概述

本策略是一个结合Hull MA、价格频道、EMA信号和线性回归的摆荡交易策略。该策略利用Hull MA判断市场趋势方向,价格频道和线性回归判断底部区域,EMA信号判断入市时机,以捕捉中短线趋势。

策略原理

该策略主要由以下几部分指标组成:

- Hull MA

- Hull MA一般参数期间为337,代表中长线趋势方向

- 当2倍18周期WMA高于337周期WMA时为多头市场,反之为空头市场

- 价格频道

- 价格频道由高低价EMA组成,代表容易形成支撑和阻力的区域

- EMA信号

- EMA信号期间一般为89周期,代表短线趋势和入市信号

- 线性回归

- 快线6周期,判断底部和突破

- 慢线89周期,判断中长线趋势方向

入场逻辑:

多头入场:Hull MA向上且价格高于上轨,线性回归向上穿越短期EMA 空头入场:Hull MA向下且价格低于下轨,线性回归向下穿越短期EMA

出场逻辑:

多头出场:价格低于下轨且穿越线性回归向下 空头出场:价格高于上轨且穿越线性回归向上

优势分析

该策略具有以下优势:

- 多指标组合,判断更准确

- Hull MA判断主趋势,频道判断支撑压力,EMA判断入场时机

- 摆荡交易,捕捉中短线趋势

- 策略为反转为主的摆荡交易策略,能捕捉每个中短线周期的趋势

- 风险可控,回撤较小

- 策略只在高概率区域发出信号,避免追高杀跌

风险分析

该策略也存在一定的风险:

- 参数优化空间有限

- 主要参数如EMA周期较为固定,优化空间小

- 震荡行情中可能亏损

- 价格横盘震荡时,止损可能被触发

- 需要一定的技术分析基础

- 策略思路需要一定的价格行为和指标知识,不适合所有人

可以从以下几点进行优化:

- 调整止损策略,例如余震止损

- 优化进场离场逻辑

- 增加其他指标过滤,例如MACD

总结

本策略综合运用Hull MA、价格频道、EMA和线性回归等多个指标,形成一个较为完整的中短线摆荡交易策略。相比单一指标,该策略可以大大提高判断准确性,在趋势和反转中捕捉利润。但也存在一定风险,需要技术分析基础。通过参数调整和进场离场逻辑优化,可以进一步提高策略稳定性。

