概述

该策略利用了移动平均线EMA、相对强弱指标RSI、商品信道指标CCI三大主流指标结合,通过EMA均线是否回转识别价格趋势,然后使用过买过卖的RSI和CCI指标进行辅助判断,形成交易信号。属于中间期交易策略。

策略原理

用4周期和8周期的EMA均线交叉来判断价格趋势,4周期快速判断,8周期慢速确定;

EMA均线向上回转时,即4周期线上穿8周期线,再辅助判断RSI指标高于65(相对超买区)和CCI指标高于0(代表没有超买超卖),满足则产生做多信号;

EMA均线向下回转时,即4周期线下穿8周期线,再辅助判断RSI指标低于35(相对超卖区)和CCI指标低于0(代表没有超买超卖),满足则产生做空信号;

形成信号后,根据输入的止损距离和止盈距离来设置止损和止盈价格。

总体来说,该策略综合考量了中短期价格趋势和短期指标超买超卖区间避让,比较稳定,同时止损止盈设置也会有效控制单次交易的最大损失。

优势分析

多指标综合判断,避免误判概率较大的单一指标交易策略;

EMA均线判断主趋势,避免被短期波动误导判断;RSI和CCI指标避让超买超卖区,增加胜率;

自动设置止损和止盈控制单笔交易风险,有效防止极端行情导致亏损扩大;

该策略属于技术面交易策略,不受基本面影响,市场任何단位周期都可以使用,易于实盘。

风险分析

突发重大利空/利好消息面前技术指标容易失效;

股价剧烈波动时,止损可能被突破,应适当放宽止损幅度;

该策略属于短线频繁交易策略,交易成本会对盈利造成一定影响,适合具有成本优势的高频策略。

优化方向

增加机器学习算法,结合股票基本面情况自动调整参数;

增加自适应止损机制,而不是固定的止损距离。

总结

该交易策略综合多个指标判断,在合理参数设置下,可以获得比较稳定的中短期交易盈利,属于易于实盘的技术面策略。但同时也应注意防范突发重大基本消息,适当放宽止损距离等风险防范措施,这也是未来可以进一步优化的方向。

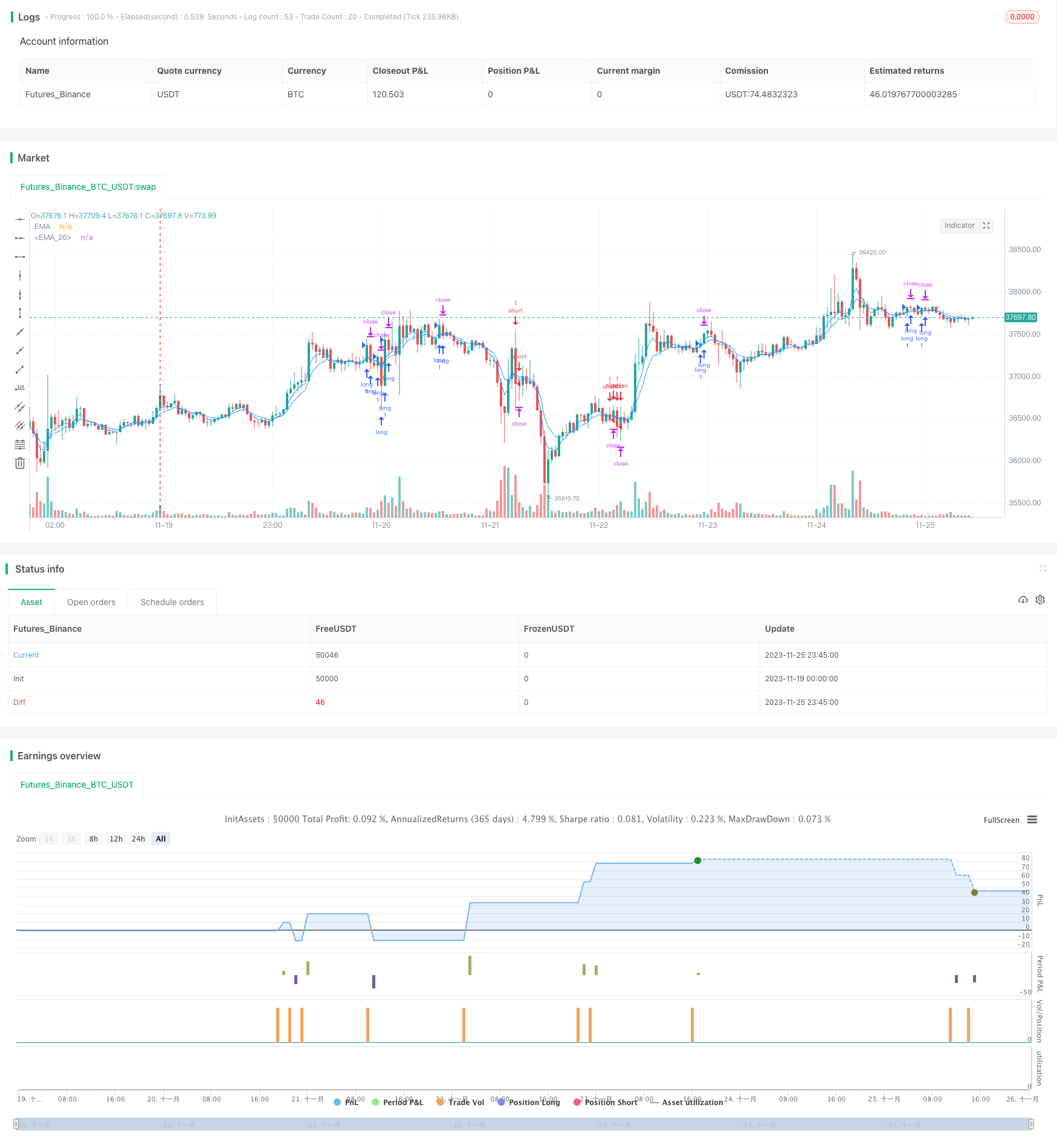

/*backtest

start: 2023-11-19 00:00:00

end: 2023-11-26 00:00:00

period: 45m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © SoftKill21

//@version=4

strategy(title="Moving Average Exponential", shorttitle="EMA", overlay=true)

