概述

CCI零点反转交易策略(CCI Zero Cross Trading Strategy)是一个基于商品通道指数(CCI)的量化交易策略。该策略通过追踪CCI指标与零轴的交叉情况来产生交易信号,在CCI上穿零轴时做多,在CCI下穿零轴时做空,属于趋势跟踪类型策略。

策略原理

CCI零点反转交易策略的基本原理是:

使用CCI指标判断市场的超买超卖情况。CCI指标值上穿100线为市场超买信号,下穿-100线为市场超卖信号。

监测CCI指标与零轴的交叉情况。当CCI从下向上穿过零线时产生做多信号;当CCI从上向下穿过零线时产生做空信号。

根据CCI交叉零轴的做多做空信号入场,并设置CCI超买超卖区域作为止损位。

具体来说,该策略的入场规则是:

当CCI指标从负值向正值穿过零轴时,做多入场,止损价设在-100线。

当CCI指标从正值向负值穿过零轴时,做空入场,止损价设在100线。

该策略主要依赖CCI指标判断市场的超买超卖程度,通过捕捉其 reversal 的机会获得利润。CCI交叉零轴可以有效捕捉市场中期趋势的转换点。整体来说,该策略逻辑简单清晰,容易实施。

优势分析

CCI零点反转交易策略的主要优势有:

策略信号来源单一,仅基于CCI指标与零轴的交叉情况,实现了简单有效的趋势跟踪。

利用CCI指标的反转特征,有效捕捉中期趋势的转换点,收益潜力大。

止损点设置在CCI的超买超卖区域,可以及时止损,控制风险。

策略实现逻辑简单清晰,参数选择容易,适合量化交易的算法化。

CCI指标对市场普遍适用,策略适应性强,可应用在多种品种的量化交易中。

风险分析

CCI零点反转交易策略也存在一些风险,主要集中在以下几个方面:

CCI指标存在一定的滞后性,可能错过价格快速反转的最佳入场时点。

止损范围比较小,无法承受更大的行情波动。

仅依赖CCI指标易受假突破的影响,产生错误信号。

无法有效过滤趋势中出现的震荡局面,会增加交易频率和滑点成本。

多空头持仓时间不确定,无法预估获利回吐的时间节点。

针对上述风险,我们可以通过参数优化、止损范围调整、增加过滤条件等方式进行改进和控制。

优化方向

CCI零点反转交易策略还有进一步优化的空间,主要包括:

优化CCI参数,找到更加适合品种特性的指标参数。

增加价格突破或形态条件,过滤震荡局面,减少错误信号。

增加移动止损方式跟踪利润,或预设盈利比例的移动止盈。

结合其他指标形成多指标过滤条件,提高策略稳定性。

在趋势更加明确后加大仓位,在震荡时减少仓位。

通过参数调整、风控优化、动态止盈等方法,可以进一步提升CCI零点反转交易策略的效率和收益率。

总结

CCI零点反转交易策略是基于商品通道指数的简单有效的量化策略。它利用CCI指标的趋势跟踪特性,通过捕捉其反转节点获得收益。策略优势主要体现在实现简单、适用性强、参数少等方面,但也面临一定的风险,需要引入辅助技术指标和优化方法进行控制。总体而言,该策略流程清晰,易于扩展,是值得考虑的量化交易策略之一。

