概述

反向开盘吞噬策略是一种基于股票首个K线的简单日内交易策略。该策略的核心思路是在每天开盘后的第一个K线出现时,判断其涨跌方向,并做出反向操作。如果首个K线是红色阳线,则做多;如果首个K线是绿色阴线,则做空。该策略同时设置了止损和止盈的出场机制。

策略原理

该策略的原理基于开盘后的首根K线的特殊性。开盘时,多空双方的力量对抗最为激烈,行情出现反转的概率较大。判断首根K线的涨跌方向,并反其道而行之,就是该策略的核心思路。

具体来说,在新的一天开盘后,策略会记录下首个K线的开盘价、收盘价和涨跌情况。如果开盘价高于收盘价(绿色阴线),代表空头获胜,则做多;如果开盘价低于收盘价(红色阳线),代表多头获胜,则做空。通过这样的反向操作,策略试图追捕开盘后的反转机会。

同时,策略还设置了止损和止盈机制,包括做多止损价格、做多止盈价格、做空止损价格和做空止盈价格,对多空仓位进行风险和盈利控制,避免过度损失或过早割肉。

优势分析

反向开盘吞噬策略具有以下优势:

思路简单清晰,容易理解和实现。

利用了开盘时段的高预测价值特征,抓住反转机会。

同时设置止损止盈,可以有效控制风险。

策略思路具有普适性,适用于大部分股票。

参与成本较低,易于资金控制。

风险分析

反向开盘吞噬策略也存在一定风险,主要包括:

开盘反转失败的概率。如果首根K线的反转信号失效,可能造成较大损失。

无法有效过滤低质量个股。该策略对股票的基本面分析不足,可能选中一些基本面差的烂股。

无法有效控制突发事件的系统性风险,如重大负面消息面的影响。

止损止盈设置不当可能导致亏损扩大或利润缩水。

优化方向

反向开盘吞噬策略可以从以下几个方面进行优化:

增加开盘反转信号的有效性检验,避免无效信号。例如结合成交量分析。

结合股票基本面和技术指标进行股票池的优选,过滤低质量个股。

增加对重大事件和消息面的监控模块,控制系统性风险。

运用遗传算法、机器学习等方法动态优化止损止盈的设置。

总结

反向开盘吞噬策略通过判断首根K线的方向并做出反向操作,试图抓住开盘后的反转机会。该策略思路简单,参与成本低,有一定的实战价值。但我们也要清醒认识到其中的风险,并在实践中不断完善与优化策略,使之更稳健可靠。

