概述

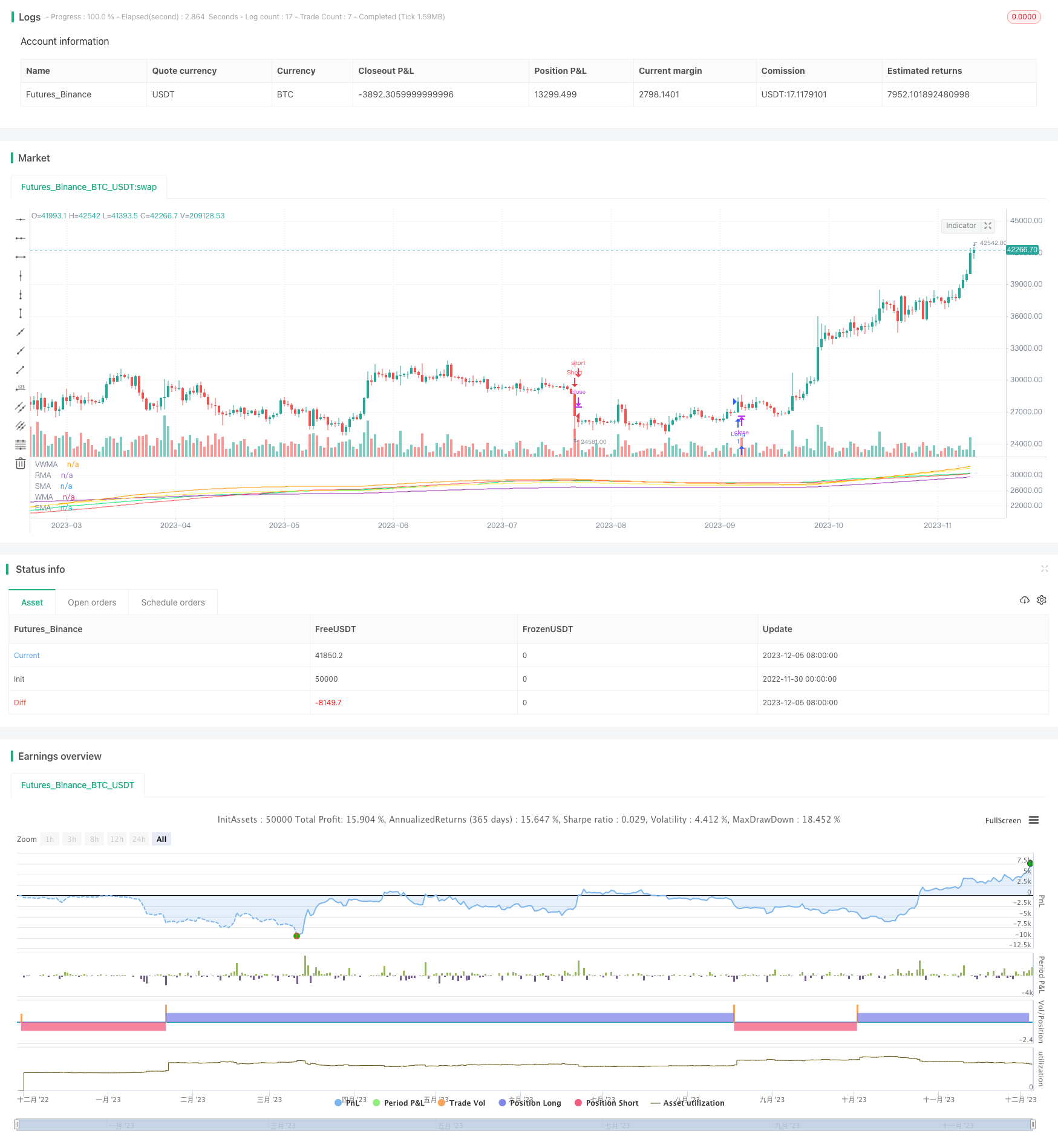

本策略结合了5种不同类型的移动平均线,当5种移动平均线的方向一致时生成交易信号。策略利用多种移动平均线的聚合,可以有效过滤市场噪音,识别趋势方向。

策略原理

本策略使用SMA、EMA、RMA、WMA和VWMA五种移动平均线。分别计算快线长度为8天,慢线长度为144天的五种移动平均线。当所有的快线上涨且慢线上涨时产生多头信号;当所有的快线下跌且慢线下跌时产生空头信号。

优势分析

- 聚合多种移动平均线,识别信号更加可靠,避免产生假信号

- 利用多种移动平均线的优势,如SMA平滑价格,VWMA考量成交量,WMA赋予权重等

- 参数可调整,可优化快线和慢线的长度

风险分析

- 多种移动平均线 aggregated,当中一两种产生错误信号时也会影响策略

- 无法在趋势开始时及时发出信号

- 需要参数优化获得最佳参数

优化方向

- 可以测试不同移动平均线的组合和参数

- 可以结合其他指标进行 confirmation,如 MACD,RSI 等

- 可以根据市场环境动态调整移动平均线参数

总结

本策略通过聚合多种主流移动平均线,在所有移动平均线达成共识时产生交易信号。这种策略可以有效利用各移动平均线的优势,同时过滤掉部分噪音,识别市场趋势方向。参数优化和指标组合确认都可以进一步增强策略稳定性。总体来说,这是一个简单实用的趋势跟踪策略。

策略源码

//@version=2

strategy(title="MACD Multi-MA Strategy", overlay=false )

src = close

len1 = input(8, "FAST LOOKBACK")

len2 = input(144, "SLOW LOOKBACK")

/////////////////////////////////////////////

length = len2-len1

ma = vwma(src, length)

plot(ma, title="VWMA", color=lime)

length1 = len2-len1

ma1 = rma(src, length1)

plot(ma1, title="RMA", color=purple)

length2 = len2-len1

ma2 = sma(src, length2)

plot(ma2, title="SMA", color=red)

length3 = len2-len1

ma3 = wma(src, length3)

plot(ma3, title="WMA", color=orange)

length4 = len2-len1

ma4 = ema(src, length4)

plot(ma4, title="EMA", color=yellow)

long = ma > ma[1] and ma1 > ma1[1] and ma2 > ma2[1] and ma3 > ma3[1] and ma4 > ma4[1]

short = ma < ma[1] and ma1 < ma1[1] and ma2 < ma2[1] and ma3 < ma3[1] and ma4 < ma4[1]

strategy.entry("Long", strategy.long, when=long)

strategy.entry("Short", strategy.short, when=short)