概述

Alpha趋势跟踪止损策略是在Alpha趋势策略的基础上加入了跟踪止损机制,可以更有效地控制风险,提高整体回报率。

策略原理

该策略首先利用Alpha指标判断价格趋势,当Alpha指标上扬时为看涨信号,Alpha指标下跌时为看跌信号。策略根据Alpha指标的金叉死叉来产生买入和卖出信号。

同时,策略启用了跟踪止损机制。跟踪止损值默认为当日收盘价的10%,当持有多头头寸时,如果价格下跌超过止损值则止损退出;当持有空头头寸时,如果价格上涨超过止损值则止损退出。这样可以更好地锁定盈利,降低风险。

优势分析

Alpha趋势判断价格趋势的能力较强,效果好于普通移动平均线等指标。

启用跟踪止损机制,可以有效地控制单笔亏损,减少风险。

该策略风险控制能力较强,即使行情不利也能尽量减少损失。

该策略参考数较少,计算效率高,适合高频交易。

风险分析

该策略在横盘调整时会产生较多不必要的交易信号,这会增加交易成本和滑点损失。

启用跟踪止损时需要合理设置止损比例,比例过大过小都不利于策略盈利。

标的价格剧烈波动时,会导致止损被触发的概率较大,增加了套牢风险。

优化止损参数时需要综合考虑标的特性、交易频率等多种因素,不能只追求最大化收益。

以上风险可以通过调整Alpha指标参数,设置DYNAMIC止损,缩短交易周期等方法进行缓解。

优化方向

可以测试不同的指标参数,寻找更适合的Alpha指标参数组合。

尝试基于ATR动态设置止损幅度,使其能更好地适应市场波动。

可以结合其他指标筛选信号,如MACD、KD等,过滤掉一些误信号。

可以基于真实盘和回测结果自动优化参数,使用机器学习等技术提高参数选择的智能化。

总结

Alpha趋势跟踪止损策略融合了趋势判断与风险控制,可以有效判别价格趋势,并锁定盈利降低风险。相比于简单的趋势跟踪策略,该策略可以获得更高的稳定收益。通过多方面的优化,有望获得更出色的绩效。

