概述

该策略主要利用价格在连续8天高于或低于5日简单移动平均线后发生反转的特点,来捕捉中短线上的动量效应。当价格连续8天低于5日线后第一天收盘价再次上穿5日线时,做多;当价格连续8天高于5日线后第一天收盘价再次下穿5日线时,做空。

策略原理

- 计算5日简单移动平均线SMA。

- 定义多头趋势TrendUp为收盘价大于或等于SMA,空头趋势TrendDown为收盘价小于或等于SMA。

- 确认趋势反转的条件:连续8日收盘价低于SMA后,下一日收盘价转为多头(上穿SMA)时触发买入信号;连续8日收盘价高于SMA后,下一日收盘价转为空头(下穿SMA)时触发卖出信号。

- 入场:买入条件Buy为上一日触发买入信号TriggerBuy且当前为空头趋势时做多;卖出条件Sell为上一日触发卖出信号TriggerSell且当前为多头趋势时做空。

- 出场:多头止损为收盘价下穿SMA时平仓;空头止损为收盘价上穿SMA时平仓。

优势分析

- 利用价格反转的特点,适合捕捉中短线动量。

- 连续8日突破SMA形成趋势运行的情况较多,增加交易机会。

- 5日线参数较优,避免被过多假突破愚弄。

- 风险可控,有明确的止损点。

风险分析

- 行情震荡时止损点可能会被频繁触发。

- 突破运行的天数如果设定过长,可能错过最佳入场时机。

- 如果行情出现长期单边运行,该策略难以获利。

可以适当调整SMA的参数;优化入场条件,防止假突破;结合趋势判断指标强化效果。

优化方向

- 参数优化:可以测试不同周期的SMA参数,寻找更优参数。

- 进场优化:加入成交量指标,避免假突破;或增加阳线阴线判断,规避震荡。

- 出场优化:可测试收盘价回落一定幅度后止损,增加止损BUFFER。

- 风控优化:可设置每日止损次数,避免亏损过多。

- 结合其他指标:可加入RSI,MACD等判断趋势指标,识别趋势态势。

总结

该策略通过判断价格运动状态,捕捉中短线价格from突破到反转的过程,实现规避震荡、顺势而为的交易策略。关键是参数设定和进场的判断要严谨,防止被噪音误导;同时出场止损要合理,防止亏损过大。如果再辅以趋势判断指标,可以获得更出色的效果。该策略逻辑清晰易懂,代码简洁,值得深入研究优化。

策略源码

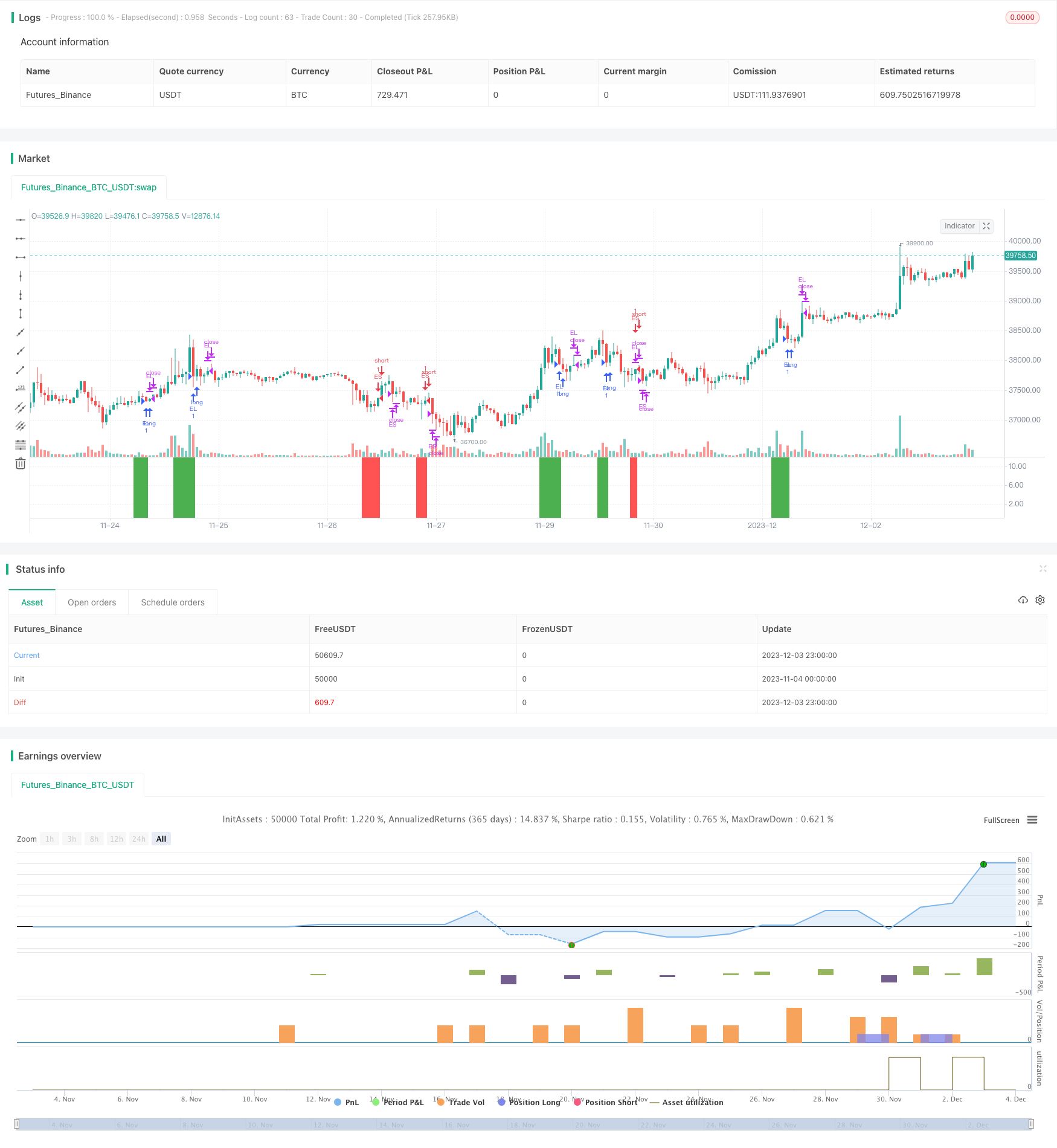

/*backtest

start: 2023-11-04 00:00:00

end: 2023-12-04 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Marcuscor

//@version=5

// Inpsired by Linda Bradford Raschke: a strategy for trading momentum in futures markets

strategy("8D Run", initial_capital = 50000, commission_value = 0.0004)

SMA = ta.sma(close,5)

TrendUp = close >= SMA

TrendDown = close <= SMA

//logic to long

TriggerBuy = ta.barssince(close < SMA) >= 8

Buy = TriggerBuy[1] and TrendDown

strategy.entry("EL", strategy.long, when = Buy)

strategy.close(id = "EL", when = close > SMA)

// 1) color background when "run" begins and 2) change color when buy signal occurs

bgcolor(TriggerBuy? color.green : na, transp = 90)

bgcolor(Buy ? color.green : na, transp = 70)

// logic to short

TriggerSell = ta.barssince(close > SMA) >= 8

Sell = TriggerSell[1] and TrendUp

strategy.entry("ES", strategy.short, when = Sell)

strategy.close(id = "ES", when = close < SMA)

// 1) color background when "run" begins and 2) change color when sell signal occurs

bgcolor(TriggerSell ? color.red : na, transp = 90)

bgcolor(Sell ? color.red : na, transp = 70)