概述

本策略是一个针对美元指数(ES)3分钟间隔的短仓专家顾问策略。它通过计算一系列指数移动平均线,结合特定的形态条件来产生交易信号。

策略原理

该策略的核心指标是T3平均线。T3平均线首先计算一组指数移动平均线xe1~xe6,时间间隔为用户设定的T3参数。然后通过一组特定的加权系数,计算这些指数移动平均的加权平均值,作为最终的T3平均线。

当收盘价低于T3平均线时产生买入信号;当收盘价高于T3平均线时产生卖出信号。此外,策略还判断了特定的K线形态作为入场信号的辅助条件。只有当符合形态条件和T3平均线信号同时出现时,才会发出交易指令。

优势分析

该策略最大的优势在于多重过滤和参数优化。一方面,结合价位指标和图形指标进行多重过滤,可以减少许多噪声交易。另一方面,关键参数T3和形态判断规则可以进行优化,从而针对不同市场调整入场精度。

此外,相比简单移动平均线等指标,T3指标的叠加平滑可以有效过滤市场噪音,识别趋势转换点。而三分钟周期适合日内交易,可以快速捕捉短期机会。

风险及解决方法

该策略主要的风险在于参数优化不当和持仓时间过长。如果T3参数设定过大,那么策略的指标变化会滞后;如果设定过小,则会增加噪声交易的概率。此外,三分钟周期操作如果没有及时止损,亏损风险较大。

为控制风险,首先需要针对不同品种反复测试,确定参数的最优范围。其次,要严格执行止损策略,及时止损退出,控制单笔亏损在一定比例以内。

优化方向

该策略主要有以下几个优化方向:

优化T3参数,找到不同交易品种的参数最优区间

优化图形指标判断逻辑,提高形态识别准确率

增加滞后止损,追踪止损等止损优化方法

增加基于收益率或最大回撤的资金管理模块

增加机器学习模型判断的辅助入场模块

通过以上几个方向的优化,可以逐步提升策略的稳定性和盈利能力。

总结

本策略作为一个短线日内交易策略,具有指标优化空间大、多重过滤和快速出手等优势。通过参数优化、止损优化、资金管理等一系列优化手段,可以将其调教为一个适应高频交易的有效策略。

