概述

这是一个仅做多的Ichimoku云图量化策略。策略通过Ichimoku指标判断趋势方向,配合K线形态、移动平均线和 Stochastic RSI 指标过滤信号,在趋势向上时选择较好的入场点做多。

策略原理

该策略主要判断标准如下:

- Ichimoku先导线1上穿先导线2,表示趋势转多

- K线收盘价上穿先导线1,符合追踪趋势的条件

- K线为阳线,趋势向上

- 启用移动平均线时,要求快线上穿慢线

- 启用Stochastic RSI时,要求K线上穿D线

当以上条件同时满足时,策略会开仓做多;当价格跌破先导线1时,策略会平仓离场。

该策略主要利用Ichimoku云图判断主趋势方向,再结合辅助指标过滤信号,在趋势向上时选择较好点位入场。

策略优势

- 利用Ichimoku云图判断主趋势,回测表明其判断准确率很高

- 结合多种辅助指标过滤入场点位,可显著提高获利率

- 仅做多策略,适用于判断为多头行情的币种

- 参数优化空间大,可调整指标参数进一步优化

策略风险

- Ichimoku云图判断失败的概率存在,可能误判趋势方向

- 行情突变时止损点可能被突破,导致亏损扩大

- 针对多头行情设计,不适合行情暗藏转势迹象的币种

- 参数设置不当可能导致过于激进入场或过于保守

对策:

- 结合更多指标判断趋势,提高判断准确率

- 设置合理止损点,严格控制单笔亏损

- 根据不同币种行情选择适用策略

- 仔细测试与优化参数,使策略更稳定

策略优化方向

- 优化辅助指标参数设置,进一步提高策略稳定性

- 增加止损机制,例如追踪止损、指数移动平均线止损等

- 增加仓位管理,例如固定仓位、仓位平均等

- 针对具体币种进行参数调整优化

总结

该Ichimoku云图量化策略通过判断趋势方向,实现高胜率且风险可控的仅多头做单策略。策略优势明显,在多头行情中效果突出。下一步可从指标优化、止损机制、仓位管理等方面进行改进,使策略更加完善稳定。

