概述

该策略名为“基于转折点的RSI背离策略”(Pivot-based RSI Divergence Strategy)。它利用RSI指标在不同周期上的背离来判断买入卖出点,并在此基础上增加了长线RSI作为过滤条件,从而提高策略的稳定性。

策略原理

该策略主要判断短线RSI(如5日RSI)与价格出现“隐藏型多头背离”或“常规型多头背离”时机会买入;出现“隐藏型空头背离”或“常规型空头背离”时机会卖出。

所谓“常规型多头背离”是指:价格创新低而RSI未创新低;“隐藏型多头背离”则相反,价格未创新低而RSI创新低。两者定义中的“新低”和“新高”是相对于一定滚动窗口的历史极值而言的。

此外,策略还引入长线RSI(如50日RSI)作为过滤条件。只有当长RSI大于50时,才考虑买入信号;当长RSI小于30时,考虑止损或止盈退出。

策略优势

该策略最大的优势在于同时利用短线RSI的背离信号和长线RSI的过滤,能够在一定程度上避免被套和错过行情。具体来说,主要具有以下几个优势:

- 短线RSI背离信号能提前判断价格反转机会,及时捕捉行情转折点;

- 长线RSI过滤条件避免在趋势不确定时盲目做多;

- 多种类型的止盈方式,分批止盈有利于减少风险;

- Pyramiding机制允许加仓,进一步提高盈利空间。

策略风险

该策略也存在一些风险需要注意:

- RSI背离并不总是有效,有可能出现假信号;

- 加仓后风险会放大。如果判断错误,亏损会加速扩大;

- 止盈设置不当也可能导致过早止盈或盈利不足。

对应风险管理措施包括:合理设定止损止盈条件、控制每个头寸大小、分批减仓以平滑盈亏曲线等。

优化方向

该策略还存在进一步优化的空间:

- RSI参数可以进一步优化,找到最佳参数组合;

- 可以测试其他指标的背离信号,如MACD、KD等;

- 可以在特定品种(如原油、贵金属等)上专门优化参数,提高适应性。

总结

本策略综合运用短线与长线RSI的多空背离信号,在控制风险的同时,提高盈利效率。它体现了量化交易策略设计的多项原则,包括何时入场、何时离场、分批建仓减仓、设置止损止盈等。这是一个可供参考借鉴的RSI背离策略范例。

