概述

本策略名称为“双时间轴RSI反转”,它是一个基于相对强度指数(RSI)的量化交易策略。该策略运用两个不同周期的RSI作为买入和卖出信号,实现低买高卖,获取股票价格反转带来的交易机会。

策略原理

该策略使用快速周期(默认55天)RSI和慢速周期(默认126天)RSI构建交易信号。当快速周期RSI上穿慢速周期RSI时生成买入信号,反之当快速周期RSI下穿慢速周期RSI时生成卖出信号。这样通过比较两个不同时间区间内价格动量的相对强弱,发现短期和长期趋势反转机会。

进入信号后,策略会设置止盈止损点。止盈点默认为进入价格的0.9倍,止损点默认为进入价格的3%。同时当重新出现反向信号时,也会平掉当前头寸。

策略优势

- 利用双RSI比较发现短期和长期价格趋势的变化点,捕捉反转机会

- 双RSI滤除假突破带来的噪音交易

- 配置止盈止损点,可以限制单笔损失

策略风险

- 股价剧烈波动期间,RSI信号可能频繁反转

- 止损点过小,可能导致小幅震荡后就止损

- 双RSI参数设置不当,可能错过大的反转趋势

策略优化

- RSI参数可以测试更多组合,找到最佳参数

- 可以结合其他指标过滤假突破信号

- 动态调整止盈止损比例,让止盈更加灵活

总结

本策略“双时间轴RSI反转”通过比较快速周期和慢速周期两个RSI的交叉作为交易信号,目标捕捉短期价格反转机会。同时设置止盈止损规则规避风险。这是一种典型的利用指标多时间轴比较实现价格反转交易的策略。优化空间在于参数调整和风控规则优化。

策略源码

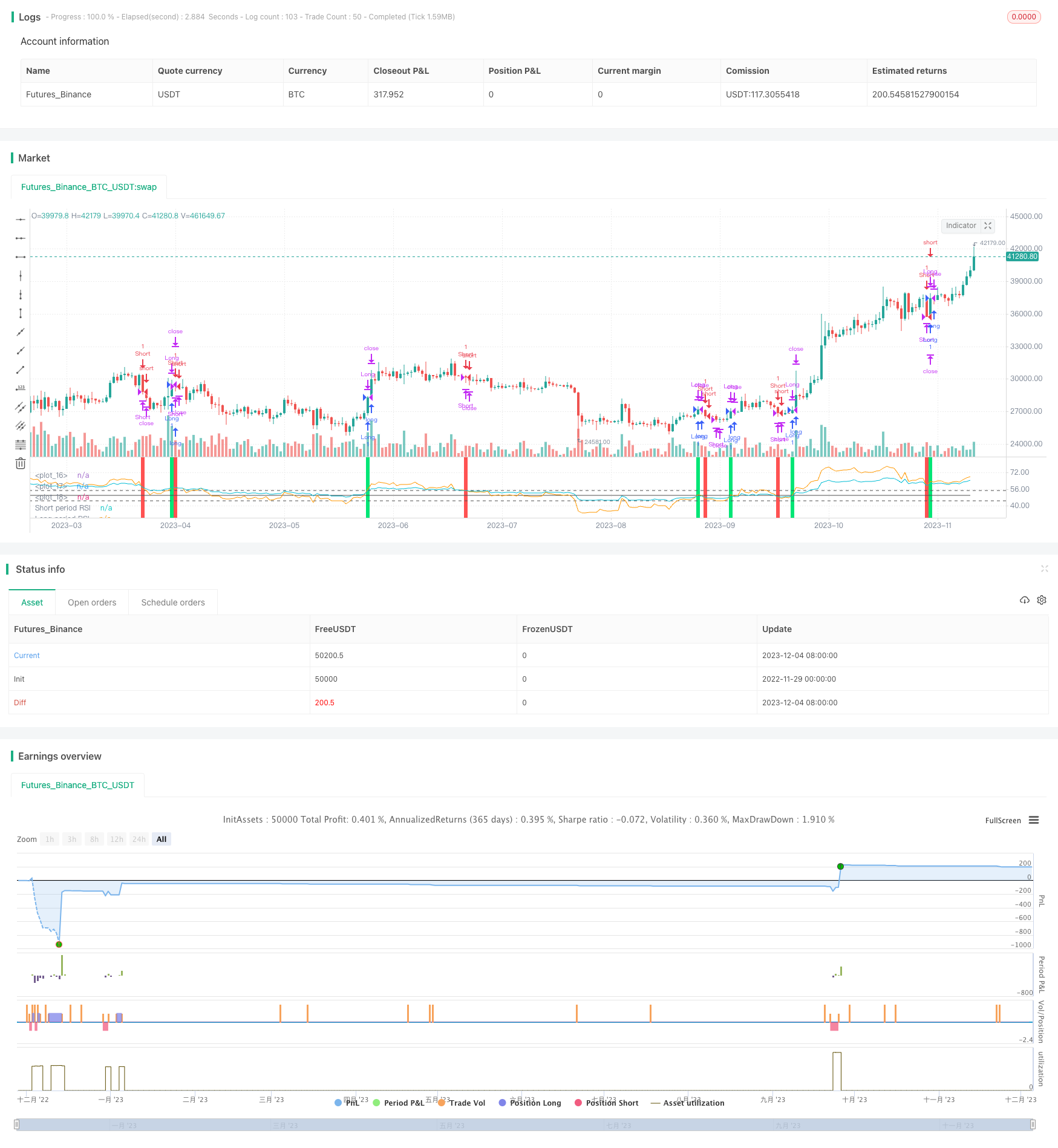

/*backtest

start: 2022-11-29 00:00:00

end: 2023-12-05 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy(title="Relative Strength Index", shorttitle="RSI")

slen = input(55, title="Short length")

llen = input(126, title="Long length")

sup = ema(max(change(close), 0), slen)

sdown = ema(-min(change(close), 0), slen)

rsi1 = sdown == 0 ? 100 : sup == 0 ? 0 : 100 - (100 / (1 + sup / sdown))

lup = ema(max(change(close), 0), llen)

ldown = ema(-min(change(close), 0), llen)

rsi2 = ldown == 0 ? 100 : lup == 0 ? 0 : 100 - (100 / (1 + lup / ldown))

ob = input(55, title="Overbought")

os = input(45, title="Oversold")

tp = input(.9, title="Take profit level %")*.01

sl = input(3, title="Stoploss level %")*.01

mid = avg(ob,os)

plot (mid, color=#4f4f4f, transp=0)

hline (ob, color=#4f4f4f)

hline (os, color=#4f4f4f)

long = crossover(rsi1,rsi2)

short = crossunder(rsi1,rsi2)

vall = valuewhen(long,close,0)

lexit1 = high>=(vall*tp)+vall

lexit2 = low<=vall-(vall*sl)

vals = valuewhen(short,close,0)

sexit1 = low<=vals - (vals*tp)

sexit2 = high>=vals + (vals*sl)

bgcolor (color=long?lime:na,transp=50)

bgcolor (color=short?red:na, transp=50)

strategy.entry("Long", strategy.long, when=long)

strategy.close("Long", when=lexit1)

strategy.close("Long", when=lexit2)

strategy.close("Long", when=short)

strategy.entry("Short", strategy.short, when=short)

strategy.close("Short", when=sexit1)

strategy.close("Short", when=sexit2)

strategy.close("Short", when=long)

plot (rsi1, color=orange, transp=0,linewidth=1, title="Short period RSI")

plot (rsi2, color=aqua , transp=0,linewidth=1, title="Long period RSI")