概述

这是一个基于双重移动平均线指标的反转交易策略。该策略通过计算两组不同参数设置的移动平均线,根据其方向变化来判断价格趋势,并设定方向变化的灵敏度参数,从而产生交易信号。

策略原理

该策略的核心指标是双重移动平均线。策略允许选择移动平均线的类型(SMA、EMA等)、长度和价格源(收盘价、典型价格等)。计算出两组移动平均线之后,通过定义参数reaction判断其方向。当快线上穿慢线时产生买入信号,下穿时产生卖出信号。reaction参数用来调整识别转折点的灵敏度。

此外,策略还设定了变化方向和持续上涨/下跌的条件判定,避免产生错误信号。并用不同颜色可视化表示价格的涨跌状态。当价格持续上涨时,movavg线显示为绿色,下跌时为红色。

优势分析

这种双重movavg策略结合不同参数设定的快慢线,可以有效滤波交易市场的噪声,识别较强势的趋势。相比单一movavg策略,它减少了错误信号,可以在趋势更加明确时入场,从而获得更高的胜率。

灵敏度参数reaction让该策略可以灵活适应不同周期和品种。策略过程直观简单,容易理解和优化。

风险分析

该策略最大的风险在于错过转折点而亏损或反向建仓。这与参数reaction设定有关。如果reaction太小,则容易产生错误信号;如果reaction太大,则可能错过较好的入场点。

另一个风险是无法有效控制亏损。当价格出现剧烈波动时,无法快速止损,导致亏损扩大。这需要配合止损策略来控制。

优化方向

该策略的优化方向主要集中在参数reaction、移动平均线类型及长度的选择。reaction可适当增加来减少错误信号。移动平均线参数可据不同周期和品种进行测试,选择产生信号最佳的组合。

另外,结合其他辅助指标如RSI、KD等来确认交易信号也是优化思路。或使用机器学习方法自动优选参数。

总结

本策略整体来说较简单实用,通过双重移动平均线滤波并产生交易信号,可有效识别趋势反转,是一种典型的趋势跟踪策略。优化参数组合后,其顺市捕捉能力和抗市持仓能力都会得到提高。与止损和位置管理机制配合使用效果更佳。

