概述

移动平均线交叉穿越策略是一种基于技术指标的量化交易策略。该策略通过计算两条移动平均线之间的交叉关系,判断市场的趋势方向,并相应生成交易信号。

策略原理

该策略的核心指标是两条移动平均线:一条较长期的40周期简单移动平均线(SMA),以及股票的收盘价。当股票的收盘价从下方向上突破40周期SMA时,表示市场趋势可能发生转折,股票进入新的上升趋势,这时策略会生成做多信号;当收盘价下跌突破40周期SMA时,表示股票上升趋势结束,可能进入下跌通道,这时策略会平仓做多头仓位。

通过比较收盘价与SMA的突破关系,可以捕捉到价格趋势的转折点,进而根据趋势方向做出交易决策。

策略优势

该策略具有以下几个优势:

- 规则简单清晰,容易理解与实施;

- 可有效捕捉股票中长线趋势的转折,及时调整仓位;

- SMA指标对异常价格变动有一定的滤波效果,可减少错误信号;

- 可自定义SMA参数,适用于不同的交易品种与周期。

策略风险

该策略也存在以下风险:

- SMA指标作为趋势跟踪工具,对突发事件的响应滞后;

- 可能出现频繁交易与反复震荡,增加交易成本和套利风险;

- 参数设置不当可能导致过度交易或错过机会。

可通过调整SMA参数、设置止损线等方法来控制风险。

优化方向

该策略还可从以下几个方面进行优化:

- 增加多个移动平均线比较,形成交易过滤器,减少错误信号;

- 结合其他指标判断,如成交量fgraph矩,增强决策可靠性;

- 动态优化SMA参数,让它自动适应市场变化;

- 设定复合条件的止损机制,控制单笔损失。

总结

移动平均线交叉策略通过比较价格与SMA的关系变化判断趋势转折,是一种较为经典的规则型交易策略。该策略实施简单,容易跟踪中长期趋势获利,同时也存在一定盈利回吐和滞后识别风险。可通过参数设定与组合指标判断来控制风险与提高决策效果。

策略源码

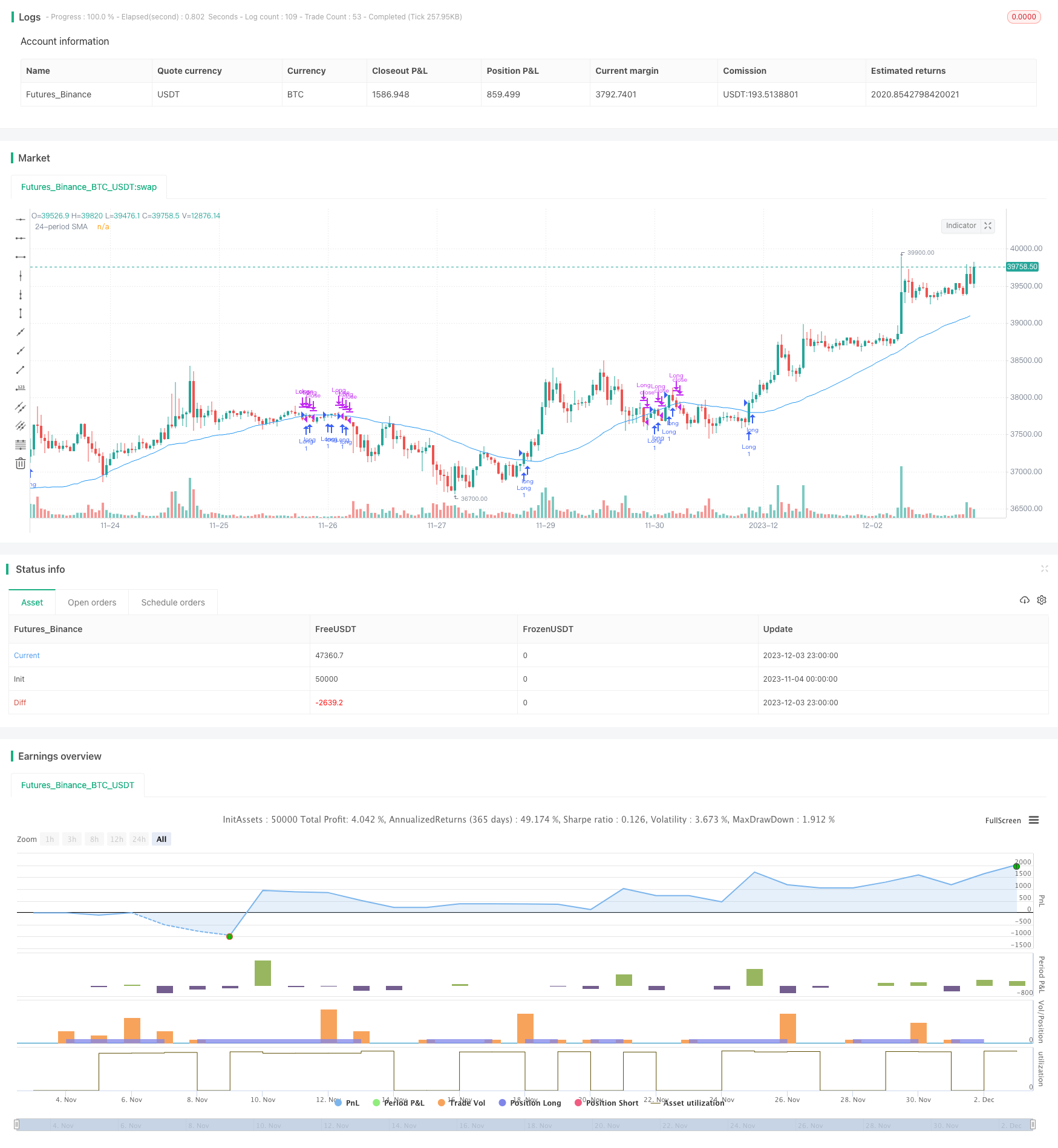

/*backtest

start: 2023-11-04 00:00:00

end: 2023-12-04 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="MA Crossover (40)", overlay=true)

// Input for the SMA length (24)

sma_length = input(40, title="SMA Length")

sma = ta.sma(close, sma_length)

// Determine if the current candle crosses above the 24-period SMA

longCondition = ta.crossover(close, sma)

// Determine if the current candle crosses and closes below the 24-period SMA

closeLongCondition = ta.crossunder(close, sma)

// Plot the 24-period SMA

plot(sma, color=color.blue, title="24-period SMA")

// Long entry signal

if (longCondition)

strategy.entry("Long", strategy.long)

// Close long position when the current candle crosses and closes below the 24-period SMA

if (closeLongCondition)

strategy.close("Long")

// Create alerts

alertcondition(longCondition, title="Candle Crosses Above SMA 40", message="Candle has crossed above SMA 40.")

alertcondition(longCondition, title="Candle Closes Above SMA 40", message="Candle has closed above SMA 40.")