概述

投机鸿沟策略是一个追踪趋势的量化交易策略,它使用 SAR 平滑曲线作为主要的交易信号,辅以 EMA、挤压动量和波动性震荡器等多种过滤器,通过配置 SAR 参数来识别趋势反转点,实现低风险趋势跟踪。这是一个非常适合中长线投资的策略。

策略原理

该策略使用抛物线 SAR 作为主要的交易信号指标。SAR 能够有效判断价格趋势的反转点,当 SAR 符号发生改变时,意味着趋势发生转折。此策略一般在 SAR 翻转时发出买入或卖出信号。

另外,策略还提供了 SAR 突破选项。也就是在 SAR 尚未完全翻转之前,价格已经突破最后一个 SAR 值的情况下产生信号。这可以进一步追求策略的灵敏度。

为了过滤假信号,该策略还引入了 EMA、挤压动量和波动性震荡器三个辅助过滤器,可单独使用也可组合使用,用以确认价格趋势和交易信号的可靠性。

最后,策略提供了固定止损、固定止盈和风险回报比例止损等三种止损止盈方式。这使得策略可以灵活适应不同类型交易品种的特点。

优势分析

SAR 能够准确判断价格趋势反转,并能及时捕捉新的价格趋势,适合中长线趋势追踪。

多重过滤器设置降低了假突破的概率,提高信号可靠性。

配置简单灵活,可自定义参数以适应不同交易品种。

提供多种止盈止损方式,可以追求风险回报的平衡。

可直接连接交易机器人,实现自动化交易。

风险分析

在非趋势性市场下,可能出现增多的假信号和无效交易。

SAR 参数设置不当也会影响信号判断的准确性。

作为趋势跟踪策略,大幅震荡市场中容易达到止损线。

针对以上风险,可适当调整 SAR 参数或过滤器参数,降低无效交易的概率。也可以适当放宽止损限制,以承受更大的行情波动。

优化方向

SAR 参数优化。可以通过历史回测数据优化 SAR 的步长和增量参数,获得更稳定和高效的交易策略。

引入趋势判断指标。为策略添加 MACD、DMI 等辅助判断指标,提高对趋势的判断能力。

优化风险回报比。调整固定止盈止损百分比和风险回报比率参数,适当承担更高风险以获取更高收益。

添加外汇品种。目前策略只支持数字货币交易,可以扩展支持外汇、商品和证券市场品种。

总结

投机鸿沟是一个非常实用的追踪趋势型量化策略。它响应灵敏,信号判断可靠,通过止损止盈管理可以获取长期稳定收益。适当的参数和规则优化可以进一步提高策略的效率。这是一个值得长期使用的高效量化策略。

