概述

该策略是基于唐奇安通道指标的趋势跟随策略,结合ATR指标的动态止损来锁定利润,属于趋势跟随类策略。

策略原理

该策略使用长度为20周期的唐奇安通道指标,通道中线为最高价和最低价的平均值。当价格上穿通道中线时做多,当价格下穿通道中线时做空。平仓条件是价格触碰动态止损线,止损线的计算是最近3根K线的最低价减去ATR指标值的三分之一作为做多止损,最近3根K线的最高价加上ATR指标值的三分之一作为做空止损。

优势分析

该策略主要具有以下优势:

- 使用唐奇安通道判断市场趋势方向,能够有效捕捉趋势

- 结合ATR动态跟踪止损,可以在保证盈利的同时有效控制风险

- 计算止损线时加入ATR因子,将市场波动性考虑进去,止损更加合理

- 止损线的计算方式比较稳定可靠,避免止损过于接近,减少止损被追究的概率

风险分析

该策略主要存在以下风险:

- 唐奇安通道具有一定的滞后性,可能错过短线机会

- ATR参数设置不当可能导致止损过于宽松或过于接近

- 趋势判断机制相对简单,在盘整市场中可能出现较多错误信号

- 缺乏有效的支持阻力判断机制,进入市场的时机选择可能不当

优化方向

该策略可以从以下几个方面进行优化:

- 增加其他指标判断,避免在没有明确趋势的市场中频繁交易

- 增加支持阻力位判断,优化入场时机

- 尝试其他动态止损计算方式,进一步优化止损策略

- 测试不同唐奇安通道周期参数对策略效果的影响

- 加入交易量或增量等过滤条件,减少误入错信号

总结

该策略整体来说属于简单实用型趋势跟随策略,通过唐奇安通道判断趋势方向,并使用动态止损来锁定利润,可有效跟踪趋势capturing。策略实用性较强,但可进一步通过多种方式进行优化,使策略在更复杂的市场环境中仍能保持稳定收益。

