概述

双EMA黄金交叉突破策略通过计算快线EMA和慢线EMA的交叉情况,结合交易量突破、K线形态以及价格突破判断来产生买入和卖出信号。该策略综合多种技术指标,旨在提高信号的可靠性,在捕捉价格趋势的同时控制风险。

策略原理

双EMA黄金交叉突破策略的核心逻辑基于双EMA的黄金交叉理论。该理论认为,当短期EMA上穿较长期EMA时,代表价格上涨势头较强,应该建立多头仓位;当短期EMA下穿较长期EMA时,代表价格下跌势头较强,应该建立空头仓位。

具体来说,该策略首先计算9日EMA和21日EMA。当9日EMA上穿21日EMA时,产生“长”信号;当9EMA下穿21EMA时,产生“短”信号。为了过滤假信号,策略还设置了以下判断条件:

交易量条件。最近K线的交易量需要大于前5根K线的平均交易量的85%。这个条件可以过滤出交易量不足的假信号。

价格突破条件。价格需要突破9日EMA,作为进场确认。

K线形态条件。需要识别出反转K线形态,包括向上吞没形态或向下吞没形态。这可以避免在盘整震荡时重复进出场。

在多头仓位中,当价格跌破9日EMA时,执行平仓退出。在空头仓位中,当价格涨破9日EMA时,同样执行平仓退出。

优势分析

双EMA黄金交叉突破策略结合多种技术指标信号,可以有效识别价格趋势,提高交易胜率。其主要优势有:

使用双EMA判断主要趋势方向,可靠性较高。

增加交易量过滤,避免在交易量不足时发出错误信号。

增加K线形态判断,可以过滤震荡盘整市场的噪音。

价格突破EMA时进场,可以确认趋势。

设定止损退出机制,可以主动控制风险。

风险分析

双EMA黄金交叉突破策略也存在一定的风险,主要集中在以下几个方面:

在震荡行情中,EMA可能发出错误信号,从而导致交易亏损。可以通过整体趋势判断来决定是否开仓。

固定的EMA周期设置可能无法适应市场的变化,可以尝试采用自适应EMA。

反转K线形态判断依然存在一定误判概率,停损机制可以用来控制风险。

策略可能会错过部分行情,无法完美追踪价格。可以适当调整参数,或与其他策略组合使用。

优化方向

双EMA黄金交叉突破策略还有以下几点主要优化方向:

测试更多的EMA组合,寻找最佳参数。

增加自适应EMA,根据市场变化调整EMA参数。

优化仓位管理,不同行情采用不同的仓位。

结合更多指标进行优化,如MACD、KDJ等,形成策略组合。

引入机器学习等高级技术进行模型融合,提高策略稳定性。

总结

双EMA黄金交叉突破策略通过双EMA判断趋势方向,并增加交易量/价格/K线形态多重过滤,可以有效识别趋势,在控制风险的同时提高交易效率。该策略操作简单,容易实施,同时还留有很多优化空间,是一种值得推荐的突破交易策略。

