概述

双均线突破策略通过计算快线EMA和慢线EMA,并设定买入信号为快线上穿慢线时做多,卖出信号为快线下穿慢线时平仓。该策略同时结合了MACD指标作为辅助判断指标。当MACD柱线上穿0轴时产生买入信号,可与均线策略匹配,进一步验证信号。另外,策略还监控单日涨幅是否达到一定比例,如果单日涨幅超过设定阈值,也会产生买入信号。

在退出机制上,策略设置了止损位和止盈位。止损位固定在入场价的一定比例下方,用于控制下跌风险;止盈位则固定在入场价的一定比例上方,用于锁定利润。

综上,该策略结合了多种指标,进出场规则明确,既考虑趋势跟踪,也关注短线操作机会,优化后可以应用于高波动股票的择时交易。

策略原理

双均线突破策略的核心指标是快线EMA和慢线EMA。EMA代表指数移动平均线,是一种趋势跟踪指标。快线EMA参数一般设置短期,用来捕捉短期趋势;慢线EMA参数一般设置长期,用来判断长期趋势方向。当快线上穿慢线时,代表短期趋势变强,可以做多;当快线下穿慢线时,代表短期趋势转弱,应该平仓。

该策略的快线EMA周期默认为12天,慢线EMA周期默认为26天。这组参数比较典型,匹配时间段也较为合适。股票每日收盘价作为计算EMA的价格输入。

另外,策略还引入MACD作为辅助判断指标。MACD指标的定义是快线EMA(默认12天)减去慢线EMA(默认26天),再对MACD进行平滑处理得到信号线。当MACD上穿0轴代表短期获利超过长期获利,是买入信号。该信号与均线策略匹配,可以达到验证的效果,提高信号的可靠性。

最后,监控股票的单日涨幅是否高于一个预设阈值(默认8%),如果单日涨幅超过这个数值,也会产生买入信号。因为对于高波动股票而言,大幅单日放量涨停板是常见的行情特征,这时也是一个捕捉短线机会的信号。

在退出上,策略预设了止损位和止盈位。止损位固定在入场价的一定比例下方(默认5%),用于控制损失;止盈位固定在入场价的一定比例上方(默认40%),用于锁定利润。

优势分析

双均线突破策略具有以下优势:

结合趋势跟踪和短线操作,灵活度高。双均线本身适合判断中长期趋势,叠加MACD指标和放量突破判断,可以兼顾短线交易机会。

买卖信号比较可靠,容易判断。快线EMA上穿慢线EMA形成标准的金叉信号,判断简单直观。结合MACD指标可以达到验证效果,提高信号质量。

运用止盈止损原则,风险可控。预设止损位可以快速割掉亏损部分,避免大面积损失;设置止盈位也可以锁定部分利润。

规则参数可调,适应性强。快线EMA周期、慢线EMA周期、单日涨幅阈值等参数都可以自由设置,可以针对不同股票进行优化,提高适应性。

风险分析

双均线突破策略也存在以下风险:

单一指标组合可能产生虚假信号。双均线和MACD都可能出现头假信号的情况,跟踪效果不佳。可以考虑引入更多不同类型指标进行匹配验证。

未考虑大级别止损。如遇到重大黑天鹅事件,未设置足够大的总体止损阈值,可能造成巨额损失。这需要人工干预进行风险控制。

快线EMA和慢线EMA参数设置不当可能失效。如果参数设置不匹配,也会出现多次震荡造成虚假信号。需要针对股票特点进行参数测试和优化。

买卖点选择时点不精确。策略并没有选择最佳买卖点位,这需要引入更复杂判断规则或机器学习等手段进行优化。

优化方向

双均线突破策略可以从以下维度进行优化:

增加验证指标,提高信号质量。可以测试引入KDJ、BOLL等其他指标,组成多指标验证体系,减少假信号。

增加机器学习模型判断,找出最优买卖点。可以收集大量历史数据,构建模型判断最佳买卖时机,降低Timing Risk。

优化EMA周期参数,测试不同参数对策略效果的影响。可以网格搜索不同参数,找到最佳参数组合,提高策略稳定性。

增加自适应止损机制。可以根据market regime设计动态跟踪止损位。遇到特殊行情止损幅度适当放宽,提高策略胜率。

优化止盈位。可以研究出最佳止盈比率,比如设置动态止盈位,在行情向好时适当追涨等。

总结

双均线突破策略整体框架完整,指标选择和 Parameter 设置合理,是一套适合高波动股票交易的趋势跟踪短线策略。但策略仍有优化空间,建议从增加判断指标、机器学习辅助、参数优化等方面进行深化,可以进一步提升策略效果。

