概述

本策略运用加权标准差指标,结合移动平均线,实现对加密货币的趋势交易。策略根据一定周期内的收盘价及成交量,计算出价格的加权标准差通道。当价格突破通道上下轨时,做多做空。同时,设置止损止盈条件,降低单笔损失。

策略原理

代码中定义了两个自定义函数,分别从时间序列和数组计算加权标准差。主要步骤是:

- 根据收盘价和成交量,计算加权平均价

- 计算每根K线与平均价的误差的平方

- 按照样本量及权重调整后的平均值,计算方差

- 开方得到标准差

这样,我们便得到了一个中心在加权平均价,上下距离为一个标准差的通道。当价格从下方突破该通道底部时,做多;当从上方突破通道顶部时,做空。

优势分析

这套策略最大的优势在于,融合了移动平均线和波动率分析。移动平均线判断市场趋势方向,标准差界定合理区间,二者相互验证,可靠性较高。另外,成交量权重可过滤假突破,实际突破概率更大。

该策略还设置了止损止盈点,有利于把握趋势,而避免反转造成 Loss 过大。这是许多新手无法掌握的要点。

风险分析

主要风险在于,市场可能出现剧烈波动。这时标准差通道也会大幅波动,不利于判断。此外,如果选择周期过短,容易被噪音干扰,出错率较大。

对策是,可适当调整周期参数,平滑曲线。也可以考虑结合其他指标,如 RSI 等,增加突破的确认效果。

优化方向

- 优化周期参数。可以测试 5 分钟、15 分钟、30 分钟等不同周期,寻找最佳组合

- 优化止损止盈比例。测试不同的止损止盈点,取得最优回报率

- 增加过滤条件。比如结合成交量,避免虚假突破带来 Loss

- 增加蜡烛指标。如通过收盘价位置、影线长度等确认K线实体,减少错误率

总结

本策略成功利用加权标准差指标,辅以移动平均线判断方向,实现对加密货币的趋势跟踪。同时,合理的止损止盈设置有助于把握市场节奏,避免过度反转带来损失。通过参数调整与多指标验证,可进一步优化,并形成可靠的量化交易策略。