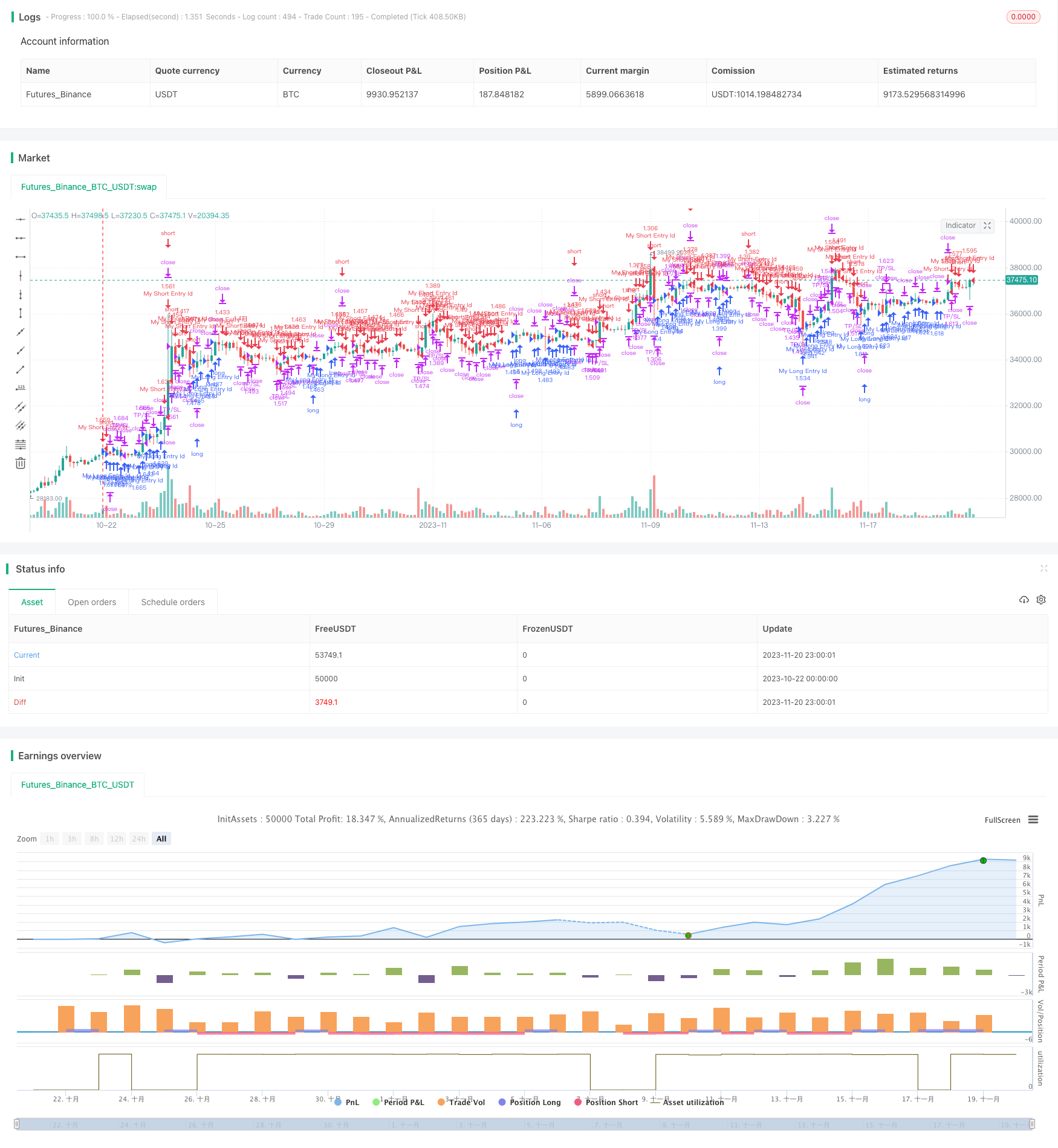

/*backtest

start: 2023-10-22 00:00:00

end: 2023-11-21 00:00:00

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © vikris

//@version=4

strategy("[VJ]First Candle Strategy", overlay = true,calc_on_every_tick = true,default_qty_type=strategy.percent_of_equity,default_qty_value=100,initial_capital=750,commission_type=strategy.commission.percent,

commission_value=0.02)

// ********** Strategy inputs - Start **********

// Used for intraday handling

// Session value should be from market start to the time you want to square-off

// your intraday strategy

// Important: The end time should be at least 2 minutes before the intraday

// square-off time set by your broker

var i_marketSession = input(title="Market session", type=input.session,

defval="0915-1455", confirm=true)

// Make inputs that set the take profit % (optional)

longProfitPerc = input(title="Long Take Profit (%)",

type=input.float, minval=0.0, step=0.1, defval=1) * 0.01

shortProfitPerc = input(title="Short Take Profit (%)",

type=input.float, minval=0.0, step=0.1, defval=1) * 0.01

// Set stop loss level with input options (optional)

longLossPerc = input(title="Long Stop Loss (%)",

type=input.float, minval=0.0, step=0.1, defval=0.5) * 0.01

shortLossPerc = input(title="Short Stop Loss (%)",

type=input.float, minval=0.0, step=0.1, defval=0.5) * 0.01

// ********** Strategy inputs - End **********

// ********** Supporting functions - Start **********

// A function to check whether the bar or period is in intraday session

barInSession(sess) => time(timeframe.period, sess) != 0

// Figure out take profit price

longExitPrice = strategy.position_avg_price * (1 + longProfitPerc)

shortExitPrice = strategy.position_avg_price * (1 - shortProfitPerc)

// Determine stop loss price

longStopPrice = strategy.position_avg_price * (1 - longLossPerc)

shortStopPrice = strategy.position_avg_price * (1 + shortLossPerc)

// ********** Supporting functions - End **********

// ********** Strategy - Start **********

// See if intraday session is active

bool intradaySession = barInSession(i_marketSession)

// Trade only if intraday session is active

//=================Strategy logic goes in here===========================

// If start of the daily session changed, then it's first bar of the new session

isNewDay = time("D") != time("D")[1]

var firstBarCloseValue = close

var firstBarOpenValue = open

if isNewDay

firstBarCloseValue := close

firstBarOpenValue := open

greenCandle = firstBarOpenValue < firstBarCloseValue

redCandle = firstBarOpenValue > firstBarCloseValue

buy = redCandle

sell = greenCandle

// plot(firstBarCloseValue)

// plot(firstBarOpenValue)

//Final Long/Short Condition

longCondition = buy

shortCondition =sell

//Long Strategy - buy condition and exits with Take profit and SL

if (longCondition and intradaySession)

stop_level = longStopPrice

profit_level = longExitPrice

strategy.entry("My Long Entry Id", strategy.long)

strategy.exit("TP/SL", "My Long Entry Id", stop=stop_level, limit=profit_level)

//Short Strategy - sell condition and exits with Take profit and SL

if (shortCondition and intradaySession)

stop_level = shortStopPrice

profit_level = shortExitPrice

strategy.entry("My Short Entry Id", strategy.short)

strategy.exit("TP/SL", "My Short Entry Id", stop=stop_level, limit=profit_level)

// Square-off position (when session is over and position is open)

squareOff = (not intradaySession) and (strategy.position_size != 0)

strategy.close_all(when = squareOff, comment = "Square-off")

// ********** Strategy - End **********