概述

该策略通过计算多时间段的SMA均线,并取平均值构建均线指标。当价格上涨突破均线时产生买入信号,当价格下跌突破均线时产生卖出信号,属于典型的均线交叉策略。

策略原理

- 计算5个不同周期(8日,21日,50日,100日,200日)的SMA均线

- 将5条均线值取平均,得到最终的均线指标

- 当收盘价上涨突破均线时,产生买入信号

- 当收盘价下跌突破均线时,产生卖出信号

该策略通过多时间段SMA的平均,能够有效平滑曲线,滤除假突破。与单一均线相比,具有更高的稳定性。

优势分析

- 使用多时间段均线能够有效滤除市场噪音,识别趋势

- 平滑曲线,避免产生大量假信号

- 策略逻辑简单清晰,容易理解实现,适合新手学习

- 可自定义均线周期组合,优化指标效果

风险分析

- 均线系统整体滞后,无法及时跟踪价格变化

- 突破失效时,停损点较远,亏损风险大

- 震荡趋势中,止损线被频繁触发

可以通过适当缩短部分均线周期,以及加入其他指标确认,来减小这些风险。

优化方向

- 优化均线周期组合,找到最佳参数

- 加入成交量等指标确认突破信号

- 结合趋势指标,避免震荡市场的虚假信号

- 开发自动参数优化程序,动态寻找最优参数

总结

该策略总体思路清晰,通过多时间段均线的集成,能够有效识别趋势,是一个稳定实用的策略。但我们也需要注意到其滞后性以及误报风险。通过进一步优化参数设定、加入确认指标等手段,可以持续改进该策略,使其成为一个强大的量化交易工具。