策略源码

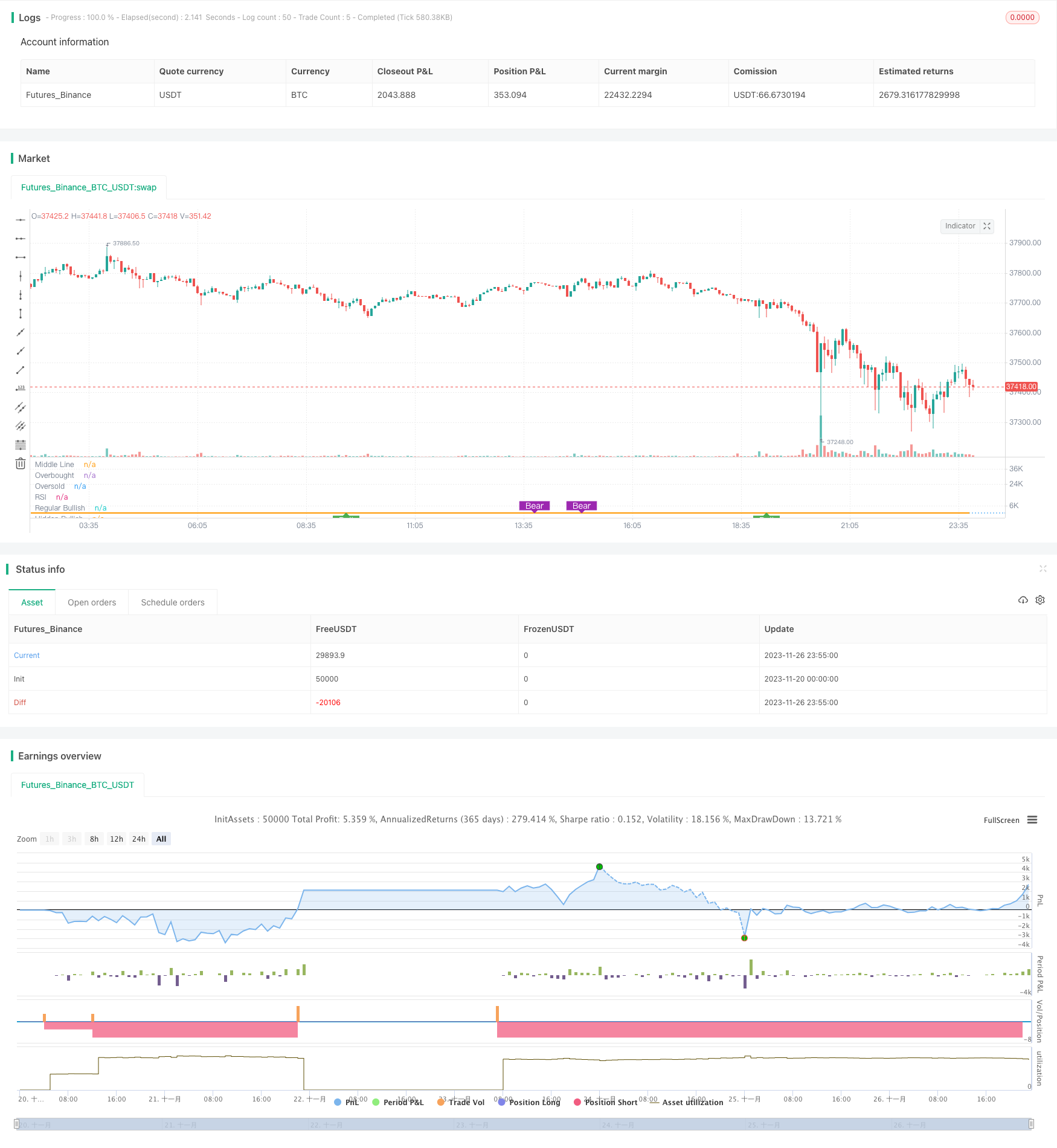

/*backtest

start: 2023-11-20 00:00:00

end: 2023-11-27 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © mohanee

//@version=4

//GOOGL setting 5 ,50 close, 3 , 1 profitLevel at 75 and No stop Loss shows win rate 99.03 % profit factor 5830.152

strategy(title="RSI5_50 with Divergence", overlay=false,pyramiding=2, default_qty_type=strategy.fixed, default_qty_value=3, initial_capital=10000, currency=currency.USD)

len = input(title="RSI Period", minval=1, defval=5)

longRSILen = input(title="Long RSI Period", minval=10, defval=50)

src = input(title="RSI Source", defval=close)

lbR = input(title="Pivot Lookback Right", defval=3)

lbL = input(title="Pivot Lookback Left", defval=1)

takeProfitRSILevel = input(title="Take Profit at RSI Level", minval=50, defval=75)

stopLoss = input(title="Stop Loss%(if checked 8% rule applied)", defval=false)

shortTermRSI = rsi(close,len)

longTermRSI = rsi(close,longRSILen)

rangeUpper = input(title="Max of Lookback Range", defval=60)

rangeLower = input(title="Min of Lookback Range", defval=5)

plotBull = input(title="Plot Bullish", defval=true)

plotHiddenBull = input(title="Plot Hidden Bullish", defval=true)

plotBear = input(title="Plot Bearish", defval=true)

plotHiddenBear = input(title="Plot Hidden Bearish", defval=false)

bearColor = color.purple

bullColor = color.green

hiddenBullColor = color.new(color.green, 80)

hiddenBearColor = color.new(color.red, 80)

textColor = color.white

noneColor = color.new(color.white, 100)

plot(shortTermRSI, title="RSI", linewidth=2, color=#8D1699)

plot(longTermRSI, title="longTermRSI", linewidth=2, color=color.orange)

hline(50, title="Middle Line", linestyle=hline.style_dotted)

obLevel = hline(70, title="Overbought", linestyle=hline.style_dotted)

osLevel = hline(30, title="Oversold", linestyle=hline.style_dotted)

fill(obLevel, osLevel, title="Background", color=longTermRSI >=50 ? color.green:color.purple, transp=65) // longTermRSI >=50

plFound = na(pivotlow(shortTermRSI, lbL, lbR)) ? false : true

phFound = na(pivothigh(shortTermRSI, lbL, lbR)) ? false : true

_inRange(cond) =>

bars = barssince(cond == true)

rangeLower <= bars and bars <= rangeUpper

//------------------------------------------------------------------------------

// Regular Bullish

// shortTermRSI: Higher Low

oscHL = shortTermRSI[lbR] > valuewhen(plFound, shortTermRSI[lbR], 1) and _inRange(plFound[1])

