概述

本策略结合了双EMA黄金交叉、标准化ATR噪音过滤器和ADX趋势指标,旨在为交易者提供更可靠的买入信号。该策略综合多个指标过滤虚假信号,识别更可靠的交易机会。

策略原理

该策略使用8周期和20周期的EMA构建双EMA黄金交叉系统。当短周期EMA上穿长周期EMA时生成买入信号。

此外,策略还设置了多个辅助指标进行过滤:

14周期ATR,经过标准化处理,过滤掉市场中过小的价格波动。

14周期ADX,用来识别趋势的力度。只有在强势趋势中才会考虑交易信号。

14周期成交量SMA,过滤掉成交量较小的时间点。

4/14周期Super Trend指标,判断多空市场方向。

在满足趋势方向、ATR标准化值、ADX值和成交量条件后,EMA黄金交叉才会最终触发买入信号。

策略优势

- 多指标组合,可靠性较高

该策略集成了EMA、ATR、ADX、Super Trend等多个指标,通过指标互补形成较强的信号过滤体系,可靠性较高。

- 参数可调节空间大

ATR标准化值阈值、ADX阈值、持仓周期等参数都可根据实际情况优化调整,策略灵活度较高。

- 可区分多空市场

通过Super Trend指标判断多空市,针对多空市场使用不同的参数标准,避免错失机会。

策略风险

- 参数优化难度大

策略参数组合复杂,优化难度较大,需要大量回测找到最优参数。

- 指标错触发风险

尽管有多重过滤,由于指标本质带有滞后性,仍有错触发风险。需要充分考虑止损理论。

- 交易频率偏低

受到多重指标和滤波的影响,策略交易频率会比较低,可能长期无交易的情况。

策略优化方向

- 优化参数组合

通过大量回测数据找到指标参数的最优组合。

- 增加机器学习

基于大量历史数据,运用机器学习算法自动优化策略参数,实现策略的自适应性。

- 考虑更多市场因素

结合更多指标判断市场结构、情绪等因素,丰富策略的多样性。

总结

本策略综合考虑了趋势、波动性和量价因素,通过多指标过滤和参数调节形成交易体系。综合而言,该策略可靠性较高,可通过进一步优化其参数组合和建模方式提升策略的交易效率。

策略源码

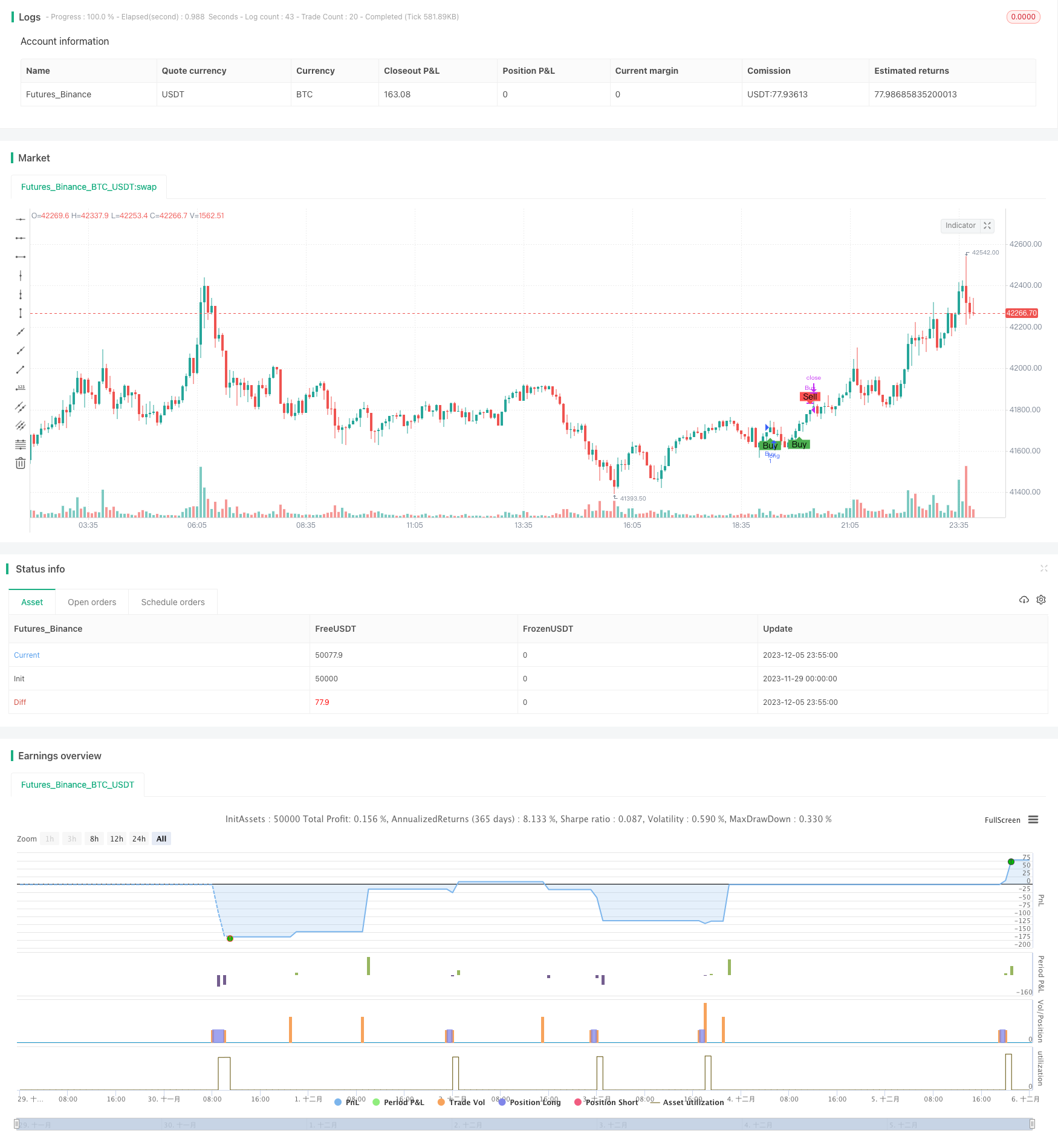

/*backtest

start: 2023-11-29 00:00:00

end: 2023-12-06 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Description:

//This strategy is a refactored version of an EMA cross strategy with a normalized ATR filter and ADX control.

