概述

该策略的目的是追踪趋势性股票(或其他趋势性市场)的低风险策略, 旨在实现最小回撤率(例如,在撰写本文时,AAPL仅有约1.36%的回撤率,FB约有1.93%的回撤率,而SPY为0.80%的回撤率,所有这些都保持有利可图)。

策略原理

该策略利用200日移动均线,自定义布林带,52周期加权移动平均TSI和ADX强度。

买入信号是:收盘价高于200日移动平均线 + 5根K线收盘价高于上部自定义布林带 + TSI为正 + ADX高于20。

由于回测证明,该策略仅适用于趋势性股票,已删除一些卖出/做空条件,仅采用做多订单。

优势分析

该策略的优势在于回撤率低,风险最小,适用于大部分趋势性股票的低风险操作,根据测试数据显示收益高且回测期间仅AAPL有1.36%的最大回撤,FB有1.93%最大回撤。

通过组合使用布林带,MA均线,TSI指标等多种技术指标,并设置ADX判断趋势强弱,在判断趋势向上时买入,企图抓住趋势股票的中长线上涨机会。相比单一指标判断,该策略综合运用多种技术指标,判断更加准确可靠,风险更低。

该策略还包含止损策略,TSI指标方向转变时及时止损,最大程度锁定收益,有效控制风险。

风险分析

该策略主要面临的风险有两个:

突发事件风险。某些黑天鹅事件可能导致股票大幅震荡下跌,无法止损。

趋势结束风险。股票从趋势进入盘整时,可能产生较大回撤。

针对风险一可以设置更严格的止损机制,或人工干预止损。针对风险二可以结合更多判断因素检测趋势结束,例如增加成交量指标等。

优化方向

该策略还可以从以下几个方面进行优化:

增加止损策略,设置更精确的止损点,更好控制风险。

优化均线参数,测试不同参数组合的稳定性。

增加量能指标等判断系统,更准确判断趋势的开始和结束。

测试更长的时间周期参数,适应更长线的操作。

总结

该策略通过ADX判断趋势强度,TSI指标判断趋势方向,布林带判断突破,移动平均线判断长期趋势,多种指标相互验证,判断买入时机。止损策略可以有效控制风险。该策略适合长线追踪趋势股,回撤率低,收益较高,具有一定优势。但仍需针对风险进行优化,使策略更为稳健。

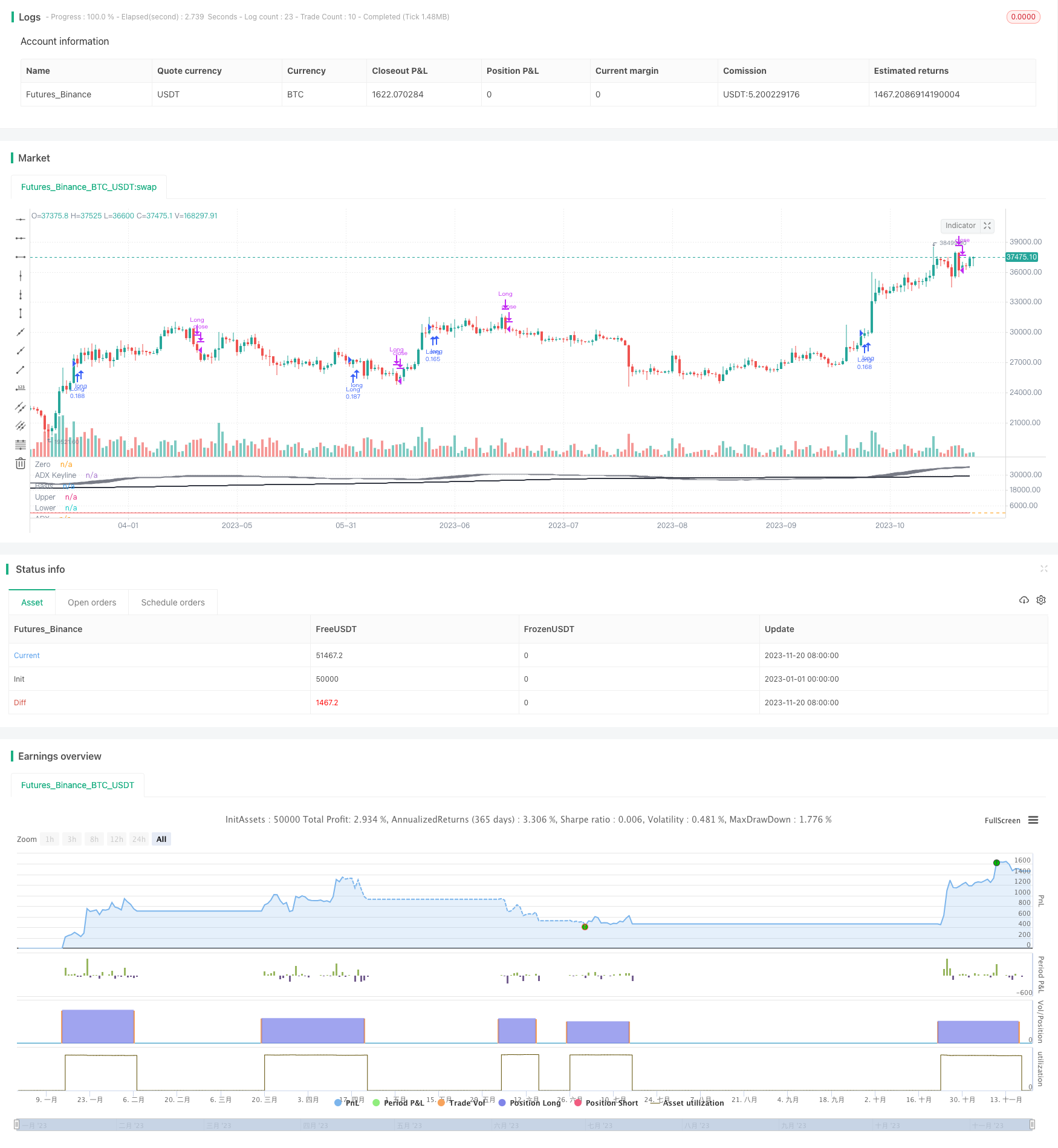

/*backtest

start: 2023-01-01 00:00:00

end: 2023-11-21 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © gary_trades

