一、策略名称

Bollinger+RSI双重多头策略

二、策略概述

本策略利用布林线指标与RSI指标的组合,在两者同时显示超卖信号时建仓做多,在两者同时显示超买信号时平仓。相比单一指标,能更可靠确认交易信号,避免假信号。

三、策略原理

- 使用RSI指标判断超买超卖

- RSI低于50视为超卖

- RSI高于50视为超买

- 使用布林线判断价格异常

- 价格低于下轨视为超卖

- 价格高于上轨视为超买

- 当RSI和布林线同时显示超卖信号时,做多建仓

- RSI指标线低于50

- 价格线低于布林线下轨

- 当RSI和布林线同时显示超买信号时,平仓

- RSI指标线高于50

- 价格线高于布林线上轨

四、策略优势

- 两种指标结合,信号更可靠,避免假信号

- 仅建立多头仓位,简化逻辑,降低交易风险

五、策略风险及解决方法

- 布林线参数设置不当,上下轨限制太宽泛,增加误交易风险

- 优化布林线参数,合理设置布林线周期及标准差

- RSI参数设置不当,超买超卖判断标准不当,增加误交易风险

- 优化RSI参数,调整RSI周期,合理设置超买超卖标准

- 行情不具有趋势性时, Ravin效果不佳

- 结合趋势型指标,避免震荡行情操作

六、策略优化方向

- 优化布林线及RSI参数设置

- 增加止损机制

- 结合MACD等趋势型指标

- 增加短线与长线结合判断

七、总结

本策略结合布林线与RSI两种指标的优势,在两者同时显示超买超卖信号时交易,避免单一指标产生的假信号,从而提高信号准确率。相比先前版本,仅建立多头仓位,降低了交易风险。后续可通过参数优化、止损机制、与趋势型指标结合等方式进行策略优化,使之更适应不同市场环境。