//It aims to provide traders with signals for long positions based on market conditions defined by various indicators.

//How it Works:

//1. EMA: Uses short (8 periods) and long (20 periods) EMAs to identify crossovers.

//2. ATR: Uses a 14-period ATR, normalized to its 20-period historical range, to filter out noise.

//3. ADX: Uses a 14-period RMA to identify strong trends.

//4. Volume: Filters trades based on a 14-period SMA of volume.

//5. Super Trend: Uses a Super Trend indicator to identify the market direction.

//How to Use:

//- Buy Signal: Generated when EMA short crosses above EMA long, and other conditions like ATR and market direction are met.

//- Sell Signal: Generated based on EMA crossunder and high ADX value.

//Originality and Usefulness:

//This script combines EMA, ATR, ADX, and Super Trend indicators to filter out false signals and identify more reliable trading opportunities.

//USD Strength is not working, just simulated it as PSEUDO CODE: [close>EMA(50)]

//Strategy Results:

//- Account Size: $1000

//- Commission: Not considered

//- Slippage: Not considered

//- Risk: Less than 5% per trade

//- Dataset: Aim for more than 100 trades for sufficient sample size

//Note: This script should be used for educational purposes and should not be considered as financial advice.

//Chart:

//- The script's output is plotted as Buy and Sell signals on the chart.

//- No other scripts are included for clarity.

//- Have tested with 30mins period

//- You are encouraged to play with parameters, let me know if you

//@version=5

strategy("Advanced EMA Cross with Normalized ATR Filter, Controlling ADX", shorttitle="ALP V5", overlay=true )

// Initialize variables

var bool hasBought = false

var int barCountSinceBuy = 0

// Define EMA periods

emaShort = ta.ema(close, 8)

emaLong = ta.ema(close, 20)

// Define ATR parameters

atrLength = 14

atrValue = ta.atr(atrLength)

maxHistoricalATR = ta.highest(atrValue, 20)

minHistoricalATR = ta.lowest(atrValue, 20)

normalizedATR = (atrValue - minHistoricalATR) / (maxHistoricalATR - minHistoricalATR)

// Define ADX parameters

adxValue = ta.rma(close, 14)

adxHighLevel = 30

isADXHigh = adxValue > adxHighLevel

// Initialize risk management variables

var float stopLossPercent = na

var float takeProfitPercent = na

// Calculate USD strength

// That's not working as usd strenght, since I couldn't manage to get usd strength

//I've just simulated it as if the current close price is above 50 days average (it's likely a bullish trend), usd is strong (usd_strenth variable is positive)

usd_strength = close / ta.ema(close, 50) - 1

// Adjust risk parameters based on USD strength

if (usd_strength > 0)

stopLossPercent := 3

takeProfitPercent := 6

else

stopLossPercent := 4

takeProfitPercent := 8

// Initialize position variable

var float positionPrice = na

// Volume filter

minVolume = ta.sma(volume, 14) * 1.5

isVolumeHigh = volume > minVolume

// Market direction using Super Trend indicator

[supertrendValue, supertrendDirection] = ta.supertrend(4, 14)

bool isBullMarket = supertrendDirection < 0

bool isBearMarket = supertrendDirection > 0

// Buy conditions for Bull and Bear markets

buyConditionBull = isBullMarket and ta.crossover(emaShort, emaLong) and normalizedATR > 0.2

buyConditionBear = isBearMarket and ta.crossover(emaShort, emaLong) and normalizedATR > 0.5

buyCondition = buyConditionBull or buyConditionBear

// Sell conditions for Bull and Bear markets

sellConditionBull = isBullMarket and (ta.crossunder(emaShort, emaLong) or isADXHigh)

sellConditionBear = isBearMarket and (ta.crossunder(emaShort, emaLong) or isADXHigh)

sellCondition = sellConditionBull or sellConditionBear

// Final Buy and Sell conditions

if (buyCondition)

strategy.entry("Buy", strategy.long)

positionPrice := close

hasBought := true

barCountSinceBuy := 0

if (hasBought)

barCountSinceBuy := barCountSinceBuy + 1

// Stop-loss and take-profit levels

longStopLoss = positionPrice * (1 - stopLossPercent / 100)

longTakeProfit = positionPrice * (1 + takeProfitPercent / 100)

// Final Sell condition

finalSellCondition = sellCondition and hasBought and barCountSinceBuy >= 3 and isVolumeHigh

if (finalSellCondition)

strategy.close("Buy")

positionPrice := na

hasBought := false

barCountSinceBuy := 0

// Implement stop-loss and take-profit

strategy.exit("Stop Loss", "Buy", stop=longStopLoss)

strategy.exit("Take Profit", "Buy", limit=longTakeProfit)

// Plot signals

plotshape(series=buyCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="Buy")

plotshape(series=finalSellCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="Sell")