概述

该策略基于Camarilla支点的突破信号,结合RSI反转指标作为低吸机会,形成高级的动量反转型低吸策略。当价格突破Camarilla支点时产生交易信号,RSI低位则进一步确认吸筹机会,属于高级的动量反转策略。

策略原理

策略的核心信号来自于Camarilla支点。Camarilla支点基于昨日价格范围计算,分为S1到S5支点和R1到R5支点。当价格从S1支点向上突破时产生买入信号,当价格从R1支点向下突破时产生卖出信号。此外,结合RSI指标判断是否处于超卖状态,可以提高入场的成功率。

具体来说,策略首先根据昨日最高价、最低价以及收盘价,计算Camarilla支点。然后判断收盘价是否突破支点,以此产生交易信号。同时判断RSI指标是否处于低位,低于30视为超卖。只有收盘价突破支点并且RSI低于30,才会产生真正的交易信号。做多信号为向上突破S1支点,做空信号为向下突破R1支点。

举例来说,如果昨日价格在10-11之间波动,今日收盘价突破11.05(S1支点),同时RSI指标显示20,则产生买入信号。如果今日收盘价突破10.95(R1支点),RSI显示20,则产生卖出信号。因此,该策略融合了突破信号和超卖信号的优点。

优势分析

该策略最大的优势在于识别超跌和反转机会。Camarilla支点本身会把握价格的重要支持和阻力点。结合RSI指标判断反转时机,可以精确定位底部,避免追涨杀跌。这属于比较高级的突破策略。

另外,支点是动态计算的,会及时跟进价格变化。不像传统技术指标,需要设置参数。策略继承了支点分析的优势,更加灵活。此外,反转机会比较明确,不会出现频繁的虚假信号。

风险分析

该策略最大的风险在于,价格可能假突破。尽管结合RSI指标来确认超卖状态,但是价格突破支点后仍有可能出现反转。这会导致止损被击穿。

另一个风险是,RSI指标发生失效。即使出现超跌,但是RSI未降到30以下。这时并没有形成交易信号,会错过反转机会。针对这一风险,可以适当优化RSI的参数设置。

优化方向

该策略可以通过以下几个方面进行优化:

优化RSI的参数。可以测试不同的超卖线,是30好还是20更合适。

增加其他指标进行组合。比如KDJ指标,可以进一步确认反转信号的可靠性。

测试不同的Camarilla支点。可以只使用S1和R1,减少假突破的概率。

优化止损策略。可以根据ATR指标设置止损位,或者追踪突破的支点作为止损位。

测试不同的品种合约。适用于股指、外汇、商品等不同品种。参数需要调整。

总结

该策略属于高级的动量反转型突破策略。通过Camarilla支点判断突破信号,RSI指标确定超卖状态。策略优势在于识别反转机会,最大的风险是价格假突破。通过参数优化以及风险管理,可以进一步提高策略的稳定性和盈利能力。

