优势分析

该策略结合了趋势跟踪和统计学中的线性回归方法,でき避免追随短期价格震荡,只跟随长期趋势,从而获得较低的交易频率和较高的胜率。

该策略参数调优空间大,可以通过调整参数适用于不同品种和时间周期,实现良好的泛化性。

风险分析

该策略存在被套利的风险。当价格出现明显趋势反转时,策略会产生较大亏损。此外,参数设置不当也会导致过度交易或错失良好交易机会。

可以设置止损来控制亏损风险。同时,必须慎重评估参数的选择,避免过度优化。

优化方向

该策略可以在以下方面进行进一步优化:

增加止损、止盈逻辑,以锁定利润、控制风险

增加参数自适应优化模块,使参数可以动态调整

增加机器学习模型判断趋势反转点,进一步提高策略胜率

尝试不同品种、时间周期的适配性,提高泛化能力

总结

该策略总体上是一个立足长期趋势、控制风险的量化策略。它融合了趋势跟踪和线性回归方法,可以过滤噪音交易信号。通过参数调优,它可以很好地适配不同品种和周期,是一种值得重点研究和改进的有效策略。

策略源码

/*backtest

start: 2022-11-15 00:00:00

end: 2023-11-21 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © carefulCamel61097

// ################################################################################################

// "This is a trend following strategy that performed very well on the past 5 years"

// "Intended to be used on BTC-USDT, 4hr timeframe"

// "A factor 2 Leverage can be added by changing Order Size to 200% of equity"

// "Higher leverage is not recommended due to big drawdowns"

// "Also seems to work on 1D timeframe, although ideal parameters may be different"

// "Also seems to work on ETH-USDT and some other altcoins, although ideal parameters are different"

// ################################################################################################

//@version=5

strategy("Trend Following based on Trend Confidence", overlay=false )

// Inputs

source = input(close)

since = input(timestamp('2000-01-01'), title='Start trading interval')

till = input(timestamp('2030-01-01'), title='End trading interval')

length = input(30, title='Length')

longs_on = input.bool(true, title='Longs')

shorts_on = input.bool(true, title='Shorts')

// Parameters for best performance 2018 - 2022

// long_entry = input.float(0.26, step=0.01, title='Long entry threshold')

// long_exit = input.float(-0.10, step=0.01, title='Long exit threshold')

// short_entry = input.float(-0.24, step=0.01, title='Short entry threshold')

// short_exit = input.float(-0.04, step=0.01, title='Short exit threshold')

long_entry = input.float(0.25, step=0.01, title='Long entry threshold')

long_exit = input.float(-0.10, step=0.01, title='Long exit threshold')

short_entry = input.float(-0.25, step=0.01, title='Short entry threshold')

short_exit = input.float(-0.05, step=0.01, title='Short exit threshold')

stop_loss = input.float(10, step=1, title='Stop loss (percentage)') / 100

// Trend Confidence

linreg = ta.linreg(source, length, 0)

linreg_p = ta.linreg(source, length, 0+1)

x = bar_index

slope = linreg - linreg_p

intercept = linreg - x*slope

deviationSum = 0.0

for i = 0 to length-1

deviationSum := deviationSum + math.pow(source[i]-(slope*(x-i)+intercept), 2)

deviation = math.sqrt(deviationSum/(length))

slope_perc = slope / source[0]

deviation_perc = deviation / source[0]

trend_confidence = slope_perc / deviation_perc

// Strategy

in_interval = true

sl_long = strategy.position_avg_price * (1 - stop_loss)

sl_short = strategy.position_avg_price * (1 + stop_loss)

if in_interval and longs_on and ta.crossover(trend_confidence, long_entry)

strategy.entry("TC Long Entry", strategy.long)

strategy.exit("TC Long Exit", stop=sl_long)

if in_interval and longs_on and ta.crossunder(trend_confidence, long_exit)

strategy.close("TC Long Entry")

if in_interval and shorts_on and ta.crossunder(trend_confidence, short_entry)

strategy.entry("TC Short Entry", strategy.short)

strategy.exit("TC Short Exit", stop=sl_short)

if in_interval and shorts_on and ta.crossover(trend_confidence, short_exit)

strategy.close("TC Short Entry")

// Plots

plot(trend_confidence, "Trend Confidence", color.rgb(255, 255, 255))

plot(long_entry, "", color.rgb(0, 255, 0), linewidth=1)

plot(long_exit, "", color.rgb(255, 0, 0), linewidth=1)

plot(short_entry, "", color=bar_index % 10 == 0 ? color.rgb(0, 255, 0) : #00000000, linewidth=1)

plot(short_exit, "", color=bar_index % 10 == 0 ? color.rgb(255, 0, 0) : #00000000, linewidth=1)