概述

该策略是一种趋势跟踪策略,它利用低频傅立叶变换提取价格序列中的低频趋势成分,结合快中慢三条移动平均线实现趋势识别和交易信号生成。当快速MA上穿中速MA且价格高于慢速MA时做多,当快速MA下穿中速MA且价格低于慢速MA时做空。该策略适合追踪中长线趋势。

策略原理

使用低频傅里叶变换提取价格序列的低频趋势成分。低频傅里叶变换可以有效过滤高频噪音,使得提取到的趋势信号更加平稳。

快中慢三条移动平均线进行趋势判断。其中慢速MA为200周期,中速MA为20周期,快速MA为5周期。慢速MA过滤噪声,中速MA捕捉趋势转折,快速MA发出交易信号。

当快速MA上穿中速MA且价格高于慢速MA时,判断行情进入上升趋势,做多;当快速MA下穿中速MA且价格低于慢速MA时,判断行情进入下降趋势,做空。

该策略是一个趋势跟踪策略,当判断进入趋势后,会尽可能长时间持有头寸,争取在趋势中获利。

优势分析

使用低频傅里叶变换有效过滤了高频噪声,使得识别的趋势信号更加可靠平稳。

采用快中慢MA有效判断了市场趋势的转折,避免了虚假信号。慢MA参数设置较大,有效过滤了噪声。

该策略追踪中长线趋势有明显优势。当判断行情进入趋势后,会持续加仓跟踪趋势,从而获得超额收益。

该策略参数优化空间大,用户可以根据不同品种和周期进行参数调整,适应性强。

风险分析

作为趋势跟踪策略,该策略无法有效判断和反应突发事件引发的趋势反转,可能导致亏损加剧。

在震荡行情中,该策略会产生较多获利交易和损失交易。但最终仍有可能盈利,需要有一定的心理承受能力。

传统趋势跟踪策略容易形成“钝化”,从趋势中提前离场是该策略需要解决的问题。

可以设置止损来控制单笔损失。也可以在回测中加入突发事件的测试,评估策略的抗风险能力。

优化方向

尝试不同的移动平均线算法,适应更多品种和周期。

增加止损、连续亏损退出等止损策略,控制风险。

增加趋势强度指标,避免在震荡和弱趋势中出现过多交易。

增加机器学习模型判断趋势转折,使策略对突发事件有一定的适应能力。

总结

该低频傅里叶变换趋势跟踪移动平均线策略,具有过滤噪声、识别趋势、追踪趋势的优势,适合中长线持有。作为趋势跟踪策略,它主要面临着趋势反转和持续震荡的风险。这些风险都有一定的应对策略。总的来说,该策略参数空间大,优化潜力高,适合有一定策略开发和风险控制能力的投资人实盘验证。

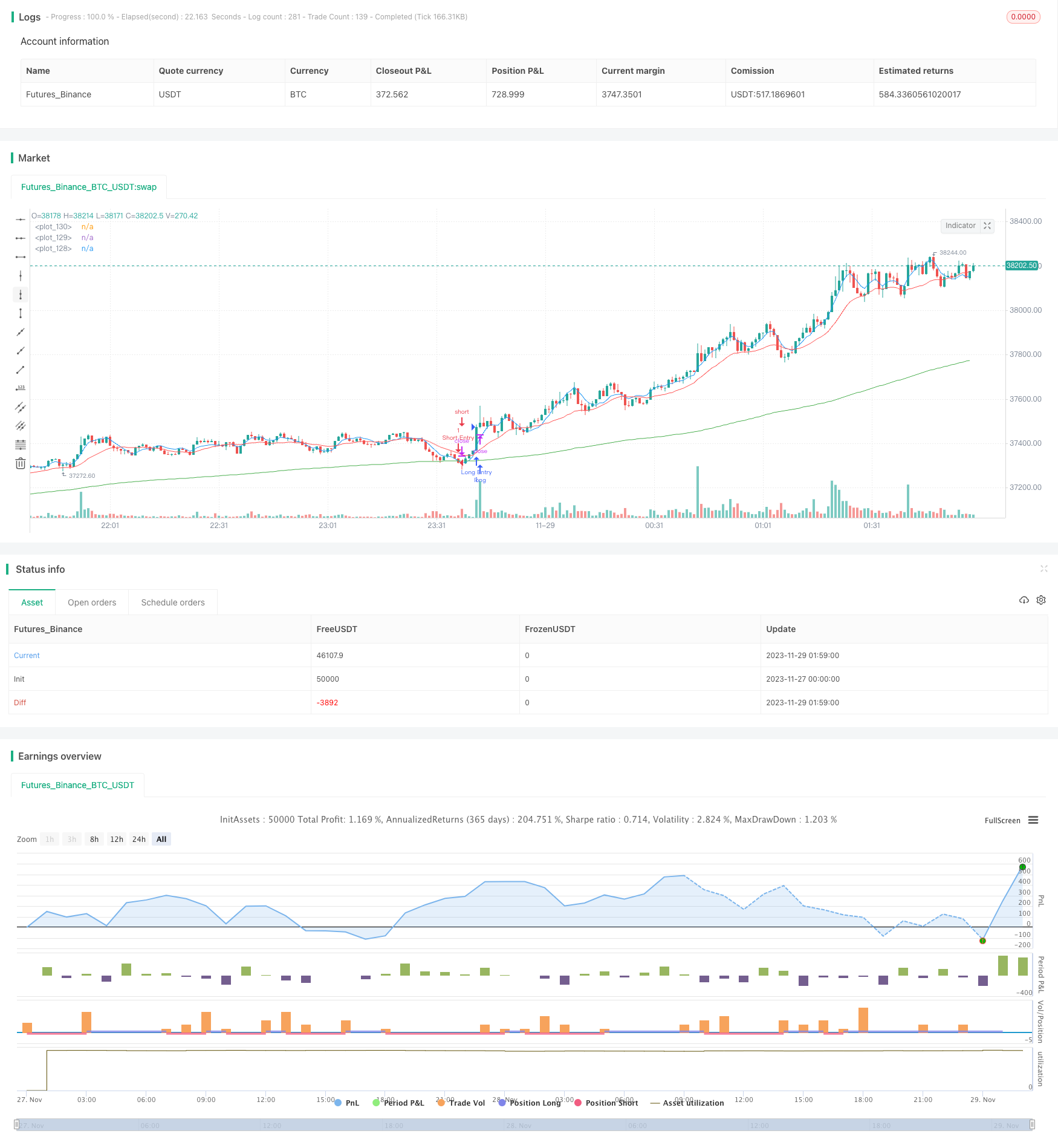

/*backtest

start: 2023-11-27 00:00:00

end: 2023-11-29 02:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © 03.freeman

//@version=4

strategy("FTSMA", overlay=true )

src=input(close,"Source")

slowMA=input(200,"Slow MA period")

mediumMA=input(20,"Mid MA period")

fastMA=input(5,"Fast MA period")

plotSMA=input(true,"Use MA")

sin1=input(1,"First sinusoid",minval=1)

sin2=input(2,"Second sinusoid",minval=1)

sin3=input(3,"Third sinusoid",minval=1)

smoothinput = input('EMA', title = "MA Type", options =['EMA', 'SMA', 'ALMA','FRAMA','RMA', 'SWMA', 'VWMA','WMA','LinearRegression'])

linearReg=input(false, "Use linear regression?")

linregLenght=input(13, "Linear regression lenght")

linregOffset=input(0, "Linear regression offset")

//------FRAMA ma---------

ma(src, len) =>

float result = 0

int len1 = len/2

frama_SC=200

frama_FC=1

e = 2.7182818284590452353602874713527

w = log(2/(frama_SC+1)) / log(e) // Natural logarithm (ln(2/(SC+1))) workaround

H1 = highest(high,len1)

L1 = lowest(low,len1)

N1 = (H1-L1)/len1

H2_ = highest(high,len1)

H2 = H2_[len1]

L2_ = lowest(low,len1)

L2 = L2_[len1]

N2 = (H2-L2)/len1

H3 = highest(high,len)

L3 = lowest(low,len)

N3 = (H3-L3)/len

dimen1 = (log(N1+N2)-log(N3))/log(2)

dimen = iff(N1>0 and N2>0 and N3>0,dimen1,nz(dimen1[1]))

alpha1 = exp(w*(dimen-1))

oldalpha = alpha1>1?1:(alpha1<0.01?0.01:alpha1)

oldN = (2-oldalpha)/oldalpha

N = (((frama_SC-frama_FC)*(oldN-1))/(frama_SC-1))+frama_FC

alpha_ = 2/(N+1)

alpha = alpha_<2/(frama_SC+1)?2/(frama_SC+1):(alpha_>1?1:alpha_)

frama = 0.0

frama :=(1-alpha)*nz(frama[1]) + alpha*src

result := frama

result

// ----------MA calculation - ChartArt and modified by 03.freeman-------------

calc_ma(src,l) =>

_ma = smoothinput=='SMA'?sma(src, l):smoothinput=='EMA'?ema(src, l):smoothinput=='WMA'?wma(src, l):smoothinput=='LinearRegression'?linreg(src, l,0):smoothinput=='VWMA'?vwma(src,l):smoothinput=='RMA'?rma(src, l):smoothinput=='ALMA'?alma(src,l,0.85,6):smoothinput=='SWMA'?swma(src):smoothinput=='FRAMA'?ma(sma(src,1),l):na

//----------------------------------------------

//pi = acos(-1)

// Approximation of Pi in _n terms --- thanks to e2e4mfck

f_pi(_n) =>

_a = 1. / (4. * _n + 2)

_b = 1. / (6. * _n + 3)

_pi = 0.

for _i = _n - 1 to 0

_a := 1 / (4. * _i + 2) - _a / 4.

