这是一个非常经典的移动平均线金叉死叉策略。该策略借助TENKAN和KIJUN两条不同周期的移动平均线,形成金叉和死叉信号,进行长短操作。

策略原理

该策略主要基于一种叫“一目均衡表”的日本股票技术分析方法,用TENKAN线和KIJUN线等多条移动平均线来判断市场趋势方向。

首先,TENKAN线是9日线,代表短期趋势;KIJUN线是26日线,代表中期趋势。当短期上穿中期时,产生买入信号;当短期下穿中期时,产生卖出信号。这样,就构成了经典的移动平均线金叉死叉策略。

然后,该策略还引入空中线和光云线。空中线是短期和中期移动平均线的平均数,光云线B是52日移动平均线。它们构成“云带”,判断长期趋势方向。价格在光云上的空间就是多头市场,价格在光云下的空间就是空头市场。

最后,为过滤假信号,该策略还检测价格是否与OTO线(26日价格的延迟线)的关系——只有当价格在OTO线之下才产生买入信号;只有当价格在OTO线之上才产生卖出信号。

策略优势

这是一个非常典型的移动平均线策略,优势主要体现在三个方面:

使用两条不同周期的均线,可以有效判断短期和中期两个时间维度的趋势方向。

借助光云线判断长期趋势,避免在长期看跌市场中仍看多。

检测价格与延迟价格的关系,可以过滤掉很多假信号,减少不必要的交易。

所以,该策略综合利用均线的多种功能,可以顺势而为,及时抓住短中长三个时间维度的趋势机会。

策略风险

该策略的主要风险在于:

均线策略容易产生大量假信号。如果不能很好地设定参数,则会因为频繁交易而被套牢。

该策略偏重技术面,没有考虑基本面因素。如果公司业绩或市场政策发生重大变化,技术信号也可能会失效。

该策略只考虑了买入卖出的决策,没有设置止损机制。一旦判断错误,亏损可能会加大。

所以,我们需要寻找更先进的均线系统,或合理设定止损,或加入基本面信号,来进一步完善该策略,降低风险。

策略优化方向

该策略还可以从以下几个方面进行优化:

寻找更稳定和高效的参数组合。我们可以通过更多的数据回测,找到让策略绩效更优异的参数值。

增加止损机制。合理的止损可以有效控制策略的最大损失。

加入基本面信号。例如业绩预期revision的数据可以判断公司前景,从而提高策略效果。

优化OTO线策略。现有的实现很简单,我们可以寻找更稳定和精确判断价格与历史价格关系的方法。

结合选股信号。加入像PE,ROE等因子的评分,可以过滤掉一些质量比较差的标的。

总结

这是一个非常典型和实用的移动平均线策略。它同时关注了短、中、长三个时间维度的趋势,运用均线的不同功能来设计交易信号,效果不错。我们可以在此基础上,通过参数优化、止损、选股等方法进行改进,使其绩效更出色。总的来说,这是一个值得重点研究和长期跟踪的量化策略。

