概述

双轨突破均线交叉策略是一种趋势跟踪型的量化交易策略。该策略运用双轨道机制判断市场趋势方向,配合均线交叉信号进行进场。具体来说,策略使用不同周期的平均线构建双轨道,通过价格突破上轨或下轨来判断趋势;然后结合快慢均线交叉信号过滤入场时机。

策略原理

双轨突破均线交叉策略主要由以下几部分组成:

趋势判断模块:使用不同周期均线构建双轨,价格突破上轨判断为上涨趋势,突破下轨判断为下跌趋势。

入场模块:快速均线上穿中长线均线时做多,下穿时做空。同时需要判断趋势方向。

出场模块:快速均线下穿中长线均线时平仓。

策略首先利用 Trend Required 参数设定需要判断的趋势强度。当价格突破上轨或下轨时,判断为趋势形成。此后,当快速均线上穿中长线均线时,做多入场;当快速均线下穿中长线均线时,做空入场。入场后,以快速均线下穿中长线均线作为离场信号。

此外,策略还设有止损、止盈模块。具体参数可以进行调整优化,以控制风险和获利。

优势分析

相比单轨或单均线策略,双轨突破均线交叉策略综合了趋势判断和入场时机选择,可以更好地把握市场节奏。具体优势有:

双轨设定可以更准确判断趋势,避免错过机会。

均线交叉过滤可以减少假突破做反方向操作的概率。

可以通过参数调整,实现风险和收益的优化。

策略逻辑简单清晰,容易理解,便于跟踪。

风险分析

双轨突破均线交叉策略也存在一定的风险,主要表现在:

双轨道设定并不能完全避免趋势判断错误的概率。

均线参数设置不当可能导致交易频率过高或反向操作。

止损点设置过于宽松,无法有效控制单次损失。

对应解决方法如下:

调整双轨参数,适当放宽突破判断范围。

优化均线周期组合,确保交易频率合理。

测试不同止损点水平,找到最优参数。

优化方向

双轨突破均线交叉策略还有以下几个可优化的方向:

测试不同均线周期参数,找到最优组合。

尝试加入更多均线,构建多均线过滤系统。

测试不同的止损算法,如追踪止损、震荡止损等。

加入复利机制,优化资金利用效率。

结合其他指标进行过滤,如布林带、KDJ等。

总结

双轨突破均线交叉策略综合考虑了趋势判断和入场时机选择,可以有效把握市场节奏。相比单一指标,该策略具有判断更准、过滤更优的特点。通过参数优化和模块升级,有望进一步提高策略的稳定性和收益率。

