概述

本策略基于相对强弱指数(RSI)和平均真实波动幅度(ATR)通道,适用于5分钟和15分钟时间周期,属于超级scalping类型策略。策略通过RSI指标判断长短方向进入点,并利用ATR通道设置止损和止盈,实现高频交易。

策略原理

- 使用21日指数移动平均线(EMA)和65日EMA形成金叉死叉,判断大趋势方向。

- RSI低于50时看跌,高于50时看涨,发出买入和卖出信号。

- ATR通道上下轨分别为:close+ATR和close-ATR。 close突破ATR上轨时卖出,下破ATR下轨时买入。

- 利用ATR的2倍设置止损,5倍设置止盈。

优势分析

- 使用金叉死叉判断大趋势,避免逆势操作。

- RSI可确定较好的入场时机。

- ATR通道设置止损止盈点效果好,大幅提高盈亏比。

- 适合高频scalping交易,获利快。

风险分析

- 需密切注意盯盘,错过入场或止损点可能造成较大亏损。

- 趋势市场中可能出现多次加仓,需要控制好资金比例。

- 需要足够的资金支持频繁交易。

优化方向

- 优化ATR参数,使止损止盈更加合理。

- 增加其他指标过滤,提高入场质量。

- 加入自动止损和止盈功能。

- 增加资金管理和仓位控制模块。

总结

本策略属于高频scalping交易类型,通过RSI指标和ATR通道设定入场出场点,实现快速交易。优点是获利快,风险控制到位,适合逢高短轻的操作。但需要密切盯盘,而且需要足够的资金支持频繁交易。整体来说,该策略顺势操作效果好,可通过进一步优化来提升盈利能力。

策略源码

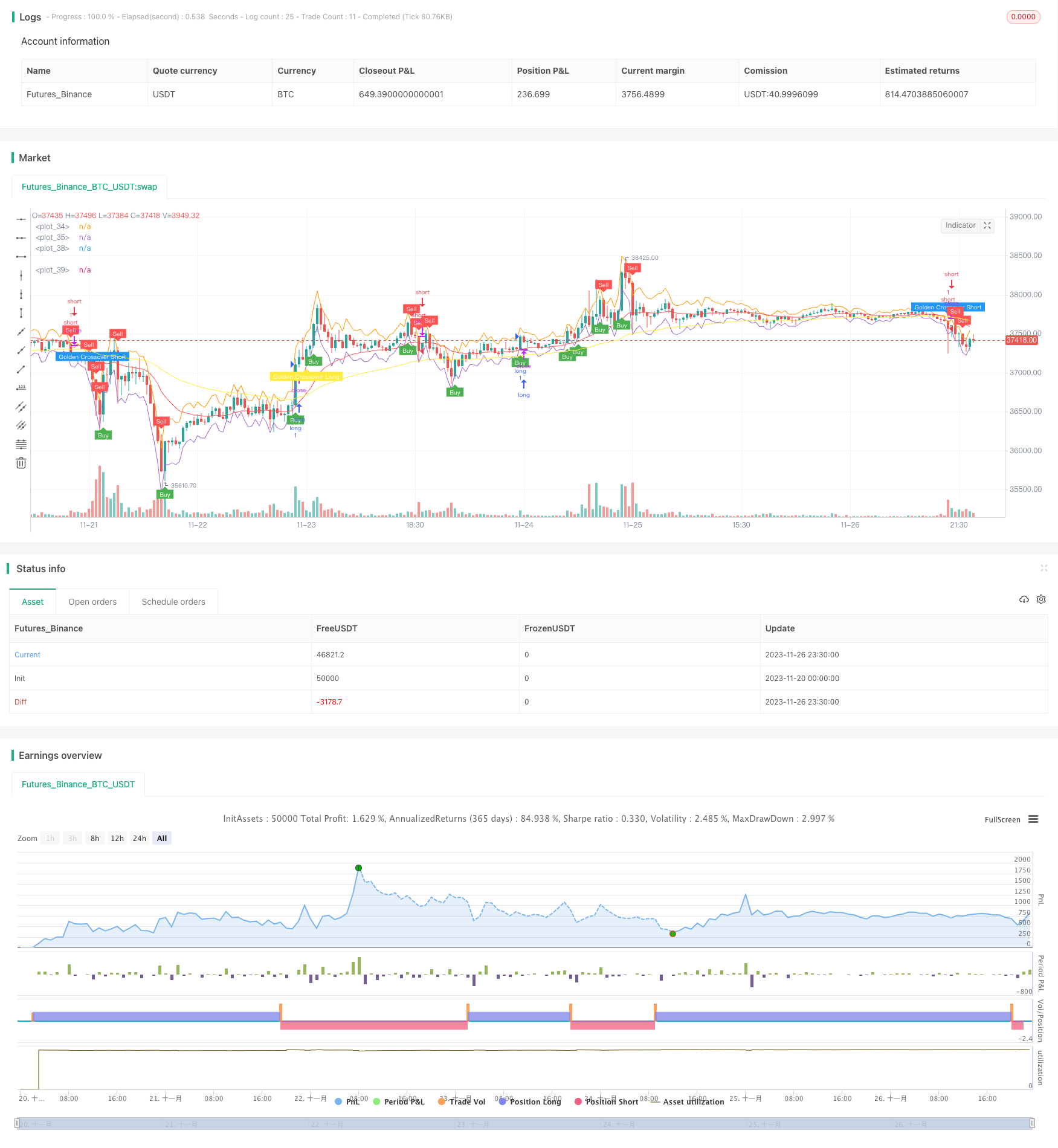

/*backtest

start: 2023-11-20 00:00:00

end: 2023-11-27 00:00:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Super Scalper - 5 Min 15 Min", overlay=true)

// Create Indicator's

shortSMA = ema(close, 21)

longSMA = ema(close, 65)

rsi = rsi(close, 14)

atr = atr(14)

// Specify conditions

longCondition = open < close-atr

shortCondition = open > atr+close

GoldenLong = crossover(shortSMA,longSMA)

Goldenshort = crossover(longSMA,shortSMA)

plotshape(shortCondition, title="Sell Label", text="Sell", location=location.abovebar, style=shape.labeldown, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

plotshape(longCondition, title="Buy Label", text="Buy", location=location.belowbar, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

plotshape(Goldenshort, title="Golden Sell Label", text="Golden Crossover Short", location=location.abovebar, style=shape.labeldown, size=size.tiny, color=color.blue, textcolor=color.white, transp=0)

plotshape(GoldenLong, title="Golden Buy Label", text="Golden Crossover Long", location=location.belowbar, style=shape.labelup, size=size.tiny, color=color.yellow, textcolor=color.white, transp=0)

// Execute trade if condition is True

if (longCondition)

stopLoss = low - atr * 2

takeProfit = high + atr * 5

strategy.entry("long", strategy.long, 1, when = rsi > 50)

if (shortCondition)

stopLoss = high + atr * 2

takeProfit = low - atr * 5

strategy.entry("short", strategy.short, 1, when = rsi < 50)

// Plot ATR bands to chart

plot(atr+close)

plot(close-atr)

// Plot Moving Averages

plot(shortSMA, color = color.red)

plot(longSMA, color = color.yellow)