概述

该策略为LazyBear的原始波浪趋势策略,增加了第二止损、多个止盈价格以及高时间框架EMA过滤器。其利用波浪趋势指标生成交易信号,再结合EMA过滤和止损止盈管理,实现自动化趋势跟踪交易。

策略原理

该策略的核心指标是波浪趋势指标(WaveTrend),它由三部分组成:

AP:平均价格=(最高价+最低价+收盘价)/3

ESA:AP的n1期EMA

CI:(AP-ESA)/ (0.015×AP-ESA的n1期EMA)的绝对值的n1期EMA

TCI:CI的n2期EMA,即波浪趋势线1(WT1)

WT2:WT1的4周期SMA

当WT1上穿WT2产生金叉时,做多;当WT1下穿WT2产生死叉时,平仓。

此外,策略还引入高时间框架EMA作为过滤器,只有当价格高于EMA时才能做多,低于EMA时才能做空,从而过滤掉部分假信号。

策略优势

- 利用波浪趋势指标自动跟踪趋势,避免人为判断错误

- 增加第二止损,有效控制单笔亏损

- 多个止盈价格,最大程度锁定利润

- EMA过滤器,过滤假信号,提高胜率

策略风险及优化

- 不能过滤趋势反转,可能造成损失

- 参数设置不当可能导致过于频繁交易

- 可测试不同参数组合,优化参数

- 可考虑结合其他指标判断趋势反转

总结

该策略综合考虑了趋势跟踪、风险控制、利润最大化等多个维度,通过波浪趋势指标自动捕捉趋势,配合EMA过滤器提高交易效率,在把握趋势的同时控制风险,是一个高效稳定的趋势跟踪策略。通过进一步的参数优化和增加反转判断,可以进一步扩展该策略的适用性。