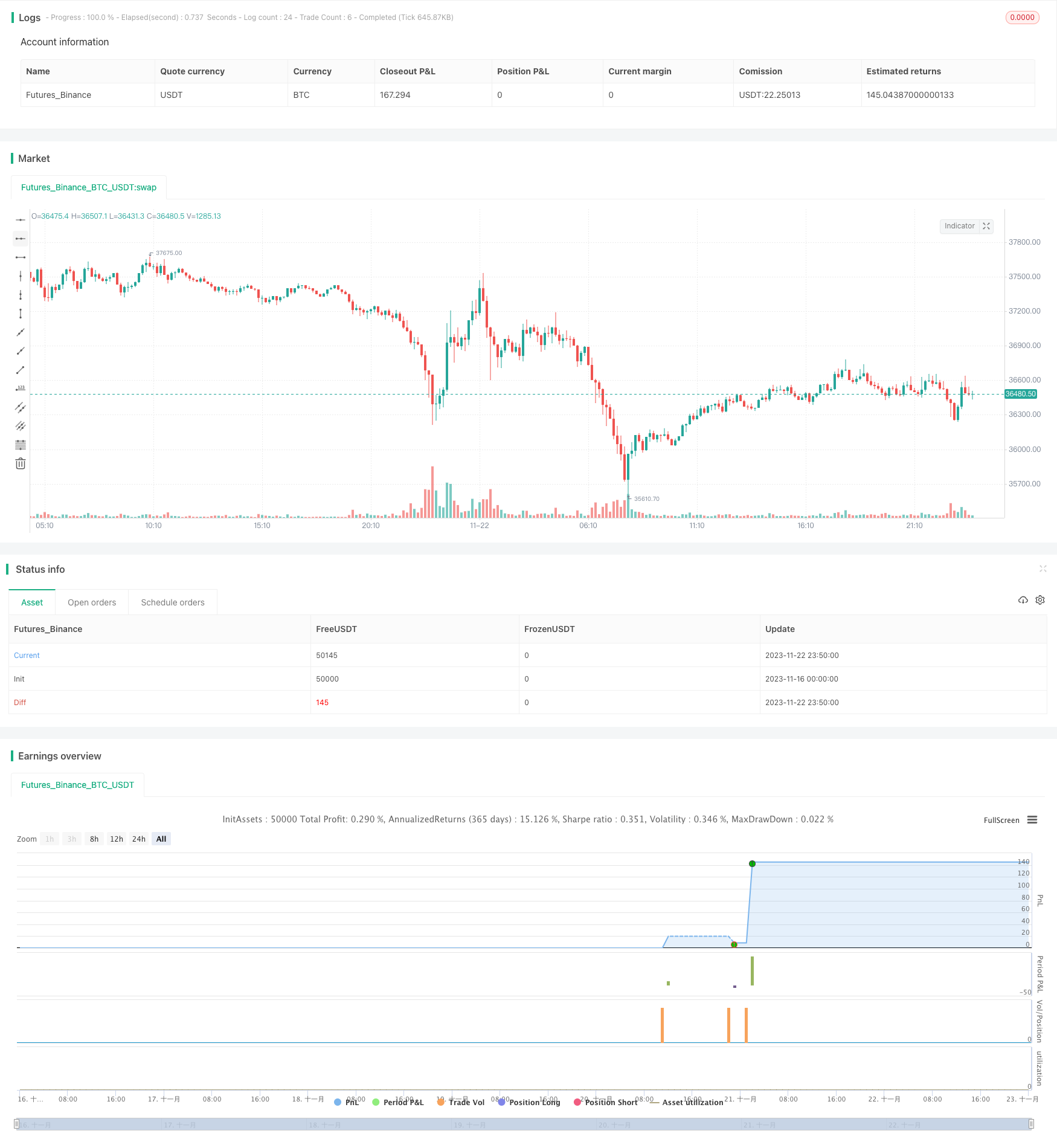

/*backtest

start: 2023-11-16 00:00:00

end: 2023-11-23 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("ES 3m Short Only (Triple RED)", overlay=true)

// Alert Message '{{strategy.order.alert_message}}'

//3min

T3 = input(150)//to 600

xPrice3 = close

xe1 = ta.ema(xPrice3, T3)

xe2 = ta.ema(xe1, T3)

xe3 = ta.ema(xe2, T3)

xe4 = ta.ema(xe3, T3)

xe5 = ta.ema(xe4, T3)

xe6 = ta.ema(xe5, T3)

b3 = 0.7

c1 = -b3*b3*b3

c2 = 3*b3*b3+3*b3*b3*b3

c3 = -6*b3*b3-3*b3-3*b3*b3*b3

c4 = 1+3*b3+b3*b3*b3+3*b3*b3

nT3Average = c1 * xe6 + c2 * xe5 + c3 * xe4 + c4 * xe3

// Buy Signal - Price is below T3 Average

buySignal3 = xPrice3 < nT3Average

sellSignal3 = xPrice3 > nT3Average

//NinjaTrader Settings.

acct = "Sim101"

ticker = "ES 12-23"

qty = 1

takeProfitTicks = 4

stopLossTicks = 16

tickSize = 0.25

takeProfitShort = close - takeProfitTicks * tickSize

stopLossShort = close + stopLossTicks * tickSize

OCOMarketShort = '{ "alert": "OCO Market Short", "account": "' + str.tostring(acct) + '", "ticker": "' + str.tostring(ticker) + '", "qty": "' + str.tostring(qty) + '", "take_profit_price": "' + str.tostring(takeProfitShort) + '", "stop_price": "' + str.tostring(stopLossShort) + '", "tif": "DAY" }'

CloseAll = '{ "alert": "Close All", "account": "' + str.tostring(acct) + '", "ticker": "' + str.tostring(ticker) + '" }'

IsUp = close > open

IsDown = close < open

PatternPlot = IsDown[2] and IsDown[1] and IsDown and close[1] <= high[0] and close[1] > close[0] and low[1] > low[0] and high[2] > high[1] and low[2] <= low[1]

if (PatternPlot and sellSignal3)

strategy.entry('Short', strategy.short, alert_message=OCOMarketShort)

strategy.exit('Close Short', 'Short', profit=takeProfitTicks, loss=stopLossTicks, alert_message=CloseAll)

//plotshape(PatternPlot, title="Custom Pattern", style=shape.circle, location=location.abovebar, color=color.red, size=size.small)