概述

波道策略(Bollinger Bands Strategy)是一个利用布林线波动带进行趋势跟踪和超买超卖信号的经典策略。这个版本在原有策略基础上增加了止损机制来控制风险。

策略通过布林带的上下轨的金叉死叉判断市场的超买超卖情况,通过追踪布林带进行趋势跟踪。布林带上轨和下轨之间的区域反映了当前市场的波动范围。布林带由中轨、上轨和下轨构成,中轨是n日简单移动平均线,上轨和下轨由中轨加减k倍的n日标准差确定。

原理

布林带是一个反映市场波动率和震荡幅度的技术指标。当价格刚好触及布林带下轨附近时,说明市场处于超卖状态,此时连续出现的缺口有较大概率被补上,根据回归特征应该考虑建立多头头寸。当价格刚好触及布林带上轨附近时,说明此时市场可能处于超买状态,这时价格可能产生反转向下的行情,应该考虑建立空头头寸以获利于下跌行情。

该策略结合布林带的超买超卖信号实现建立趋势跟踪头寸,并增加止损机制来控制风险。

当价格上穿布林带下轨时,说明市场由超卖区域进入合理区域,此时可以建立多头头寸。当价格下穿布林带上轨时,说明市场进入超买区域,此时可以建立空头头寸。

建仓后,设置固定百分比的止损位来控制风险。当亏损超过设置止损幅度时止损退出当前头寸,避免过大亏损。

优势

该策略结合布林带指标判断超买超卖区域,通过判断价格与上下轨交叉实现低买高卖

利用布林带波动性特性进行趋势跟踪交易

增加止损机制,可以有效控制单笔交易的最大损失

结合趋势跟踪和止损,可以获得稳定收益

风险及优化

布林带的参数设定会影响交易信号质量。中轨长度n和标准差倍数k需要根据不同市场合理设定,否则会影响交易信号准确率。

止损设置过大过小都会影响收益稳定性。止损幅度设置过大会加大单笔亏损风险,过小会增加止损被触发概率。需要根据不同品种合理设置止损百分比。

可以考虑结合其他指标进行信号过滤,提高交易信号准确率。

可以测试不同持仓时间设定,如结合小时级或更短周期布林带进行更高频交易,提高资金使用效率。

总结

该策略结合布林带判断超买超卖区域建立头寸,增加止损来控制风险,是一种常见的趋势跟踪型策略。通过优化参数设置,结合更准确的交易信号和止损水平的设定,可以获得稳定的盈利。

