概述

本策略是一个利用分阶梯式止盈结合滑点止损的退出策略。它在达到第一个止盈点后会将止损移至盈亏平衡点,在达到第二个止盈点后会将止损移至第一个止盈点,从而实现了一个分阶梯式的止损滑点机制。这可以锁定部分利润的同时保持较大的利润空间。

策略原理

本策略主要通过以下几个部分来实现分阶止盈滑点:

- 设置止损点和3个止盈点。

- 定义当前获利点数和止损价格的计算函数。

- 定义获利阶段的判断函数。

- 在不同的获利阶段,修改止损价格来实现滑点止损。

具体来说,它首先设置了100点的止损距离和100/200/300点的3个止盈距离。然后定义了基于当前价格和开仓价格来计算获利点数的函数curProfitInPts,以及根据点数距离计算止损价格的函数calcStopLossPrice。

关键逻辑在于getCurrentStage函数,它判断当前是否有头寸,以及获利点数是否超过了某个止盈点,如果超过则进入下一阶段。例如达到100点止盈后进入第二阶段,达到200点止盈后进入第三阶段。

最后根据阶段不同修改止损价格,从而实现滑点止损。第一阶段止损保持原始设置,第二阶段移至盈亏平衡,第三阶段移至第一个止盈点。

优势分析

这种分阶梯式止盈滑点策略具有以下几个优势:

- 可以锁定部分利润,同时保持后续较大的获利空间。

- 利用滑点止损来跟踪价格,可以减少回撤PRODID或亏损的可能性。

- 分多次止盈,相比一次性止盈可以更好控制风险。

- 策略逻辑清晰简单易于理解。

风险分析

该策略也存在一定的风险:

- 分阶止盈可能导致无法及时止盈,错过较好退出点位。可以通过调整止盈点数优化。

- 滑点幅度设置过大可能导致止损过早被触发。可以测试不同滑点幅度。

- 无法止损也会带来较大亏损风险。可以考虑在特定情况下快速止损。

优化方向

该策略可以从以下几个方向进行优化:

- 测试不同的止盈止损距离,优化参数。

- 在特殊情况下考虑快速止损机制。

- 结合技术指标判断确定止盈和止损位。

- 优化滑点幅度,平衡止盈和止损。

策略源码

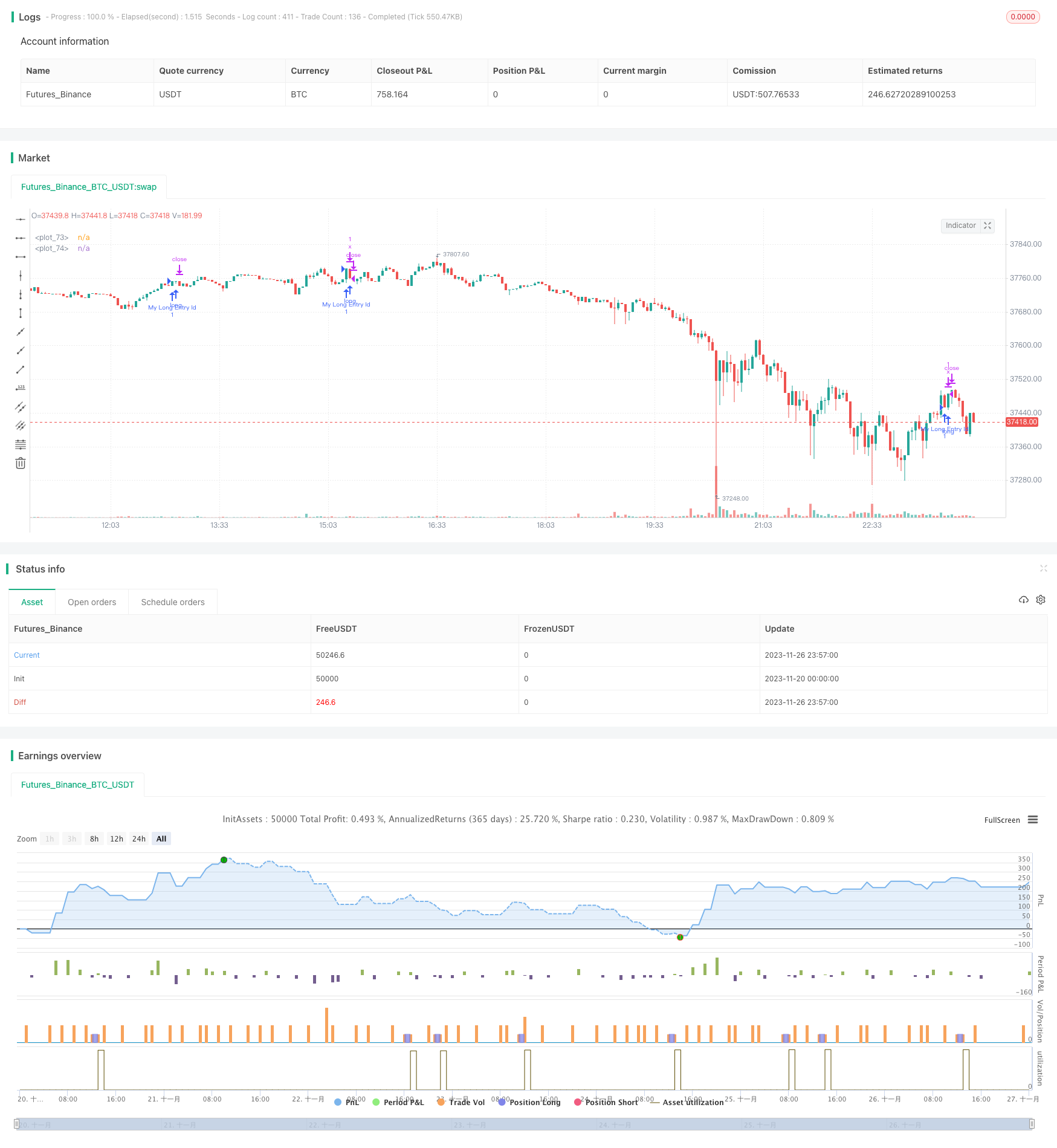

/*backtest

start: 2023-11-20 00:00:00

end: 2023-11-27 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © adolgov

// @description

// when tp1 is reached, sl is moved to break-even

// when tp2 is reached, sl is moved to tp1

// when tp3 is reached - exit

//@version=4

strategy("Stepped trailing strategy example", overlay=true)

// random entry condition

longCondition = crossover(sma(close, 14), sma(close, 28))

if (longCondition)

strategy.entry("My Long Entry Id", strategy.long)

// sl & tp in points

sl = input(100)

tp1 = input(100)

tp2 = input(200)

tp3 = input(300)

curProfitInPts() =>

if strategy.position_size > 0

(high - strategy.position_avg_price) / syminfo.mintick

else if strategy.position_size < 0

(strategy.position_avg_price - low) / syminfo.mintick

else

0

calcStopLossPrice(OffsetPts) =>

if strategy.position_size > 0

strategy.position_avg_price - OffsetPts * syminfo.mintick

else if strategy.position_size < 0

strategy.position_avg_price + OffsetPts * syminfo.mintick

else

0

calcProfitTrgtPrice(OffsetPts) =>

calcStopLossPrice(-OffsetPts)

getCurrentStage() =>

var stage = 0

if strategy.position_size == 0

stage := 0

if stage == 0 and strategy.position_size != 0

stage := 1

else if stage == 1 and curProfitInPts() >= tp1

stage := 2

else if stage == 2 and curProfitInPts() >= tp2

stage := 3

stage

stopLevel = -1.

profitLevel = calcProfitTrgtPrice(tp3)

// based on current stage set up exit

// note: we use same exit ids ("x") consciously, for MODIFY the exit's parameters

curStage = getCurrentStage()

if curStage == 1

stopLevel := calcStopLossPrice(sl)

strategy.exit("x", loss = sl, profit = tp3, comment = "sl or tp3")

else if curStage == 2

stopLevel := calcStopLossPrice(0)

strategy.exit("x", stop = stopLevel, profit = tp3, comment = "breakeven or tp3")

else if curStage == 3

stopLevel := calcStopLossPrice(-tp1)

strategy.exit("x", stop = stopLevel, profit = tp3, comment = "tp1 or tp3")

else

strategy.cancel("x")

// this is debug plots for visulalize TP & SL levels

plot(stopLevel > 0 ? stopLevel : na, style = plot.style_linebr)

plot(profitLevel > 0 ? profitLevel : na, style = plot.style_linebr)