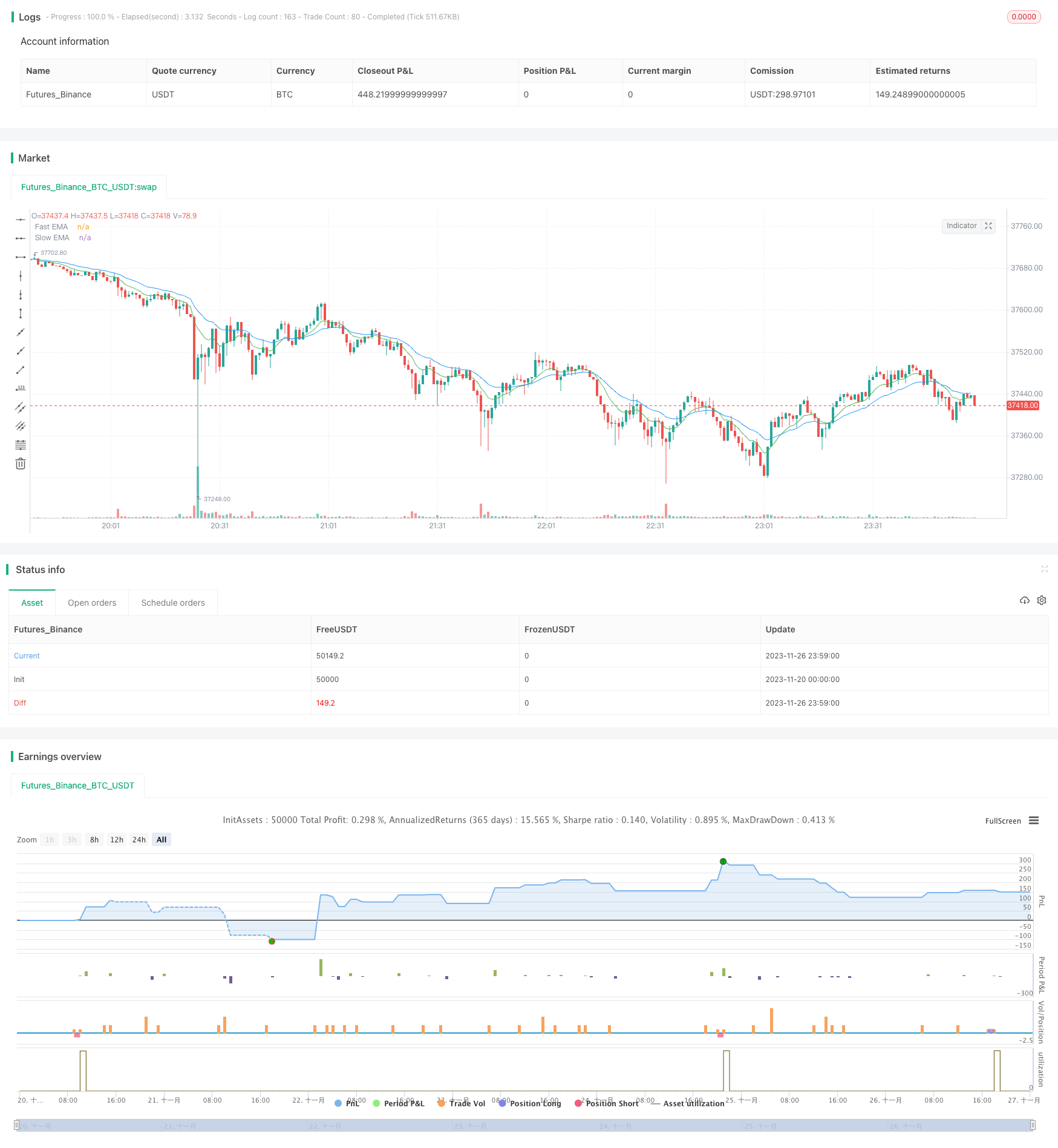

/*backtest

start: 2023-11-20 00:00:00

end: 2023-11-27 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//Author: Andrew Shubitowski

strategy("Buy/Sell Strat", overlay = true)

//Define EMAs & Crossovers (Feature 2)

a = ta.ema(close, 9)

b = ta.ema(close, 21)

crossUp = ta.crossover(a, b)

crossDown = ta.crossunder(a, b)

//Define & calc volume averages (Feature 1)

float volAvg = 0

for i = 1 to 5

volAvg := volAvg + volume[i]

volAvg := volAvg / 5

//Define candlestick pattern recongition (Feature 4)

bool reversalPatternUp = false

bool reversalPatternDown = false

if (close > close[1] and close[1] > close [2] and close[3] > close[2] and close > close[3])

reversalPatternUp := true

if (close < close[1] and close[1] < close [2] and close[3] < close[2] and close < close[3])

reversalPatternDown := true

//Execute trade (Feature 3 + 5)

if (crossUp)

strategy.entry("long", strategy.long, when = ((volume * 0.85) > volAvg and close > a and reversalPatternUp == true))

if (crossDown)

strategy.entry("short", strategy.short, when = ((volume * 0.85) > volAvg and close < a and reversalPatternDown == true))

//Exit strategy (New Feature)

close_condition_long = close < a

close_condition_short = close > a

if (close_condition_long)

strategy.close("long")

if (close_condition_short)

strategy.close("short")

//plot the EMAs

plot(a, title = "Fast EMA", color = color.green)

plot(b, title = "Slow EMA", color = color.blue)

//Some visual validation parameters

//plotchar(volAvg, "Volume", "", location.top, color.aqua) //*TEST* volume calc check

//plotshape(reversalPatternUp, style = shape.arrowup, color = color.aqua) //*TEST* reversal check

//plotshape(reversalPatternDown, style = shape.arrowup, location = location.belowbar, color = color.red) //*TEST* reversal check