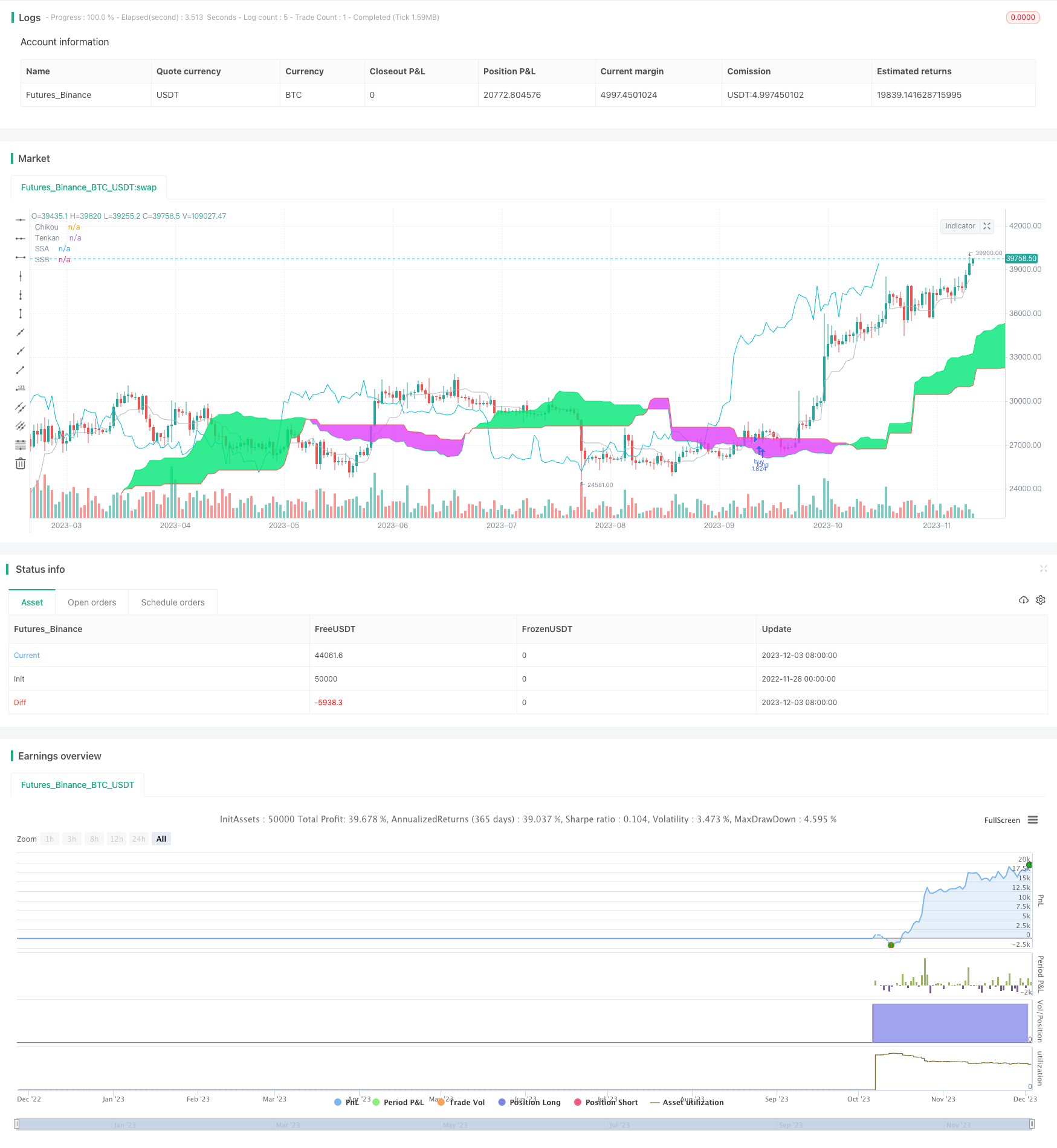

/*backtest

start: 2022-11-28 00:00:00

end: 2023-12-04 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © mdeous

//@version=4

strategy(

title="Ichimoku Kinko Hyo Strategy",

shorttitle="Ichimoku Strategy",

overlay=true,

pyramiding=0,

default_qty_type=strategy.percent_of_equity,

default_qty_value=100,

initial_capital=1000,

currency="USD",

commission_type=strategy.commission.percent,

commission_value=0.0

)

//

// SETTINGS

//

// Ichimoku

int TENKAN_LEN = input(title="Tenkan-Sen Length", defval=9, minval=1, step=1)

int KIJUN_LEN = input(title="Kijun-Sen Length", defval=26, minval=1, step=1)

int SSB_LEN = input(title="Senkou Span B Length", defval=52, minval=1, step=1)

int OFFSET = input(title="Offset For Chikou Span / Kumo", defval=26, minval=1, step=1)

// Strategy

int COOLDOWN = input(title="Orders Cooldown Period", defval=5, minval=0, step=1)

bool USE_CHIKOU = input(title="Use Imperfect Chikou Position Detection", defval=false)

//

// HELPERS

//

color _red = color.red

color _blue = color.blue

color _lime = color.lime

color _fuchsia = color.fuchsia

color _silver = color.silver

color _aqua = color.aqua

f_donchian(_len) => avg(lowest(_len), highest(_len))

//

// ICHIMOKU INDICATOR

//

float tenkan = f_donchian(TENKAN_LEN)

float kijun = f_donchian(KIJUN_LEN)

float ssa = avg(tenkan, kijun)

float ssb = f_donchian(SSB_LEN)

plot(tenkan, title="Tenkan", color=_silver)

plot(close, title="Chikou", offset=-OFFSET+1, color=_aqua)

_ssa = plot(ssa, title="SSA", offset=OFFSET-1, color=_lime)

_ssb = plot(ssb, title="SSB", offset=OFFSET-1, color=_red)

fill(_ssa, _ssb, color=ssa > ssb ? _lime : _fuchsia, transp=90)

//

// STRATEGY

//

// Check if price is "above or below" Chikou (i.e. historic price line):

// This detection is highly imperfect, as it can only know what Chikou position

// was 2*offset candles in the past, therefore if Chikou crossed the price

// line in the last 2*offset periods it won't be detected.

// Use of this detection is disabled by default,

float _chikou_val = close[OFFSET*2+1]

float _last_val = close[OFFSET+1]

bool above_chikou = USE_CHIKOU ? _last_val > _chikou_val : true

bool below_chikou = USE_CHIKOU ? _last_val < _chikou_val : true

// Identify short-term trend with Tenkan

bool _above_tenkan = min(open, close) > tenkan

bool _below_tenkan = max(open, close) < tenkan

// Check price position compared to Kumo

bool _above_kumo = min(open, close) > ssa

bool _below_kumo = max(open, close) < ssb

// Check if Kumo is bullish or bearish

bool bullish_kumo = ssa > ssb

bool bearish_kumo = ssa < ssb

// Correlate indicators to confirm the trend

bool bullish_trend = _above_tenkan and _above_kumo and bullish_kumo

bool bearish_trend = _below_tenkan and _below_kumo and bearish_kumo

// Build signals

bool buy1 = (close > open) and ((close > ssa) and (open < ssa)) // green candle crossing over SSA

bool buy2 = bullish_kumo and bearish_kumo[1] // bullish Kumo twist

bool sell1 = (close < open) and ((close < ssb) and (open > ssb)) // red candle crossing under SSB

bool sell2 = bearish_kumo and bullish_kumo[1] // bearish Kumo twist

bool go_long = below_chikou and (bullish_trend and (buy1 or buy2))

bool exit_long = above_chikou and (bearish_trend and (sell1 or sell2))

//

// COOLDOWN

//

f_cooldown() =>

_cd_needed = false

for i = 1 to COOLDOWN by 1

if go_long[i]

_cd_needed := true

break

_cd_needed

go_long := f_cooldown() ? false : go_long

//

// ORDERS

//

strategy.entry("buy", strategy.long, when=go_long)

strategy.close_all(when=exit_long)

//

// ALERTS

//

alertcondition(

condition=go_long,

title="Buy Signal",

message="{{exchange}}:{{ticker}}: A buy signal for {{strategy.market_position_size}} units has been detected (last close: {{close}})."

)

alertcondition(

condition=exit_long,

title="Sell Signal",

message="{{exchange}}:{{ticker}}: A sell signal for {{strategy.market_position_size}} units has been detected (last close: {{close}})."

)