概述

黄金通道反转策略是一种基于黄金分割线和相对强弱指标(RSI)的量化交易策略。该策略结合黄金通道理论和超买超卖指标,在大周期趋势下进行反转操作,以期在短周期内获利。

策略原理

策略首先计算出黄金分割线的两个重要价格区域,即0.618倍高点和0.618倍低点。当价格接近这两个区域时,我们认为价格可能出现反转。

此外,策略还计算RSI指标判断超买超卖状态。当RSI低于30时为超卖状态,高于70时为超买状态。这两个状态也意味着价格可能反转。

综合这两个条件,策略判断买入条件为:收盘价上穿0.618倍低点 且 RSI指标低于30;卖出条件为:收盘价下穿0.618倍高点 且 RSI指标高于70。

当触发买入信号后,策略会在该点市价开仓做多;当触发卖出信号后,策略会在该点市价开仓做空。此外,策略还会设置止盈止损位,当价格向有利方向移动到一定比例后止盈,当价格向不利方向移动到一定比例后止损。

策略优势分析

该策略结合了趋势和反转因素,既考虑大周期趋势,也利用短周期反转获利。具有以下优势:

- 黄金分割线具有天然的支撑阻力属性,是判断关键价格区域的有效工具。

- RSI指标判断超买超卖状态,提示可能的反转点。

- 做多做空信号明确,不会错过反转机会。

- 设置止盈止损策略,可控的风险。

策略风险分析

该策略也存在一些风险需要防范:

- 如果大周期没有反转,短周期反弹会造成亏损的风险。可通过放大周期判断大周期趋势来规避。

- 反转没有发生时,设置止损可能会被触发,带来亏损。可适当放宽止损范围。

- 反转时间可能会拖得很长,需要有足够的资金支持。

策略优化方向

该策略还可从以下方面进行优化:

搜集更多历史数据,对关键参数如黄金分割线的范围、RSI的超买超卖线进行测试和优化,使其更符合真实市场。

增加其它指标判断,形成更强有力的交易信号。如K线形态、成交量变化等。

根据不同交易品种的特点,调整参数或优化规则。

增加自动止损策略,跟踪价格实时变化来决定止损位置。

总结

黄金通道反转策略结合趋势因素和反转因素,利用短线获利的同时控制风险,是一种值得推荐的量化策略。优化后可望获取更佳回报。

策略源码

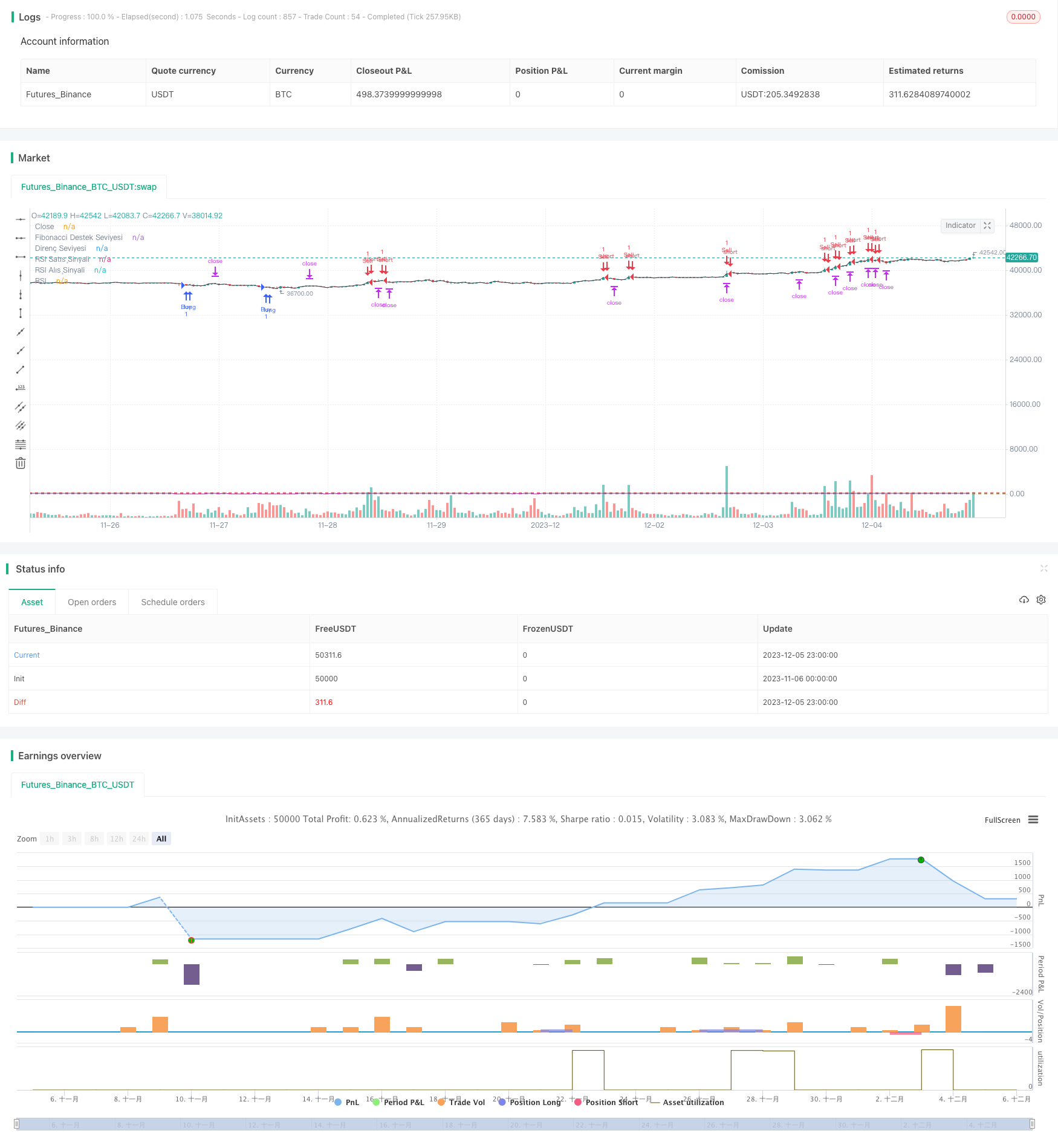

/*backtest

start: 2023-11-06 00:00:00

end: 2023-12-06 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("FBS Trade", overlay=true)

// Fibonacci seviyeleri

fibonacciLevels = input(0.618, title="Fibonacci Düzeltme Seviyesi")

// RSI ayarları

rsiLength = input(14, title="RSI Periyodu")

overboughtLevel = input(70, title="RSI Satış Sinyali Seviyesi")

oversoldLevel = input(30, title="RSI Alış Sinyali Seviyesi")

// Take Profit ve Stop Loss yüzdesi

takeProfitPercent = input(1, title="Take Profit Yüzdesi") / 100

stopLossPercent = input(1, title="Stop Loss Yüzdesi") / 100

// Fibonacci seviyelerini hesapla

highFibo = high * (1 + fibonacciLevels)

lowFibo = low * (1 - fibonacciLevels)

// RSI hesaplama

rsiValue = ta.rsi(close, rsiLength)

// Alış ve satış koşulları

buyCondition = close > lowFibo and rsiValue < 30

sellCondition = close < highFibo and rsiValue > overboughtLevel

// Take Profit ve Stop Loss seviyeleri

takeProfitLong = strategy.position_avg_price * (1 + takeProfitPercent)

stopLossLong = strategy.position_avg_price * (1 - stopLossPercent)

takeProfitShort = strategy.position_avg_price * (1 - takeProfitPercent)

stopLossShort = strategy.position_avg_price * (1 + stopLossPercent)

// Alış ve satış işlemleri

if (buyCondition)

strategy.entry("Buy", strategy.long)

if (sellCondition)

strategy.entry("Sell", strategy.short)

// Take Profit ve Stop Loss seviyeleri

if (strategy.position_size > 0)

strategy.exit("Take Profit/Close Buy", from_entry="Buy", limit=takeProfitLong, stop=stopLossLong)

if (strategy.position_size < 0)

strategy.exit("Take Profit/Close Sell", from_entry="Sell", limit=takeProfitShort, stop=stopLossShort)

// Sadece mumları ve buy/sell işlemlerini göster

plot(close, color=color.black, title="Close")

// Destek ve direnç bölgeleri

supportLevel = input(27, title="Fibonacci Destek Seviyesi")

resistanceLevel = input(200, title="Direnç Seviyesi")

hline(supportLevel, "Fibonacci Destek Seviyesi", color=color.green)

hline(resistanceLevel, "Direnç Seviyesi", color=color.red)

// Trend çizgileri

var line trendLine = na

if (ta.crossover(close, highFibo))

trendLine := line.new(bar_index[1], highFibo[1], bar_index, highFibo, color=color.green, width=2)

if (ta.crossunder(close, lowFibo))

trendLine := line.new(bar_index[1], lowFibo[1], bar_index, lowFibo, color=color.red, width=2)

// RSI ve Fibo'yu grafiğe çizme

hline(overboughtLevel, "RSI Satış Sinyali", color=color.red, linestyle=hline.style_dashed)

hline(oversoldLevel, "RSI Alış Sinyali", color=color.green, linestyle=hline.style_dashed)

plot(rsiValue, color=color.purple, title="RSI")

// 15 dakikalıkta 3 mumda bir alarm

is15MinBar = ta.change(time('15'), 1)

if (is15MinBar % 3 == 0)

alert("15 dakikalıkta 3 mum geçti.")