策略源码

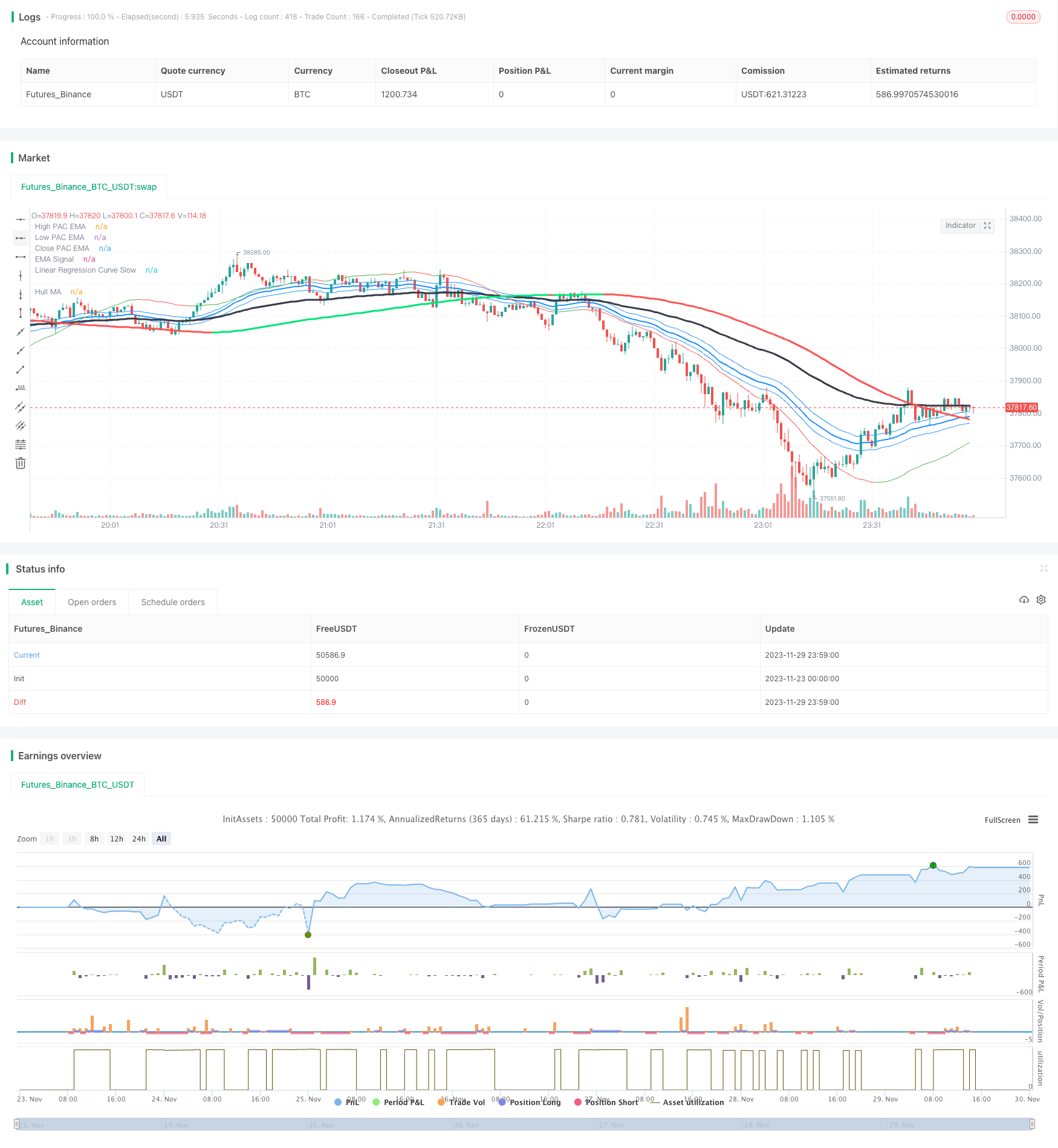

/*backtest

start: 2023-11-23 00:00:00

end: 2023-11-30 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Swing Hull/SonicR/EMA/Linear Regression Strategy", overlay=true)

//Hull MA

n=input(title="HullMA Period",defval=377)

//

n2ma=2*wma(close,round(n/2))

nma=wma(close,n)

diff=n2ma-nma

sqn=round(sqrt(n))

//

n2ma1=2*wma(close[1],round(n/2))

nma1=wma(close[1],n)

diff1=n2ma1-nma1

sqn1=round(sqrt(n))

//

n1=wma(diff,sqn)

n2=wma(diff1,sqn)

condDown = n2 >= n1

condUp = condDown != true

col =condUp ? lime : condDown ? red : yellow

plot(n1,title="Hull MA", color=col,linewidth=3)

// SonicR + Line reg

EMA = input(defval=89, title="EMA Signal")

HiLoLen = input(34, minval=2,title="High Low channel Length")

lr = input(89, minval=2,title="Linear Regression Length")

pacC = ema(close,HiLoLen)

pacL = ema(low,HiLoLen)

pacH = ema(high,HiLoLen)

DODGERBLUE = #1E90FFFF

// Plot the Price Action Channel (PAC) base on EMA high,low and close//

L=plot(pacL, color=DODGERBLUE, linewidth=1, title="High PAC EMA",transp=90)

H=plot(pacH, color=DODGERBLUE, linewidth=1, title="Low PAC EMA",transp=90)

C=plot(pacC, color=DODGERBLUE, linewidth=2, title="Close PAC EMA",transp=80)

//Moving Average//

signalMA =ema(close,EMA)

plot(signalMA,title="EMA Signal",color=black,linewidth=3,style=line)

linereg = linreg(close, lr, 0)

lineregf = linreg(close, HiLoLen, 0)

cline=linereg>linereg[1]?green:red

cline2= lineregf>lineregf[1]?green:red

plot(linereg, color = cline, title = "Linear Regression Curve Slow", style = line, linewidth = 1)

//plot(lineregf, color = cline2, title = "Linear Regression Curve Fast", style = line, linewidth = 1)

longCondition = n1>n2

shortCondition = longCondition != true

closeLong = lineregf-pacH>(pacH-pacL)*2 and close<lineregf and linereg>signalMA

closeShort = pacL-lineregf>(pacH-pacL)*2 and close>lineregf and linereg<signalMA

if shortCondition

if (close[0] < signalMA[0] and close[1] > pacL[1] and linereg>pacL and close<n1 and pacL<n1) //cross entry

strategy.entry("SHORT", strategy.short, comment="Short")

strategy.close("SHORT", when=closeShort) //output logic

if longCondition // swing condition

if (close[0] > signalMA[0] and close[1] < pacH[1] and linereg<pacH and close>n1 and pacH>n1) //cross entry

strategy.entry("LONG", strategy.long, comment="Long")

strategy.close("LONG", when=closeLong) //output logic