概述

RSI轴向均线交叉策略通过计算RSI指标及其简单移动平均线,并观察二者的金叉死叉来判断入场出场。该策略同时结合布林带为RSI轴向均线增加支撑阻力判断。

策略原理

该策略首先计算14日RSI指标,然后计算RSI指标的8日简单移动平均线。当RSI指标从下向上突破其移动平均线时产生买入信号;当RSI从上向下跌破其移动平均线时产生卖出信号。

同时,该策略为RSI轴向均线增加布林带判定。布林带通过计算标准差来判断RSI轴向均线是否已经相对过于拥挤,从而避免买入高点,卖出低点。

优势分析

RSI轴向均线交叉策略结合了趋势性指标RSI和曲线顺势指标移动平均线,能够有效判断市场趋势和随机性。RSI指标的算术平均能较好地平滑价格波动对信号的影响。

该策略加入的布林带使用标准差原理,能够自动调整上下轨的宽度,有效防止交易信号的错乱。当布林带收窄时,表示变化渐趋平缓,适合寻找反转机会;而当布林带扩大时,表示行情剧烈波动的时期,适合跟踪趋势。

风险分析

RSI轴向均线交叉策略最大的风险在于RSI指标和移动平均线本身的滞后性。当快速行情来临时,指标的计算和趋势判定都会有一定的滞后。这会导致买点被抬高,卖点被压低。

另一个主要风险是趋势牛熊转换时指标的误导。当行情出现转折而RSI和均线指标还没有反应过来时,会产生错误的交易信号从而造成损失。

解决方法包括适当调整RSI参数,缩短均线周期;加入趋势型指标辅助判断;适当放宽止损范围。

优化方向

RSI轴向均线交叉策略可以从以下几个方向进行优化:

优化RSI参数:调整RSI的长度可以平衡灵敏度和稳定性

优化移动平均线参数:调整均线类型和周期参数,优化指标的顺势性

增加止损机制:设定移动止损或时间止损,控制单笔损失

结合趋势指标:加入MACD,KDJ等指标,避免反转误判

多时间框架验证:利用更高时间框架确定趋势,避免被套

总结

RSI轴向均线交叉策略整体来说是一个比较成熟的量化交易策略。它融合了多种技术指标的优势,通过参数调整和多维度优化,可以进入市场的主流行情。该策略最大的风险在于指标的滞后性,需要搭配止损来控制损失。如果运用得当,RSI轴向均线交叉策略可以获得较为稳定的投资回报。