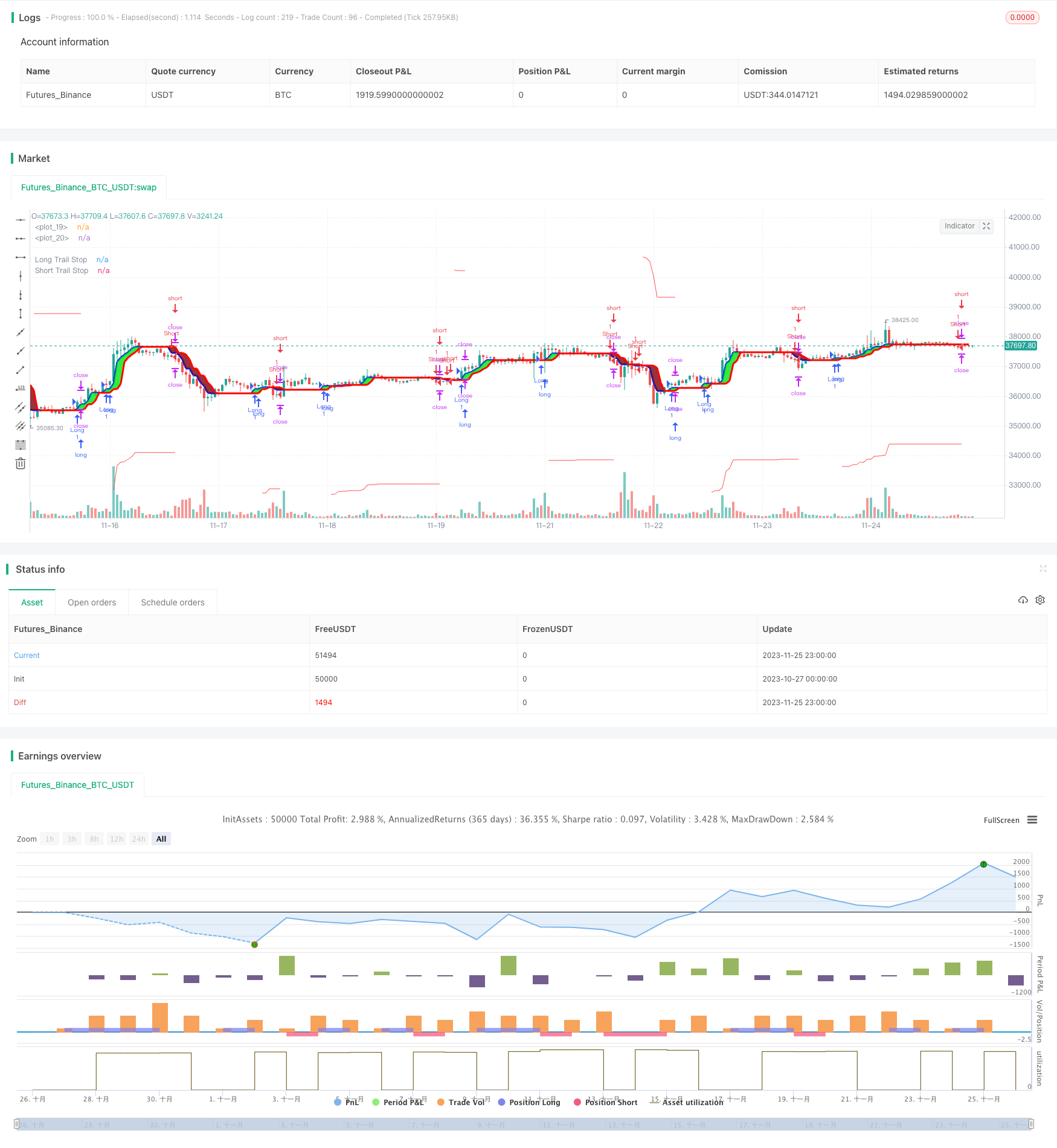

/*backtest

start: 2023-10-27 00:00:00

end: 2023-11-26 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// author © KivancOzbilgic

// developer © KivancOzbilgic

//@version=5

strategy("AlphaTrend Strategy", shorttitle='ATst', overlay=true, format=format.price, precision=2, margin_long=100, margin_short=100)

coeff = input.float(1, 'Multiplier', step=0.1)

AP = input(14, 'Common Period')

ATR = ta.sma(ta.tr, AP)

src = input(close)

showsignalsk = input(title='Show Signals?', defval=false)

novolumedata = input(title='Change calculation (no volume data)?', defval=false)

upT = low - ATR * coeff

downT = high + ATR * coeff

AlphaTrend = 0.0

AlphaTrend := (novolumedata ? ta.rsi(src, AP) >= 50 : ta.mfi(hlc3, AP) >= 50) ? upT < nz(AlphaTrend[1]) ? nz(AlphaTrend[1]) : upT : downT > nz(AlphaTrend[1]) ? nz(AlphaTrend[1]) : downT

color1 = AlphaTrend > AlphaTrend[1] ? #00E60F : AlphaTrend < AlphaTrend[1] ? #80000B : AlphaTrend[1] > AlphaTrend[3] ? #00E60F : #80000B

k1 = plot(AlphaTrend, color=color.new(#0022FC, 0), linewidth=3)

k2 = plot(AlphaTrend[2], color=color.new(#FC0400, 0), linewidth=3)

fill(k1, k2, color=color1)

buySignalk = ta.crossover(AlphaTrend, AlphaTrend[2])

sellSignalk = ta.crossunder(AlphaTrend, AlphaTrend[2])

K1 = ta.barssince(buySignalk)

K2 = ta.barssince(sellSignalk)

O1 = ta.barssince(buySignalk[1])

O2 = ta.barssince(sellSignalk[1])

plotshape(buySignalk and showsignalsk and O1 > K2 ? AlphaTrend[2] * 0.9999 : na, title='BUY', text='BUY', location=location.absolute, style=shape.labelup, size=size.tiny, color=color.new(#0022FC, 0), textcolor=color.new(color.white, 0))

plotshape(sellSignalk and showsignalsk and O2 > K1 ? AlphaTrend[2] * 1.0001 : na, title='SELL', text='SELL', location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.new(color.maroon, 0), textcolor=color.new(color.white, 0))

// //ENTER SOME SETUP TRADES FOR TSL EXAMPLE

// longCondition = ta.crossover(ta.sma(close, 10), ta.sma(close, 20))

// if longCondition

// strategy.entry('My Long Entry Id', strategy.long)

// shortCondition = ta.crossunder(ta.sma(close, 10), ta.sma(close, 20))

// if shortCondition

// strategy.entry('My Short Entry Id', strategy.short)

longCondition = buySignalk

if (longCondition)

strategy.entry("Long", strategy.long)

shortCondition = sellSignalk

if (shortCondition)

strategy.entry("Short", strategy.short)

enableTrailing = input.bool(title='Enable Trailing Stop (%)',defval = true)

//TRAILING STOP CODE

trailStop = input.float(title='Trailing (%)', minval=0.0, step=0.1, defval=10) * 0.01

longStopPrice = 0.0

shortStopPrice = 0.0

longStopPrice := if strategy.position_size > 0

stopValue = close * (1 - trailStop)

math.max(stopValue, longStopPrice[1])

else

0

shortStopPrice := if strategy.position_size < 0

stopValue = close * (1 + trailStop)

math.min(stopValue, shortStopPrice[1])

else

999999

//PLOT TSL LINES

plot(series=strategy.position_size > 0 ? longStopPrice : na, color=color.new(color.red, 0), style=plot.style_linebr, linewidth=1, title='Long Trail Stop', offset=1, title='Long Trail Stop')

plot(series=strategy.position_size < 0 ? shortStopPrice : na, color=color.new(color.red, 0), style=plot.style_linebr, linewidth=1, title='Short Trail Stop', offset=1, title='Short Trail Stop')

if enableTrailing

//EXIT TRADE @ TSL

if strategy.position_size > 0

strategy.exit(id='Close Long', stop=longStopPrice)

if strategy.position_size < 0

strategy.exit(id='Close Short', stop=shortStopPrice)