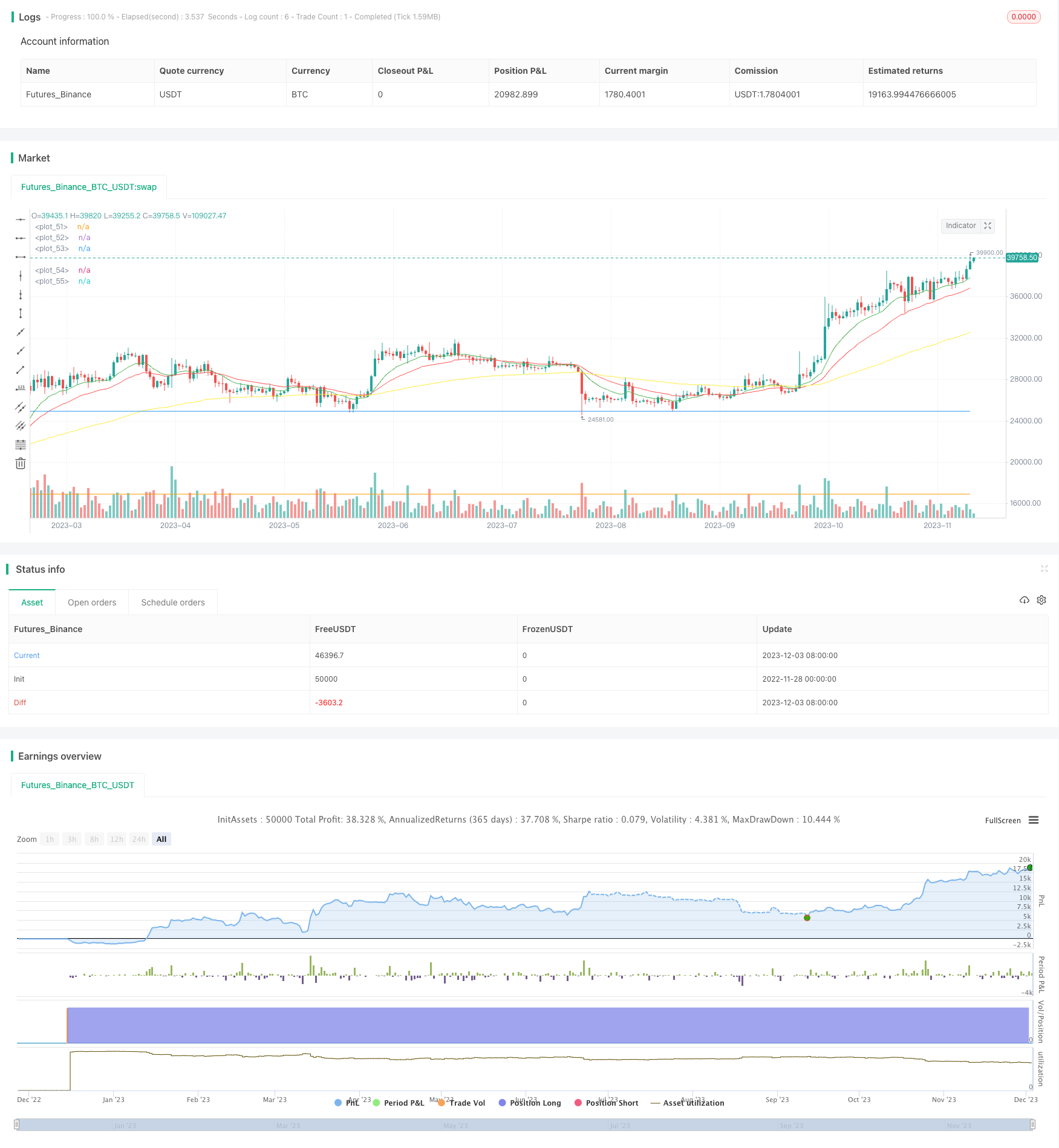

/*backtest

start: 2022-11-28 00:00:00

end: 2023-12-04 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("Volatile Stocks", overlay=true)

//Trading Strategy for Highly Volitile Stocks//

// by @ShanghaiCrypto //

////EMA////

fastLength = input(12)

slowLength = input(26)

baseLength = input(100)

price = close

emafast = ema(price, fastLength)

emaslow = ema(price, slowLength)

emabase = ema(price, baseLength)

///MACD////

MACDLength = input(9)

MACDfast = input(12)

MACDslow = input(26)

MACD = ema(close, MACDfast) - ema(close, MACDslow)

aMACD = ema(MACD, MACDLength)

delta = MACD - aMACD

////PUMP////

OneCandleIncrease = input(8, title='Gain %')

pump = OneCandleIncrease/100

////Profit Capture and Stop Loss//////

stop = input(5.0, title='Stop Loss %', type=float)/100

profit = input(40.0, title='Profit %', type=float)/100

stop_level = strategy.position_avg_price * (1 - stop)

take_level = strategy.position_avg_price * (1 + profit)

////Entries/////

if crossover(emafast, emaslow)

strategy.entry("Cross", strategy.long, comment="BUY")

if (crossover(delta, 0))

strategy.entry("MACD", strategy.long, comment="BUY")

if close > (open + open*pump)

strategy.entry("Pump", strategy.long, comment="BUY")

/////Exits/////

strategy.exit("SELL","Cross", stop=stop_level, limit=take_level)

strategy.exit("SELL","MACD", stop=stop_level, limit=take_level)

strategy.exit("SELL","Pump", stop=stop_level, limit=take_level)

////Plots////

plot(emafast, color=green)

plot(emaslow, color=red)

plot(emabase, color=yellow)

plot(take_level, color=blue)

plot(stop_level, color=orange)