策略源码

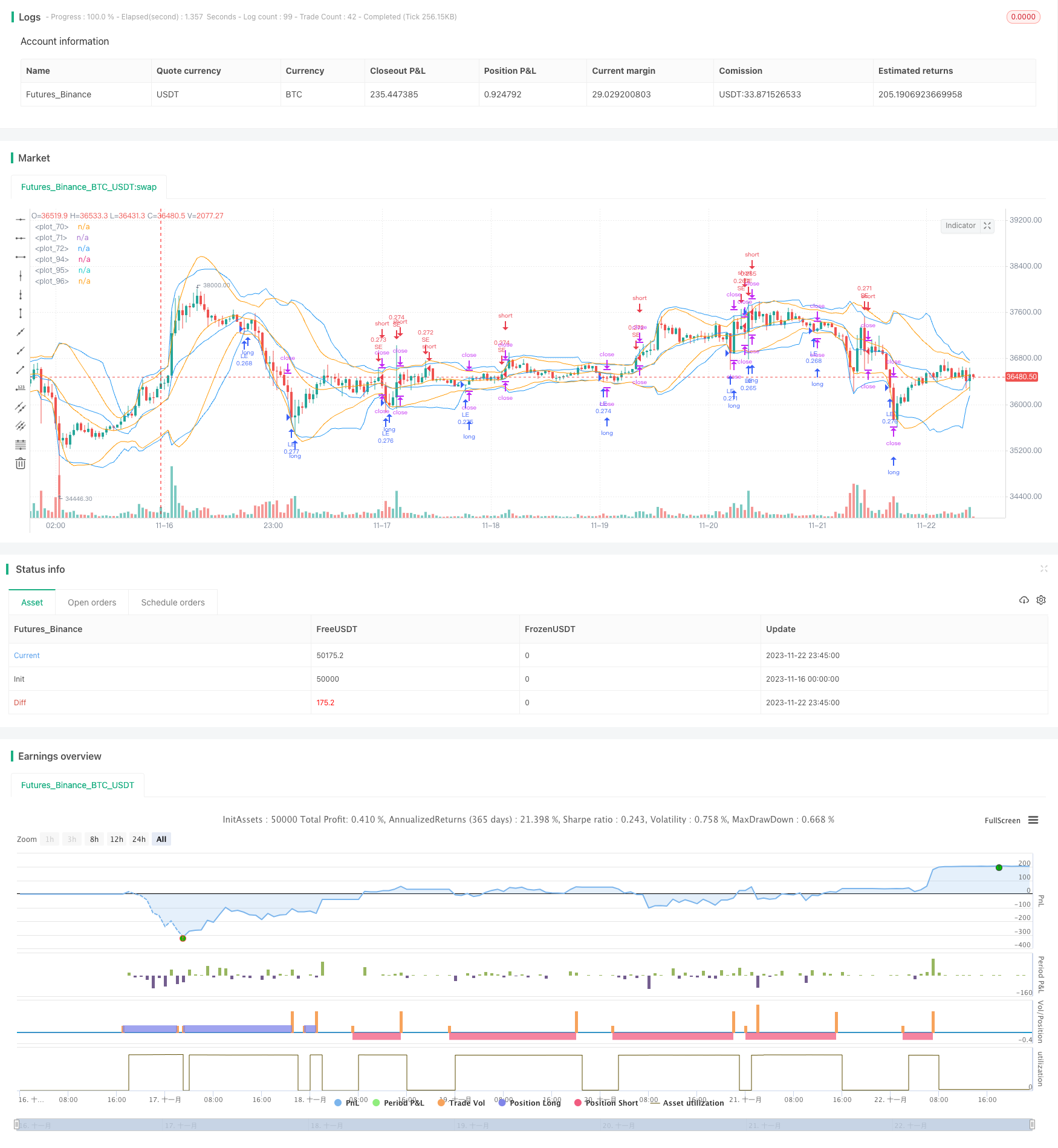

/*backtest

start: 2023-11-16 00:00:00

end: 2023-11-23 00:00:00

period: 45m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © rumpypumpydumpy © cache_that_pass

//@version=4

strategy("[cache_that_pass] 1m 15m Function - Weighted Standard Deviation", overlay=true, pyramiding=0, default_qty_type=strategy.percent_of_equity, default_qty_value=20, initial_capital=10000, commission_type=strategy.commission.percent, commission_value=0.075)

f_weighted_sd_from_series(_src, _weight, _n) => //{

// @function: Calculates weighted mean, variance, standard deviation, MSE and RMSE from time series variables

// @parameters:

// _src: time series variable of sample values

// _weight: time series of corresponding weight values.

// _n : number of samples

_xw = _src * _weight

_sum_weight = sum(_weight, _n)

_mean = sum(_xw, _n) / _sum_weight

float _sqerror_sum = 0

int _nonzero_n = 0

for _i = 0 to _n - 1

_sqerror_sum := _sqerror_sum + pow(_mean - _src[_i], 2) * _weight[_i]

_nonzero_n := _weight[_i] != 0 ? _nonzero_n + 1 : _nonzero_n

_variance = _sqerror_sum / ((_nonzero_n - 1) * _sum_weight / _nonzero_n)

_dev = sqrt(_variance)

_mse = _sqerror_sum / _sum_weight

_rmse = sqrt(_mse)

[_mean, _variance, _dev, _mse, _rmse]

//}

// -----------------------------------------------------------------------------

f_weighted_sd_from_arrays(_a_src, _a_weight, _n) => //{

// @function: Calculates weighted mean, variance, standard deviation, MSE and RMSE from arrays

// Expects index 0 of the arrays to be the most recent sample and weight values!

// @parameters:

// _a_src: array of sample values

// _a_weight: array of corresponding weight values.