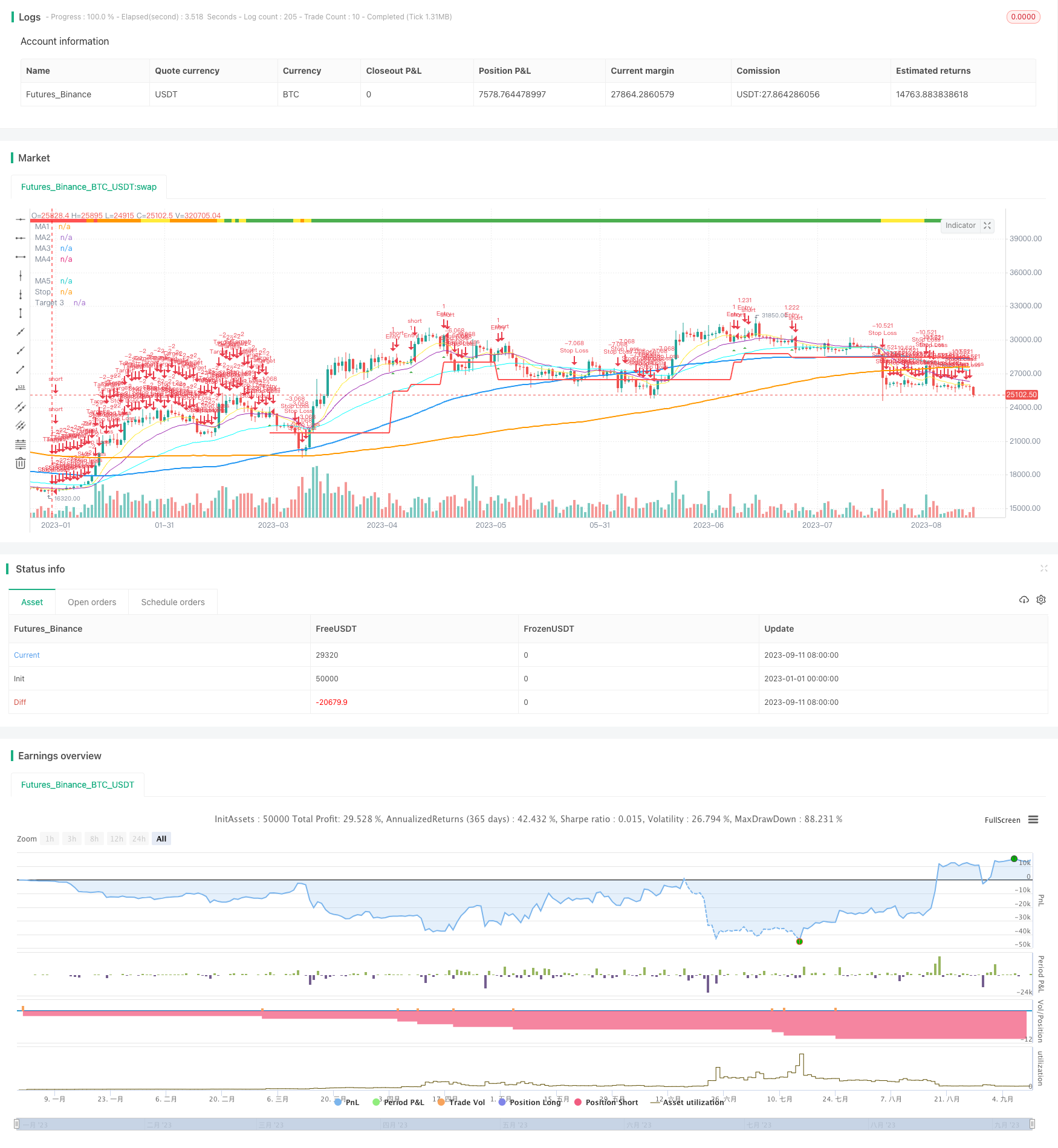

/*backtest

start: 2023-01-01 00:00:00

end: 2023-09-12 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//Author = Dustin Drummond https://www.tradingview.com/u/Dustin_D_RLT/

//Strategy based in part on original 10ema Basic Swing Trade Strategy by Matt Delong: https://www.tradingview.com/u/MattDeLong/

//Link to original 10ema Basic Swing Trade Strategy: https://www.tradingview.com/script/8yhGnGCM-10ema-Basic-Swing-Trade-Strategy/

//This is the Original EMAC - Exponential Moving Average Cross Strategy built as a class for reallifetrading dot com and so has all the default settings and has not been optimized

//I would not recomend using this strategy with the default settings and is for educational purposes only

//For the fully optimized version please come back around the same time tomorrow 6/16/21 for the EMAC - Exponential Moving Average Cross - Optimized

//EMAC - Exponential Moving Average Cross

strategy(title="EMAC - Exponential Moving Average Cross", shorttitle = "EMAC", overlay = true, calc_on_every_tick=false, default_qty_value = 100, initial_capital = 100000, default_qty_type = strategy.fixed, pyramiding = 0, process_orders_on_close=true)

//creates a time filter to prevent "too many orders error" and allows user to see Strategy results per year by changing input in settings in Stratey Tester

startYear = input(2015, title="Start Year", minval=1980, step=1)

timeFilter = (year >= startYear) and (month >= 1) and (dayofmonth >= 1)

//R Size (Risk Amount)

rStaticOrPercent = input(title="R Static or Percent", defval="Static", options=["Static", "Percent"])

rSizeStatic = input(2000, title="R Size Static", minval=1, step=100)

rSizePercent = input(3, title="R Size Percent", minval=.01, step=.01)

rSize = rStaticOrPercent == "Static" ? rSizeStatic : rStaticOrPercent == "Percent" ? (rSizePercent * .01 * strategy.equity) : 1

//Recent Trend Indicator "See the standalone version for detailed description"

res = input(title="Trend Timeframe", type=input.resolution, defval="W")

trend = input(26, minval=1, title="# of Bars for Trend")

trendMult = input(15, minval=0, title="Trend Growth %", step=.25) / 100

currentClose = security(syminfo.tickerid, res, close)

pastClose = security(syminfo.tickerid, res, close[trend])

//Trend Indicator

upTrend = (currentClose >= (pastClose * (1 + trendMult)))

downTrend = (currentClose <= (pastClose * (1 - trendMult)))

sidewaysUpTrend = (currentClose < (pastClose * (1 + trendMult)) and (currentClose > pastClose))

sidewaysDownTrend = (currentClose > (pastClose * (1 - trendMult)) and (currentClose < pastClose))