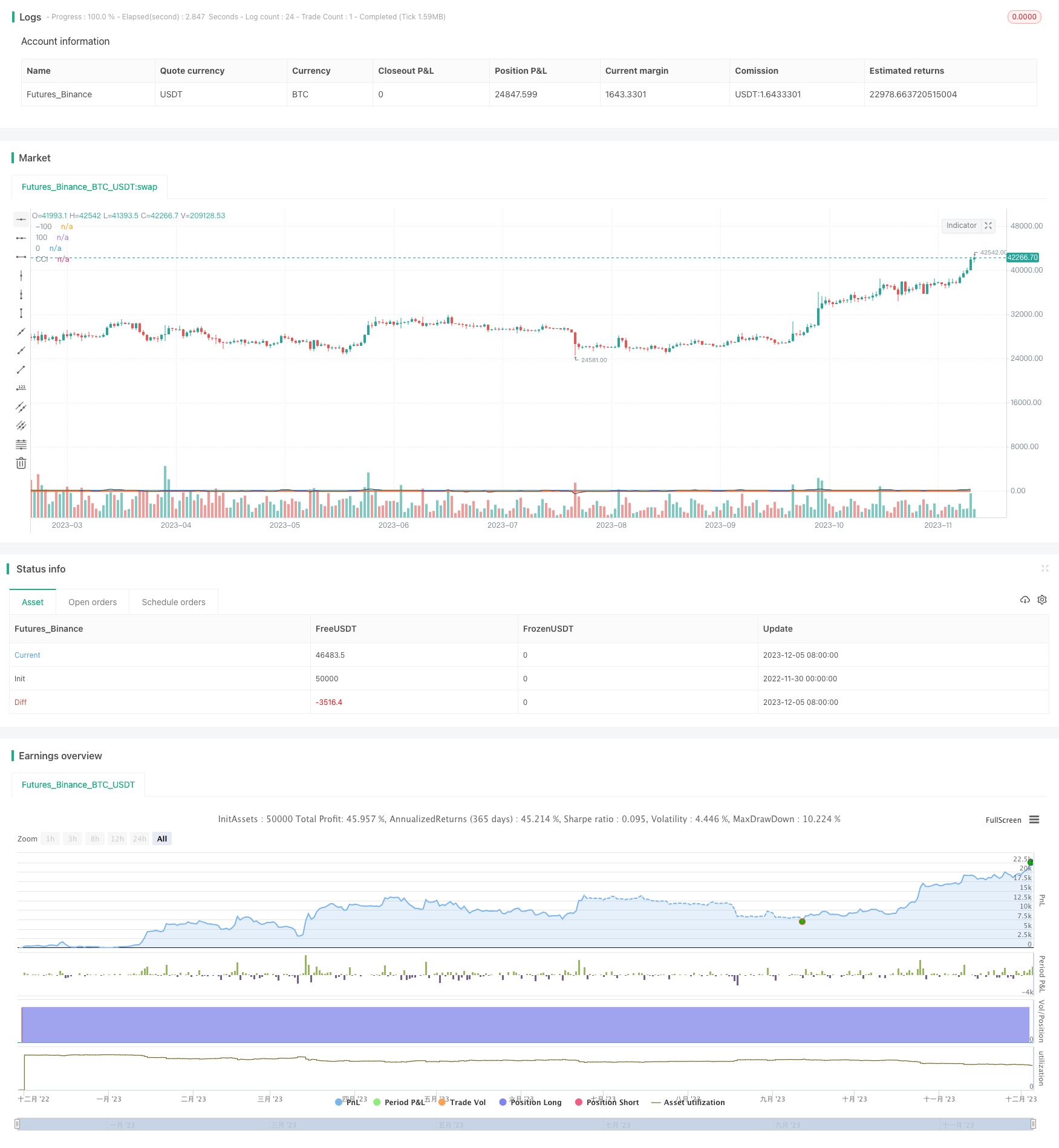

/*backtest

start: 2022-11-30 00:00:00

end: 2023-12-06 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("CCI 0Trend Strategy (by Marcoweb) v1.0", shorttitle="CCI_0T_Strat_v1.0", overlay=true)

///////////// CCI

CCIlength = input(20, minval=1, title="CCI Period Length")

CCIoverSold = -100

CCIoverBought = 100

CCIzeroLine = 0

CCI = cci(hlc3, CCIlength)

price = hlc3

vcci = cci(price, CCIlength)

source = close

buyEntry = crossover(source, CCIoverSold)

sellEntry = crossunder(source, CCIoverBought)

plot(CCI, color=black,title="CCI")

p1 = plot(CCIoverSold, color=red,title="-100")

p2 = plot(CCIoverBought, color=blue,title="100")

p3 = plot(CCIzeroLine, color=orange,title="0")

///////////// CCI 0Trend v1.0 Strategy

if (not na(vcci))

if (crossover(CCI, CCIoverSold))

strategy.entry("CCI_L", strategy.long, stop=CCIoverSold, comment="CCI_L")

else

strategy.cancel(id="CCI_L")

if (crossunder(CCI, CCIoverBought))

strategy.entry("CCI_S", strategy.short, stop=CCIoverBought, comment="CCI_S")

else

strategy.cancel(id="CCI_S")

//plot(strategy.equity, title="equity", color=red, linewidth=2, style=areabr)