//This script has been designed to be used on trending stocks as a low risk trade with minimal drawdown, utilising 200 Moving Average, Custom Bollinger Band, TSI with weighted moving average and ADX strength.

//Backtest dates are set to 2010 - 2020 and all other filters (moving average, ADX, TSI , Bollinger Band) are not locked so they can be user amended if desired.

//Buy signal is given when trading above the 200 moving average + 5 candles have closed above the upper custom Bollinger + the TSI is positive + ADX is above 20.

//As back testing proved that this traded better only in tends then some Sell/Short conditions have been removed and this focueses on Long orders.

//Only requires 2 additional lines of code to add shorting orders.

//Close for either long or short trades is signaled once the TSI crosses in the opposite direction indicating change in trend strength or if stop loss is trggered.

//Further optimization could be achieved by adding a stop loss.

//NOTE: This only shows the lower indicators however for visualization you can use my script "CUSTOM BOLLINGER WITH SMA", which is the upper indicators in this stratergy.

//------------

//@version=4

strategy(shorttitle="Trend Chaser", title="ADX_TSI_Bol Band Trend Chaser", overlay=false, pyramiding=0,

currency=currency.USD, default_qty_type=strategy.percent_of_equity, default_qty_value=10,

initial_capital=10000, commission_value=0.1)

//------------

//Custom Bollinger Band

length = input(20, minval=1)

src = input(close, title="Source")

mult = input(0.382, minval=0.001, maxval=50, title="StdDev")

basis = sma(src, length)

dev = mult * stdev(src, length)

upper = basis + dev

lower = basis - dev

offset = input(0, "Offset", type = input.integer, minval = -500, maxval = 500)

plot(basis, "Basis", color=color.gray, offset = offset, display=display.none)

p1 = plot(upper, "Upper", color=color.gray, offset = offset, display=display.none)

p2 = plot(lower, "Lower", color=color.gray, offset = offset, display=display.none)

fill(p1, p2, title = "Background", color=#787B86, transp=85)

//------------

//Moving Average

MAlen = input(200, minval=1, title="Length")

MAout = sma(src, MAlen)

plot(MAout, color=color.black, title="MA", offset=offset, linewidth=2, display=display.none)

//------------

//True Strength WMA

TSlong = input(title="Long Length", type=input.integer, defval=25)

TSshort = input(title="Short Length", type=input.integer, defval=13)

TSsignal = input(title="Signal Length", type=input.integer, defval=52)

double_smooth(src, TSlong, TSshort) =>

fist_smooth = wma(src, TSlong)

wma(fist_smooth, TSshort)

price = close

pc = change(price)

double_smoothed_pc = double_smooth(pc, TSlong, TSshort)

double_smoothed_abs_pc = double_smooth(abs(pc), TSlong, TSshort)

tsi_value = 100 * (double_smoothed_pc / double_smoothed_abs_pc)

tsi2 = wma(tsi_value, TSsignal)

plot(tsi_value, color=color.blue)

plot(wma(tsi_value, TSsignal), color=color.red)

hline(0, title="Zero")

//------------

//ADX

adxlen = input(13, title="ADX Smoothing")

dilen = input(13, title="DI Length")

keyLevel = input(20, title="Keylevel for ADX")

dirmov(len) =>

up = change(high)

down = -change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = rma(tr, len)

plus = fixnan(100 * rma(plusDM, len) / truerange)

minus = fixnan(100 * rma(minusDM, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adx = 100 * rma(abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

sig = adx(dilen, adxlen)

plot(sig, color=color.black, title="ADX", style=plot.style_histogram, transp=40)

plot(20, color=color.green, title="ADX Keyline", linewidth=1)

//------------

//Identify Triggers

//Back Test Range

start = timestamp("America/New_York", 2010, 1, 1, 9,30)

end = timestamp("America/New_York", 2030, 7, 1, 0, 0)

//Custom Bollinger Band

Long1 = close > upper[5] and close[5] > upper [6]

Short1 = close < lower[5] and close[5] < lower [6]

//Moving Average

Long2 = close >= MAout[1]

Short2 = close <= MAout[1]

//True Strength WMA

Long3 = tsi_value > tsi2

Short3 = tsi_value < tsi2

//ADX

ADXkey = adx(dilen, adxlen) > 20 and adx(dilen, adxlen) < 100

//Buy

Buy = Long1 and Long2 and Long3 and ADXkey

CloseLong = crossunder(tsi_value,tsi2)

//Short

Sell = Short1 and Short2 and Short3 and ADXkey

CloseShort = crossover(tsi_value,tsi2)

//------------

//Entry and Exit

if time >= start and time <= end

strategy.entry("Long", true, when = Buy)

strategy.close("Long", when = CloseLong)