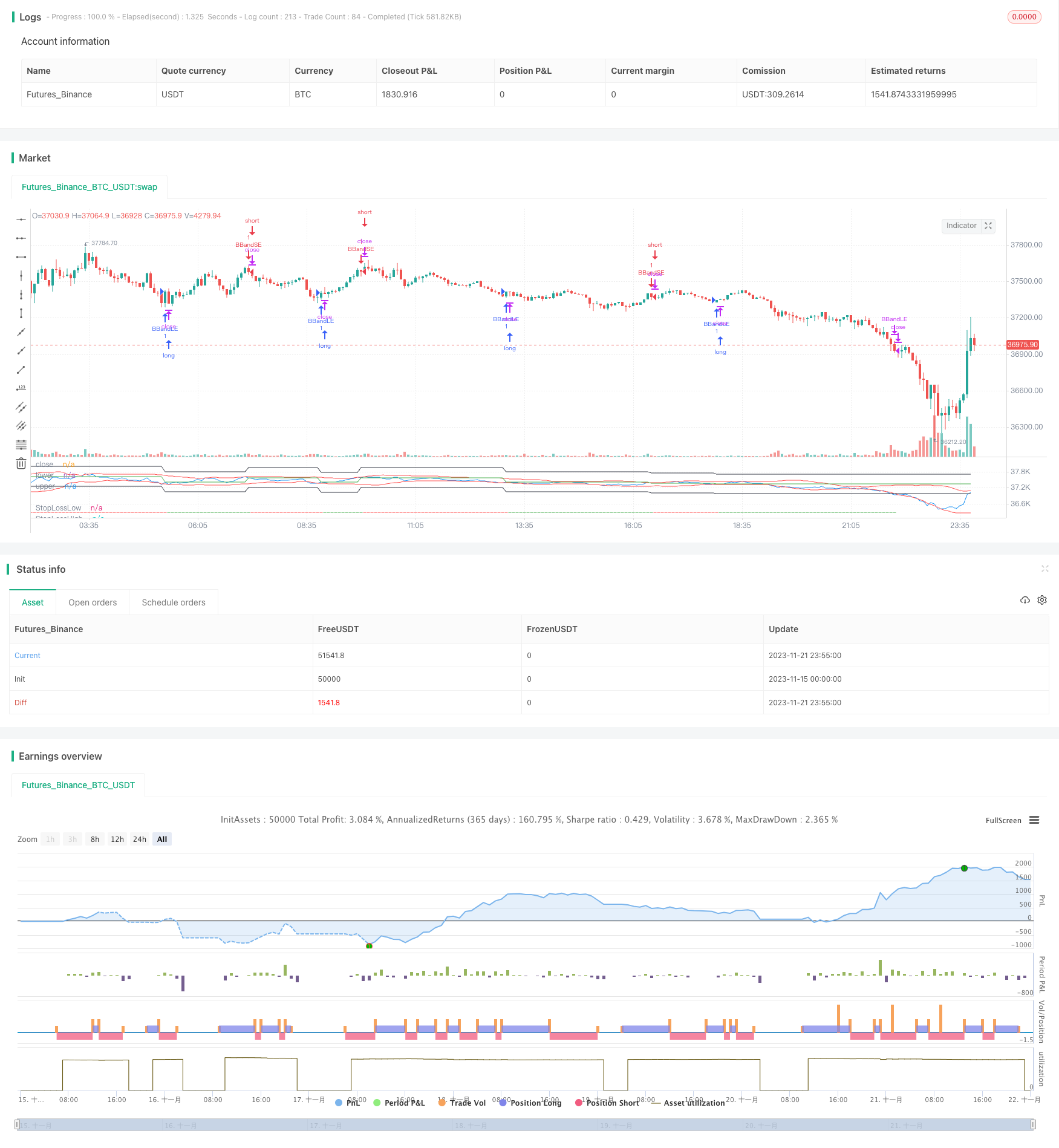

/*backtest

start: 2023-11-15 00:00:00

end: 2023-11-22 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="Bollinger Bands Strategy", overlay=false, shorttitle="BBS", pyramiding=0, currency=currency.USD, commission_type=strategy.commission.percent, commission_value=0.03, initial_capital=1000)

source = input(close, "Source")

length = input.int(20, minval=1)

mult = input.float(2.0, minval=0.001, maxval=50, step=0.001)

stopLossFactor = input.float(1, "Stop Loss Percent", maxval = 100, minval = 0, step=0.1)

basis = ta.sma(source, length)

dev = mult * ta.stdev(source, length)

upper = basis + dev

lower = basis - dev

var float lastTradePrice = na

var float stopLossLow = na

var float stopLossHigh = na

var bool currentIsLong = na

var bool nextExpectedIsLong = true

var bool existedLong = false

var bool existedShort = false

buyEntry = ta.crossover(source, lower)

sellEntry = ta.crossunder(source, upper)

if (buyEntry and nextExpectedIsLong == true)

strategy.entry("BBandLE", strategy.long, comment="BBandLE")

nextExpectedIsLong := false

if(nz(strategy.position_size[1], 0) < 0) // new position detected

lastTradePrice := close

stopLossLow := lastTradePrice * (1 - (stopLossFactor / 100))

stopLossHigh := lastTradePrice * (1 + (stopLossFactor / 100))

else

strategy.cancel("BBandLE")

if (sellEntry and nextExpectedIsLong == false)

strategy.entry("BBandSE", strategy.short, comment="BBandSE")

nextExpectedIsLong := true

if(nz(strategy.position_size[1], 0) > 0) // new position detected

lastTradePrice := close

stopLossLow := lastTradePrice * (1 - (stopLossFactor / 100))

stopLossHigh := lastTradePrice * (1 + (stopLossFactor / 100))

else

strategy.cancel("BBandSE")

strategy.close("BBandLE", close < stopLossLow)

strategy.close("BBandSE", close > stopLossHigh)

// if(nz(strategy.position_size[1], 0) < 0 and close > stopLossHigh)

// strategy.entry("BBandLE", strategy.long, comment="BBandLE")

// lastTradePrice := close

// stopLossLow := lastTradePrice * (1 - (stopLossFactor / 100))

// stopLossHigh := lastTradePrice * (1 + (stopLossFactor / 100))

// if(nz(strategy.position_size[1], 0) > 0 and close < stopLossLow)

// strategy.exit("BBandSE", strategy.short, comment="BBandSE")

// lastTradePrice := close

// stopLossLow := lastTradePrice * (1 - (stopLossFactor / 100))

// stopLossHigh := lastTradePrice * (1 + (stopLossFactor / 100))

plot(source, "close", color.blue)

plot(lower, "lower", color.red)

plot(upper, "upper", color.red)

plot(stopLossLow, "StopLossLow", color.black)

plot(stopLossHigh, "StopLossHigh", color.black)

plot(lastTradePrice, "lastTradePrice", color.green)

plotchar(strategy.position_size > 0, char="-", size=size.tiny, location=location.bottom, color=color.green)

plotchar(strategy.position_size < 0, char="-", size=size.tiny, location=location.bottom, color=color.red)