// Price: Lower Low

priceLL = low[lbR] < valuewhen(plFound, low[lbR], 1)

bullCond = plotBull and priceLL and oscHL and plFound

plot(

plFound ? shortTermRSI[lbR] : na,

offset=-lbR,

title="Regular Bullish",

linewidth=2,

color=(bullCond ? bullColor : noneColor),

transp=0

)

plotshape(

bullCond ? shortTermRSI[lbR] : na,

offset=-lbR,

title="Regular Bullish Label",

text=" Bull ",

style=shape.labelup,

location=location.absolute,

color=bullColor,

textcolor=textColor,

transp=0

)

//------------------------------------------------------------------------------

// Hidden Bullish

// shortTermRSI: Lower Low

oscLL = shortTermRSI[lbR] < valuewhen(plFound, shortTermRSI[lbR], 1) and _inRange(plFound[1])

// Price: Higher Low

priceHL = low[lbR] > valuewhen(plFound, low[lbR], 1)

hiddenBullCond = plotHiddenBull and priceHL and oscLL and plFound

plot(

plFound ? shortTermRSI[lbR] : na,

offset=-lbR,

title="Hidden Bullish",

linewidth=2,

color=(hiddenBullCond ? hiddenBullColor : noneColor),

transp=0

)

plotshape(

hiddenBullCond ? shortTermRSI[lbR] : na,

offset=-lbR,

title="Hidden Bullish Label",

text=" H Bull ",

style=shape.labelup,

location=location.absolute,

color=bullColor,

textcolor=textColor,

transp=0

)

longCondition= longTermRSI >=50 and ( (bullCond or hiddenBullCond ) ) or (strategy.position_size>0 and crossover(shortTermRSI,20) )

//last condition above is to leg in if you are already in the Long trade,

strategy.entry(id="RSIDivLE", long=true, when=longCondition)

//------------------------------------------------------------------------------

// Regular Bearish

// shortTermRSI: Lower High

oscLH = shortTermRSI[lbR] < valuewhen(phFound, shortTermRSI[lbR], 1) and _inRange(phFound[1])

// Price: Higher High

priceHH = high[lbR] > valuewhen(phFound, high[lbR], 1)

bearCond = plotBear and priceHH and oscLH and phFound

plot(

phFound ? shortTermRSI[lbR] : na,

offset=-lbR,

title="Regular Bearish",

linewidth=2,

color=(bearCond ? bearColor : noneColor),

transp=0

)

plotshape(

bearCond ? shortTermRSI[lbR] : na,

offset=-lbR,

title="Regular Bearish Label",

text=" Bear ",

style=shape.labeldown,

location=location.absolute,

color=bearColor,

textcolor=textColor,

transp=0

)

//------------------------------------------------------------------------------

// Hidden Bearish

// shortTermRSI: Higher High

oscHH = shortTermRSI[lbR] > valuewhen(phFound, shortTermRSI[lbR], 1) and _inRange(phFound[1])

// Price: Lower High

priceLH = high[lbR] < valuewhen(phFound, high[lbR], 1)

hiddenBearCond = plotHiddenBear and priceLH and oscHH and phFound

plot(

phFound ? shortTermRSI[lbR] : na,

offset=-lbR,

title="Hidden Bearish",

linewidth=2,

color=(hiddenBearCond ? hiddenBearColor : noneColor),

transp=0

)

plotshape(

hiddenBearCond ? shortTermRSI[lbR] : na,

offset=-lbR,

title="Hidden Bearish Label",

text=" H Bear ",

style=shape.labeldown,

location=location.absolute,

color=bearColor,

textcolor=textColor,

transp=0

)

//calculate stop Loss

stopLossVal = stopLoss==true ? ( strategy.position_avg_price - (strategy.position_avg_price*0.08) ) : 0

//partial profit

strategy.close(id="RSIDivLE", comment="TP1", qty=strategy.position_size*3/4, when=strategy.position_size>0 and (longTermRSI>=takeProfitRSILevel or crossover(longTermRSI,90)))

strategy.close(id="RSIDivLE",comment="TP2", qty=strategy.position_size*3/4 , when=crossover(longTermRSI,70))

strategy.close(id="RSIDivLE",comment="TP3", qty=strategy.position_size/2, when=crossover(longTermRSI,65))

strategy.close(id="RSIDivLE",comment="TP4", qty=strategy.position_size/2 , when=crossover(longTermRSI,60))

//close the whole position when stoploss hits or longTermRSI goes below 30

strategy.close(id="RSIDivLE",comment="Exit", when=crossunder(longTermRSI,30) or close<stopLossVal)