概述

本策略融合了相对强度指数(TSI)、商品路径指数(CCI)和霍尔移动平均(Hull MA)三个指标,形成一个趋势跟踪型的交易策略。它可以在1小时或更高时间框架下,对任意交易品种进行长线的跟踪交易。

策略原理

该策略主要基于TSI和CCI两个指标判断行情趋势和超买超卖情况,以及Hull MA判断价格中期趋势,三者综合作为建仓的基本条件。

具体来说,当TSI的快线上穿慢线,CCI指标上穿+20&&n1上升时,做多;当TSI的快线下穿慢线,CCI指标下穿-20&&n1下降时,做空。 Hull MA用来过滤中期趋势,只有当价格低于Hull MA时才做多,价格高于Hull MA时才做空。

这样通过不同周期指标的确认,可以有效过滤假突破,跟踪中长线趋势。

优势分析

这是一个相对稳定和高效的趋势跟踪策略,主要有以下几点优势:

使用TSI判断长期趋势方向更可靠,避免被短期市场噪音干扰;

CCI指标的加入,可以确认超买超卖现象,过滤掉部分假信号;

Hull MA的判断让入场点更加精准,大幅提高获利概率;

不同参数指标的集成,可以提高信号的可靠性,降低干扰概率。

策略参数设置灵活,可以适应不同市场周期的优化。

风险分析

尽管该策略稳定性较高,但仍有一定的风险需要注意:

行情可能出现剧烈反转,无法快速止损,造成较大亏损;

TSIDiff和CCI指标都可能出现假信号和滞后,misses部分入场点;

参数设置不当也会导致交易频率过高或信号质量下降。

对策:

适当调整止损点,控制单笔亏损;

酌情结合其它指标确认,提高信号准确率;

按照市场调整参数,保证策略稳定。

优化方向

该策略还可从以下几个方面进行优化:

尝试不同参数指标的组合,找到最佳匹配指标;

加入机器学习算法,实现参数的自适应优化;

增加资金管理模块,使盈利更加稳定;

结合更多过滤器,提升策略胜率。

这将是未来的优化重点。

总结

本策略综合运用TSI、CCI和Hull MA三个指标,形成一个较为稳定和高效的趋势跟踪策略。它成功应用多时间段指标的优势,提高了信号的质量。下一步将通过参数优化、过滤器增强等手段进一步增强策略的稳定性与盈利能力。

