概述

蜜蜂趋势ATR横向突破策略是一种基于ATR指标与布林带进行交易信号生成的中短线突破型策略。它主要监测股价在一定宽度的上下ATR通道内的趋势变化,在下穿下轨或上穿上轨时,结合趋势过滤进行交易决策。

策略原理

该策略主要由三部分组成:

ATR通道:通过ATR指标计算股价的波动范围,并以该范围上下形成通道。通道宽度通过ATR lookback周期和ATRdivisor因子控制。

蜜蜂线:以股价中枢线为基准线。中枢线计算方法为:昨日高低收的平均值。

趋势过滤:通过离差动向指标计算价格趋势,并设定信号周期,当 pricesig ‘>’: pricesig[3] 时为趋势向上,当 pricesig ‘<’ pricesig[3]时为趋势向下。

具体交易信号生成逻辑为:

多头信号: pricesig > pricesig[3] 且 价格下穿下轨 时做多;

空头信号: pricesig < pricesig[3] 且 价格上穿上轨 时做空;

其他情况无交易。

该策略同时设定止盈止损条件,以控制交易风险。

优势分析

蜜蜂趋势ATR突破策略具有如下优势:

采用ATR指标计算股价波动范围,能动态捕捉市场变化;

结合中枢线评估股价横盘并设置通道突破交易点,避免追高杀跌;

离差动向指标进行趋势判断,避免逆势交易,提高胜率;

设置止盈止损条件控制单笔风险;

策略参数设定灵活,可调整通道宽度、ATR周期等因素优化策略。

风险分析

该策略也存在一定风险:

中短线交易波动大,风险相对较高,需要谨慎资金管理;

股价剧烈波动时,ATR通道范围计算可能不准,容易造成错误交易;

离差动向指标对趋势判断也可能犯错,从而影响交易信号的准确性。

针对以上风险,可通过适当调整ATR通道参数、加大趋势过滤信号周期等方式进行优化和改进。

优化方向

该策略可从以下几个方面进行优化:

调整ATR通道宽度,降低或提高参数atrDivisor,压缩或放大通道范围。

调整ATR lookback周期参数,改变通道对最近波动的敏感度。

调整趋势信号周期参数,改善多空趋势判断的准确性。

加入其他指标进行多因子验证,提高交易信号质量。

优化止盈止损算法,改进风险控制。

总结

蜜蜂趋势ATR突破策略整合运用股价波动范围分析和趋势判断指标,在捕捉市场热点的同时控制交易风险,是一种灵活度高、适应性强的量化策略。该策略可通过参数调整与信号优化不断改进,具有广阔的运用前景。

