概述

本策略基于双ALMA移动平均线的金叉死叉信号,结合MACD指标的多空信号,实现自动做多做空。策略适用于4小时及以上时间周期,测试数据为BNB/USDT,时间段为2017年至今,手续费设置为0.03%。

策略原理

策略使用ALMA快线和慢线构建双移动平均线。快线长度为20,慢线长度为40,均采用0.9的偏移量,标准差为5。当快线上穿慢线时生成做多信号,当快线下穿慢线时生成做空信号。

同时,策略结合MACD指标的直方图信号。只有当MACD直方图为正(上升),做多信号才有效;只有当MACD直方图为负(下降),做空信号才有效。

该策略同时设置了止盈止损条件。做多止盈为2倍,止损为0.2倍;做空止盈为0.05倍,止损为1倍。

优势分析

该策略结合双移动平均线的趋势判断和MACD指标的能量判断,可以有效过滤假信号,提高入场的准确性。止盈止损设置合理,最大程度锁定盈利,避免大额亏损。

回测数据adopted自2017年以来,包含多次牛熊转换,策略在跨周期条件下依然表现不俗。这证明策略适应市场的线性与非线性特征。

风险分析

策略有如下风险:

- 双移动平均线本身存在滞后,可能错过短线机会

- MACD直方图为零时,策略将不会产生信号

- 止盈止损比例是事前设置,可能与实际行情出现偏差

解决方法:

- 适当缩短移动平均线周期,提高对短线的敏感性

- 优化MACD参数,使直方图波动更为频繁

- 动态调整止盈止损的设置

优化方向

该策略还可从以下几个方面进行优化:

- 尝试不同类型的移动平均线,寻找更好的平滑效果

- 优化移动平均线和MACD的参数,拟合不同品种和周期

- 加入附加条件,如交易量变化等,过滤信号

- 实时调整止盈止损的比例,让策略更具适应性

总结

本策略成功结合移动平均线的趋势判断和MACD的辅助判断,并设置合理的止盈止损,能够在多种行情下获得稳定收益。通过持续优化参数设置、加入附加过滤条件等手段,策略的稳定性和盈利能力还可得到进一步提升。

