概述

该策略是一个位置型的趋势跟踪策略,它利用EMA波段、Leledc枯竭线和布林带的组合来识别趋势,并在趋势出现信号时建立多头或空头头寸。

策略原理

开仓条件

当价格突破中线EMA波段时(即高点EMA和低点EMA的中间价位),做多;当价格突破中线EMA波段下方时,做空。

可以选择启用慢EMA滤波器,只有在关闭价突破中线EMA波段,并且慢EMA同向时才开仓。

可以选择在中线EMA击穿后启用再突破信号,只有价格再次触碰中线EMA波段才开仓。

平仓条件

选择最近波段止损,价格触碰相反方向的中线EMA波段时止损。

选择相反波段止损,价格突破相反方向中线EMA波段时止损。

可选定延迟止损,如果价格在中线EMA波段内徘徊一定周期后止损。

选择在Leledc枯竭线时止损。当连续若干根K线同向收盘,并且创近期最高或最低价时,判断趋势结束,止损。

选择在布林带回归线时止损。当价格在超买超卖区域回归布林带中轨时,判断趋势结束,止损。

可选定在离破购买区或卖出区时止损。当价格突破内部或外部的购买区或卖出区后,判断趋势结束,止损。

逆向开仓条件

在Leledc枯竭线或布林带回归线出现时,并且极值点突破购买区或卖出区的一定范围,可选择逆向开仓。

逆向头寸有独立的止损条件可选择。

策略优势

利用EMA波段判断趋势方向,避免被震荡行情误导。

Leledc枯竭线可有效判断趋势结束,布林带回归线确认多空头寸过度扩张的时机,二者配合可确保趋势跟踪效果。

启用逆向开仓后,可在震荡行情中进行范围交易,在趋势行情中追踪更多行情。

中线EMA波段、购买区与卖出区的画图可直观判断当前趋势方向和力度。

策略风险

EMA指标对参数设置比较敏感,EMA长度设置不当可能导致乱仓。

Leledc枯竭线和布林带回归线作为判断趋势终结的技术指标也可能失效,从而错过止损点产生较大亏损。

逆向开仓增加了策略风险,必须设置止损来控制风险。

策略优化

可以测试不同的EMA长度参数,找到更适合品种和周期的参数组合。

Leledc枯竭线和布林带回归线可调整参数,寻找更准确判断趋势终结的指标参数。

逆向开仓的止损点可进一步优化,使逆向交易风险收益匹配更优。

中线EMA波段可考虑用简单移动平均线或其他指标替代,寻找更稳定判断趋势中线的技术指标。

总结

该策略整合了趋势判断、枯竭点确认和逆向交易入场等多种技术指标与技术方法,可谓功能齐全。在参数调整和风险控制到位的前提下,可以获得优异的稳定收益,值得进一步研究与优化。