// _n : number of samples

float _mean = na, float _variance = na, float _dev = na, float _mse = na

float _rmse = na, float _sqerror_sum = na, float _sum_weight = na

float[] _a_xw = array.new_float(_n)

int _nonzero_n = 0

if array.size(_a_src) >= _n

_sum_weight := 0

_sqerror_sum := 0

for _i = 0 to _n - 1

array.set(_a_xw, _i, array.get(_a_src, _i) * array.get(_a_weight, _i))

_sum_weight := _sum_weight + array.get(_a_weight, _i)

_nonzero_n := array.get(_a_weight, _i) != 0 ? _nonzero_n + 1 : _nonzero_n

_mean := array.sum(_a_xw) / _sum_weight

for _j = 0 to _n - 1

_sqerror_sum := _sqerror_sum + pow(_mean - array.get(_a_src, _j), 2) * array.get(_a_weight, _j)

_variance := _sqerror_sum / ((_nonzero_n - 1) * _sum_weight / _nonzero_n)

_dev := sqrt(_variance)

_mse := _sqerror_sum / _sum_weight

_rmse := sqrt(_mse)

[_mean, _variance, _dev, _mse, _rmse]

//}

// -----------------------------------------------------------------------------

// Example usage :

// -----------------------------------------------------------------------------

len = input(20)

// -----------------------------------------------------------------------------

// From series :

// -----------------------------------------------------------------------------

[m, v, d, mse, rmse] = f_weighted_sd_from_series(close, volume, len)

plot(m, color = color.blue)

plot(m + d * 2, color = color.blue)

plot(m - d * 2, color = color.blue)

// -----------------------------------------------------------------------------

// -----------------------------------------------------------------------------

// From arrays :

// -----------------------------------------------------------------------------

var float[] a_src = array.new_float()

var float[] a_weight = array.new_float()

if barstate.isfirst

for i = 1 to len

array.unshift(a_weight, i)

array.unshift(a_src, close)

if array.size(a_src) > len

array.pop(a_src)

[a_m, a_v, a_d, a_mse, a_rmse] = f_weighted_sd_from_arrays(a_src, a_weight, len)

plot(a_m, color = color.orange)

plot(a_m + a_d * 2, color = color.orange)

plot(a_m - a_d * 2, color = color.orange)

// -----------------------------------------------------------------------------

series_text = "Mean : " + tostring(m) + "\nVariance : " + tostring(v) + "\nSD : " + tostring(d) + "\nMSE : " + tostring(mse) + "\nRMSE : " + tostring(rmse)

array_text = "Mean : " + tostring(a_m) + "\nVariance : " + tostring(a_v) + "\nSD : " + tostring(a_d) + "\nMSE : " + tostring(a_mse) + "\nRMSE : " + tostring(a_rmse)

debug_text = "Volume weighted from time series : \n" + series_text + "\n\nLinearly weighted from arrays : \n" + array_text

//debug = label.new(x = bar_index, y = close, text = debug_text, style = label.style_label_left)

//.delete(debug[1])

//test strategy

if low <= (m - d * 2)

strategy.entry("LE", strategy.long)

if high >= (m + d * 2)

strategy.entry("SE", strategy.short)

// User Options to Change Inputs (%)

stopPer = input(3.11, title='Stop Loss %', type=input.float) / 100

takePer = input(7.50, title='Take Profit %', type=input.float) / 100

// Determine where you've entered and in what direction

longStop = strategy.position_avg_price * (1 - stopPer)

shortStop = strategy.position_avg_price * (1 + stopPer)

shortTake = strategy.position_avg_price * (1 - takePer)

longTake = strategy.position_avg_price * (1 + takePer)

if strategy.position_size > 0

strategy.exit(id="Close Long", stop=longStop, limit=longTake)

// strategy.close("LE", when = (longStop) or (longTake), qty_percent = 100)

if strategy.position_size < 0

strategy.exit(id="Close Short", stop=shortStop, limit=shortTake)

// strategy.close("SE", when = (shortStop) or (shortTake), qty_percent = 100)