本文介绍一种基于K线形态的动量突破交易策略。该策略通过识别蜡烛形态,判断市场趋势和进入时机。

策略概述

动量突破策略主要判断潜在的反转信号,通过识别多头吞噬形态或空头吞噬形态进入场内。识别到信号后,快速追踪趋势,实现超额收益。

策略原理

动量突破策略的核心判断逻辑基于识别吞噬形态,吞噬形态分为多头吞噬和空头吞噬两种。

多头吞噬是指当日收盘价高于开盘价,并且上一根K线的收盘价低于上一根K线的开盘价。这种形态通常预示着市场情绪的改变,多空心理发生逆转,因此是进行适当追涨的良好时机。

空头吞噬刚好与多头吞噬相反,是指当日收盘价低于开盘价,并且上一根K线的收盘价高于上一根K线的开盘价。这同样预示着市场情绪发生变化,因此也是空头介入的机会。

识别到吞噬形态后,动量突破策略会快速建立仓位,实现超额杠杆,追踪潜在的反转趋势。此外,策略还会动态调整止损价和止盈价,在保证盈利的同时严格控制风险。

策略优势

- 快速判断市场反转时机,捕捉潜在机会

- 风险收益比较匹配,止损止盈设置合理

- 杠杆率可调整,满足不同风险偏好

- 全自动交易,效率较高

策略风险

- 吞噬形态仅作为参考,不能完全确定反转

- 反转失败概率存在,可能形成窄幅震荡

- 杠杆过高容易爆仓

- 需要足够的资金支持适当仓位

针对风险,可以从以下几个方面进行优化:

- 结合其他指标过滤信号

- 适当调整杠杆限制风险

- 增加仓位建立步骤,分批成本均价

- 优化止盈止损策略,保证收益

策略优化

动量突破策略可以从以下几个维度进行优化:

多因子验证信号可靠性 可以加入均线、波动率等指标来验证吞噬信号,确保信号的可靠性。

结合情感指标判断市场心理 结合市场的恐慌指数、贪婪指数等情感判断指标,能更准确判断市场反转时机。

优化止盈止损策略 可以通过移动止损、渐进止盈、移动止盈等方式来锁定利润,降低回撤风险。

引入算法交易 可以用机器学习等算法模型来辅助判断交易信号,提高策略的自动化程度。

总结

动量突破策略整体来说是一种较为典型的反转策略。它通过捕捉关键的K线信号,快速判断并跟踪市场趋势反转。虽然仍存在一定的风险,但可以通过多种方式进行有效优化,将收益风险比控制在合理区间,适合积极进取型的投资者采用。