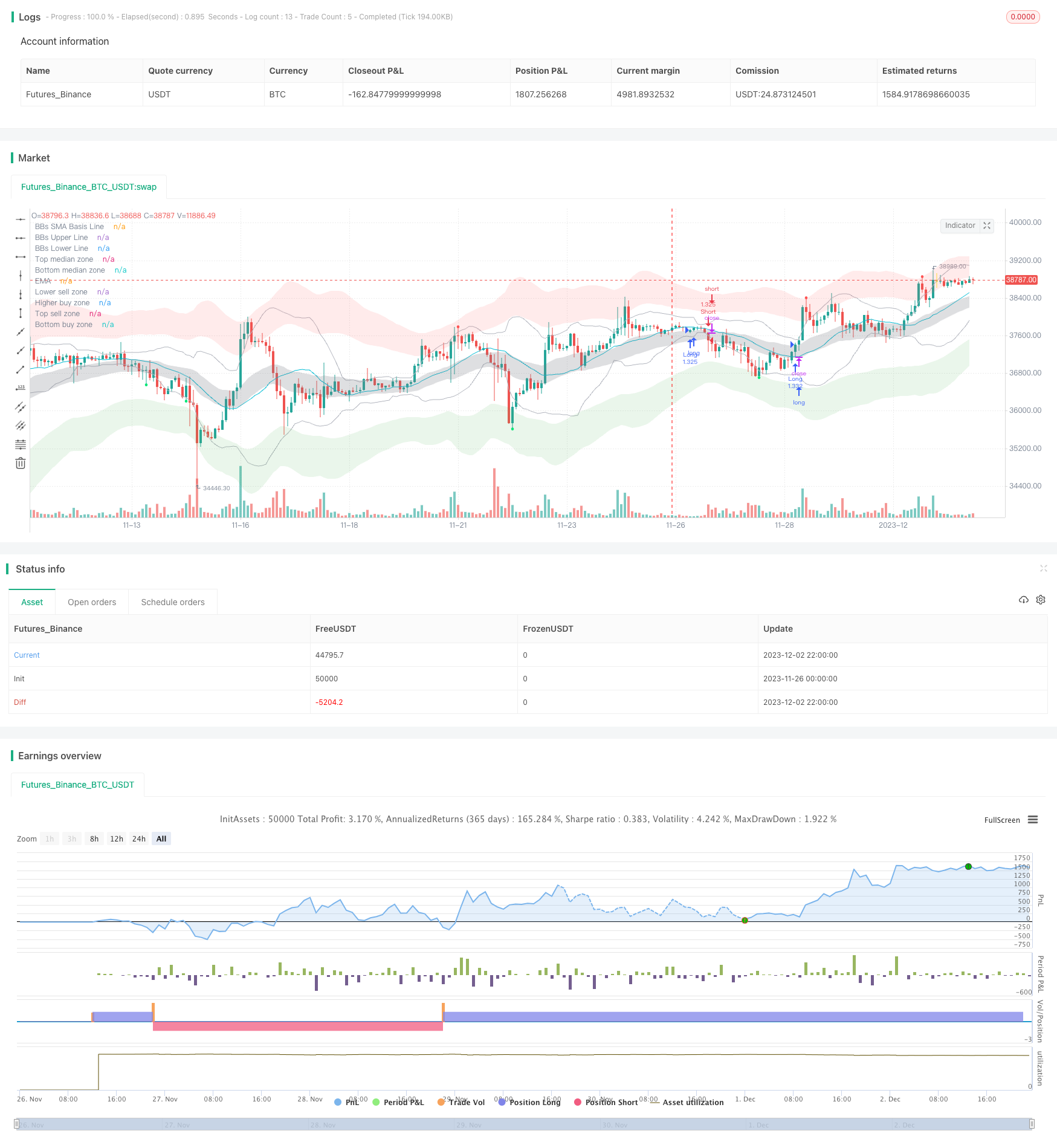

/*backtest

start: 2023-11-26 00:00:00

end: 2023-12-03 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © danielx888

// Credits to Joy_Bangla for the Leledc exhaustion bar code

// Credits to VishvaP for the 34 EMA bands code

// Credits to SlumdogTrader for the BB exhaustion code (edited for functionality)

//@version=5

strategy(title='EMA bands + leledc + bollinger bands trend catching strategy w/ countertrend scalp', shorttitle='Trend Pooristics', overlay=true, initial_capital = 1000, commission_value= 0.036, pyramiding= 0, default_qty_type= strategy.percent_of_equity, default_qty_value= 100, margin_long=0, margin_short=0, max_bars_back=200)

EMAlength = input.int(title='EMA Length', defval=34, minval=1, step=1)

//get user inputs

needLong = input.bool(true, title = "Enable middle EMA band breakout: Long", group="Open Conditions")

needShort = input.bool(true, title = "Enable middle EMA band breakdown: Short", group="Open Conditions")

midClose = input.string('Opposite band', title='Close on crosses through middle EMA bands', tooltip='Selecting -Delayed bars inside- will delay closing positions by the specified amount of bars if candles close inside the middle EMA bands but do not breakout the opposite side.', options=['Nearest band', 'Opposite band', 'Delayed bars inside'], group='Close Conditions')

needCTlong = input.bool(false, title = "Enable counter-trend trades: Long", tooltip='Does not work with -default positioning: short- enabled', group="Counter Trade Settings")

CTlongType = input.string('Leledc', title = 'Trigger', options=['Leledc', 'BB Exhaustion'], group='Counter Trade Settings')

needCTshort = input.bool(false, title = "Enable counter-trend trades: Short", tooltip='Does not work with -default positioning: long- enabled', group="Counter Trade Settings")

CTshortType = input.string('Leledc', title = 'Trigger', options=['Leledc', 'BB Exhaustion'], group='Counter Trade Settings')

alwaysLong = input.bool(false, title = "Enable default positioning: Long", tooltip='Does not work with -Default to short- also selected. Works best when early close conditions are used', group = 'Open Conditions')

alwaysShort = input.bool(false, title = "Enable default positioning: Short", tooltip='Does not work with -Default to long- also selected. Works best when early close conditions are used', group = 'Open Conditions')

s_longBounce = input.bool(false, 'Enable middle EMA band bounce re-entry: Long', tooltip='Works best when early close conditions are used', group= 'Open Conditions')

s_shortBounce = input.bool(false, 'Enable middle EMA band bounce re-entry: Short', tooltip='Works best when early close conditions are used', group= 'Open Conditions')

numBars = input.int(4, title='Delayed close no. of bars', minval=1, maxval=10, step=1, group='Close Conditions')

useSlowEMA = input.bool(false, title='Use slow EMA filter',tooltip='Has no effect on counter-trend trades', group='Open Conditions')

useLele = input.bool(false, title='Close on Leledc bars', group='Close Conditions')

string whichLele = input.string('First', title='Which Leledc bar?', options=['First', 'Second', 'Third', 'Fourth', 'Fifth'], group='Close Conditions')

useBBExtend = input.bool(false, title='Close on Bollinger Band exhaustion bars', tooltip='Bollinger Band Exhaustion bars are candles that close back inside the Bollinger Bands when RSI is overbought or oversold. Settings for both can be changed under the -Bollinger Bands Exhaustion Bar Settings- header.', group='Close Conditions')

string whichBBext = input.string('First', title='Which BB exhaustion bar?', options=['First', 'Second', 'Third'], group='Close Conditions')

reverBandClose = input.bool(false, title='Close on loss of Buy/Sell zone', group='Close Conditions')

whichCTband = input.string(defval = 'Inner', title = 'Leledc/BB must be outside which Buy/Sell zone to open', options=['Inner', 'Outer'], group="Counter Trade Settings")

i_CTlongCloseCond = input.string(title='Closing conditions for counter-trend longs', defval='Cross Top Middle Band', tooltip='-Cross- type close conditions market close position on candle closes above selected region \n\n-Touch- type enable trailing limit orders that follow the selected region', options=['Cross Outer Buy Zone', 'Cross Inner Buy Zone', 'Touch Inner Buy Zone', 'Cross Bottom Middle Band', 'Touch Bottom Middle Band', 'Cross Top Middle Band', 'Touch Top Middle Band', 'Cross Inner Sell Zone', 'Touch Inner Sell Zone', 'Cross Outer Sell Zone', 'Touch Outer Sell Zone', 'First Leledc', 'First BB Exhaustion'], group='Counter Trade Settings')