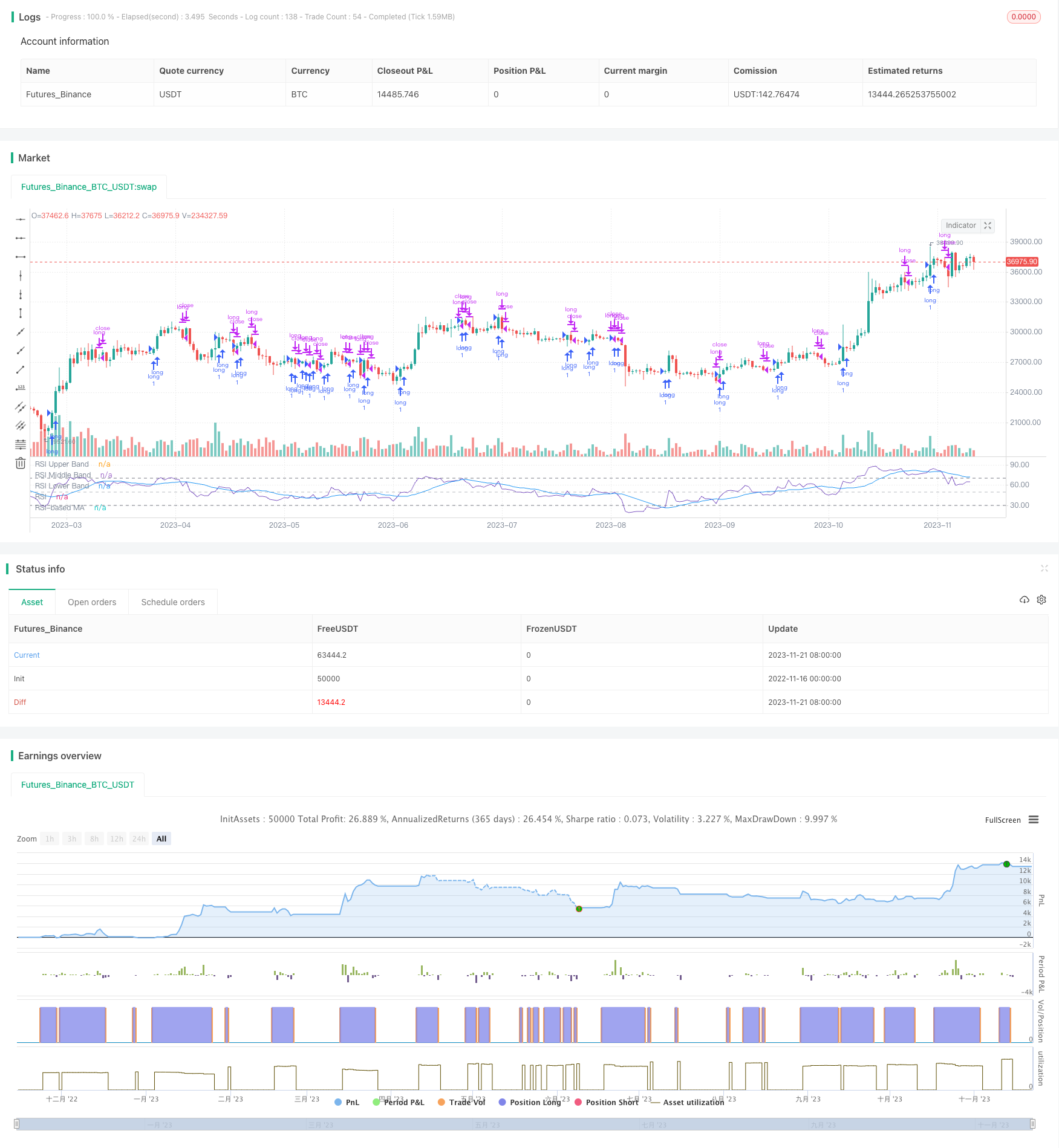

/*backtest

start: 2022-11-16 00:00:00

end: 2023-11-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// Copyright (c) 2020-present, Alex Orekhov (everget)

// Corrected Moving Average script may be freely distributed under the terms of the GPL-3.0 license.

strategy('rsisma', shorttitle='rsisma')

ma(source, length, type) =>

switch type

"SMA" => ta.sma(source, length)

"Bollinger Bands" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

rsiLengthInput = input.int(14, minval=1, title="RSI Length", group="RSI Settings")

rsiSourceInput = input.source(close, "Source", group="RSI Settings")

maTypeInput = input.string("SMA", title="MA Type", options=["SMA", "Bollinger Bands", "EMA", "SMMA (RMA)", "WMA", "VWMA"], group="MA Settings")

maLengthInput = input.int(14, title="MA Length", group="MA Settings")

bbMultInput = input.float(2.0, minval=0.001, maxval=50, title="BB StdDev", group="MA Settings")

up = ta.rma(math.max(ta.change(rsiSourceInput), 0), rsiLengthInput)

down = ta.rma(-math.min(ta.change(rsiSourceInput), 0), rsiLengthInput)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

rsiMA = ma(rsi, maLengthInput, maTypeInput)

isBB = maTypeInput == "Bollinger Bands"

plot(rsi, "RSI", color=#7E57C2)

plot(rsiMA, "RSI-based MA", color=color.blue)

rsiUpperBand = hline(70, "RSI Upper Band", color=#787B86)

hline(50, "RSI Middle Band", color=color.new(#787B86, 50))

rsiLowerBand = hline(30, "RSI Lower Band", color=#787B86)

fill(rsiUpperBand, rsiLowerBand, color=color.rgb(126, 87, 194, 90), title="RSI Background Fill")

bbUpperBand = plot(isBB ? rsiMA + ta.stdev(rsi, maLengthInput) * bbMultInput : na, title = "Upper Bollinger Band", color=color.green)

bbLowerBand = plot(isBB ? rsiMA - ta.stdev(rsi, maLengthInput) * bbMultInput : na, title = "Lower Bollinger Band", color=color.green)

fill(bbUpperBand, bbLowerBand, color= isBB ? color.new(color.green, 90) : na, title="Bollinger Bands Background Fill")

long = ta.crossover(rsi, rsiMA)

short = ta.crossunder(rsi, rsiMA)

if long

strategy.entry("long", strategy.long)

if short

strategy.close("long", comment = "long TP")

// long1 = close * 9

// long2 = long1 / 100

// long3 = long2 + close

//plot(long3,color=color.blue)

// if short

// strategy.entry("short", strategy.short)

// if long

// strategy.close("short", comment = "short TP")