策略源码

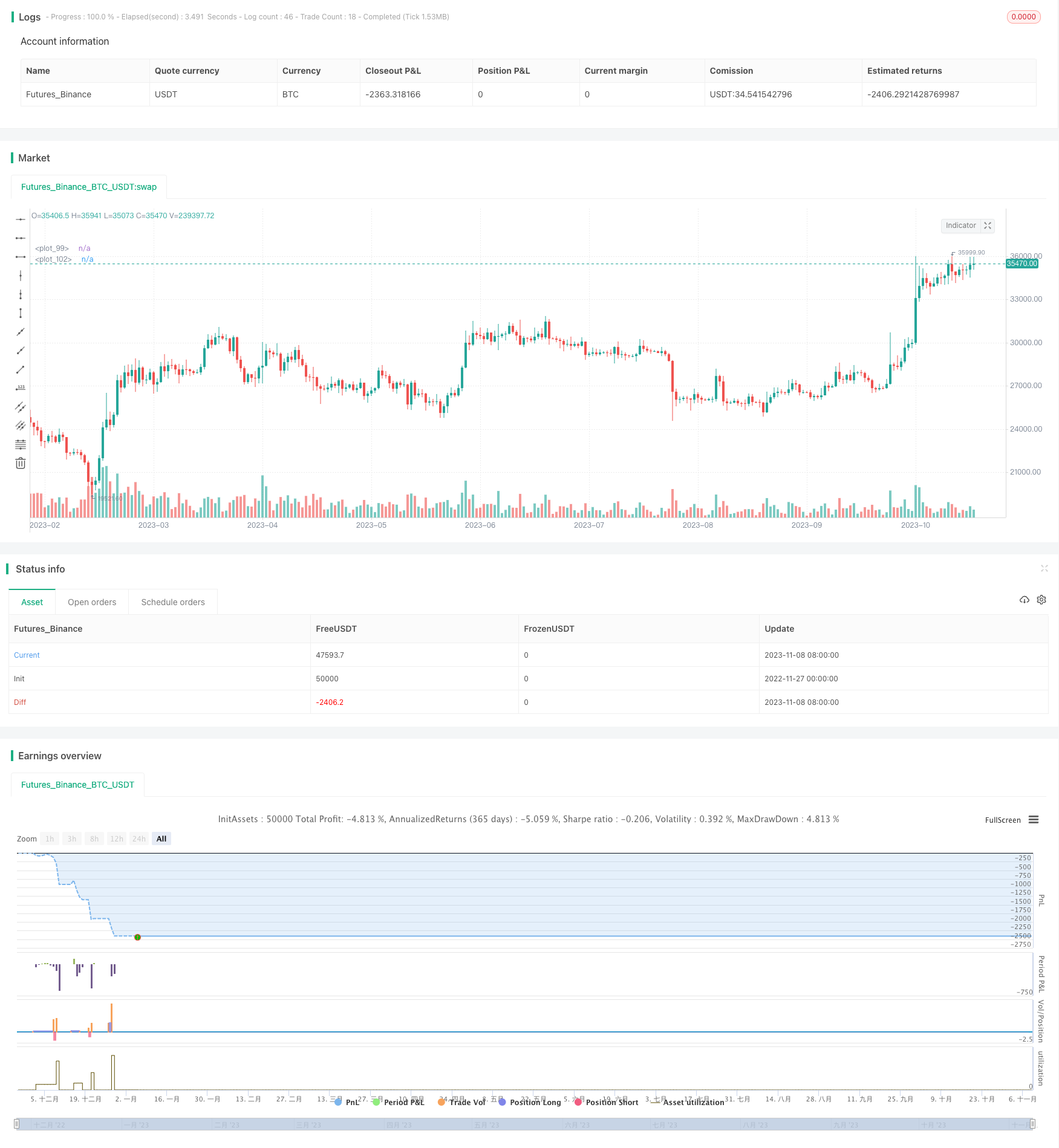

/*backtest

start: 2022-11-27 00:00:00

end: 2023-11-09 05:20:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title = "MomGulfing", shorttitle = "MomGulfing", overlay = true, initial_capital=10000, pyramiding=3, calc_on_order_fills=false, calc_on_every_tick=false, currency="USD", default_qty_type=strategy.cash, default_qty_value=1000, commission_type=strategy.commission.percent, commission_value=0.04)

syear = input(2021)

smonth = input(1)

sday = input(1)

fyear = input(2022)

fmonth = input(12)

fday = input(31)

start = timestamp(syear, smonth, sday, 01, 00)

finish = timestamp(fyear, fmonth, fday, 23, 59)

date = time >= start and time <= finish ? true : false

longs = input(true)

shorts = input(true)

rr = input(2.5)

position_risk_percent = input(1)/100

signal_bar_check = input.string(defval="3", options=["1", "2", "3"])

margin_req = input(80)

sl_increase_factor = input(0.2)

tp_decrease_factor = input(0.0)

check_for_volume = input(true)

var long_sl = 0.0

var long_tp = 0.0

var short_sl = 0.0

var short_tp = 0.0

var long_lev = 0.0

var short_lev = 0.0

initial_capital = strategy.equity

position_risk = initial_capital * position_risk_percent

bullishEngulfing_st = close[1] < open[1] and close > open and high[1] < close and (check_for_volume ? volume[1]<volume : true)

bullishEngulfing_nd = close[2] < open[2] and close[1] > open[1] and close > open and high[2] > close[1] and high[2] < close and (check_for_volume ? volume[2]<volume : true)

bullishEngulfing_rd = close[3] < open[3] and close[2] > open[2] and close[1] > open[1] and close > open and high[3] > close[2] and high[3] > close[1] and high[3] < close and (check_for_volume ? volume[3]<volume : true)