策略源码

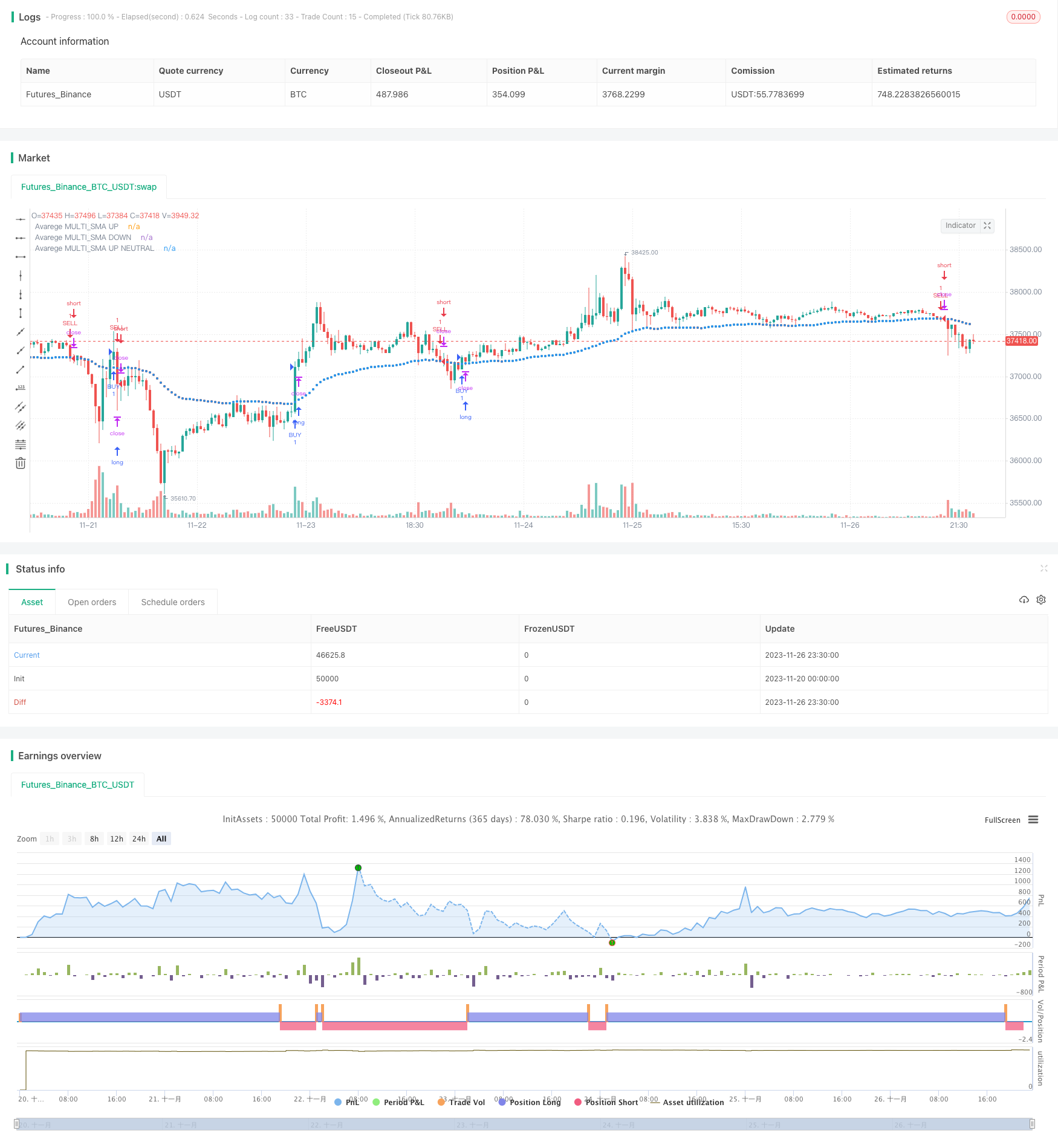

/*backtest

start: 2023-11-20 00:00:00

end: 2023-11-27 00:00:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("STRATEGY AVERAGE MULTI_SMA", overlay=true)

sma1 = sma(close,input(title="SMA 1", defval=8))

sma2 = sma(close,input(title="SMA 2", defval=21))

sma3 = sma(close,input(title="SMA 3", defval=50))

sma4 = sma(close,input(title="SMA 4", defval=100))

sma5 = sma(close,input(title="SMA 5", defval=200))

mediaSMA= (sma1+sma2+sma3+sma4+sma5)/5

//color mediaSMA

MediaUP = mediaSMA>mediaSMA[1]

colorUP = (MediaUP ? #3CFF35 : na)

MediaDOWN = mediaSMA<mediaSMA[1]

colorDOWN =(MediaDOWN ? #FF0F03 : na)

colorN =(not MediaUP and not MediaDOWN and mediaSMA==mediaSMA[1] ? white : na )

plot(mediaSMA,title="Avarege MULTI_SMA UP", color=colorUP, style=circles, linewidth=2, transp=0)

plot(mediaSMA,title="Avarege MULTI_SMA DOWN", color=colorDOWN, style=circles, linewidth=2, transp=0)

plot(mediaSMA,title="Avarege MULTI_SMA UP NEUTRAL", color=colorN, style=circles, linewidth=2, transp=0)

//plot(sma1,color=blue,linewidth=1, style=line,transp=0,title="SMA 1")

//plot(sma2,color=yellow,linewidth=1, style=line,transp=0,title="SMA 2")

//plot(sma3,color=green,linewidth=1, style=line,transp=0,title="SMA 3")

//plot(sma4,color=purple,linewidth=1, style=line,transp=0,title="SMA 4")

//plot(sma5,color=red,linewidth=1, style=line,transp=0,title="SMA 5")

// Strategy

//BUY

comprar=close>mediaSMA and mediaSMA>mediaSMA[1]

fechar=close<mediaSMA and mediaSMA<mediaSMA[1]

strategy.entry("BUY",strategy.long,when=comprar)

strategy.entry("SELL",strategy.short, when=fechar)

//SELL

vender=close<mediaSMA and mediaSMA<mediaSMA[1]

fechar2=close>mediaSMA and mediaSMA>mediaSMA[1]

strategy.entry("SELL",strategy.short, when=vender)

strategy.entry("BUY", strategy.long,when=fechar2)