策略源码

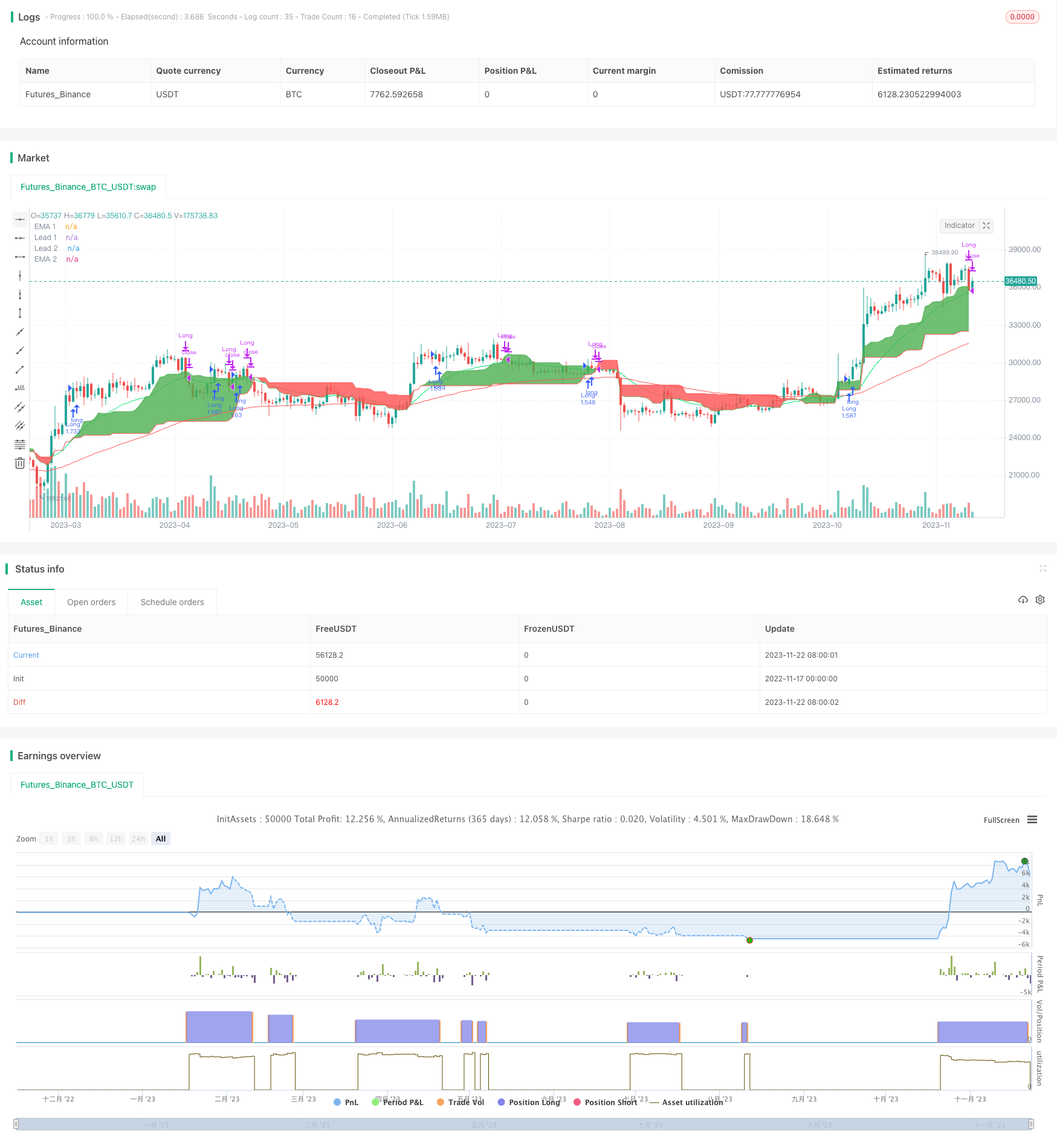

/*backtest

start: 2022-11-17 00:00:00

end: 2023-11-23 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="Ichimoku only Long Strategy", shorttitle="Ichimoku only Long", overlay = true, pyramiding = 0, calc_on_order_fills = false, commission_type = strategy.commission.percent, commission_value = 0, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, initial_capital=10000, currency=currency.USD)

// Time Range

FromMonth=input(defval=1,title="FromMonth",minval=1,maxval=12)

FromDay=input(defval=1,title="FromDay",minval=1,maxval=31)

FromYear=input(defval=2017,title="FromYear",minval=2017)

ToMonth=input(defval=1,title="ToMonth",minval=1,maxval=12)

ToDay=input(defval=1,title="ToDay",minval=1,maxval=31)

ToYear=input(defval=9999,title="ToYear",minval=2017)

start=timestamp(FromYear,FromMonth,FromDay,00,00)

finish=timestamp(ToYear,ToMonth,ToDay,23,59)

window()=>true

// See if this bar's time happened on/after start date

afterStartDate = time >= start and time<=finish?true:false

//Enable RSI

enableema = input(true, title="Enable EMA?")

enablestochrsi = input(false, title="Enable Stochastik RSI?")

//EMA

emasrc = close,

len1 = input(24, minval=1, title="EMA 1")

len2 = input(90, minval=1, title="EMA 2")

ema1 = ema(emasrc, len1)

ema2 = ema(emasrc, len2)

col1 = color.lime

col2 = color.red

//EMA Plots

plot(ema1, title="EMA 1", linewidth=1, color=col1)

plot(ema2, title="EMA 2", linewidth=1, color=col2)

//STOCH RSI

smoothK = input(3, minval=1, title="RSI K Line")

smoothD = input(3, minval=1, title="RSI D Line")

lengthRSI = input(14, minval=1, title="RSI Length")

lengthStoch = input(14, minval=1, title="Stochastik Length")

src = input(close, title="RSI Source")

rsi1 = rsi(src, lengthRSI)

k = sma(stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK)

d = sma(k, smoothD)

//Ichimoku

conversionPeriods = input(9, minval=1, title="Ichi Conversion Line Length")

basePeriods = input(26, minval=1, title="Ichi Base Line Length")

laggingSpan2Periods = input(52, minval=1, title="Ichi Lagging Span 2 Length")

displacement = input(1, minval=0, title="Ichi Displacement")

donchian(len) => avg(lowest(len), highest(len))

conversionLine = donchian(conversionPeriods)

baseLine = donchian(basePeriods)

leadLine1 = avg(conversionLine, baseLine)

leadLine2 = donchian(laggingSpan2Periods)

p1 = plot(leadLine1, offset = displacement - 1, color=color.green,

title="Lead 1")

p2 = plot(leadLine2, offset = displacement - 1, color=color.red,

title="Lead 2")

fill(p1, p2, color = leadLine1 > leadLine2 ? color.green : color.red)

//Long Condition

crossup = k[0] > d[0] and k[1] <= d[1]

ichigreenabovered = leadLine1 > leadLine2

ichimokulong = close > leadLine1

greencandle = close > open

redcandle = close < open

emacond = ema1 > ema2

longcondition = ichigreenabovered and ichimokulong and greencandle

//Exit Condition

ichimokuexit = close < leadLine1

exitcondition = ichimokuexit and redcandle

//Entrys

if (enablestochrsi == false) and (enableema == false) and (longcondition) and (afterStartDate) and (strategy.opentrades < 1)

strategy.entry("Long", strategy.long)

if (enablestochrsi == true) and (enableema == false) and (longcondition) and (crossup) and (afterStartDate) and (strategy.opentrades < 1)

strategy.entry("Long", strategy.long)

if (enableema == true) and (enablestochrsi == false) and (longcondition) and (emacond) and (afterStartDate) and (strategy.opentrades < 1)

strategy.entry("Long", strategy.long)

if (enableema == true) and (enablestochrsi == true) and (longcondition) and (emacond) and (crossup) and (afterStartDate) and (strategy.opentrades < 1)

strategy.entry("Long", strategy.long)

//Exits

if (afterStartDate)

strategy.close(id = "Long", when = exitcondition)