bullishEngulfing = signal_bar_check == "1" ? bullishEngulfing_st : signal_bar_check == "2" ? bullishEngulfing_st or bullishEngulfing_nd : bullishEngulfing_st or bullishEngulfing_nd or bullishEngulfing_rd

long_stop_level = bullishEngulfing_st ? math.min(low[1], low) : bullishEngulfing_nd ? math.min(low[2], low[1], low) : bullishEngulfing_rd ? math.min(low[3], low[2], low[1], low) : na

rr_amount_long = close-long_stop_level

long_exit_level = close + rr*rr_amount_long

long_leverage = math.floor(margin_req/math.floor((rr_amount_long/close)*100))

bearishEngulfing_st = close[1] > open[1] and close < open and low[1] > close and (check_for_volume ? volume[1]<volume : true)

bearishEngulfing_nd = close[2] > open[2] and close[1] < open[1] and close < open and low[2] < close[1] and low[2] > close and (check_for_volume ? volume[2]<volume : true)

bearishEngulfing_rd = close[3] > open[3] and close[2] < open[2] and close[1] < open[1] and close < open and low[3] < close[2] and low[3] < close[1] and low[3] > close and (check_for_volume ? volume[3]<volume : true)

bearishEngulfing = signal_bar_check == "1" ? bearishEngulfing_st : signal_bar_check == "2" ? bearishEngulfing_st or bearishEngulfing_nd : bearishEngulfing_st or bearishEngulfing_nd or bearishEngulfing_rd

short_stop_level = bearishEngulfing_st ? math.max(high[1], high) : bearishEngulfing_nd ? math.max(high[2], high[1], high) : bearishEngulfing_rd ? math.max(high[3], high[2], high[1], high) : na

rr_amount_short = short_stop_level-close

short_exit_level = close - rr*rr_amount_short

short_leverage = math.floor(margin_req/math.floor((rr_amount_short/short_stop_level)*100))

long = longs and date and bullishEngulfing

short = shorts and date and bearishEngulfing

bgcolor(long[1] ? color.new(color.teal, 80) : (short[1] ? color.new(color.purple, 80) : na))

if long and strategy.position_size <= 0

long_lev := long_leverage

if short and strategy.position_size >= 0

short_lev := short_leverage

long_pos_size = long_lev * position_risk

long_pos_qty = long_pos_size/close

short_pos_size = short_lev * position_risk

short_pos_qty = short_pos_size/close

if long

if strategy.position_size <= 0

long_sl := long_stop_level

long_tp := long_exit_level

else if strategy.position_size > 0

long_sl := long_stop_level + sl_increase_factor*rr_amount_long

long_tp := long_exit_level - tp_decrease_factor*rr_amount_long

strategy.entry("L"+str.tostring(long_lev)+"X", strategy.long, qty=long_pos_qty)

label_text = str.tostring(long_lev)+"X\nSL:"+str.tostring(long_sl)+"\nTP:"+str.tostring(long_tp)

label.new(bar_index+1, na, text=label_text, color=color.green, style=label.style_label_up, xloc=xloc.bar_index, yloc=yloc.belowbar)

else if short

if strategy.position_size >= 0

short_sl := short_stop_level

short_tp := short_exit_level

else if strategy.position_size < 0

short_sl := short_stop_level - sl_increase_factor*rr_amount_short

short_tp := short_exit_level + tp_decrease_factor*rr_amount_short

strategy.entry("S"+str.tostring(short_lev)+"X", strategy.short, qty=short_pos_qty)

label_text = str.tostring(short_lev)+"X\nSL:"+str.tostring(short_sl)+"\nTP:"+str.tostring(short_tp)

label.new(bar_index+1, na, text=label_text, color=color.red, style=label.style_label_down, xloc=xloc.bar_index, yloc=yloc.abovebar)

if (strategy.position_size > 0)

strategy.exit(id="L TP/SL", stop=long_sl, limit=long_tp)

if (strategy.position_size < 0)

strategy.exit(id="S TP/SL", stop=short_sl, limit=short_tp)

sl_level = strategy.position_size > 0 ? long_sl : strategy.position_size < 0 ? short_sl : na

plot(sl_level, color=color.red, style=plot.style_linebr)

tp_level = strategy.position_size > 0 ? long_tp : strategy.position_size < 0 ? short_tp : na

plot(tp_level, color=color.green, style=plot.style_linebr)