//Plot Trend on Chart

plotshape(upTrend, "Up Trend", style=shape.square, location=location.top, color=color.green, size=size.small)

plotshape(downTrend, "Down Trend", style=shape.square, location=location.top, color=color.red, size=size.small)

plotshape(sidewaysUpTrend, "Sideways Up Trend", style=shape.square, location=location.top, color=color.yellow, size=size.small)

plotshape(sidewaysDownTrend, "Sideways Down Trend", style=shape.square, location=location.top, color=color.orange, size=size.small)

//What trend signals to use in entrySignal

trendRequired = input(title="Trend Required", defval="Orange", options=["Green", "Yellow", "Orange", "Red"])

goTrend = trendRequired == "Orange" ? upTrend or sidewaysUpTrend or sidewaysDownTrend : trendRequired == "Yellow" ? upTrend or sidewaysUpTrend : trendRequired == "Green" ? upTrend : trendRequired == "Red" ? upTrend or sidewaysUpTrend or sidewaysDownTrend or downTrend : na

//MAs Inputs Defalt is 10 EMA, 20 EMA, 50 EMA, 100 SMA and 200 SMA

ma1Length = input(10, title="MA1 Period", minval=1, step=1)

ma1Type = input(title="MA1 Type", defval="EMA", options=["SMA", "EMA", "WMA"])

ma2Length = input(20, title="MA2 Period", minval=1, step=1)

ma2Type = input(title="MA2 Type", defval="EMA", options=["SMA", "EMA", "WMA"])

ma3Length = input(50, title="MA3 Period", minval=1, step=1)

ma3Type = input(title="MA3 Type", defval="EMA", options=["SMA", "EMA", "WMA"])

ma4Length = input(100, title="MA4 Period", minval=1, step=1)

ma4Type = input(title="MA4 Type", defval="SMA", options=["SMA", "EMA", "WMA"])

ma5Length = input(200, title="MA5 Period", minval=1, step=1)

ma5Type = input(title="MA5 Type", defval="SMA", options=["SMA", "EMA", "WMA"])

//MAs defined

ma1 = ma1Type == "EMA" ? ema(close, ma1Length) : ma1Type == "SMA" ? sma(close, ma1Length) : wma(close, ma1Length)

ma2 = ma2Type == "EMA" ? ema(close, ma2Length) : ma2Type == "SMA" ? sma(close, ma2Length) : wma(close, ma2Length)

ma3 = ma3Type == "EMA" ? ema(close, ma3Length) : ma3Type == "SMA" ? sma(close, ma3Length) : wma(close, ma3Length)

ma4 = ma4Type == "SMA" ? sma(close, ma4Length) : ma4Type == "EMA" ? ema(close, ma4Length) : wma(close, ma4Length)

ma5 = ma5Type == "SMA" ? sma(close, ma5Length) : ma5Type == "EMA" ? ema(close, ma5Length) : wma(close, ma5Length)

//Plot MAs

plot(ma1, title="MA1", color=color.yellow, linewidth=1, style=plot.style_line)

plot(ma2, title="MA2", color=color.purple, linewidth=1, style=plot.style_line)

plot(ma3, title="MA3", color=#00FFFF, linewidth=1, style=plot.style_line)

plot(ma4, title="MA4", color=color.blue, linewidth=2, style=plot.style_line)

plot(ma5, title="MA5", color=color.orange, linewidth=2, style=plot.style_line)

//Allows user to toggle on/off ma1 > ma2 filter

enableShortMAs = input(title="Enable Short MA Cross Filter", defval="Yes", options=["Yes", "No"])

shortMACross = enableShortMAs == "Yes" and ma1 > ma2 or enableShortMAs == "No"

//Allows user to toggle on/off ma4 > ma5 filter

enableLongMAs = input(title="Enable Long MA Cross Filter", defval="Yes", options=["Yes", "No"])

longMACross = enableLongMAs == "Yes" and ma4 >= ma5 or enableLongMAs == "No"

//Entry Signals

entrySignal = (strategy.position_size <= 0 and close[1] < ma1[1] and close > ma1 and close > ma2 and close > ma3 and shortMACross and ma1 > ma3 and longMACross and goTrend)

secondSignal = (strategy.position_size > 0 and close[1] < ma1[1] and close > ma1 and close > ma2 and close > ma3 and shortMACross and ma1 > ma3 and longMACross and goTrend)

plotshape(entrySignal, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small)

plotshape(secondSignal, style=shape.triangleup, location=location.belowbar, color=color.lime, size=size.small)