策略源码

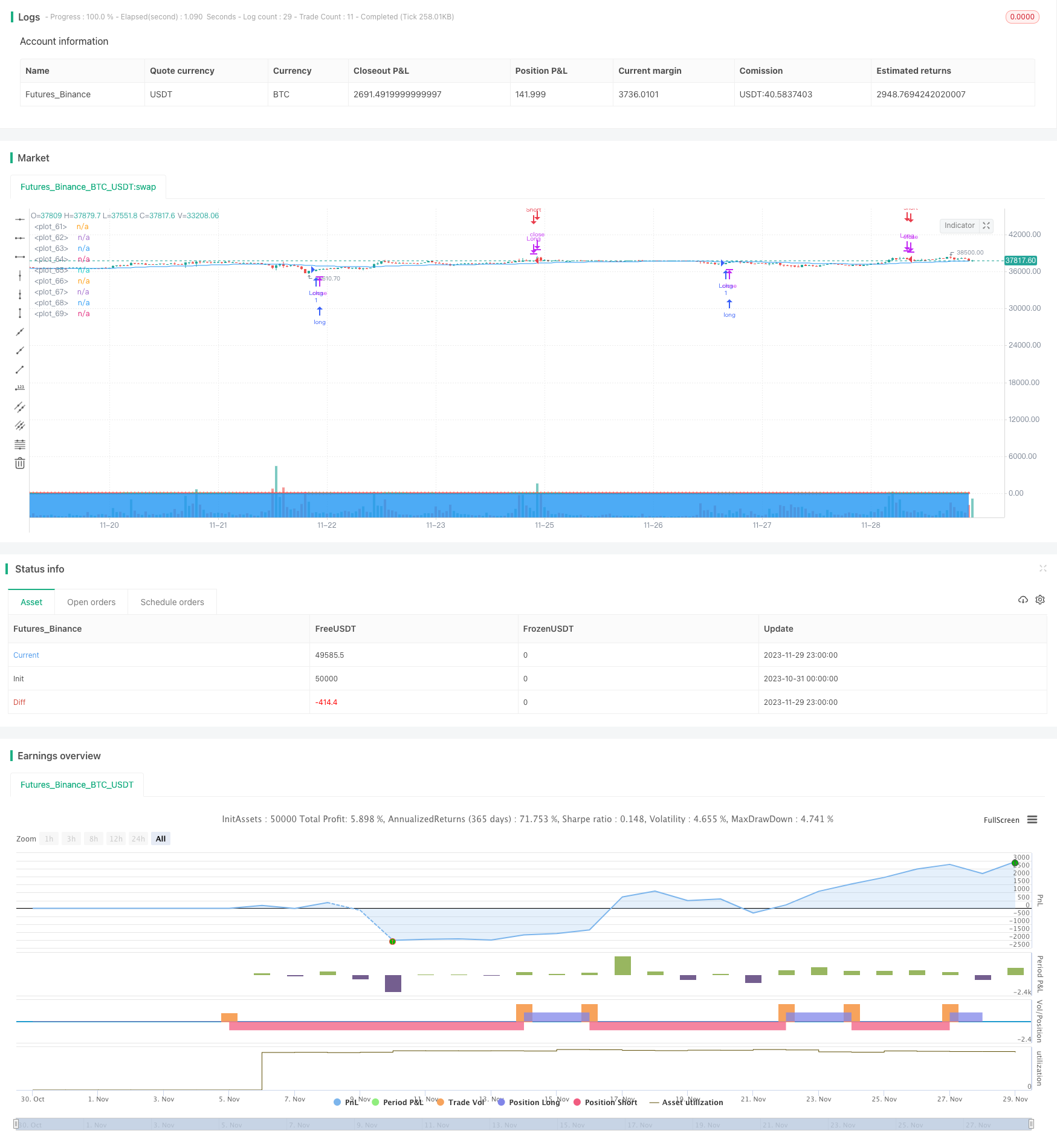

/*backtest

start: 2023-10-31 00:00:00

end: 2023-11-30 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © undacovacobra

//@version=4

strategy("WaveTrend Strategy [LazyBear] with Secondary Stop Loss", overlay=true)

// Input parameters

n1 = input(10, "Channel Length")

n2 = input(21, "Average Length")

obLevel1 = input(60, "Over Bought Level 1")

obLevel2 = input(53, "Over Bought Level 2")

osLevel1 = input(-60, "Over Sold Level 1")

osLevel2 = input(-53, "Over Sold Level 2")

useEmaFilter = input(false, "Use EMA Filter")

emaLength = input(50, "EMA Length")

emaTimeFrame = input("60", "EMA Time Frame")

tradeMode = input("Both", "Trade Mode", options=["Long Only", "Short Only", "Both"])

useSecondarySL = input(false, "Use Secondary Stop Loss")

slPercentage = input(5.0, "Stop Loss Percentage (%)")

// WaveTrend Indicator Calculations

ap = hlc3

esa = ema(ap, n1)

d = ema(abs(ap - esa), n1)

ci = (ap - esa) / (0.015 * d)

tci = ema(ci, n2)

wt1 = tci

wt2 = sma(wt1, 4)

// EMA Calculation with Selected Time Frame

getEma(timeFrame) =>

security(syminfo.tickerid, timeFrame, ema(close, emaLength))

emaFilter = getEma(emaTimeFrame)

// Secondary Stop Loss Calculation

longStopPrice = strategy.position_avg_price * (1 - slPercentage / 100)

shortStopPrice = strategy.position_avg_price * (1 + slPercentage / 100)

// Long Entry and Exit Conditions with EMA Filter and Trade Mode

longEntry = crossover(wt1, wt2) and wt2 < osLevel1 and (not useEmaFilter or close > emaFilter) and (tradeMode == "Long Only" or tradeMode == "Both")

if (longEntry)

strategy.entry("Long", strategy.long)

longExit = crossunder(wt1, wt2) and wt2 > obLevel1

if (longExit)

strategy.close("Long")

if (useSecondarySL and strategy.position_size > 0 and low < longStopPrice)

strategy.close("Long", comment="SL Hit")

// Short Entry and Exit Conditions with EMA Filter and Trade Mode

shortEntry = crossunder(wt1, wt2) and wt2 > obLevel1 and (not useEmaFilter or close < emaFilter) and (tradeMode == "Short Only" or tradeMode == "Both")

if (shortEntry)

strategy.entry("Short", strategy.short)

shortExit = crossover(wt1, wt2) and wt2 < osLevel1

if (shortExit)

strategy.close("Short")

if (useSecondarySL and strategy.position_size < 0 and high > shortStopPrice)

strategy.close("Short", comment="SL Hit")

// Plotting

plot(0, color=color.gray)

plot(obLevel1, color=color.red)

plot(osLevel1, color=color.green)

plot(obLevel2, color=color.red, style=plot.style_cross)

plot(osLevel2, color=color.green, style=plot.style_cross)

plot(wt1, color=color.green)

plot(wt2, color=color.red, style=plot.style_cross)

plot(wt1-wt2, color=color.blue, style=plot.style_area, transp=80)

plot(emaFilter, color=color.blue)