len4 = input(4, minval=1, title="Length_MA4")

src4 = input(close, title="Source")

offset4 = input(title="Offset", type=input.integer, defval=0, minval=-500, maxval=500)

out4 = ema(src4, len4)

plot(out4, title="EMA", color=color.blue, offset=offset4)

len8 = input(8, minval=1, title="Length_MA8")

src8 = input(close, title="Source")

offset8 = input(title="Offset", type=input.integer, defval=0, minval=-500, maxval=500)

out8 = ema(src8, len8)

plot(out8, title="EMA", color=color.blue, offset=offset8)

//rsioma

src = close, len = input(14, minval=1, title="Length")

up = rma(max(change(ema(src, len)), 0), len)

down = rma(-min(change(ema(src, len)), 0), len)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

//plot(rsi, color=color.blue)

//band1 = hline(80)

//band0 = hline(20)

//fill(band1, band0, color=color.purple, transp=90)

//hline(50, color=color.gray, linestyle=plot.style_line)

sig = ema(rsi, 21)

//plot(sig, color=color.purple)

//woodie

cciTurboLength = input(title="CCI Turbo Length", type=input.integer, defval=6, minval=3, maxval=14)

cci14Length = input(title="CCI 14 Length", type=input.integer, defval=14, minval=7, maxval=20)

source = close

cciTurbo = cci(source, cciTurboLength)

cci14 = cci(source, cci14Length)

last5IsDown = cci14[5] < 0 and cci14[4] < 0 and cci14[3] < 0 and cci14[2] < 0 and cci14[1] < 0

last5IsUp = cci14[5] > 0 and cci14[4] > 0 and cci14[3] > 0 and cci14[2] > 0 and cci14[1] > 0

histogramColor = last5IsUp ? color.green : last5IsDown ? color.red : cci14 < 0 ? color.green : color.red

// Exit Condition

// Exit Condition

a = input(12)*10

b = input(15)*10

c = a*syminfo.mintick

d = b*syminfo.mintick

longCondition = crossover(out4, out8) and (rsi >= 65 and cci14>=0)

shortCondition = crossunder(out4, out8) and (rsi <=35 and cci14<=0)

long_stop_level = float(na)

long_profit_level1 = float(na)

long_profit_level2 = float(na)

long_even_level = float(na)

short_stop_level = float(na)

short_profit_level1 = float(na)

short_profit_level2 = float(na)

short_even_level = float(na)

long_stop_level := longCondition ? close - c : long_stop_level [1]

long_profit_level1 := longCondition ? close + d : long_profit_level1 [1]

//long_profit_level2 := longCondition ? close + d : long_profit_level2 [1]

//long_even_level := longCondition ? close + 0 : long_even_level [1]

short_stop_level := shortCondition ? close + c : short_stop_level [1]

short_profit_level1 := shortCondition ? close - d : short_profit_level1 [1]

//short_profit_level2 := shortCondition ? close - d : short_profit_level2 [1]

//short_even_level := shortCondition ? close + 0 : short_even_level [1]

//ha

// === Input ===

//ma1_len = input(1, title="MA 01")

//ma2_len = input(40, title="MA 02")

// === MA 01 Filter ===

//o=ema(open,ma1_len)

//cc=ema(close,ma1_len)

//h=ema(high,ma1_len)

//l=ema(low,ma1_len)

// === HA calculator ===

//ha_t = heikinashi(syminfo.tickerid)

//ha_o = security(ha_t, timeframe.period, o)

//ha_c = security(ha_t, timeframe.period, cc)

//ha_h = security(ha_t, timeframe.period, h)

//ha_l = security(ha_t, timeframe.period, l)

// === MA 02 Filter ===

//o2=ema(ha_o, ma2_len)

//c2=ema(ha_c, ma2_len)

//h2=ema(ha_h, ma2_len)

//l2=ema(ha_l, ma2_len)

// === Color def ===

//ha_col=o2>c2 ? color.red : color.lime

// === PLOTITING===

//plotcandle(o2, h2, l2, c2, title="HA Smoothed", color=ha_col)

tp=input(120)

sl=input(96)

strategy.entry("long", strategy.long, when = longCondition)

//strategy.close("long", when = o2>c2 , comment="ha_long")

strategy.entry("short", strategy.short , when =shortCondition )

//strategy.close("short", when = o2<=c2 , comment = "ha_short" )

//strategy.close("long",when=long_profit_level1 or long_stop_level , comment="tp/sl")

//strategy.close("short",when=short_profit_level1 or short_stop_level , comment="tp/sl")

strategy.exit("x_long","long",profit = tp, loss = sl) //when = o2>c2)

strategy.exit("x_short","short",profit = tp, loss = sl) //when = o2<c2)