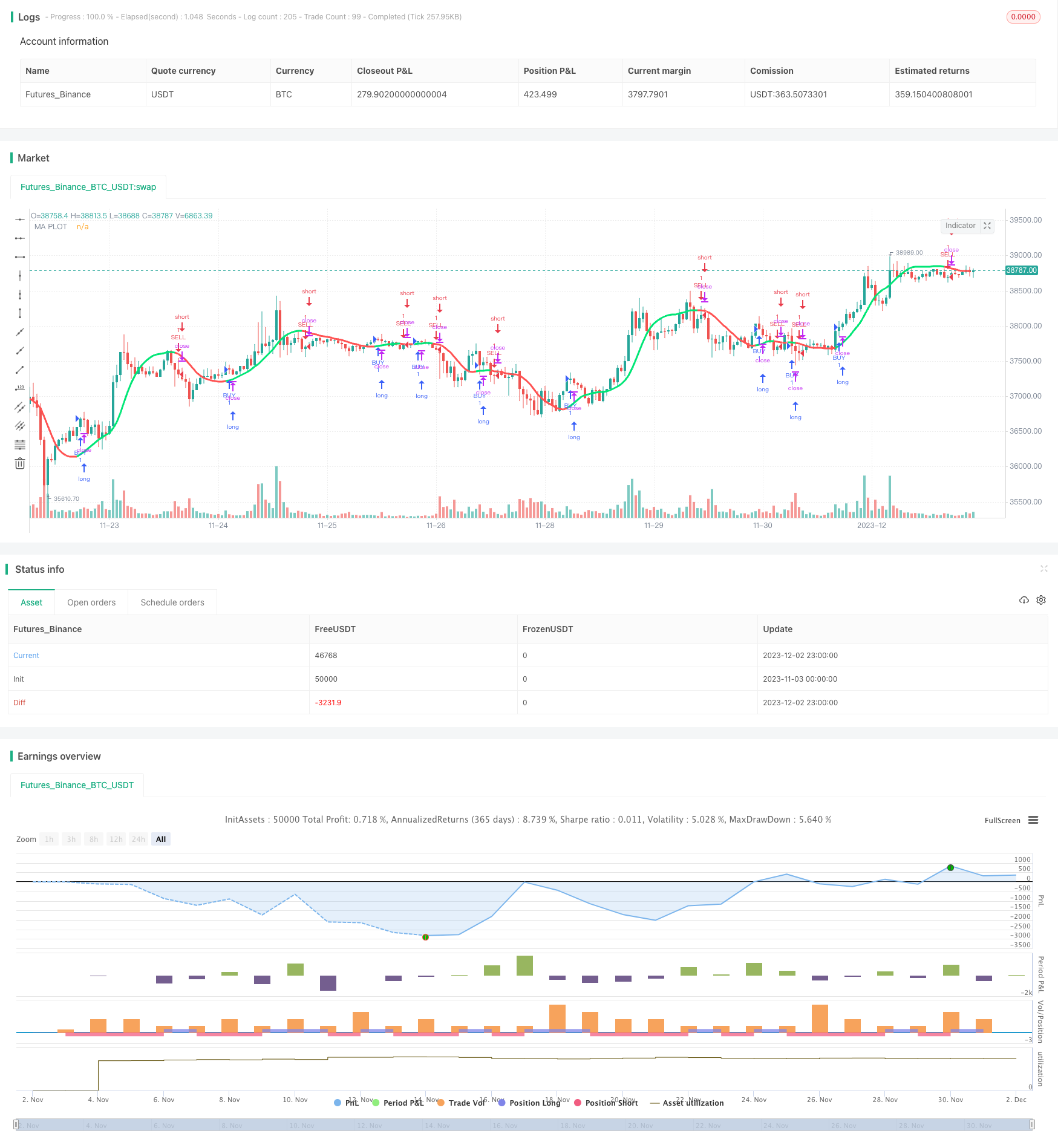

/*backtest

start: 2023-11-03 00:00:00

end: 2023-12-03 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(shorttitle="MA_color strategy", title="Moving Average Color", overlay=true)

// === INPUTS

ma_type = input(defval="HullMA", title="MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "HullMA", "ZEMA", "TMA", "SSMA"])

ma_len = input(defval=32, title="MA Lenght", minval=1)

ma_src = input(close, title="MA Source")

reaction = input(defval=2, title="MA Reaction", minval=1)

// SuperSmoother filter

// © 2013 John F. Ehlers

variant_supersmoother(src,len) =>

a1 = exp(-1.414*3.14159 / len)

b1 = 2*a1*cos(1.414*3.14159 / len)

c2 = b1

c3 = (-a1)*a1

c1 = 1 - c2 - c3

v9 = 0.0

v9 := c1*(src + nz(src[1])) / 2 + c2*nz(v9[1]) + c3*nz(v9[2])

v9

variant_smoothed(src,len) =>

v5 = 0.0

v5 := na(v5[1]) ? sma(src, len) : (v5[1] * (len - 1) + src) / len

v5

variant_zerolagema(src,len) =>

ema1 = ema(src, len)

ema2 = ema(ema1, len)

v10 = ema1+(ema1-ema2)

v10

variant_doubleema(src,len) =>

v2 = ema(src, len)

v6 = 2 * v2 - ema(v2, len)

v6

variant_tripleema(src,len) =>

v2 = ema(src, len)

v7 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len)

v7

variant(type, src, len) =>

type=="EMA" ? ema(src,len) :

type=="WMA" ? wma(src,len):

type=="VWMA" ? vwma(src,len) :

type=="SMMA" ? variant_smoothed(src,len) :

type=="DEMA" ? variant_doubleema(src,len):

type=="TEMA" ? variant_tripleema(src,len):

type=="HullMA"? wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len))) :

type=="SSMA" ? variant_supersmoother(src,len) :

type=="ZEMA" ? variant_zerolagema(src,len) :

type=="TMA" ? sma(sma(src,len),len) : sma(src,len)

// === Moving Average

ma_series = variant(ma_type,ma_src,ma_len)

direction = 0

direction := rising(ma_series,reaction) ? 1 : falling(ma_series,reaction) ? -1 : nz(direction[1])

change_direction= change(direction,1)

change_direction1= change(direction,1)

pcol = direction>0 ? lime : direction<0 ? red : na

plot(ma_series, color=pcol,style=line,join=true,linewidth=3,transp=10,title="MA PLOT")

/////// Alerts ///////

alertcondition(change_direction,title="Change Direction MA",message="Change Direction MA")

longCondition = direction>0

shortCondition = direction<0

if (longCondition)

strategy.entry("BUY", strategy.long)

if (shortCondition)

strategy.entry("SELL", strategy.short)