//ATR for Stops

atrValue = (atr(14))

//to test ATR enable next line

//plot(atrValue, linewidth=1, color=color.black, style=plot.style_line)

atrMult = input(2.5, minval=.25, step=.25, title="Stop ATR Multiple")

//Only target3Mult is used in current strategy target1 and target2 might be used in the future with pyramiding

//target1Mult = input(1.0, minval=.25, step=.25, title="Targert 1 Multiple")

//target2Mult = input(2.0, minval=.25, step=.25, title="Targert 2 Multiple")

target3Mult = input(3.0, minval=.25, step=.25, title="Target Multiple")

enableAtrStop = input(title="Enable ATR Stops", defval="Yes", options=["Yes", "No"])

//Intitial Recomended Stop Location

atrStop = entrySignal and ((high - (atrMult * atrValue)) < low) ? (high - (atrMult * atrValue)) : low

//oneAtrStop is used for testing only enable next 2 lines to test

//oneAtrStop = entrySignal ? (high - atrValue) : na

//plot(oneAtrStop, "One ATR Stop", linewidth=2, color=color.orange, style=plot.style_linebr)

initialStop = entrySignal and enableAtrStop == "Yes" ? atrStop : entrySignal ? low : na

//Stops changed to stoploss to hold value for orders the next line is old code "bug"

//plot(initialStop, "Initial Stop", linewidth=2, color=color.red, style=plot.style_linebr)

//Set Initial Stop and hold value "debug code"

stoploss = valuewhen(entrySignal, initialStop, 0)

plot(stoploss, title="Stop", linewidth=2, color=color.red)

enableStops = input(title="Enable Stops", defval="Yes", options=["Yes", "No"])

yesStops = enableStops == "Yes" ? 1 : enableStops == "No" ? 0 : na

//Calculate size of trade based on R Size

//Original buggy code:

//positionSize = (rSize/(close - initialStop))

//Added a minimum order size of 1 "debug code"

positionSize = (rSize/(close - initialStop)) > 1 ? (rSize/(close - initialStop)) : 1

//Targets

//Enable or Disable Targets

enableTargets = input(title="Enable Targets", defval="Yes", options=["Yes", "No"])

yesTargets = enableTargets == "Yes" ? 1 : enableTargets == "No" ? 0 : na

//Only target3 is used in current strategy target1 and target2 might be used in the future with pyramiding

//target1 = entrySignal ? (close + ((close - initialStop) * target1Mult)) : na

//target2 = entrySignal ? (close + ((close - initialStop) * target2Mult)) : na

target3 = entrySignal ? (close + ((close - initialStop) * target3Mult)) : na

//plot(target1, "Target 1", linewidth=2, color=color.green, style=plot.style_linebr)

//plot(target2, "Target 2", linewidth=2, color=color.green, style=plot.style_linebr)

plot(target3, "Target 3", linewidth=2, color=color.green, style=plot.style_linebr)

//Set Target and hold value "debug code"

t3 = valuewhen(entrySignal, target3, 0)

//To test t3 and see plot enable next line

//plot(t3, title="Target", linewidth=2, color=color.green)

//MA1 Cross Exit

enableEarlyExit = input(title="Enable Early Exit", defval="Yes", options=["Yes", "No"])

earlyExit = enableEarlyExit == "Yes" ? 1 : enableEarlyExit == "No" ? 0 : na

ma1CrossExit = strategy.position_size > 0 and close < ma1

//Entry Order

strategy.order("Entry", long = true, qty = positionSize, when = (strategy.position_size <= 0 and entrySignal and timeFilter))

//Early Exit Order

strategy.close_all(when = ma1CrossExit and timeFilter and earlyExit, comment = "MA1 Cross Exit")

//Stop and Target Orders

//strategy.cancel orders are needed to prevent bug with Early Exit Order

strategy.order("Stop Loss", false, qty = strategy.position_size, stop=stoploss, oca_name="Exit",when = timeFilter and yesStops, comment = "Stop Loss")

strategy.cancel("Stop Loss", when = ma1CrossExit and timeFilter and earlyExit)

strategy.order("Target", false, qty = strategy.position_size, limit=t3, oca_name="Exit", when = timeFilter and yesTargets, comment = "Target")

strategy.cancel("Target", when = ma1CrossExit and timeFilter and earlyExit)