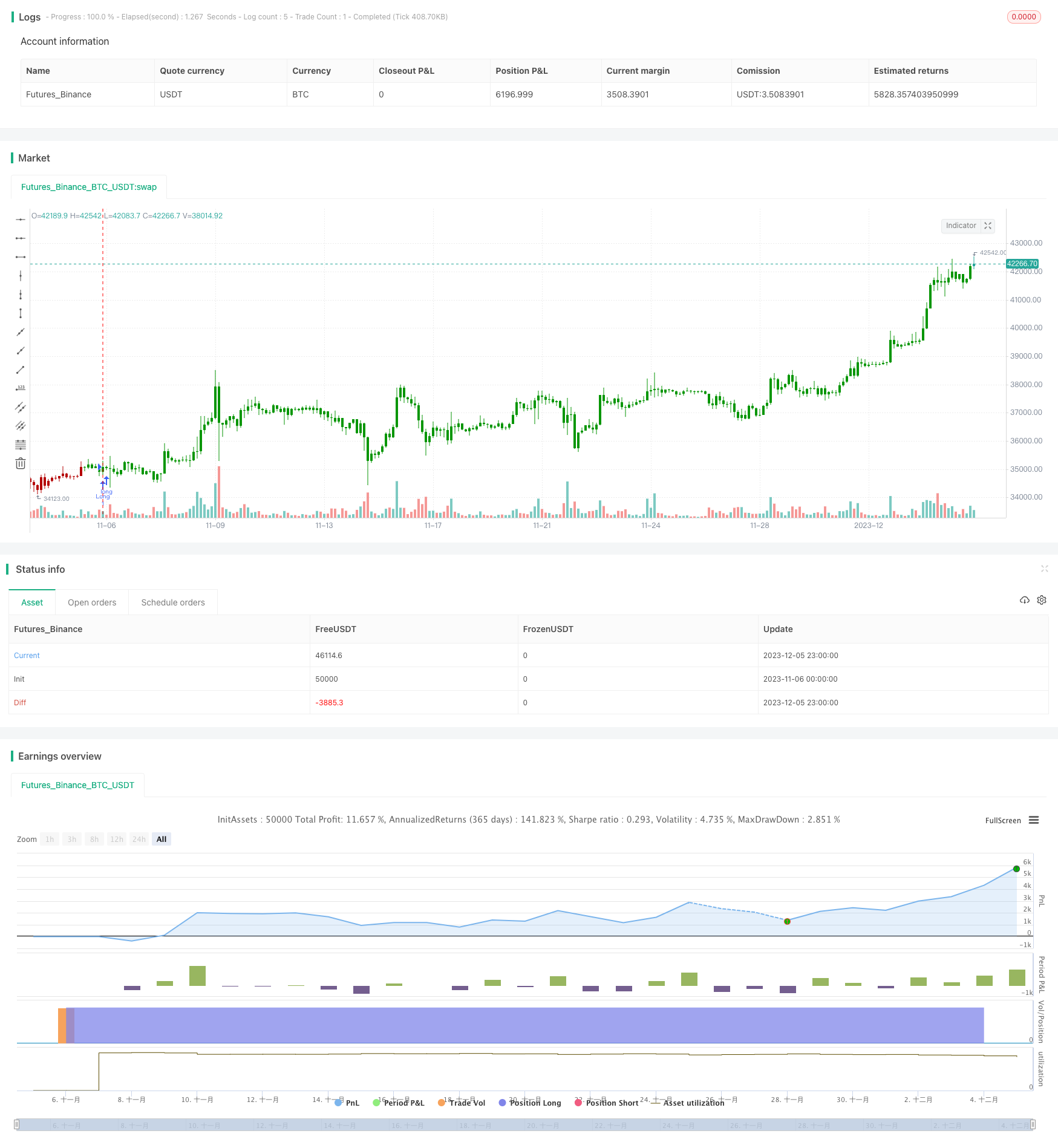

/*backtest

start: 2023-11-06 00:00:00

end: 2023-12-06 00:00:00

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 07/05/2020

// Pivot point studies highlight prices considered to be a likely turning point

// when looking at values from a previous period, whether it be daily, weekly,

// quarterly or annual. Each pivot point study has its own characteristics on

// how these points are calculated.

//

// Red color = Sell

// Green color = Buy

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

strategy(title="Camarilla Pivot Points Backtest", shorttitle="CPP", overlay = true)

res = input(title="Resolution", type=input.resolution, defval="D")

SellFrom = input(title="Sell from ", defval="R1", options=["R1", "R2", "R3", "R4", "R5"])

BuyFrom = input(title="Buu from ", defval="S1", options=["S1", "S2", "S3", "S4", "S5"])

reverse = input(false, title="Trade reverse")

xHigh = security(syminfo.tickerid,res, high)

xLow = security(syminfo.tickerid,res, low)

xClose = security(syminfo.tickerid,res, close)

xXLC3 = (xHigh+xLow+xClose) / 3

xRange = xHigh-xLow

S1 = xClose - xRange * (1.1 / 12)

S2 = xClose - xRange * (1.1 / 6)

S3 = xClose - xRange * (1.1 / 4)

S4 = xClose - xRange * (1.1 / 2)

R1 = xClose + xRange * (1.1 / 12)

R2 = xClose + xRange * (1.1 / 6)

R3 = xClose + xRange * (1.1 / 4)

R4 = xClose + xRange * (1.1 / 2)

R5 = (xHigh/xLow) * xClose

S5 = xClose - (R5 - xClose)

pos = 0

S = iff(BuyFrom == "S1", S1,

iff(BuyFrom == "S2", S2,

iff(BuyFrom == "S3", S3,

iff(BuyFrom == "S4", S4,

iff(BuyFrom == "S5", S5, 0)))))

B = iff(SellFrom == "R1", R1,

iff(SellFrom == "R2", R2,

iff(SellFrom == "R3", R3,

iff(SellFrom == "R4", R4,

iff(SellFrom == "R5", R5, 0)))))

pos := iff(close > B, 1,

iff(close < S, -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )