概述

动态K线大阳线交易策略是一个利用动态K线判断突破的策略。它通过识别大阳线K线形态以及计算动态止损位和止盈位来实现。

策略原理

该策略的主要逻辑是:

计算K线实体大小占整体K线范围的百分比,如果实体大小大于设定的大阳线阈值,则判断为大阳线。

如果识别到大阳线,则做多进入长仓。同时计算止损位和止盈位。止损位低于入场价特定点数,止盈位高于入场价特定点数。

如果识别到大阴线,则做空进入短仓。同时计算止损位和止盈位。止损位高于入场价特定点数,止盈位低于入场价特定点数。

多头仓位止损或止盈后平仓。空头仓位止盈或止损后平仓。

优势分析

该策略主要有以下优势:

策略逻辑简单清晰,容易理解实现,适合新手学习。

利用大阳线等典型K线形态,可以有效捕捉市场突破 momentum。

动态计算止损止盈位,可以有效控制风险。

只需要一个参数即可实现,容易优化调整。

风险分析

该策略也存在一些风险:

大阳线突破不一定能持续,可能是假突破。

止损止盈点数设置不当可能导致过早止损或止盈。

不同品种和周期参数需要调整优化。

实盘滑点等问题可能导致盈亏不一致。

以上风险可以通过参数优化,严格的风险管理,适当调整持仓时间等方式减轻。

优化方向

该策略可以从以下几个方向进行优化:

评估不同交易品种和周期参数的效果。

测试不同的阳线体大小阈值。

优化止损止盈的点数大小。

增加其他过滤条件,如交易量,震荡幅度等。

评估突破K线数,进一步验证突破可靠性。

总结

动态K线大阳线交易策略整体来说是一个非常实用的量化策略。它通过捕捉高概率趋势突破机会实现盈利,同时利用动态止损止盈有效控制风险。该策略可以进一步通过参数优化等方式进行改进,是初学者学习量化交易的好选择。

策略源码

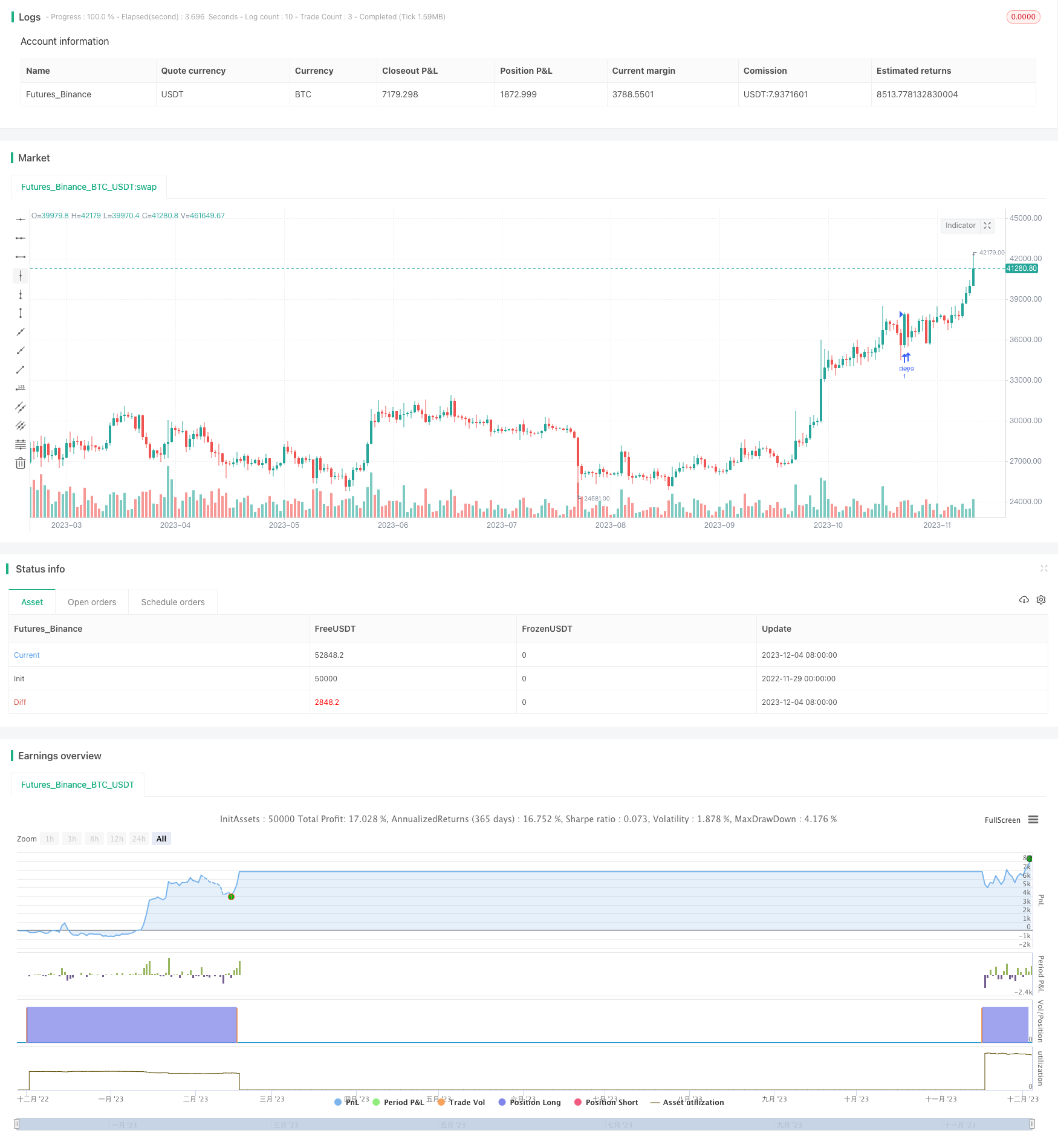

/*backtest

start: 2022-11-29 00:00:00

end: 2023-12-05 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Manham Big Bar Trading Strategy", overlay=true)

// Define inputs

lookback_period = input(20, title="Lookback Period")

bullish_threshold = input(26, title="Bullish Marubozu Threshold")

bearish_threshold = input(30, title="Bearish Marubozu Threshold")

target_points = input(37, title="Target Points")

stop_loss_points = input(24, title="Stop Loss Points")

// Calculate body size as a percentage of the total range of the candle

body_size = abs(close - open) / (high - low) * 30

// Identify bullish Marubozu

is_bullish_marubozu = close > open and body_size >= bullish_threshold

// Identify bearish Marubozu

is_bearish_marubozu = open > close and body_size >= bearish_threshold

// Calculate stop loss and target levels

stop_loss = strategy.position_avg_price - stop_loss_points * syminfo.mintick

take_profit = strategy.position_avg_price + target_points * syminfo.mintick

// Strategy conditions

if is_bullish_marubozu

strategy.entry("Buy", strategy.long)

strategy.exit("Sell", "Buy", stop=stop_loss, limit=take_profit)

if is_bearish_marubozu

strategy.entry("Sell", strategy.short)

strategy.exit("Cover", "Sell", stop=take_profit, limit=stop_loss)