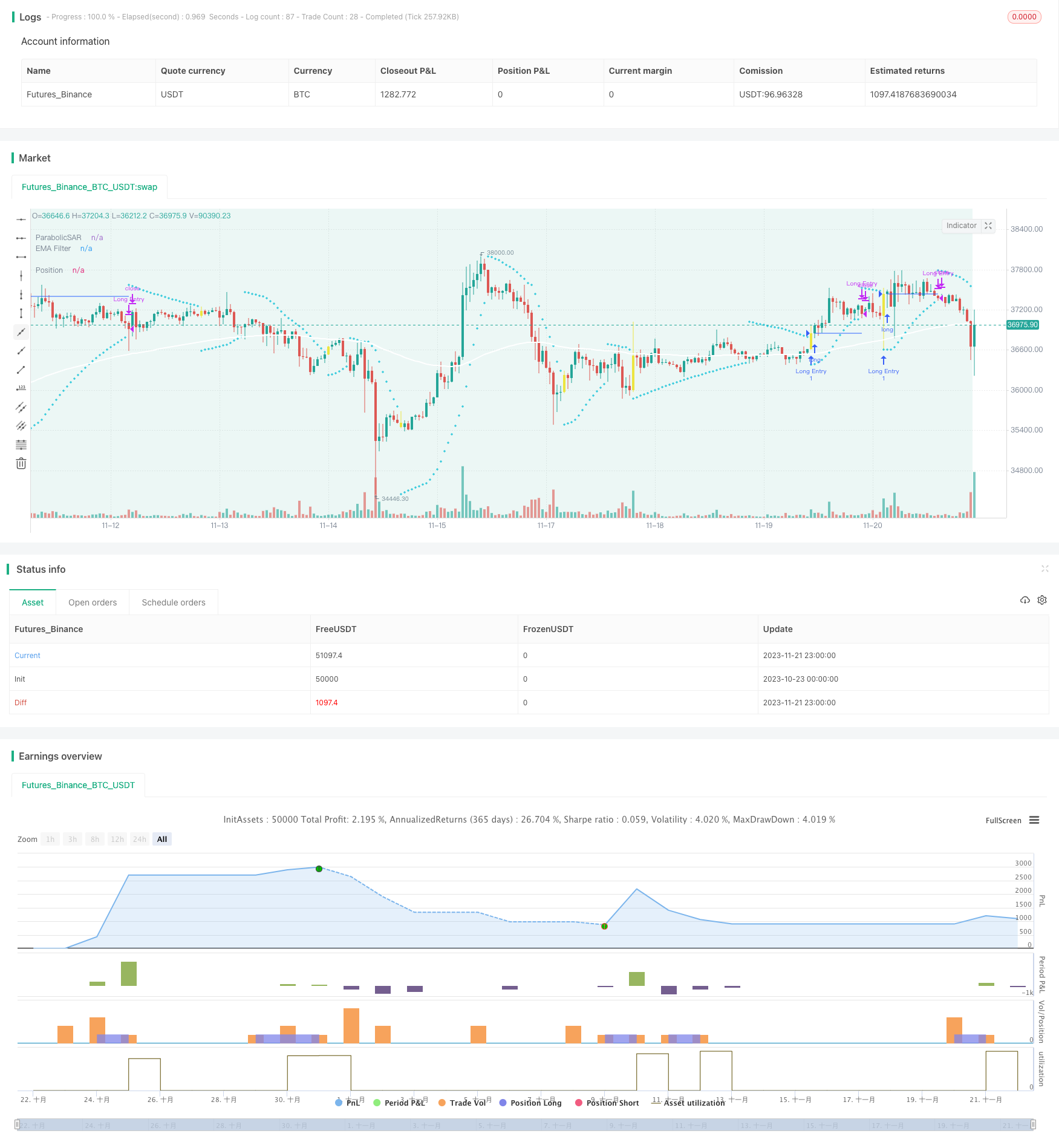

/*backtest

start: 2023-10-23 00:00:00

end: 2023-11-22 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//VERSION =================================================================================================================

//@version=5

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// This strategy is intended to study.

// It can also be used to signal a bot to open a deal by providing the Bot ID, email token and trading pair in the strategy settings screen.

// As currently written, this strategy uses a SAR PARABOLIC to send signal, and EMA, Squeeze Momentum, Volatility Oscilator as filter.

// There are two enter point, when SAR Flips, or Breakout Point - the last SAR Value before it Flips.

// There are tree options for exit: SAR Flips, Fixed Stop Loss ande Fixed Take Profit in % and Risk Reward tha can be set, 0.5/1, 1/1, 1/2 etc.

//Autor M4TR1X_BR

//▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

//STRATEGY ================================================================================================================

strategy(title = 'BT-SAR Ema, Squeeze, Voltatility',

shorttitle = 'SAR ESV',

overlay = true)

//▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// INPUTS =================================================================================================================

// TIME INPUTS

usefromDate = input.bool(defval = true, title = 'Start date', inline = '0', group = "Time Filters")

initialDate = input(defval = timestamp('01 Jan 2022 00:00 UTC'), title = '', inline = "0",group = 'Time Filters',tooltip="This start date is in the time zone of the exchange ")

usetoDate = input.bool(defval = true, title = 'End date', inline = '1', group = "Time Filters")

finalDate = input(defval = timestamp('31 Dec 2029 23:59 UTC'), title = '', inline = "1",group = 'Time Filters',tooltip="This end date is in the time zone of the exchange")

// TIME LOGIC

inTradeWindow = true

// SAR PARABOLIC INPUTS ==================================================================================================

string sargroup= "SAR PARABOLIC ========================================="

start = input.float(defval=0.02,title='Start',inline='',group = sargroup)

increment = input.float(defval=0.02,title='Increment',inline='',group = sargroup)

maximum = input.float(defval=0.2,title='Maximo',inline='',group = sargroup)

// SAR PARABOLIC LOGIC

out = ta.sar(start, increment, maximum)