策略源码

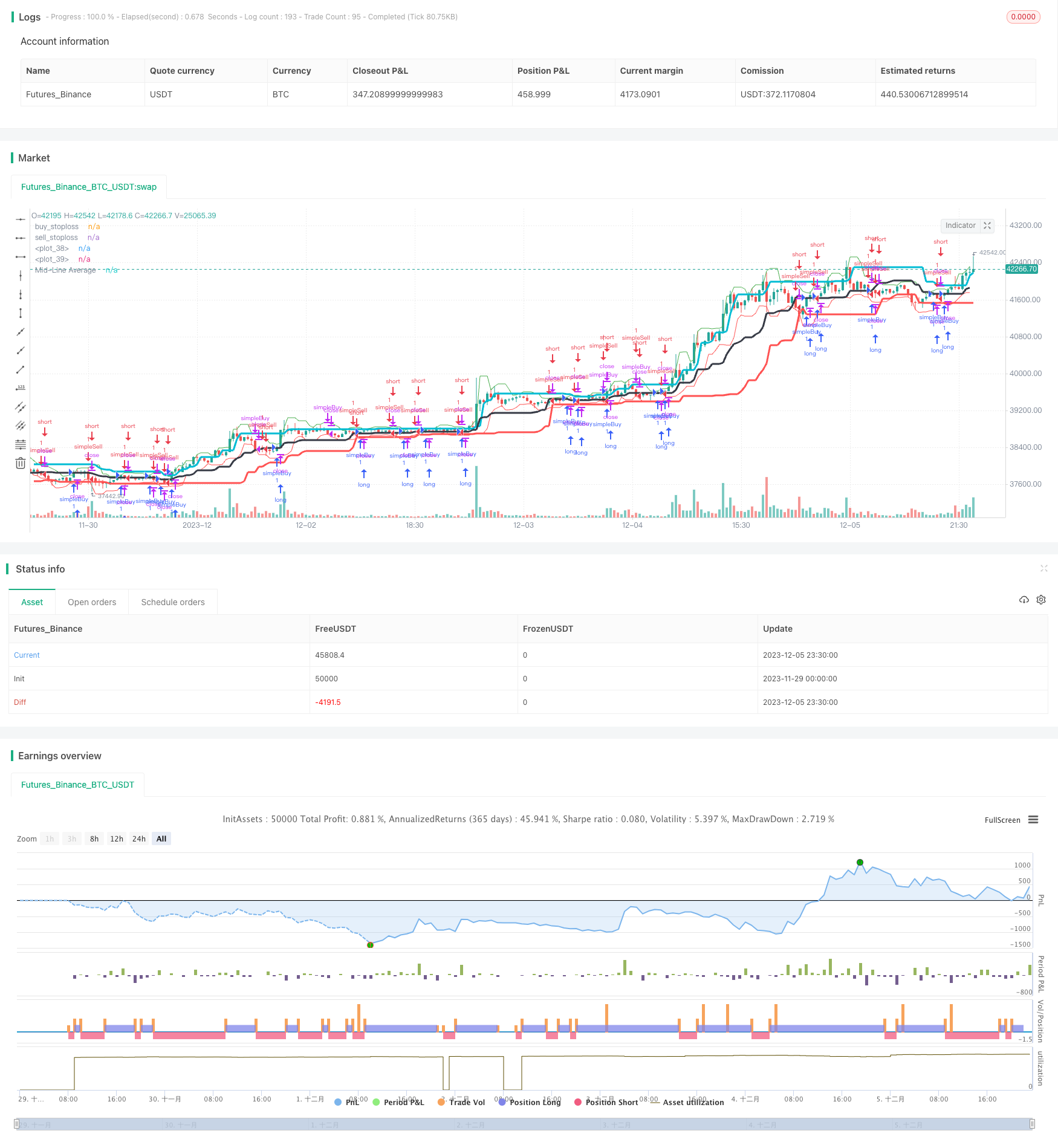

/*backtest

start: 2023-11-29 00:00:00

end: 2023-12-06 00:00:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title = "dc", overlay = true)

atrLength = input(title="ATR Length:", defval=20, minval=1)

testStartYear = input(2017, "Backtest Start Year")

testStartMonth = input(1, "Backtest Start Month")

testStartDay = input(1, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testEndYear = input(2018, "Backtest Start Year")

testEndMonth = input(12)

testEndDay = input(31, "Backtest Start Day")

testPeriodEnd = timestamp(testEndYear,testEndMonth,testEndDay,0,0)

testPeriod() =>

true

//time >= testPeriodStart ? true : false

dcPeriod = input(20, "Period")

dcUpper = highest(close, dcPeriod)[1]

dcLower = lowest(close, dcPeriod)[1]

dcAverage = (dcUpper + dcLower) / 2

atrValue=atr(atrLength)

useTakeProfit = na

useStopLoss = na

useTrailStop = na

useTrailOffset = na

//@version=1

Buy_stop = lowest(low[1],3) - atr(20)[1] / 3

plot(Buy_stop, color=red, title="buy_stoploss")

Sell_stop = highest(high[1],3) + atr(20)[1] / 3

plot(Sell_stop, color=green, title="sell_stoploss")

plot(dcLower, style=line, linewidth=3, color=red, offset=1)

plot(dcUpper, style=line, linewidth=3, color=aqua, offset=1)

plot(dcAverage, color=black, style=line, linewidth=3, title="Mid-Line Average")

strategy.entry("simpleBuy", strategy.long, when=(close > dcAverage) and cross(close,dcAverage))

strategy.close("simpleBuy",when= ( close< Buy_stop))

strategy.entry("simpleSell", strategy.short,when=(close < dcAverage) and cross(close,dcAverage) )

strategy.close("simpleSell",when=( close > Sell_stop))

//strategy.exit("Exit simpleBuy", from_entry = "simpleBuy", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

//strategy.exit("Exit simpleSell", from_entry = "simpleSell", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)