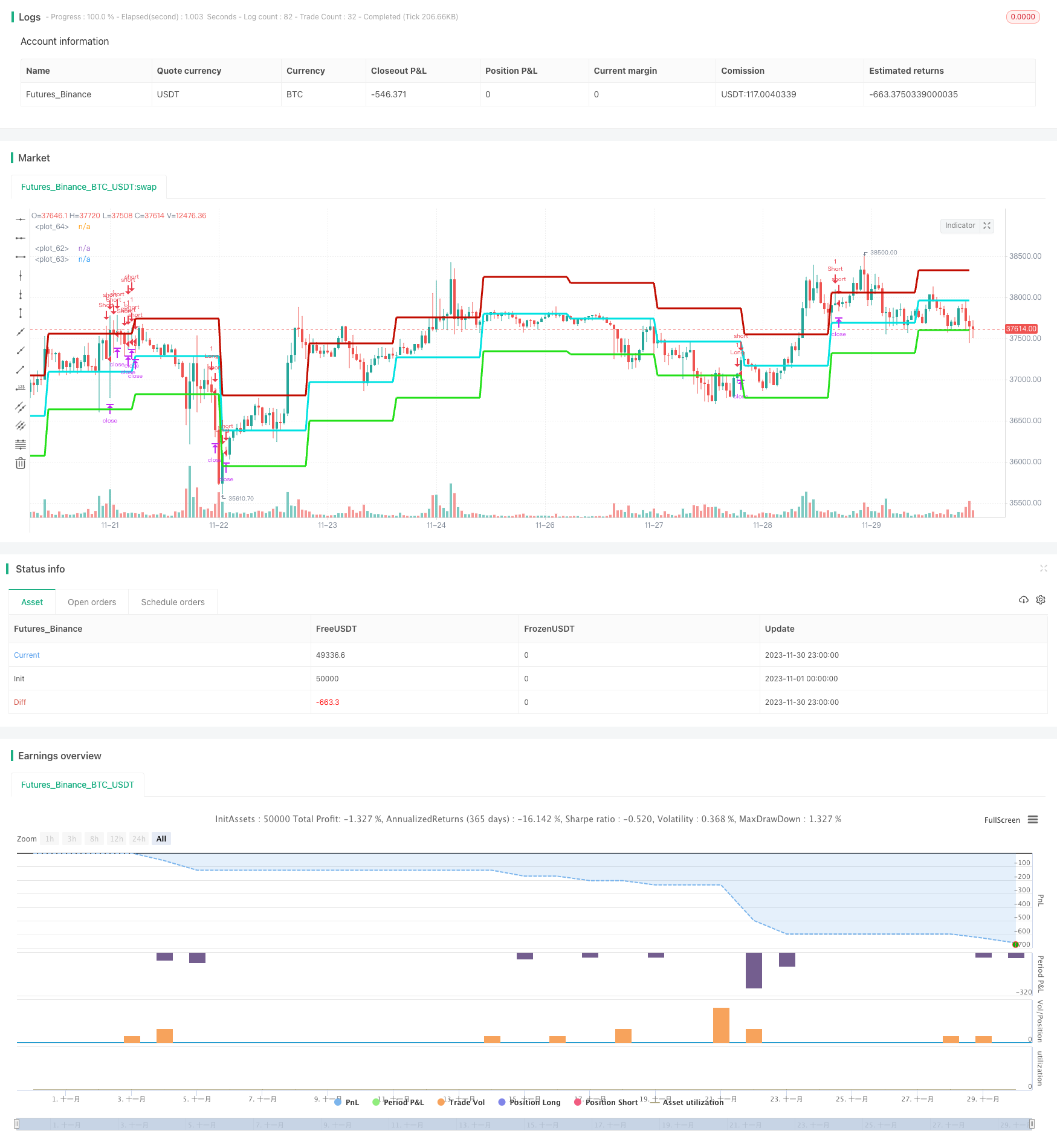

/*backtest

start: 2023-11-01 00:00:00

end: 2023-11-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy(title="Strategy - Bobo PATR Swing", overlay=true, default_qty_type = strategy.fixed, default_qty_value = 1, initial_capital = 10000)

// === STRATEGY RELATED INPUTS AND LOGIC ===

PivottimeFrame = input(title="Pivot Timeframe", defval="D")

ATRSDtimeFrame = input(title="ATR Band Timeframe (Lower timeframe = wider bands)", defval="D")

len = input(title="ATR lookback (Lower = bands more responsive to recent price action)", defval=13)

myatr = atr(len)

dailyatr = request.security(syminfo.tickerid, ATRSDtimeFrame, myatr[1])

atrdiv = input(title="ATR divisor (Lower = wider bands)", type=float, defval=2)

pivot0 = (high[1] + low[1] + close[1]) / 3

pivot = request.security(syminfo.tickerid, PivottimeFrame, pivot0)

upperband1 = (dailyatr / atrdiv) + pivot

lowerband1 = pivot - (dailyatr / atrdiv)

middleband = pivot

// == TREND CALC ===

i1=input(2, "Momentum Period", minval=1) //Keep at 2 usually

i2=input(20, "Slow Period", minval=1)

i3=input(5, "Fast Period", minval=1)

i4=input(3, "Smoothing Period", minval=1)

i5=input(4, "Signal Period", minval=1)

i6=input(50, "Extreme Value", minval=1)

hiDif = high - high[1]

loDif = low[1] - low

uDM = hiDif > loDif and hiDif > 0 ? hiDif : 0

dDM = loDif > hiDif and loDif > 0 ? loDif : 0

ATR = rma(tr(true), i1)

DIu = 100 * rma(uDM, i1) / ATR

DId = 100 * rma(dDM, i1) / ATR

HLM2 = DIu - DId

DTI = (100 * ema(ema(ema(HLM2, i2), i3), i4)) / ema(ema(ema(abs(HLM2), i2), i3), i4)

signal = ema(DTI, i5)

// === RISK MANAGEMENT INPUTS ===

inpTakeProfit = input(defval = 0, title = "Take Profit (In Market MinTick Value)", minval = 0)

inpStopLoss = input(defval = 100, title = "Stop Loss (In Market MinTick Value)", minval = 0)

// === RISK MANAGEMENT VALUE PREP ===

// if an input is less than 1, assuming not wanted so we assign 'na' value to disable it.

useTakeProfit = inpTakeProfit >= 1 ? inpTakeProfit : na

useStopLoss = inpStopLoss >= 1 ? inpStopLoss : na

// === STRATEGY - LONG POSITION EXECUTION ===

enterLong = (((low<=lowerband1) and (close >lowerband1)) or ((open <= lowerband1) and (close > lowerband1))) and (strategy.opentrades <1) and (atr(3) > atr(50)) and (signal>signal[3])

exitLong = (high > middleband)

strategy.entry(id = "Long", long = true, when = enterLong)

strategy.close(id = "Long", when = exitLong)

// === STRATEGY - SHORT POSITION EXECUTION ===

enterShort = (((high>=upperband1) and (close < upperband1)) or ((open >= upperband1) and (close < upperband1))) and (strategy.opentrades <1) and (atr(3) > atr(50)) and (signal<signal[3])

exitShort = (low < middleband)

strategy.entry(id = "Short", long = false, when = enterShort)

strategy.close(id = "Short", when = exitShort)

// === STRATEGY RISK MANAGEMENT EXECUTION ===

strategy.exit("Exit Long", from_entry = "Long", profit = useTakeProfit, loss = useStopLoss)

strategy.exit("Exit Short", from_entry = "Short", profit = useTakeProfit, loss = useStopLoss)

// === CHART OVERLAY ===

plot(upperband1, color=#C10C00, linewidth=3)

plot(lowerband1, color=#23E019, linewidth=3)

plot(middleband, color=#00E2E2, linewidth=3)

//plot(strategy.equity, title="equity", color=red, linewidth=2, style=areabr)