i_CTshortCloseCond = input.string(title='Closing conditions for counter-trend shorts', defval='First Leledc', tooltip='-Cross- type close conditions market close position on candle closes below selected region \n\n-Touch- type enable trailing limit orders that follow the selected region',options=['Cross Outer Sell Zone', 'Cross Inner Sell Zone', 'Touch Inner Sell Zone', 'Cross Top Middle Band', 'Touch Top Middle Band', 'Cross Bottom Middle Band', 'Touch Bottom Middle Band', 'Cross Inner Buy Zone', 'Touch Inner Buy Zone', 'Cross Outer Buy Zone', 'Touch Outer Buy Zone', 'First Leledc', 'First BB Exhaustion'], group='Counter Trade Settings')

i_CTlongSL = input.float(10, 'Flat stop-loss % for counter-trend longs', 0, 100, 0.1, 'Input 0 to disable stop-loss for counter-trend trades. Enabling stop-loss will not apply to middle band breakout, bounce, or default positional trades',group='Counter Trade Settings')

i_CTshortSL = input.float(10, 'Flat stop-loss % for counter-trend shorts', 0, 100, 0.1, 'Input 0 to disable stop-loss for counter-trend trades. Enabling stop-loss will not apply to middle band breakout, bounce, or default positional trades',group='Counter Trade Settings')

// calculate and plot slow EMA

showSlowEMA = input.bool(false, title='Show Slow EMA', group='Visual Elements')

slowEMAlen = input.int(200, title='Slow EMA Length', step=1, minval=1, group='Open Conditions')

slowEMA = ta.ema(close, slowEMAlen)

plot(showSlowEMA ? slowEMA : na)

maj = input(true, 'Show Leledc Exhausion Bars', group='Visual Elements')

//*****************************

// SlumdogTrader's Bollinger Bands + RSI Double Strategy - Profit Trailer

//====================================================================================================//

///////////// Bollinger Bands Settings

BBlength = input.int(20, minval=1, title='Bollinger Bands SMA Period Length', group='Bollinger Bands Exhaustion Bar Settings')

BBmult = input.float(1.8, minval=0.001, maxval=50, title='Bollinger Bands Standard Deviation', group='Bollinger Bands Exhaustion Bar Settings')

price = input(close, title='Source')

BBbasis = ta.sma(price, BBlength)

BBdev = BBmult * ta.stdev(price, BBlength)

BBupper = BBbasis + BBdev

BBlower = BBbasis - BBdev

source = close

buyEntry = ta.crossover(source, BBlower)

sellEntry = ta.crossunder(source, BBupper)

plot(BBbasis, color=color.new(color.aqua, 0), title='BBs SMA Basis Line', display=display.none)

p1 = plot(BBupper, color=color.new(color.silver, 0), title='BBs Upper Line', display=display.none)

p2 = plot(BBlower, color=color.new(color.silver, 0), title='BBs Lower Line', display=display.none)

fill(p1, p2, display=display.none)

///////////// RSI Settings

RSIlength = input.int(8, minval=1, step=1, title='RSI Period Length', group='Bollinger Bands Exhaustion Bar Settings')

RSIos = input.int(30, minval=0, maxval=50, step=1,title='RSI Oversold Value', group='Bollinger Bands Exhaustion Bar Settings')

RSIob = input.int(70, minval=50, maxval=100, step=1, title='RSI Overbought value', group='Bollinger Bands Exhaustion Bar Settings')

vrsi = ta.rsi(price, RSIlength)

RSIoverSold = vrsi < RSIos

RSIoverBought = vrsi > RSIob

///////////// Colour Settings

switch1 = input(true, title='Enable Bollinger Bands exhaustion bar coloring', group='Visual Elements')

switch2 = input(false, title='Enable Bollinger bands exhaustion bar background coloring', tooltip='Enabling this can help visualize when dialing in Bollinger Bands and RSI settings', group='Visual Elements')

OSOBcolor = RSIoverBought and price[1] > BBupper and price < BBupper ? color.yellow : RSIoverSold and price[1] < BBlower and price > BBlower ? color.blue : na

bgcolor(switch2 ? color.new(OSOBcolor,70) : na)

///////////// RSI + Bollinger Bands Strategy

//if not na(vrsi)

//

// if ta.crossover(vrsi, RSIoverSold) and ta.crossover(source, BBlower)

// strategy.entry('RSI_BB_L', strategy.long, stop=BBlower, oca_type=strategy.oca.cancel, comment='RSI_BB_L')

// else

// strategy.cancel(id='RSI_BB_L')

//

// if ta.crossunder(vrsi, RSIoverBought) and ta.crossunder(source, BBupper)

// strategy.entry('RSI_BB_S', strategy.short, stop=BBupper, oca_type=strategy.oca.cancel, comment='RSI_BB_S')

// else

// strategy.cancel(id='RSI_BB_S')

//

//plot(strategy.equity, title="equity", color=red, linewidth=2, style=areabr)

//====================================================================================================//

//*****************************

//*****************************

// © Joy_Bangla Leledc Exhaustion V4

//====================================================================================================//

//min = input(false, 'Minor Leledc Exhaustion Bar :: Show')

i_leleVol = input.bool(false, 'Require Volume breakout for Leledc bars', group='Leledc Exhaustion Bar Settings')

i_volMult = input.float(1.5,'Volume Multiplier', 0.1,20,0.1, group='Leledc Exhaustion Bar Settings')

leleVol = volume > ta.sma(volume,100)*i_volMult

leledcSrc = input(close, 'Source', group='Leledc Exhaustion Bar Settings')

maj_qual = input(6, 'Bar count no', group='Leledc Exhaustion Bar Settings')

maj_len = input(30, 'Highest / Lowest', group='Leledc Exhaustion Bar Settings')

//min_qual = input(5, 'Minor Leledc Exhausion Bar :: Bar count no')

//min_len = input(5, 'Minor Leledc Exhausion Bar :: Bar count no')

bindexSindex = input(1, 'bindexSindex', group='Leledc Exhaustion Bar Settings')

closeVal = input(4, 'Close', group='Leledc Exhaustion Bar Settings')

lele(qual, len) =>

bindex = 0

sindex = 0

bindex := nz(bindex[bindexSindex], 0)

sindex := nz(sindex[bindexSindex], 0)

ret = 0

if close > close[closeVal]

bindex += 1

bindex

if close < close[closeVal]

sindex += 1

sindex

if i_leleVol and not leleVol

ret := 0

ret

else

if bindex > qual and close < open and high >= ta.highest(high, len)

bindex := 0

ret := -1

ret

if sindex > qual and close > open and low <= ta.lowest(low, len)

sindex := 0

ret := 1

ret

return_1 = ret

return_1

major = lele(maj_qual, maj_len)

//minor = lele(min_qual, min_len)

plotchar(maj ? major == -1 ? high : na : na, char='•', location=location.absolute, color=color.new(color.red, 0), size=size.small)

plotchar(maj ? major == 1 ? low : na : na, char='•', location=location.absolute, color=color.new(color.lime, 0), size=size.small)

//plotchar(min ? minor == 1 ? high : na : na, char='x', location=location.absolute, color=color.new(color.red, 0), size=size.small)

//plotchar(min ? minor == -1 ? low : na : na, char='x', location=location.absolute, color=color.new(color.lime, 0), size=size.small)

//leledcMajorBullish = major == 1 ? low : na

//leledcMajorBearish = major == -1 ? high : na

//leledcMinorBullish = minor == 1 ? low : na

//leledcMinorBearish = minor == -1 ? high : na

//==============================================//

//alertcondition(leledcMajorBullish, title='Major Bullish Leledc', message='Major Bullish Leledc')

//alertcondition(leledcMajorBearish, title='Major Bearish Leledc', message='Major Bearish Leledc')

//alertcondition(leledcMinorBullish, title='Minor Bullish Leledc', message='Minor Bullish Leledc')

//alertcondition(leledcMinorBearish, title='Minor Bearish Leledc', message='Minor Bearish Leledc')

//====================================================================================================//

//*****************************

//*****************************

// © VishvaP 34 EMA Bands v2

//====================================================================================================//

//Constants

//price = close

highShortEMA = ta.ema(high, EMAlength)

lowShortEMA = ta.ema(low, EMAlength)

EMA = ta.ema(close, EMAlength)

//==============================================//

//1D Bands [Not Used]

//bandsHigh = highShortEMA * math.phi

//bandsLow = lowShortEMA * math.rphi

//==============================================//

//Lower reversion zone bands (buy zone)

shortbandsHigh = ((highShortEMA - EMA) * math.phi) * math.pi + EMA

shortbandsLow = (-(EMA - lowShortEMA) * math.phi) * math.pi + EMA

//Lower reversion zone bands smoothed

shortbandsHighEMA = ta.wma(shortbandsHigh, 8)

shortbandsLowEMA = ta.wma(shortbandsLow, 8)

//==============================================//

//Higher reversion zone bands (sell zone)

phiExtensionHigh = ((highShortEMA - EMA) * math.phi) * (math.phi + 4) + EMA

phiExtensionLow = (-(EMA - lowShortEMA) * math.phi) * (math.phi + 4) + EMA

//Higher reversion zone bands smoothed

phiExtensionHighEMA = ta.wma(phiExtensionHigh, 8)

phiExtensionLowEMA = ta.wma(phiExtensionLow, 8)

//==============================================//

//Median zone bands [plot]

highP1 = plot(highShortEMA, color = color.new(color.blue, 100), title = "Top median zone")

lowP1 = plot(lowShortEMA, color = color.new(color.blue, 100), title = "Bottom median zone")

plot(EMA, color = color.new(color.gray, 100), title = "EMA")

//1D bands [not used]

//highP2 = plot(bandsHigh)

//lowP2 = plot(bandsLow)

//Lower reversion zone bands [plot]

highP3 = plot(shortbandsHighEMA, color = color.new(color.yellow, 100), title = "Lower sell zone")

lowP3 = plot(shortbandsLowEMA, color = color.new(color.teal, 100), title = "Higher buy zone")

//Higher reversion zone bands [plot]

phiPlotHigh = plot(phiExtensionHighEMA, color = color.new(color.red, 100), title = "Top sell zone")

phiPlotLow = plot(phiExtensionLowEMA, color = color.new(color.green, 100), title = "Bottom buy zone")

//==============================================//

//Sell zone region [fill]

fill(phiPlotHigh, highP3, color.new(color.red, 85), title = "Sell zone")

//Buy zone region [fill]

fill(lowP3, phiPlotLow, color.new(color.green, 85), title = "Buy zone")

//Median zone region [fill]

fill(highP1, lowP1, color.new(color.gray, 70), title = "Median zone")

//====================================================================================================//

//*****************************

//assign bands for counter trend entry

float CTbandTop = na

float CTbandBottom = na

if whichCTband == 'Inner'

CTbandTop := shortbandsHighEMA

CTbandBottom := shortbandsLowEMA

else

CTbandTop := phiExtensionHighEMA

CTbandBottom := phiExtensionLowEMA

//build variables for open/closing conditions on crosses of middle EMA bands

crossUpTopMB = open < highShortEMA and close > highShortEMA

wiggleUpTopMB = open > highShortEMA and close > highShortEMA and close[1] <= highShortEMA[1]

crossDownTopMB = open > highShortEMA and close < highShortEMA

wiggleDownTopMB = open < highShortEMA and close < highShortEMA and close[1] >= highShortEMA[1]

crossUpBotMB = open < lowShortEMA and close > lowShortEMA

wiggleUpBotMB = open > lowShortEMA and close > lowShortEMA and close[1] <= lowShortEMA[1]

crossDownBotMB = open > lowShortEMA and close < lowShortEMA

wiggleDownBotMB = open < lowShortEMA and close < lowShortEMA and close[1] >= lowShortEMA[1]

crossUpBotInnerRB = open < shortbandsLowEMA and close > shortbandsLowEMA

wiggleUpBotInnerRB = open > shortbandsLowEMA and close > shortbandsLowEMA and close[1] <= shortbandsLowEMA[1]

crossUpBotOuterRB = open < phiExtensionLowEMA and close > phiExtensionLowEMA

wiggleUpBotOuterRB = open > phiExtensionLowEMA and close > phiExtensionLowEMA and close[1] <= phiExtensionLowEMA[1]

crossUpTopInnerRB = open < shortbandsHighEMA and close > shortbandsHighEMA

wiggleUpTopInnerRB = open > shortbandsHighEMA and close > shortbandsHighEMA and close[1] <= shortbandsHighEMA[1]

crossUpTopOuterRB = open < phiExtensionHighEMA and close > phiExtensionHighEMA

wiggleUpTopOuterRB = open > phiExtensionHighEMA and close > phiExtensionHighEMA and close[1] <= phiExtensionHighEMA[1]

crossDownBotInnerRB = open > shortbandsLowEMA and close < shortbandsLowEMA

wiggleDownBotInnerRB = open < shortbandsLowEMA and close < shortbandsLowEMA and close[1] >= shortbandsLowEMA[1]

crossDownBotOuterRB = open > phiExtensionLowEMA and close < phiExtensionLowEMA

wiggleDownBotOuterRB = open < phiExtensionLowEMA and close < phiExtensionLowEMA and close[1] >= phiExtensionLowEMA[1]

crossDownTopInnerRB = open > shortbandsHighEMA and close < shortbandsHighEMA

wiggleDownTopInnerRB = open < shortbandsHighEMA and close < shortbandsHighEMA and close[1] >= shortbandsHighEMA[1]

crossDownTopOuterRB = open > phiExtensionHighEMA and close < phiExtensionHighEMA

wiggleDownTopOuterRB = open < phiExtensionHighEMA and close < phiExtensionHighEMA and close[1] >= phiExtensionHighEMA[1]

longBounce = open > highShortEMA and close > highShortEMA and low < highShortEMA

shortBounce = open < lowShortEMA and close < lowShortEMA and high > lowShortEMA

//build variables for counter trend trades closing conditions

CTlongCloseCond = (i_CTlongCloseCond == 'Cross Inner Sell Zone' ? (crossUpTopInnerRB or wiggleUpTopInnerRB) : (i_CTlongCloseCond == 'Cross Outer Sell Zone' ? (crossUpTopOuterRB or wiggleUpTopOuterRB) : (i_CTlongCloseCond == 'Cross Top Middle Band' ? (crossUpTopMB or wiggleUpTopMB) : (i_CTlongCloseCond == 'Cross Bottom Middle Band' ? (crossUpBotMB or wiggleUpBotMB) : (i_CTlongCloseCond == 'Cross Inner Buy Zone' ? (crossUpBotInnerRB or wiggleUpBotInnerRB) : (i_CTlongCloseCond == 'Cross Outer Buy Zone' ? (crossUpBotOuterRB or crossUpBotOuterRB) : (i_CTlongCloseCond == 'First Leledc' ? major == -1 : (i_CTlongCloseCond == 'First BB Exhaustion' ? OSOBcolor == color.yellow : na))))))))

CTlongTP = (i_CTlongCloseCond == 'Touch Inner Buy Zone' ? shortbandsLowEMA : (i_CTlongCloseCond == 'Touch Top Middle Band' ? highShortEMA : (i_CTlongCloseCond == 'Touch Bottom Middle Band' ? lowShortEMA : (i_CTlongCloseCond == 'Touch Inner Sell Zone' ? shortbandsHighEMA : (i_CTlongCloseCond == 'Touch Outer Sell Zone' ? phiExtensionHighEMA : na)))))

CTshortCloseCond = (i_CTshortCloseCond == 'Cross Inner Buy Zone' ? (crossDownBotInnerRB or wiggleDownBotInnerRB) : (i_CTshortCloseCond == 'Cross Outer Buy Zone' ? (crossDownBotOuterRB or wiggleDownBotOuterRB) : (i_CTshortCloseCond == 'Cross Bottom Middle Band' ? (crossDownBotMB or wiggleDownBotMB) : (i_CTshortCloseCond == 'Cross Top Middle Band' ? (crossDownTopMB or wiggleDownTopMB) : (i_CTshortCloseCond == 'Cross Inner Sell Zone' ? (crossDownTopInnerRB or wiggleDownTopInnerRB) : (i_CTshortCloseCond == 'Cross Outer Sell Zone' ? (crossDownTopOuterRB or crossDownTopOuterRB) : (i_CTshortCloseCond == 'First Leledc' ? major == 1 : (i_CTshortCloseCond == 'First BB Exhaustion' ? OSOBcolor == color.blue : na))))))))

CTshortTP = (i_CTshortCloseCond == 'Touch Inner Sell Zone' ? shortbandsHighEMA : (i_CTshortCloseCond == 'Touch Bottom Middle Band' ? lowShortEMA : (i_CTshortCloseCond == 'Touch Top Middle Band' ? highShortEMA : (i_CTshortCloseCond == 'Touch Inner Buy Zone' ? shortbandsLowEMA : (i_CTshortCloseCond == 'Touch Outer Buy Zone' ? phiExtensionLowEMA : na)))))

shortMidBreak = crossDownBotMB or wiggleDownBotMB

longMidBreak = crossUpTopMB or wiggleUpTopMB

//==============================================//

//longs open

if needLong

if useSlowEMA

if longMidBreak and close > slowEMA and open < highShortEMA

strategy.entry('Long', strategy.long)

else if longMidBreak

strategy.entry('Long', strategy.long)

if strategy.position_size == 0 and s_longBounce

if useSlowEMA

if close > slowEMA and longBounce

strategy.entry('Long', strategy.long)

else if longBounce

strategy.entry('Long', strategy.long)

//shorts open

if needShort

if useSlowEMA

if shortMidBreak and close < slowEMA and open > lowShortEMA

strategy.entry('Short', strategy.short)

else if shortMidBreak

strategy.entry('Short', strategy.short)

if strategy.position_size == 0 and s_shortBounce

if useSlowEMA

if close < slowEMA and shortBounce

strategy.entry('Short', strategy.short)

else if shortBounce

strategy.entry('Short', strategy.short)

//==============================================//

//calculate how many leledc bars between current bar and current position entry

int countLongLele = 0

int countShortLele = 0

int numLele = switch whichLele

'First' => 1

'Second' => 2

'Third' => 3

'Fourth' => 4

'Fifth' => 5

int i = 0

//count leles for longs

if strategy.position_size > 0

if useLele and numLele > 1

while i <= 200

if strategy.position_size[i] <= 0

break

if bar_index[i] == 0

break

if major[i] == -1

countLongLele += 1

if countLongLele == numLele

break

i += 1

//count leles for shorts

if strategy.position_size < 0

if useLele and numLele > 1

while i <= 200

if strategy.position_size[i] >= 0

break

if bar_index[i] == 0

break

if major[i] == 1

countShortLele += 1

if countShortLele == numLele

break

i += 1

//countBullLeles() =>

// count = 0

// int n = 0

// while n <= 200 and strategy.position_size[n] > 0

// if major[n] == -1

// count += 1

// return_1 = count

// return_1

//countBearLeles() =>

// count = 0

// int n = 0

// while n <= 200 and strategy.position_size[n] < 0

// if major[n] == 1

// count += 1

// return_1 = count

// return_1

//calculate how many BB extension bars between current bar and current position entry

int countLongBBs = 0

int countShortBBs = 0

int numBBs = switch whichBBext

'First' => 1

'Second' => 2

'Third' => 3

int n = 0

//count BB Extension bars for longs

if strategy.position_size > 0

if useBBExtend and numBBs > 1

while n <= 200

if strategy.position_size[n] <= 0

break

if bar_index[n] == 0

break

if OSOBcolor[n] == color.yellow

countLongBBs += 1

if countLongBBs == numBBs

break

n+= 1

//count BB Extension bars for shorts

if strategy.position_size < 0

if useBBExtend and numBBs > 1

while n <= 200

if strategy.position_size[n] >= 0

break

if bar_index[n] == 0

break

if OSOBcolor[n] == color.blue

countShortBBs += 1

if countShortBBs == numBBs

break

n+= 1

//identify bars crossing under extreme overbought/oversold reversion bands for strategy exits and color

showReverBars = input.bool(title='Enable Buy/Sell zone failure bar coloring', defval=false, group='Visual Elements')

whichReverBand = input.string(title='Which Buy/Sell zone?', defval='Inner', options=['Inner', 'Outer'], group='Close Conditions')

float reverBandTop = na

float reverBandBottom = na

if whichReverBand == 'Inner'

reverBandTop := shortbandsHighEMA

reverBandBottom := shortbandsLowEMA

else

reverBandTop := phiExtensionHighEMA

reverBandBottom := phiExtensionLowEMA

crossUpRB = open < reverBandBottom and close > reverBandBottom

wiggleUpRB = open > reverBandBottom and close > reverBandBottom and close[1] <= reverBandBottom[1]

crossDownRB = open > reverBandTop and close < reverBandTop

wiggleDownRB = open < reverBandTop and close < reverBandTop and close[1] >= reverBandTop[1]

reverBarColor = crossDownRB or (wiggleDownRB and not crossDownRB[1]) ? color.orange : crossUpRB or (wiggleUpRB and not crossUpRB[1]) ? color.purple : na

//return true after specified number of bars (numBars) closes inside the mid bands but no breakout

inMid = close > lowShortEMA and close < highShortEMA and open > lowShortEMA and open < highShortEMA

isAllMid() =>

AllMid = true

for t = 0 to numBars by 1

if longMidBreak[t] or shortMidBreak[t]

AllMid := false

AllMid

//==============================================//

//longs close

if strategy.position_size > 0

if reverBandClose

if reverBarColor == color.orange

strategy.close('Long', comment = 'Close Long')

if useBBExtend and numBBs == 1

if OSOBcolor == color.yellow

strategy.close('Long', comment = 'Close Long')

if needCTshort and CTshortType == 'BB Exhaustion'

if open > CTbandTop

strategy.entry(id='Counter Trend Short', comment = 'CT Short', direction=strategy.short)

if useBBExtend and numBBs > 1

if countLongBBs == numBBs

strategy.close('Long', comment = 'Close Long')

if needCTshort and CTshortType == 'BB Exhaustion'

if open > CTbandTop

strategy.entry(id='Counter Trend Short', comment = 'CT Short', direction=strategy.short)

if useLele and numLele == 1

if major == -1

strategy.close('Long', comment = 'Close Long')

if needCTshort and CTshortType == 'Leledc'

if high > CTbandTop

strategy.entry(id='Counter Trend Short', comment = 'CT Short', direction=strategy.short)

if useLele and numLele > 1

if countLongLele == numLele

strategy.close('Long', comment = 'Close Long')

if needCTshort and CTshortType == 'Leledc'

if high > CTbandTop

strategy.entry(id='Counter Trend Short', comment = 'CT Short', direction=strategy.short)

if midClose == 'Nearest band'

if crossDownTopMB or wiggleDownTopMB

strategy.close('Long', comment = 'Close Long')

if midClose == 'Opposite band'

if crossDownBotMB or wiggleDownBotMB

strategy.close('Long', comment = 'Close Long')

if midClose == 'Delayed bars inside'

if crossDownBotMB or wiggleDownBotMB

strategy.close('Long', comment = 'Close Long')

if isAllMid()

if open[numBars] > highShortEMA and close[numBars] < highShortEMA and inMid

strategy.close('Long', comment = 'Close Long')

//shorts close

if strategy.position_size < 0

if reverBandClose

if reverBarColor == color.purple

strategy.close('Short', comment = 'Close Short')

if useBBExtend and numBBs == 1

if OSOBcolor == color.blue

strategy.close('Short', comment = 'Close Short')

if needCTlong and CTlongType == 'BB Exhaustion'

if open < CTbandBottom

strategy.entry(id='Counter Trend Long', comment = 'CT Long', direction=strategy.long)

if useBBExtend and numBBs > 1

if countShortBBs == numBBs

strategy.close('Short', comment = 'Close Short')

if needCTlong and CTlongType == 'BB Exhaustion'

if open < CTbandBottom

strategy.entry(id='Counter Trend Long', comment = 'CT Long', direction=strategy.long)

if useLele and numLele == 1

if major == 1

strategy.close('Short', comment = 'Close Short')

if needCTlong and CTlongType == 'Leledc'

if low < CTbandBottom

strategy.entry(id='Counter Trend Long', comment= 'CT Long', direction=strategy.long)

if useLele and numLele > 1

if countShortLele == numLele

strategy.close('Short', comment = 'Close Short')

if needCTlong and CTlongType == 'Leledc'

if low < CTbandBottom

strategy.entry(id='Counter Trend Long', comment= 'CT Long', direction=strategy.long)

if midClose == 'Nearest band'

if crossUpBotMB or wiggleUpBotMB

strategy.close('Short', comment = 'Close Short')

if midClose == 'Opposite band'

if crossUpTopMB or wiggleUpTopMB

strategy.close('Short', comment = 'Close Short')

if midClose == 'Delayed bars inside'

if crossUpTopMB or wiggleUpTopMB

strategy.close('Short', comment = 'Close Short')

if isAllMid()

if open[numBars] < lowShortEMA and close[numBars] > lowShortEMA and inMid

strategy.close('Short', comment = 'Close Short')

//==============================================//

//counter trend opens and closes

CTlongSL = strategy.position_avg_price * (1 - i_CTlongSL / 100)

CTshortSL = strategy.position_avg_price * (1 + i_CTshortSL / 100)

//CT longs open

if needCTlong and strategy.position_size == 0

if CTlongType == 'Leledc'

if major == 1

if low < CTbandBottom

strategy.entry(id='Counter Trend Long', comment = 'CT Long', direction = strategy.long)

else

if OSOBcolor == color.blue

strategy.entry(id='Counter Trend Long', comment = 'CT Long', direction = strategy.long)

//CT longs closed

if strategy.position_size > 0 and strategy.opentrades.entry_id(strategy.opentrades - 1) == 'Counter Trend Long'

if i_CTlongSL > 0

if na(CTlongTP)

strategy.exit(id='Counter Trend Long', stop=CTlongSL, comment = 'CT Long SL')

else

strategy.exit(id='Counter Trend Long', stop=CTlongSL, limit=CTlongTP, comment = 'CT Long TP/SL')

else if i_CTlongSL == 0

strategy.exit(id='Counter Trend Long', limit=CTlongTP, comment = 'CT Long TP')

if CTlongCloseCond

strategy.close(id='Counter Trend Long', comment = 'Close CT Long')

//CT shorts open

if needCTshort and strategy.position_size == 0

if CTshortType == 'Leledc'

if major == -1

if high > CTbandTop

strategy.entry(id='Counter Trend Short', comment = 'CT Short', direction=strategy.short)

else

if OSOBcolor == color.yellow

strategy.entry(id='Counter Trend Short', comment= 'CT Short', direction=strategy.short)

//CT shorts closed

if strategy.position_size < 0 and strategy.opentrades.entry_id(strategy.opentrades - 1) == 'Counter Trend Short'

if i_CTshortSL > 0

if na(CTshortTP)

strategy.exit(id='Counter Trend Short', stop=CTshortSL, comment = 'CT Short SL')

else

strategy.exit(id='Counter Trend Short', stop=CTshortSL, limit=CTshortTP, comment = 'CT Short TP/SL')

else if i_CTshortSL == 0

strategy.exit(id='Counter Trend Short', limit=CTshortTP, comment = 'CT Short TP')

if CTshortCloseCond

strategy.close(id='Counter Trend Short', comment = "Close CT Short")

//default position

if alwaysLong and not alwaysShort and strategy.position_size == 0

if useSlowEMA

if close > slowEMA

strategy.entry(id='Default Long', comment = 'Default Long', direction=strategy.long)

else

strategy.entry(id='Default Long', comment='Default Long', direction=strategy.long)

if alwaysShort and not alwaysLong and strategy.position_size == 0

if useSlowEMA

if close < slowEMA

strategy.entry(id='Default Short', comment = 'Default Short', direction=strategy.short)

else

strategy.entry(id='Default Short', comment='Default Short', direction=strategy.short)

//set bar colors

trendColor = input.bool(title='Enable Trend Bar Color', tooltip='Color bars green when above mid bands, red when below, and gray when inside. Dark green and dark red bars signal a position is kept open from the delayed close settings.', defval=false, group='Visual Elements')

var colorBar = color.new(color.white, 50)

if trendColor

if switch1

if showReverBars

if reverBarColor == color.purple or reverBarColor == color.orange

colorBar := reverBarColor

else if OSOBcolor == color.yellow or OSOBcolor == color.blue

colorBar := OSOBcolor

else if close > highShortEMA

if (alwaysShort or needCTshort) and strategy.position_size < 0

colorBar := color.new(color.red, 0)

else

colorBar := color.new(color.green, 0)

else if close < lowShortEMA

if (alwaysLong or needCTlong) and strategy.position_size > 0

colorBar := color.new(color.green, 0)

else

colorBar := color.new(color.red, 0)

else if strategy.position_size > 0 and (midClose == 'Delayed bars inside' or midClose == 'Opposite band')

colorBar := color.new(#0a6136, 20)

else if strategy.position_size < 0 and (midClose == 'Delayed bars inside' or midClose == 'Opposite band')

colorBar := color.new(#600008, 20)

else

colorBar := color.new(color.gray, 0)

else

if OSOBcolor == color.yellow or OSOBcolor == color.blue

colorBar := OSOBcolor

else if close > highShortEMA

if (alwaysShort or needCTshort) and strategy.position_size < 0

colorBar := color.new(color.red, 0)

else

colorBar := color.new(color.green, 0)

else if close < lowShortEMA

if (alwaysLong or needCTlong) and strategy.position_size > 0

colorBar := color.new(color.green, 0)

else

colorBar := color.new(color.red, 0)

else if strategy.position_size > 0 and (midClose == 'Delayed bars inside' or midClose == 'Opposite band')

colorBar := color.new(#0a6136, 20)

else if strategy.position_size < 0 and (midClose == 'Delayed bars inside' or midClose == 'Opposite band')

colorBar := color.new(#600008, 20)

else

colorBar := color.new(color.gray, 0)

else if showReverBars

if reverBarColor == color.purple or reverBarColor == color.orange

colorBar := reverBarColor

else if close > highShortEMA

if (alwaysShort or needCTshort) and strategy.position_size < 0

colorBar := color.new(color.red, 0)

else

colorBar := color.new(color.green, 0)

else if close < lowShortEMA

if (alwaysLong or needCTlong) and strategy.position_size > 0

colorBar := color.new(color.green, 0)

else

colorBar := color.new(color.red, 0)

else if strategy.position_size > 0 and (midClose == 'Delayed bars inside' or midClose == 'Opposite band')

colorBar := color.new(#0a6136, 20)

else if strategy.position_size < 0 and (midClose == 'Delayed bars inside' or midClose == 'Opposite band')

colorBar := color.new(#600008, 20)

else

colorBar := color.new(color.gray, 0)

else

if close > highShortEMA

if (alwaysShort or needCTshort) and strategy.position_size < 0

colorBar := color.new(color.red, 0)

else

colorBar := color.new(color.green, 0)

else if close < lowShortEMA

if (alwaysLong or needCTlong) and strategy.position_size > 0

colorBar := color.new(color.green, 0)

else

colorBar := color.new(color.red, 0)

else if strategy.position_size > 0 and (midClose == 'Delayed bars inside' or midClose == 'Opposite band')

colorBar := color.new(#0a6136, 20)

else if strategy.position_size < 0 and (midClose == 'Delayed bars inside' or midClose == 'Opposite band')

colorBar := color.new(#600008, 20)

else

colorBar := color.new(color.gray, 0)

else if switch1

if showReverBars

if reverBarColor == color.purple or reverBarColor == color.orange

colorBar := reverBarColor

else if OSOBcolor == color.yellow or OSOBcolor == color.blue

colorBar := OSOBcolor

else

colorBar := na

else

if OSOBcolor == color.yellow or OSOBcolor == color.blue

colorBar := OSOBcolor

else

colorBar := na

else if showReverBars

if reverBarColor == color.purple or reverBarColor == color.orange

colorBar := reverBarColor

else

colorBar := na

else

colorBar := na

barcolor(colorBar)