// SAR FLIP OR BREAKOUT OPTIONS

string bkgroup ='SAR TRADE SIGNAL ====================================== '

sarTradeSignal =input.string(defval='SAR Flip',title='SAR Trade Signal', options= ['SAR Flip','SAR Breakout'],group=bkgroup, tooltip='SAR Flip: Once the parabolic SAR flips it will send a signal, SAR Breakout: Will wait the price cross last Sar Value before it flips.')

nBars = input.int(defval=4,title='Bars',group=bkgroup, tooltip ='Define the number of bars for a entry when the price cross breakout point')

float sarBreakoutPoint= ta.valuewhen((close[1] < out[1]) and (close > out),out[1],0) //Get Sar Breakout Point

bool check = (close[1] < out[1]) and (close > out) //Verify when sar flips

bool BreakoutPrice = sarTradeSignal=='SAR Breakout'? (ta.barssince(check) < nBars) and ((open < sarBreakoutPoint) and (close > sarBreakoutPoint)): (ta.barssince(check) < nBars) and (close > out)

barcolor (check? color.yellow:na,title="Signal Bar color" )

// MOVING AVERAGES INPUTS ================================================================================================

string magroup = "Moving Average ========================================"

useEma = input.bool(defval = true, title = 'Moving Average Filter',inline='', group= magroup,tooltip='This will enable or disable Exponential Moving Average Filter on Strategy')

emaType=input.string (defval='Ema',title='Type',options=['Ema','Sma'],inline='', group= magroup)

emaSource = input.source(defval=close,title=" Source",inline="", group= magroup)

emaLength = input.int(defval=100,title="Length",minval=0,inline='', group= magroup)

// MOVING AVERAGE LOGIC

float ema = emaType=='Ema'? ta.ema(emaSource,emaLength): ta.sma(emaSource,emaLength)

// VOLATILITY OSCILLATOR =================================================================================================

string vogroup = "VOLATILITY OSCILLATOR ================================="

useVltFilter=input.bool(defval=true,title="Volatility Oscillator Filter",inline='',group= vogroup,tooltip='This will enable or disable Volatility Oscillator filter on Strategy')

vltFilterLength = input.int(defval=100,title="Volatility Oscillator",inline='',group=vogroup)

vltFilterSpike = close - open

vltFilterX = ta.stdev(vltFilterSpike,vltFilterLength)

vltFilterY = ta.stdev(vltFilterSpike,vltFilterLength) * -1

// SQUEEZE MOMENTUM INPUTS ==============================================================================================

string sqzgroup = "SQUEEZE MOMENTUM ====================================="

useSqzFilter=input.bool(defval=true,title="Squeeze Momentum Filter",inline='',group= sqzgroup, tooltip='This will enable or disable Squeeze Momentum filter on Strategy')

sqzFilterlength = input.int(defval=20, title='Bollinger Bands Length',inline='',group= sqzgroup)

sqzFiltermult = input.float(defval=2.0, title='Boliinger Bands Mult',inline='',group= sqzgroup)

keltnerLength = input.int(defval=20, title='Keltner Channel Length',inline='',group= sqzgroup)

keltnerMult = input.float(defval=1.5, title='Keltner Channel Mult',inline='',group= sqzgroup)

useTrueRange = input(true, title='Use TrueRange (KC)', inline='',group= sqzgroup)

// CALCULATE BOLLINGER BANDS

sqzFilterSrc = close

basis = ta.sma(sqzFilterSrc, sqzFilterlength)

dev = keltnerMult * ta.stdev(sqzFilterSrc, sqzFilterlength)

upperBB = basis + dev

lowerBB = basis - dev

// CALCULATE KELTNER CHANNEL

sma = ta.sma(sqzFilterSrc, keltnerLength)

range_1 = useTrueRange ? ta.tr : high - low

rangema = ta.sma(range_1, keltnerLength)

upperKC = sma + rangema * keltnerMult

lowerKC = sma - rangema * keltnerMult

// CHECK IF BOLLINGER BANDS IS IN OR OUT OF KELTNER CHANNEL

sqzOn = lowerBB > lowerKC and upperBB < upperKC

sqzOff = lowerBB < lowerKC and upperBB > upperKC

noSqz = sqzOn == false and sqzOff == false

// SQUEEZE MOMENTUM LOGIC

val = ta.linreg(sqzFilterSrc - math.avg(math.avg(ta.highest(high, keltnerLength), ta.lowest(low, keltnerLength)),ta.sma(close, keltnerLength)), keltnerLength, 0)

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// TAKE PROFIT STOP LOSS INPUTS =========================================================================================

string tkpgroup='Take Profit =================================================='

tpType = input.string(defval = 'SAR Flip', title='Take Profit and Stop Loss', options=['SAR Flip','Fixed % TP/SL', 'Risk Reward TP/SL'], group=tkpgroup )

longTakeProfitPerc = input.float(defval = 1.5, title = 'Fixed TP %', minval = 0.05, step = 0.5, group=tkpgroup, tooltip = 'The percentage increase to set the take profit price target.')/100

longLossPerc = input.float(defval=1.0, title="Fixed Long SL %", minval=0.1, step=0.5, group = tkpgroup, tooltip = 'The percentage increase to set the Long Stop Loss price target.') * 0.01

//shortLossPerc = input.float(defval=1.5, title="Fixed Short SL (%)", minval=0.1, step=0.5, group = tkpgroup, tooltip = 'The percentage increase to set the Short Stop Loss price target.') * 0.01

longTakeProfitRR = input.float(defval = 1, title = 'Risk Reward TP', minval = 0.25, step = 0.25, group=tkpgroup, tooltip = 'The Risk Reward parameter.')

var plotStopLossRR = input.bool(defval=false, title='Show RR Stop Loss', group=tkpgroup)

//enableStopLossRR = input.bool(defval = false, title = 'Enable Risk Reward TP',group=tkpgroup, tooltip = 'Enable Variable Stop Loss.')

string trpgroup='Traling Profit ==============================================='

enableTrailing = input.bool(defval = false, title = 'Enable Trailing',group=trpgroup, tooltip = 'Enable or disable the trailing for take profit.')

trailingTakeProfitDeviationPerc = input.float(defval = 0.1, title = 'Trailing Take Profit Deviation %', minval = 0.01, maxval = 100, step = 0.01, group=trpgroup, tooltip = 'The step to follow the price when the take profit limit is reached.') / 100

// BOT MESSAGES

string msgroup='Alert Message For Bot ========================================='

messageEntry = input.string("", title="Strategy Entry Message",group=msgroup)

messageExit =input.string("",title="Strategy Exit Message",group=msgroup)

messageClose = input.string("", title="Strategy Close Message",group=msgroup)

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// POSITIONS =============================================================================================================

//VERIFY IF THE BUY FILTERS ARE ON OR OFF

bool emaFilterBuy = useEma? (close > ema):(close >= ema) or (close <= ema)

bool volatilityFilterBuy = useVltFilter? (vltFilterSpike > vltFilterX) : (vltFilterSpike >= 0) or (vltFilterSpike <= 0)

bool sqzFilterBuy = useSqzFilter? (val > val[1]): (val >= val[1] or val <=val[1])

bool sarflip = (close > out)

//LONG / SHORT POSITIONS LOGIC

//Var 'check' will verify if the SAR flips and if the exit price occurs it will limit in bars number a new entry on the same signal.

bool limitEntryNumbers = (ta.barssince(check) < nBars)

bool openLongPosition = sarTradeSignal == 'SAR Flip'? (sarflip and emaFilterBuy and volatilityFilterBuy and sqzFilterBuy and limitEntryNumbers) :sarTradeSignal=='SAR Breakout'? (BreakoutPrice and emaFilterBuy and volatilityFilterBuy and sqzFilterBuy): na

bool openShortPosition = na

bool closeLongPosition= tpType=='SAR Flip'? (close < out):na

bool closeShortPosition=na

// CHEK OPEN POSITONS =====================================================================================================

// open signal when not already into a position

bool validOpenLongPosition = openLongPosition and strategy.opentrades.size(strategy.opentrades - 1) <= 0

bool longIsActive = validOpenLongPosition or strategy.opentrades.size(strategy.opentrades - 1) > 0

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// TAKE PROFIT STOP LOSS CONFIG ==========================================================================================

// FIXED TAKE PROFIT IN %

float posSize = strategy.opentrades.entry_price(strategy.opentrades - 1) //Get the entry price

var float longTakeProfitPrice = na

longTakeProfitPrice := if (longIsActive)

if (openLongPosition and not (strategy.opentrades.size(strategy.opentrades - 1) > 0))

posSize * (1 + longTakeProfitPerc)

else

nz(longTakeProfitPrice[1], close * (1 + longTakeProfitPerc))

else

na

longTrailingTakeProfitStepTicks = longTakeProfitPrice * trailingTakeProfitDeviationPerc / syminfo.mintick

// FIXED STOP LOSS IN %

longStopPrice = strategy.position_avg_price * (1 - longLossPerc)

//shortStopPrice = strategy.position_avg_price * (1 + shortLossPerc)

// TAKE PROFIT BY RISK/REWARD

// Set stop loss

tta = not (strategy.opentrades.size(strategy.opentrades - 1) > 0)

float lastb = ta.valuewhen(check and tta,ta.lowest(low,5),0) - (10 * syminfo.mintick)

// TAKE PROFIT CALCULATION

float stopLossRisk = (posSize - lastb)

float takeProfitRR = posSize + (longTakeProfitRR * stopLossRisk)

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// POSITION ORDERS =====================================================================================================

// LOGIC ===============================================================================================================

// getting into LONG position

if (openLongPosition) and (inTradeWindow)

strategy.entry(id = 'Long Entry', direction = strategy.long, alert_message=messageEntry)

//submit exit orders for trailing take profit price

if (longIsActive) and (inTradeWindow)

strategy.exit(id = 'Long Take Profit', from_entry = 'Long Entry', limit = enableTrailing ? na : tpType=='Fixed % TP/SL'? longTakeProfitPrice: tpType == 'Risk Reward TP/SL'? takeProfitRR:na, trail_price = enableTrailing ? longTakeProfitPrice : na, trail_offset = enableTrailing ? longTrailingTakeProfitStepTicks : na, stop = tpType =='Fixed % TP/SL' ? longStopPrice: tpType == 'Risk Reward TP/SL'? lastb:na) //, alert_message='{ "action": "close_at_market_price", "message_type": "bot", "bot_id": 9330698, "email_token": "392265bc-84eb-4a54-a99c-758383ff9449", "delay_seconds": 0,"pair":"USDT_{{ticker}}" }')

if (closeLongPosition)

strategy.close(id = 'Long Entry', alert_message='{ "action": "close_at_market_price", "message_type": "bot", "bot_id": 9330698, "email_token": "392265bc-84eb-4a54-a99c-758383ff9449", "delay_seconds": 0,"pair":"USDT_{{ticker}}" }')

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// PLOTS ===============================================================================================================

// TRADE WINDOW ========================================================================================================

bgcolor(color = inTradeWindow ? color.new(#089981,90):na, title = 'Time Window')

// SAR PARABOLIC

var sarColor = color.new(#00bcd4,0)

plot(out, "ParabolicSAR", color=sarColor, linewidth=1,style=plot.style_cross)

//BREAKOUT LINE

var plotBkPoint = input.bool(defval=false, title='Show Breakout Point', group=bkgroup)

plot(series = (sarTradeSignal=='SAR Breakout' and plotBkPoint == true)? sarBreakoutPoint:na, title = 'Breakout line', color =color.new(#ffeb3b,50) , linewidth = 1, style = plot.style_linebr, offset = 0)

// EMA/SMA

var emafilterColor = color.new(color.white, 0)

plot(series=useEma? ema:na, title = 'EMA Filter', color = emafilterColor, linewidth = 2, style = plot.style_line)

// ENTRY PRICE

var posColor = color.new(#2962ff, 0)

plot(series = strategy.opentrades.entry_price(strategy.opentrades - 1), title = 'Position', color = posColor, linewidth = 1, style = plot.style_linebr,offset=0)

// FIXED TAKE PROFIT

var takeProfitColor = color.new(#ba68c8, 0)

plot(series = tpType=='Fixed % TP/SL'? longTakeProfitPrice:na, title = 'Fixed TP', color = takeProfitColor, linewidth = 1, style = plot.style_linebr, offset = 0)

// FIXED STOP LOSS

var stopLossColor = color.new(#ff0000, 0)

plot(series = tpType=='Fixed % TP/SL' ? longStopPrice:na, title = 'Fixed SL', color = stopLossColor, linewidth = 1, style = plot.style_linebr, offset = 0)

// RISK REWARD TAKE PROFIT

var takeProfitRRColor = color.new(#ba68c8, 0)

plot(series=tpType == 'Risk Reward TP/SL'? takeProfitRR:na,title='Risk Reward TP',color=takeProfitRRColor,linewidth=1,style=plot.style_linebr)

// STOP LOSS RISK REWARD

plot(series = (check and plotStopLossRR)? lastb:na, title = 'Last Bottom', color =color.new(#ff0000,0), linewidth = 2, style = plot.style_linebr, offset = 0)

// ======================================================================================================================