策略源码

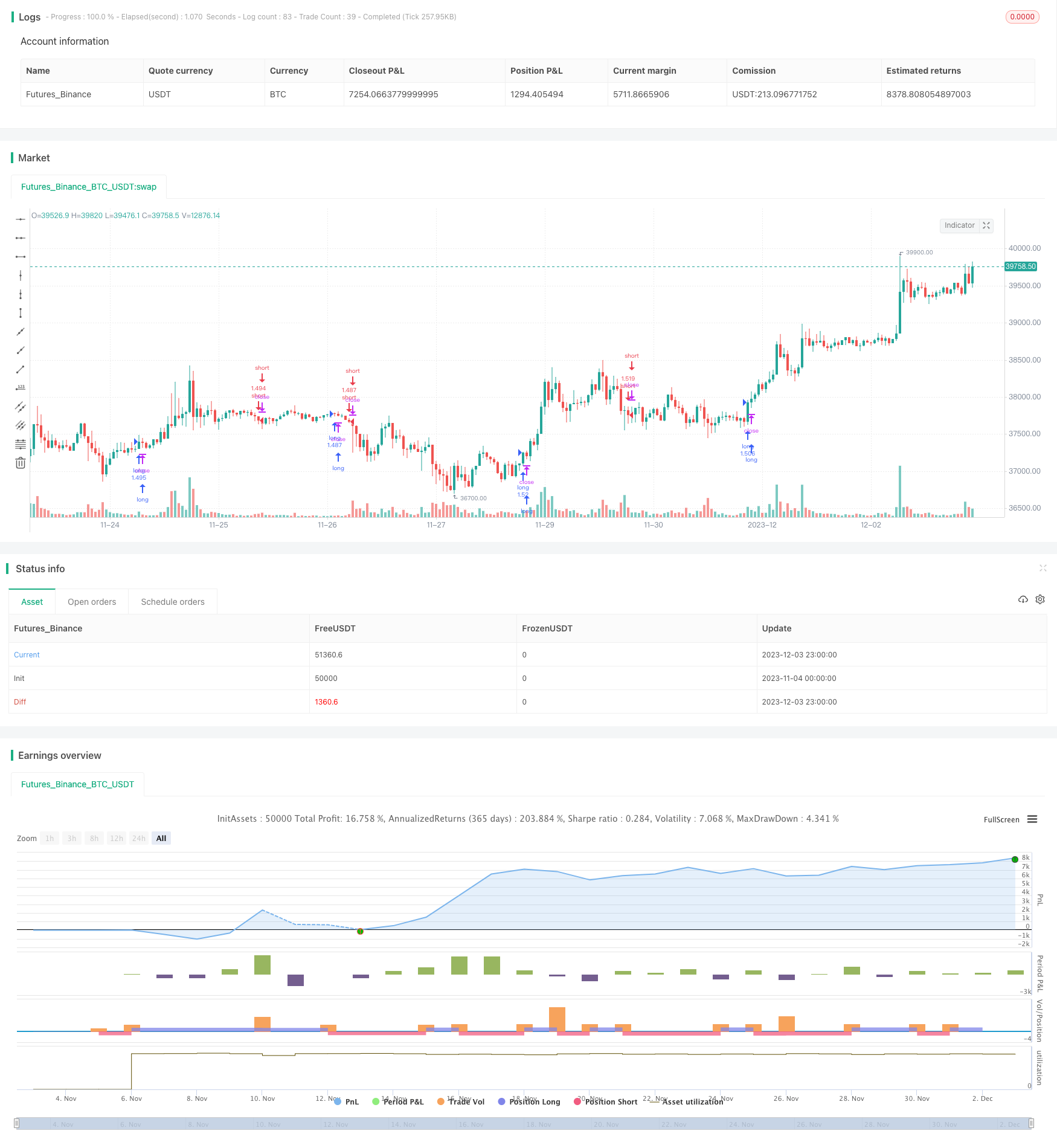

/*backtest

start: 2023-11-04 00:00:00

end: 2023-12-04 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © exlux99

//@version=4

strategy(title = "Full Crypto Swing Strategy ALMA Cross", overlay = true, pyramiding=1,initial_capital = 1, default_qty_type= strategy.percent_of_equity, default_qty_value = 100, calc_on_order_fills=false, slippage=0,commission_type=strategy.commission.percent,commission_value=0.03)

//time condition

fromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

fromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

fromYear = input(defval = 2010, title = "From Year", minval = 1970)

//monday and session

// To Date Inputs

toDay = input(defval = 31, title = "To Day", minval = 1, maxval = 31)

toMonth = input(defval = 12, title = "To Month", minval = 1, maxval = 12)

toYear = input(defval = 2031, title = "To Year", minval = 1970)

startDate = timestamp(fromYear, fromMonth, fromDay, 00, 00)

finishDate = timestamp(toYear, toMonth, toDay, 00, 00)

time_cond = time >= startDate and time <= finishDate

UseHAcandles = input(false, title="Use Heikin Ashi Candles in Algo Calculations")

haClose = UseHAcandles ? security(heikinashi(syminfo.tickerid), timeframe.period, close) : close

haOpen = UseHAcandles ? security(heikinashi(syminfo.tickerid), timeframe.period, open) : open

haHigh = UseHAcandles ? security(heikinashi(syminfo.tickerid), timeframe.period, high) : high

haLow = UseHAcandles ? security(heikinashi(syminfo.tickerid), timeframe.period, low) : low

//alma fast and slow

src = haClose

windowsize = input(title="Length Size Fast", type=input.integer, defval=20)

windowsize2 = input(title="Length Size Slow", type=input.integer, defval=40)

offset = input(title="Offset", type=input.float, defval=0.9, step=0.05)

sigma = input(title="Sigma", type=input.float, defval=5)

outfast=alma(src, windowsize, offset, sigma)

outslow=alma(src, windowsize2, offset, sigma)

//macd

fast_length = input(title="Fast Length", type=input.integer, defval=6)

slow_length = input(title="Slow Length", type=input.integer, defval=25)

signal_length = input(title="Signal Smoothing", type=input.integer, minval = 1, maxval = 50, defval = 9)

// Calculating

fast_ma = ema(src, fast_length)

slow_ma = ema(src, slow_length)

macd = fast_ma - slow_ma

signal = ema(macd, signal_length)

hist = macd - signal

long=crossover(outfast,outslow) and hist > hist[1] and time_cond

short=crossunder(outfast,outslow) and hist < hist[1] and time_cond

takeProfit_long=input(2.0, step=0.005)

stopLoss_long=input(0.2, step=0.005)

takeProfit_short=input(0.05, step=0.005)

stopLoss_short=input(1.0, step=0.005)

strategy.entry("long",1,when=long)

strategy.entry("short",0,when=short)

strategy.exit("short_tp/sl", "long", profit=close * takeProfit_long / syminfo.mintick, loss=close * stopLoss_long / syminfo.mintick, comment='LONG EXIT', alert_message = 'closeshort')

strategy.exit("short_tp/sl", "short", profit=close * takeProfit_short / syminfo.mintick, loss=close * stopLoss_short / syminfo.mintick, comment='SHORT EXIT', alert_message = 'closeshort')