策略源码

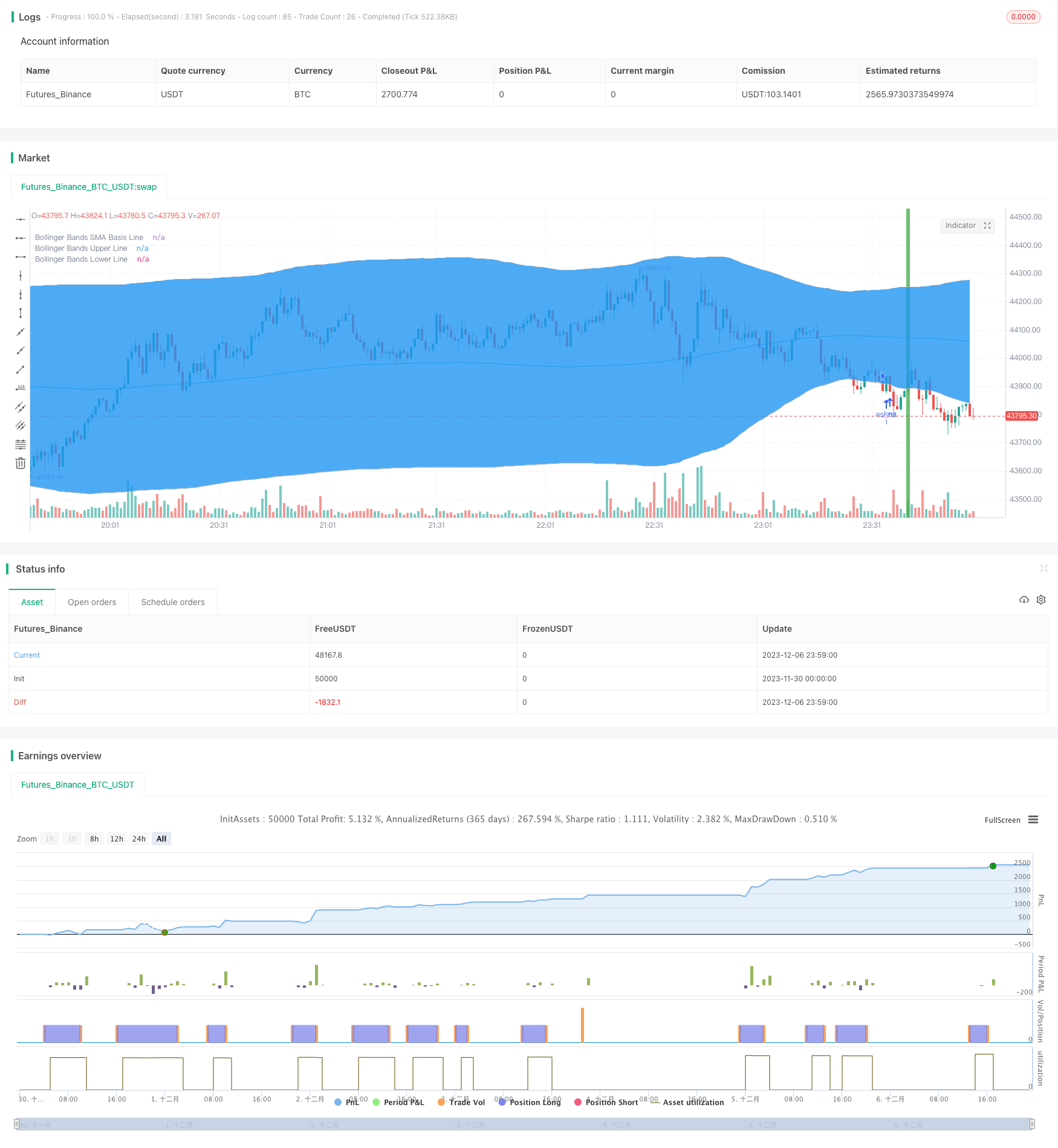

/*backtest

start: 2023-11-30 00:00:00

end: 2023-12-07 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("Bollinger + RSI, Double Strategy Long-Only (by ChartArt) v1.2", shorttitle="CA_-_RSI_Bol_Strat_1.2", overlay=true)

// ChartArt's RSI + Bollinger Bands, Double Strategy UPDATE: Long-Only

//

// Version 1.2

// Idea by ChartArt on October 4, 2017.

//

// This strategy uses the RSI indicator

// together with the Bollinger Bands

// to buy when the price is below the

// lower Bollinger Band (and to close the

// long trade when this value is above

// the upper Bollinger band).

//

// This simple strategy only longs when

// both the RSI and the Bollinger Bands

// indicators are at the same time in

// a oversold condition.

//

// In this new version 1.2 the strategy was

// simplified by going long-only, which made

// it more successful in backtesting.

//

// List of my work:

// https://www.tradingview.com/u/ChartArt/

//

// __ __ ___ __ ___

// / ` |__| /\ |__) | /\ |__) |

// \__, | | /~~\ | \ | /~~\ | \ |

//

//

///////////// RSI

RSIlength = input(6,title="RSI Period Length")

RSIoverSold = 50

RSIoverBought = 50

price = close

vrsi = rsi(price, RSIlength)

///////////// Bollinger Bands

BBlength = input(200, minval=1,title="Bollinger Period Length")

BBmult = 2 // input(2.0, minval=0.001, maxval=50,title="Bollinger Bands Standard Deviation")

BBbasis = sma(price, BBlength)

BBdev = BBmult * stdev(price, BBlength)

BBupper = BBbasis + BBdev

BBlower = BBbasis - BBdev

source = close

buyEntry = crossover(source, BBlower)

sellEntry = crossunder(source, BBupper)

plot(BBbasis, color=aqua,title="Bollinger Bands SMA Basis Line")

p1 = plot(BBupper, color=silver,title="Bollinger Bands Upper Line")

p2 = plot(BBlower, color=silver,title="Bollinger Bands Lower Line")

fill(p1, p2)

///////////// Colors

switch1=input(true, title="Enable Bar Color?")

switch2=input(true, title="Enable Background Color?")

TrendColor = RSIoverBought and (price[1] > BBupper and price < BBupper) and BBbasis < BBbasis[1] ? red : RSIoverSold and (price[1] < BBlower and price > BBlower) and BBbasis > BBbasis[1] ? green : na

barcolor(switch1?TrendColor:na)

bgcolor(switch2?TrendColor:na,transp=50)

///////////// RSI + Bollinger Bands Strategy

long = (crossover(vrsi, RSIoverSold) and crossover(source, BBlower))

close_long = (crossunder(vrsi, RSIoverBought) and crossunder(source, BBupper))

if (not na(vrsi))

if long

strategy.entry("RSI_BB", strategy.long, stop=BBlower, comment="RSI_BB")

else

strategy.cancel(id="RSI_BB")

if close_long

strategy.close("RSI_BB")

//plot(strategy.equity, title="equity", color=red, linewidth=2, style=areabr)