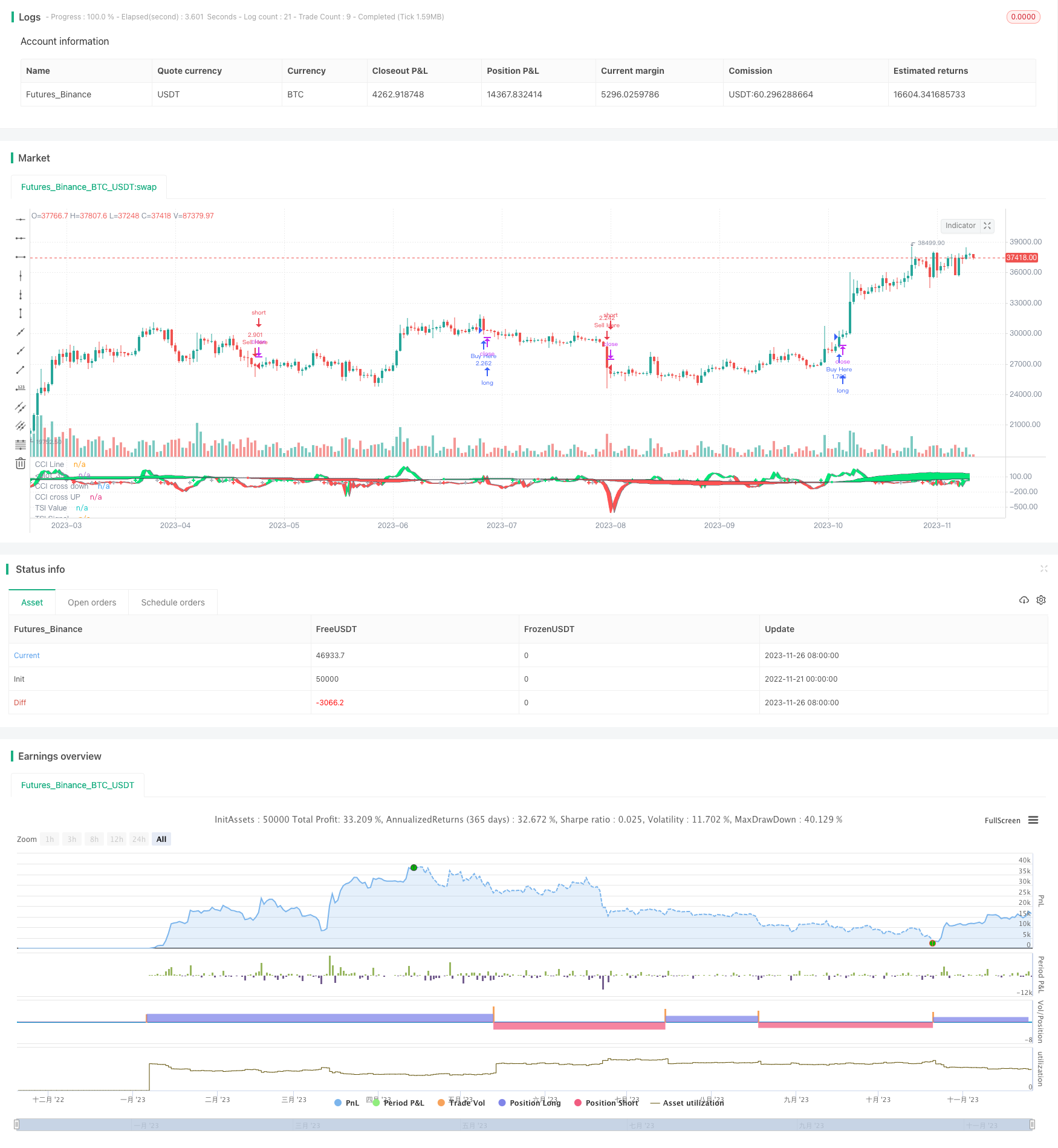

/*backtest

start: 2022-11-21 00:00:00

end: 2023-11-27 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="TSI CCI Hull", shorttitle="TSICCIHULL", default_qty_type=strategy.percent_of_equity, default_qty_value=100, calc_on_order_fills= false, calc_on_every_tick=true, pyramiding=0)

long = input(title="Long Length", type=input.integer, defval=50)

short = input(title="Short Length", type=input.integer, defval=50)

signal = input(title="Signal Length", type=input.integer, defval=25)

price=input(title="Source",type=input.source,defval=open)

Period=input(25, minval=1)

lineupper = input(title="Upper Line", type=input.integer, defval=100)

linelower = input(title="Lower Line", type=input.integer, defval=-100)

p=price

length= Period

double_smooth(src, long, short) =>

fist_smooth = ema(src, long)

ema(fist_smooth, short)

pc = change(price)

double_smoothed_pc = double_smooth(pc, long, short)

double_smoothed_abs_pc = double_smooth(abs(pc), long, short)

tsi_value = 100 * (double_smoothed_pc / double_smoothed_abs_pc)

keh = tsi_value*5 > linelower ? color.red : color.lime

teh = ema(tsi_value*5, signal*5) > lineupper ? color.red : color.lime

meh = ema(tsi_value*5, signal*5) > tsi_value*5 ? color.red : color.lime

i1=plot(tsi_value*5, title="TSI Value", color=color.black, linewidth=1,transp=100)

i2=plot(ema(tsi_value*5, signal*5), title="TSI Signal", color=color.black, linewidth=1,transp=100)

fill(i1,i2,color=meh,transp=85)

plot(cross(tsi_value*5, ema(tsi_value*5, signal*5)) ? tsi_value*5 : na, style=plot.style_circles, color=color.black, linewidth=10)

plot(cross(tsi_value*5, ema(tsi_value*5, signal*5)) ? tsi_value*5 : na, style=plot.style_circles, color=color.white, linewidth=8,transp=0)

plot(cross(tsi_value*5, ema(tsi_value*5, signal*5)) ? tsi_value*5 : na, style=plot.style_circles, color=meh, linewidth=5)

n2ma = 2 * wma(p, round(length / 2))

nma = wma(p, length)

diff = n2ma - nma

sqn = round(sqrt(length))

n1 = wma(diff, sqn)

cci = (p - n1) / (0.015 * dev(p, length))

c = cci > 0 ? color.lime : color.red

c1 = cci > 20 ? color.lime : color.silver

c2 = cci < -20 ? color.red : color.silver

cc=plot(cci, color=c, title="CCI Line", linewidth=2)

cc2=plot(cci[1], color=color.gray, linewidth=1,transp=100)

fill(cc,cc2,color=c,transp=85)

plot(cross(20, cci) ? 20 : na, style=plot.style_cross,title="CCI cross UP", color=c1, linewidth=2,transp=100,offset=-2)

plot(cross(-20, cci) ? -20 : na, style=plot.style_cross,title="CCI cross down", color=c2, linewidth=2,transp=100,offset=-2)

TSI1=ema(tsi_value*5, signal*5)

TSI2=ema(tsi_value*5, signal*5)[2]

hullma_smoothed = wma(2*wma(n1, Period/2)-wma(n1, Period), round(sqrt(Period)))

//plot(hullma_smoothed*200)

longCondition = TSI1>TSI2 and hullma_smoothed<price and cci>0

if (longCondition and cci>cci[1] and cci > 0 and n1>n1[1])

strategy.entry("Buy Here", strategy.long)

shortCondition = TSI1<TSI2 and hullma_smoothed>price and cci<0

if (shortCondition and cci<cci[1] and cci < 0 and n1<n1[1])

strategy.entry("Sell Here", strategy.short)