_b := 1 / (6. * _i + 3) - _b / 9.

_pi := (4. * _a) + (4. * _b) - _pi

pi=f_pi(20)

//---Thanks to xyse----https://www.tradingview.com/script/UTPOoabQ-Low-Frequency-Fourier-Transform/

//Declaration of user-defined variables

N = input(defval=64, title="Lookback Period", type=input.integer, minval=2, maxval=600, confirm=false, step=1, options=[2,4,8,16,32,64,128,256,512,1024,2048,4096])

//Real part of the Frequency Domain Representation

ReX(k) =>

sum = 0.0

for i=0 to N-1

sum := sum + src[i]*cos(2*pi*k*i/N)

return = sum

//Imaginary part of the Frequency Domain Representation

ImX(k) =>

sum = 0.0

for i=0 to N-1

sum := sum + src[i]*sin(2*pi*k*i/N)

return = -sum

//Get sinusoidal amplitude from frequency domain

ReX_(k) =>

case = 0.0

if(k!=0 and k!=N/2)

case := 2*ReX(k)/N

if(k==0)

case := ReX(k)/N

if(k==N/2)

case := ReX(k)/N

return = case

//Get sinusoidal amplitude from frequency domain

ImX_(k) =>

return = -2*ImX(k)/N

//Get full Fourier Transform

x(i, N) =>

sum1 = 0.0

sum2 = 0.0

for k=0 to N/2

sum1 := sum1 + ReX_(k)*cos(2*pi*k*i/N)

for k=0 to N/2

sum2 := sum2 + ImX_(k)*sin(2*pi*k*i/N)

return = sum1+sum2

//Get single constituent sinusoid

sx(i, k) =>

sum1 = ReX_(k)*cos(2*pi*k*i/N)

sum2 = ImX_(k)*sin(2*pi*k*i/N)

return = sum1+sum2

//Calculations for strategy

SLOWMA = plotSMA?calc_ma(close+sx(0,sin1),slowMA):close+sx(0,sin1)

MEDMA = plotSMA?calc_ma(close+sx(0,sin2),mediumMA):close+sx(0,sin2)

FASTMA = plotSMA?calc_ma(close+sx(0,sin3),fastMA):close+sx(0,sin3)

SLOWMA := linearReg?linreg(SLOWMA,linregLenght,linregOffset):SLOWMA

MEDMA := linearReg?linreg(MEDMA,linregLenght,linregOffset):MEDMA

FASTMA := linearReg?linreg(FASTMA,linregLenght,linregOffset):FASTMA

//Plot 3 Low-Freq Sinusoids

plot(SLOWMA, color=color.green)

plot(MEDMA, color=color.red)

plot(FASTMA, color=color.blue)

// Strategy: (Thanks to JayRogers)

// === STRATEGY RELATED INPUTS ===

// the risk management inputs

inpTakeProfit = input(defval = 0, title = "Take Profit Points", minval = 0)

inpStopLoss = input(defval = 0, title = "Stop Loss Points", minval = 0)

inpTrailStop = input(defval = 0, title = "Trailing Stop Loss Points", minval = 0)

inpTrailOffset = input(defval = 0, title = "Trailing Stop Loss Offset Points", minval = 0)

// === RISK MANAGEMENT VALUE PREP ===

// if an input is less than 1, assuming not wanted so we assign 'na' value to disable it.

useTakeProfit = inpTakeProfit >= 1 ? inpTakeProfit : na

useStopLoss = inpStopLoss >= 1 ? inpStopLoss : na

useTrailStop = inpTrailStop >= 1 ? inpTrailStop : na

useTrailOffset = inpTrailOffset >= 1 ? inpTrailOffset : na

longCondition = FASTMA>MEDMA and close > SLOWMA //crossover(FASTMA, MEDMA) and close > SLOWMA

if (longCondition)

strategy.entry("Long Entry", strategy.long)

shortCondition = FASTMA<MEDMA and close < SLOWMA //crossunder(FASTMA, MEDMA) and close < SLOWMA

if (shortCondition)

strategy.entry("Short Entry", strategy.short)

// === STRATEGY RISK MANAGEMENT EXECUTION ===

// finally, make use of all the earlier values we got prepped

strategy.exit("Exit Buy", from_entry = "Long Entry", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

strategy.exit("Exit Sell", from_entry = "Short Entry", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)